Weekly Technology Improvement Series:

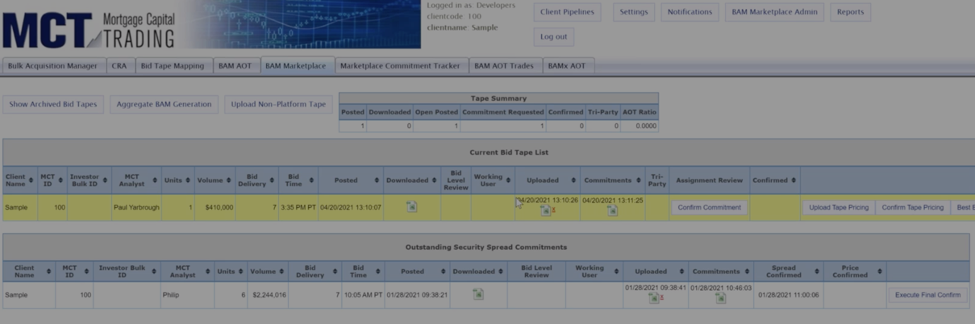

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

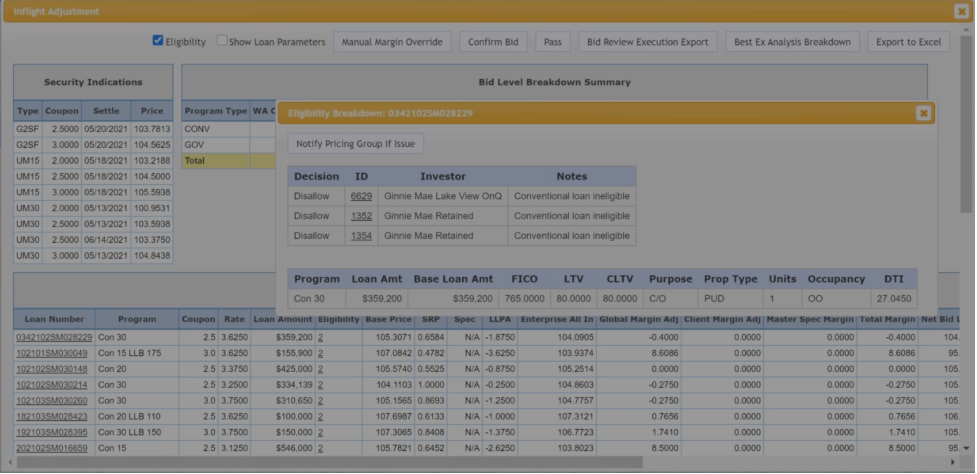

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

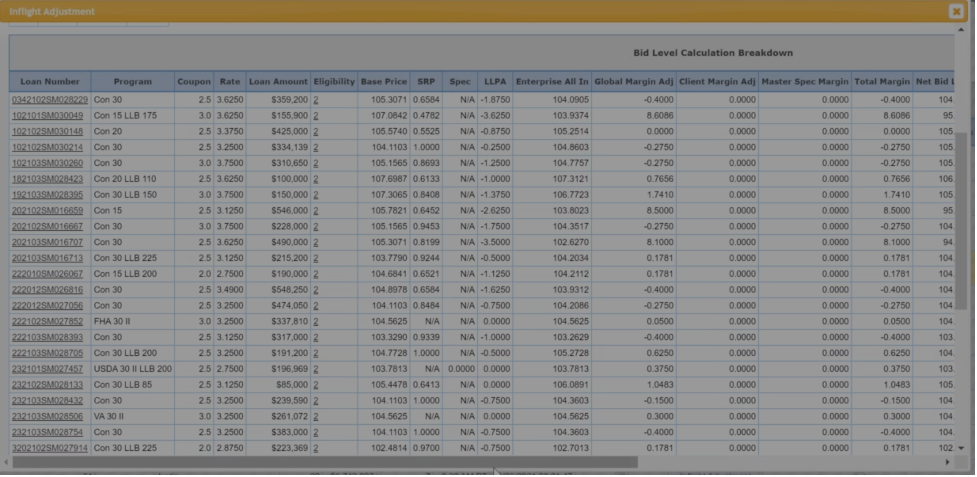

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

San Diego Business Journal Again Names MCT as Best Places to Work 2022

MCT announced that it has been named Best Places to Work 2022 by the San Diego Business Journal (SDBJ). MCT was ranked number seven in the medium-sized company category (50 – 249 U.S. employees).

MCTlive! Lock Volume Indices: September 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from September 1 through September 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

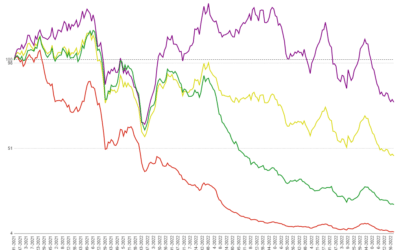

QE to QT: Current Market Recommendations [MCT Industry Webinar]

Register for this industry webinar on Friday, September 23 at 10AM Pacific, as we analyze the current market and provide recommendations as the Fed continues its transition to quantitative tightening.

How to Efficiently Scale Your Whole Loan Acquisition Channel

In this blog, we will showcase how investors can utilize MCT Marketplace, to transform the traditional process of acquiring residential whole loans in the secondary market.

MCT Webinar – The Power of Effective Cost Management in a Rapidly Contracting Market… How to Win.

In this webinar, Teraverde’s Jim Deitch will join MCT’s Tom Farmer to reveal data-driven secrets for improving operational profitability in a challenging market.

MCTlive! Lock Volume Indices: August 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from August 1 through August 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Inc. 5000 Ranks MCT® on 2022 Fastest Growing Private Companies List

SAN DIEGO, Calif., September 2, 2022 – Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that Inc. 5000 named MCT to its 2022 list of winners for the nation’s fastest-growing private companies.

Hedging Strategies for Optimal Risk Management

In this article, we will discuss hedge considerations in a volatile market, current hedging best practices, and lock desk policy recommendations.

MSRlive! Client Update – MSRlive! 2.0 Launch

In this webinar, Natalie Martinez along with Bill Shirreffs and Azad Rafat go over all of the new features and exciting transition to MSRlive! 2.0.

MCT & Freddie Mac Present: MSR Management in a Volatile Market (Video Series)

In this two-part video series, Freddie Mac and MCT’s MSR division team up to discuss strategies for managing a MSR portfolio in a volatile market. Watch Part 1 and Part 2 of the video series below or contact us today for strategic MSR guidance.

![QE to QT: Current Market Recommendations [MCT Industry Webinar]](https://mct-trading.com/wp-content/uploads/2022/09/QE-to-QT-play-sign-400x250.png)