Weekly Technology Improvement Series:

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

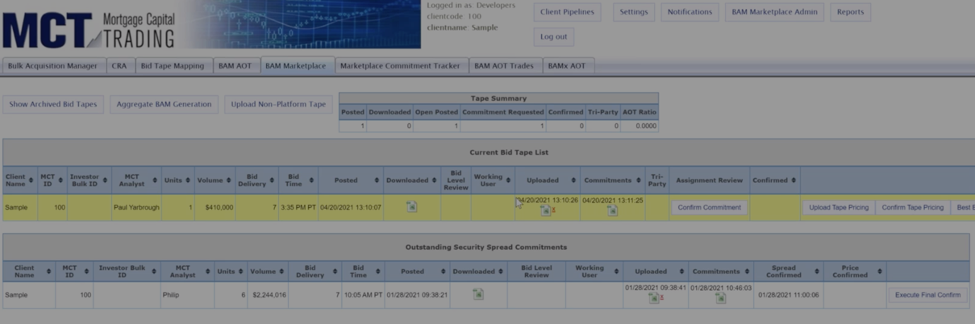

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

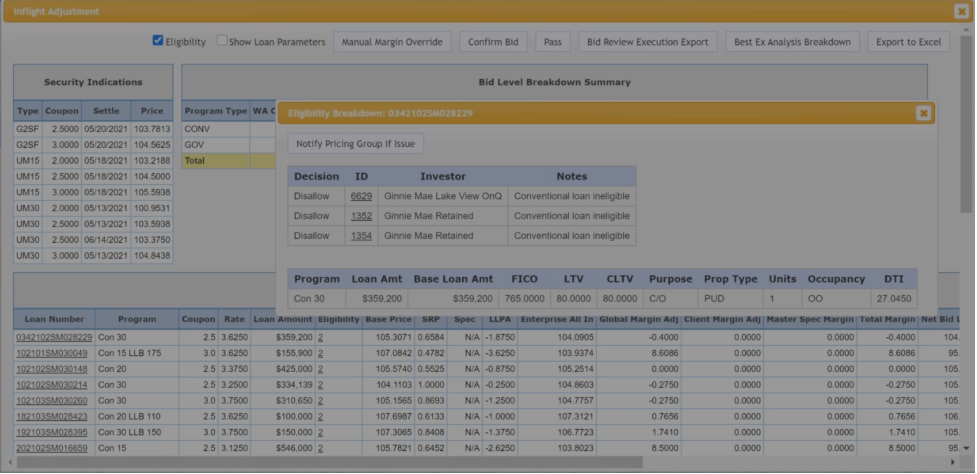

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

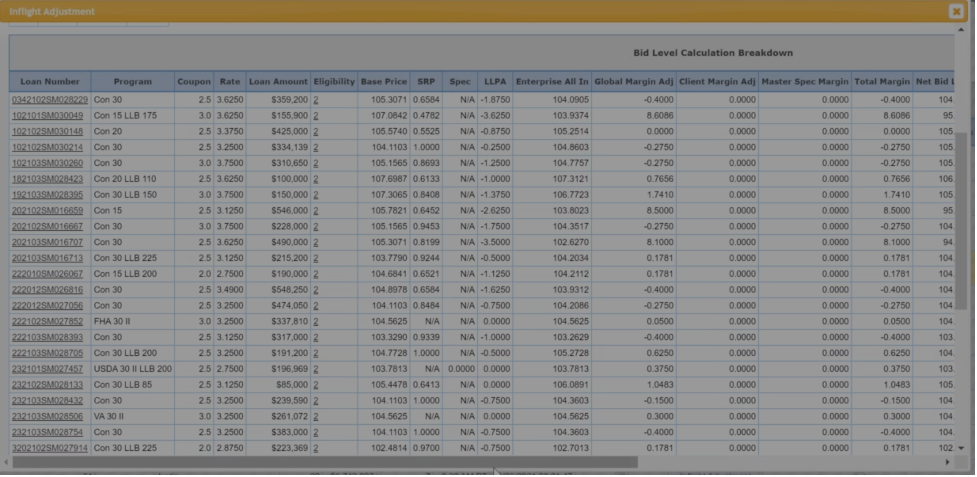

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Seasonal Slowdown Sets In as Mortgage Market Prepares to “Tread Water” into 2026

Steeper-than-expected December mortgage lock volume drop as seasonality, shutdown uncertainty, and stubborn rates keep borrowers cautious.

Seasonal Slowdown Sets In as Mortgage Market Prepares to “Tread Water” into 2026

Lock volume fell 4% MoM on seasonal trends, while YoY gains persisted as markets await jobs data to guide rates and Fed policy into 2026.

MSR Market Monthly Update – December 2025

After the latest Federal Reserve 25 basis points rate cut, the Fed appears divided over the frequency and amount of future rate cuts. Read the full release for the December 2025 MSR update.

MCT and FICO Expand Collaboration to Integrate Predictive FICO® Score 10T with MSR Valuation and Investor Price Discovery

MCT and FICO expand integration of predictive FICO® Score 10T across MSR valuation, risk models, and investor pricing to enhance accuracy and market transparency.

MCT Hires Director of AI Solutions to Accelerate Agentic Workflows, Internal Efficiency, and Next-Generation Product Innovation

MCT appoints Rick Chakra as Director of AI Solutions to accelerate agentic workflows, boost internal efficiency, and advance next-gen innovation across the mortgage secondary market.

MSR Market Monthly Update – November 2025

Mortgage rates initially moved lower immediately after the Federal Reserve October’s 25 basis points rate cut. However, mortgage rates have since reversed course and have increased since the announcement. Read the full release for the November 2025 MSR update.

Agency Execution: What’s Changing and What It Means for Lenders

Join MCT’s client-exclusive webinar on agency execution changes, opt-in updates, and associated risks, plus a brief look at Non-QM executions in today’s market.

MCT November Indices: Mortgage Pricing Drops After Powell’s Comments, but October Lock Activity Held Steady as Shutdown Drags On

MCT’s November Indices show mortgage pricing dip after Powell’s comments, steady October lock activity, and signs of rate stabilization heading into 2026.

MCT Client Webinar – MCTlive!® Release Notes – Q3 2025

Join MCT’s client-exclusive webinar to explore Q3 2025 updates in MCTlive!® and Analytics tools, featuring live demos and expert insights.

Intro To Mortgage Banking

Learn the mortgage origination process, key loan and borrower characteristics, execution considerations, and the lasting impact of the GSEs and financial crisis on modern mortgage markets in this industry webinar.