MCT® strives to increase the profitability of our clients using a blend of cutting edge software, expert advice, and industry leading educational content.

MCT® strives to increase the profitability of our clients using a blend of cutting edge software, expert advice, and industry leading educational content.

As part of our initiative to continuously innovate, we have recently released support and automation for the new Bid Tape Assignment of Trade (AOT) loan sale executions within our MCT Marketplace.

Join us in this educational post as we recap the best information on these new delivery options introduced in our industry webinar on October 11th, 2018.

According to Chief Operating Officer Phil Rasori, “Under the right conditions, bid tape AOT offers a prescriptive economic value over other executions. For this and other reasons, we’re seeing widespread interest and rapid adoption among our lender clients.”

Offering a bid tape AOT loan sale delivery option has rapidly become a priority for leading correspondent investors, with Amerihome and PennyMac joining Wells Fargo among those providing the programs. This new execution combines the granularity of price available via bid tape with the cash benefits of assigning the trade, which have historically been mutually exclusive.

About the Bid Tape AOT Webinar

The bid tape process has come a long way in the last five years. Automation and advances in technology have led to the transformation of the loan sale process. One of the biggest innovations this year has been the development of new Bid Tape AOT loan sale delivery options by investors.

In this webinar recording and recap, you will learn the background of bid tape AOT, why the new bid tape AOT process is beneficial, and how it will affect loan sale best execution for both buyers and sellers.

Speaker:

Phil Rasori, Chief Operating Officer at Mortgage Capital Trading

- Phil Rasori is a recognized thought-leader in capital markets operations within the mortgage banking community. His areas of expertise include complex financial modeling, computational dynamics, and linear programming for operational optimization.

Host:

Ian Miller, Chief Marketing Officer at Mortgage Capital Trading

- Ian Miller is an accomplished marketing executive who enjoys deconstructing complex value propositions to present them in a compelling and relatable format.

Bid Tape Assignment of Trade (AOT) – View the Live Webinar Recording

We hope you will enjoy viewing the full event. You can also view or download the slide deck used in this presentation. For a summary of the questions answered in the webinar, please read on below after this webinar recording.

Questions answered by this webinar:

- How have bid tapes come to dominate other loan sale delivery methods?

- What is the definition of Assignment Of Trade (AOT) in the context of this webinar?

- What are the benefits of AOT execution?

- How does bid tape AOT compare to legacy AOT?

- How does bid tape AOT impact TBA positions?

- How does automation improve the AOT process?

- Bid Tape AOT Over-Delivery Example Scenario

- Bid Tape AOT Under-Delivery Example Scenario

- How does bid tape AOT affect the best execution strategy?

- Bid Tape AOT Over-Delivery Best Execution Analysis Example

- Bid Tape AOT Under-Delivery Best Execution Analysis Example

- Which investors offer bid tape AOT programs so far?

- Where are these bid tape AOT transactions conducted?

- Final Summary

How have bid tapes come to dominate other loan sale delivery methods?

In 2013 there was an extremely quick rise in rates. This made the mortgage asset more popular when paired with quantitative easing. The perceived drop in prepayment speeds led to a lot of wall street and private equity interest in the mortgage asset in MSR’s. Due to this, there was a substantial increase in aggregator entrance on the buy side. This meant that if you were immediately entering the space you didn’t have the requisite AOT approvals with broker/dealers set up and it was easier to buy on a bid tape basis.

Then the granularity within the asset began accelerating. Lenders became better at providing these data points and investors became better at assimilating all these data points into sharper pricing. Due to these circumstances, bid tapes began to dominate other loan sale delivery methods.

What is the definition of Assignment Of Trade (AOT) in the context of this webinar?

Tri-party agreements are executed between the lender (assigner), investor (assignee), and broker/dealer (buyer). The loans are then delivered with the corresponding coupon or product into that trade and then the original price of the initially executed trade (the TBA) that were assigning becomes the basis of the trade price for the loan.

What are the benefits of AOT execution?

One of the main benefits of AOT execution is the savings on the bid-offer spread. With the new bid tape AOT programs, you don’t have to pair off the corresponding security. You’re going to assign that security to the investor and deliver the loans against that trade. It is a common myth that if you’ve got a $50,000 pair off on a trade and you assign the trade, the pair off disappears. However, that $50,000 is actually wrapped into the purchase price.

“It is a common myth that if you’ve got a $50,000 pair off on a trade and you assign the trade, the pair off disappears. That $50,000 is actually wrapped into the purchase price.”

For example, I need to assign $2MM of Fannie 4.5s with an original price of 101.375, my loan execution is at 101.875, and the current market is at 102.875. If there is a 100-basis point rally in this position and you (as a lender) are short that position, the trade has a 100-basis point (or $20,000) out of the money associated with it. However, when we assign the trade it’s going to take the loan value and drop it correspondingly in a linear fashion down to par. This will reduce your loan execution accordingly by 100 basis points.

How does bid tape AOT compare to legacy AOT?

The biggest differences between bid tape AOT and legacy AOT are trade tolerances, immediate AOT acceptance, and extremely short delivery periods.

Legacy AOT programs have normally required trade tolerances of 1-2% to be met, which was virtually impossible for smaller lenders. With the new bid tape AOT programs, there’s an automatic blending that allows us to assign a trade against a population of loans with the price based off a weighted-average AOT strike differential.

Another big difference is the immediate AOT acceptance, which can pose a major threat. If there is a big rally where rates are dropping, and short positions are going out of the money rapidly, you will then be required to outlay this cash against assets that are substantially in the money.

The new programs also have extremely short delivery periods. A top investor mentioned that 50% of clients’ bid tapes are delivered the same day, while 80% are delivered in two days compared to the legacy 7-day delivery periods. This makes AOT a very powerful weapon regarding margin issues. You must have the loans, but if you assign all the exposure it will be accepted immediately.

“A top investor mentioned that 50% of clients bid tapes are delivered the same day, while 80% are delivered in two days compared to the legacy 7-day delivery periods.”

How does bid tape AOT impact TBA positions?

Let’s pretend for a second that I’ve got 2.2 million in Fannie 4’s and I don’t have a $2 million trade. In the past I would have had to break that up. If I have (4) $500,000 trades, I would have to break that up into $500,000 increments and hope I make the tolerance so I can assign some of it.

With the new bid tape AOT programs, I can assign all those trades against that volume and I get a weighted-average price. Fifteen years ago, I would tell clients to hold off making a trade, so we can make a larger trade and assign it down the road to make the tolerances. That is no longer needed.

How does automation improve the AOT process?

The original process was to manually enter the trade info into the Schedule A of the tri-party agreement, then enter the trade blotter info to the corresponding dealer before sending it. E-signatures now automate the process, providing a big efficiency boost. While efficiency is important, the removal of human error is even more impactful. There’s no question that putting the wrong price, volume, or coupon into a tri-party agreement is extremely problematic.

Another benefit of automation is that the tri-party agreement is transmitted at the time of commitment request. In our whole loan trading platform, MCT Marketplace, there are four communication points. First, the MCT client will post a bid tape to the platform. The investor will then upload their bid levels on that bid tape and the best execution analysis will be performed. The third data transfer will be a request for commitments on loans the corresponding investor won. And the fourth communication will be the confirmation of those commitments coming back from the investor. The tri-party is now transmitted at the point we request those commitments and we know at the time of commitment request that those loans are committed.

Read our press release on the tri-party agreement automation to learn how MCT Marketplace is streamlining the bid tape AOT loan sale process.

Bid Tape AOT Over-Delivery Example Scenario

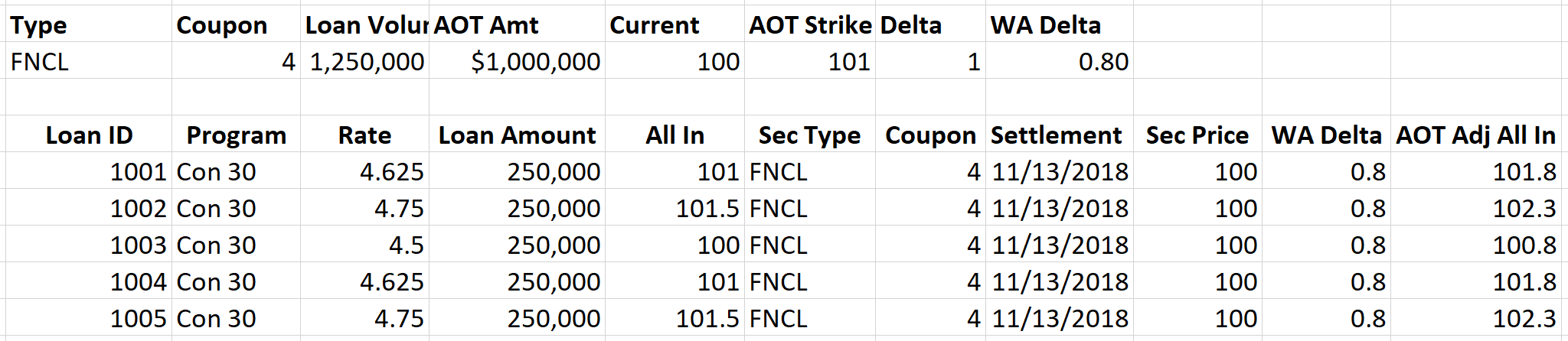

In the table below, these 5 loans equal $1,250,000. In the past, we would have taken the top four loans for $1 million and put them against that $1 million trade. That’s not the case anymore. Now, it’s an automatic blend on a weighted-average basis. In our example, I’ve got a weighted average delta of .8, security price is par, and we’re going to apply this 80-basis point positive adjustment to all 5 loans. In the past we would have only taken 4 loans and would have applied a 100-basis point pickup to those 4 loans. It’s essential that everyone understands we’ve got a weighted average AOT strike delta being applied here and we’re going to add that pickup to the all-in price to get us an AOT adjusted all in price on the right.

Bid Tape AOT Under-Delivery Example Scenario

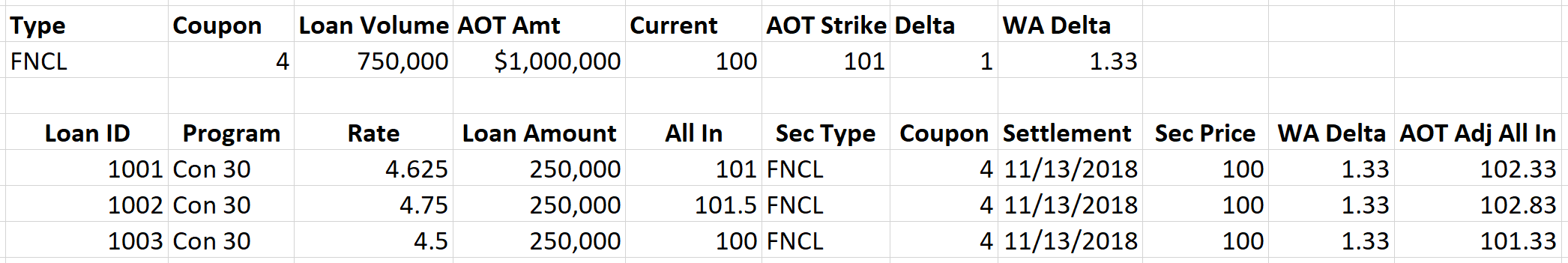

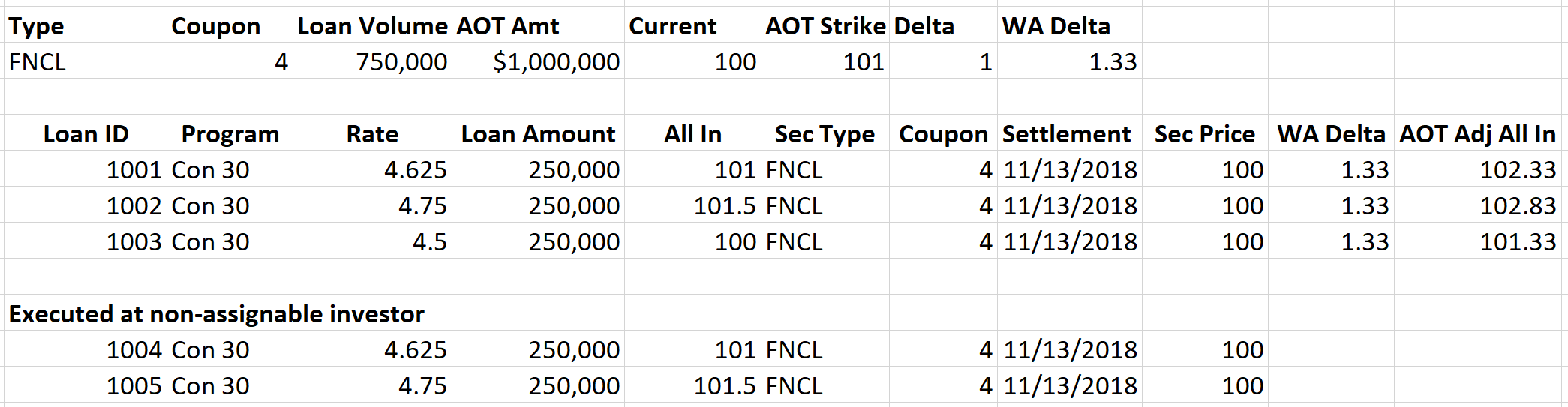

In our previous example, we talked about delivering $1.25 million against $1 million which is over delivering against a trade. Let’s say I had those 5 loans and 2 out of 5 loans went non-assignable best execution to another investor. Now I’ve only got $750,000. These programs will allow you to round up to the nearest million. That means that you’re now able to assign $1 million against $750,00 in loan volume. Using the same math, you can see we now have a 1.33 weighted average delta. The 1.33 is the actual delta and will be applied to the corresponding loans.

How does the bid tape AOT affect the best execution strategy?

The best execution strategy for incorporating the bid offer savings is to apply the appropriate amount to the appropriate and applicable trade. To get that appropriate amount, we’re going to adjust the theoretical economic value. For the best execution calculation, the goal is to look at the total bid offer savings crated by the given loans and apply it accordingly. If we think about $750,000 in this example, because we’re able to assign $1 million, we’re relieving ourselves in the cost of $1 million in pair offs. We’re not getting rid of the pair off, but we’re relieving ourselves of the cost of a $1 million bid offer spread. That means your savings is not going to be just the bid offer spread. Although you’re selling the two loans elsewhere, you’re allowing yourself to save the full $1 million.

Bid Tape AOT Over-Delivery Best Execution Analysis Example

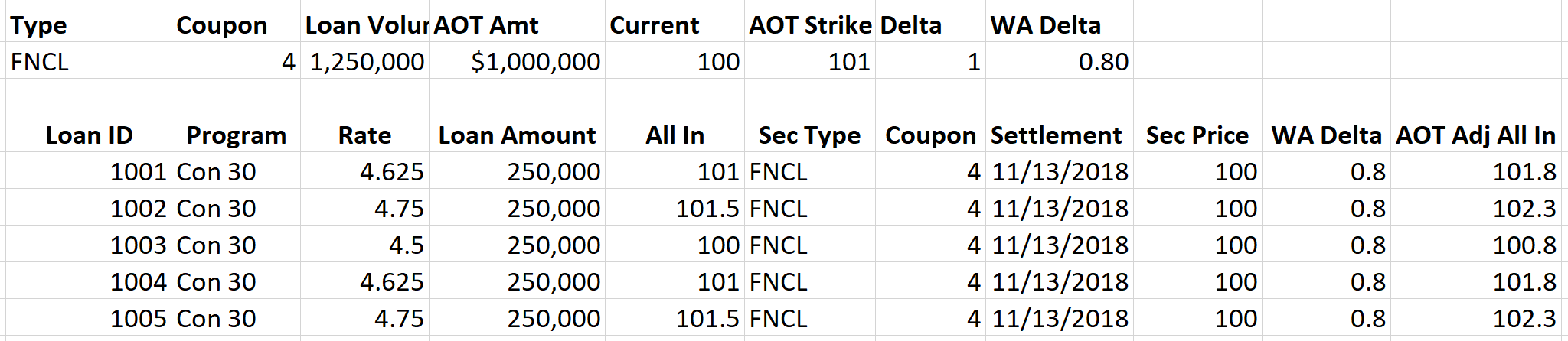

In this example, we’re going to over-deliver against $1 million and apply that pickup linearly to the four loans. In the best execution, we would not recommend applying that 80-basis point pickup among the five unless it wins. Now we’re going to bias the execution against other non-assignable investor executions by 6.25 basis points. This 6.25 basis points has nothing to do with your loans. The ability to assign that trade to the investor enables you to achieve those 6.25 basis points. However, we have to put that into best execution, and we do so in a similar way to how file fees are taken into account.

Bid Tape AOT Under-Delivery Best Execution Analysis Example

Bid tape AOT is especially beneficial for smaller lenders who are involved in under delivery. For example, three of five loans are assignable best execution and two are non-assignable best execution. You’re now saving 6.25 basis points on $1 million. Now, multiply by your ratio of 1.33 and you’re now saving 8.3 basis points. That’s a huge number in conventional execution.

This is also especially beneficial in the Ginnie Mae loans. Let’s just say they’re at 2.5 ticks right now and you have a half tic to the dealer. You now have a 3/32nd bid offer spread, that’s 9 3/8 basis points. When we apply the ratio, you get an eighth of a point. You cannot overstate the value of an eighth of a point on what is supposed to be one of the most efficient assets in the world. This could not have come at a better time with challenging margins faced throughout the industry.

“This could not have come at a better time with challenging margins faced throughout the industry.”

Which investors offer bid tape AOT programs so far?

Wells Fargo was the first to work with us on automating the assignment of trade tri party into our MCT Marketplace starting back in February. Amerihome and Penny Mac have also worked hard with us and they have their programs. I want to make clear that these programs are not just with MCT, but we’re very proud that these are automated in our platform.

Franklin American has also had a bid tape AOT program for over a year. Wells Fargo was the first one with us on automating the tri-party because of the scale we do. We have done a few of these with Citi. Freedom is also in a pilot program. There are a lot of others that are in process or interested as well.

Where are these bid tape AOT transactions conducted?

Bid tape AOT programs are supported in our MCT Marketplace. MCT Marketplace was born out of a need for security in bid tapes and moving away from emails. In this context, it’s provided a very good platform for us to work with investors to automate the AOT process. There are pieces like the tri-party and the transmission of the trade that are resource intensive and can also be problematic from a human error standpoint. We’re happy to say that we’ve automated the tri-party process with the investors listed. This is a program that is providing liquidity to the market at a very needed time.

Final Summary

Our hope is that investors and lenders can see it’s a win-win. This is a product that provides better execution for the lender without having to give up margins and makes you more competitive. There’s no question this bid tape AOT will truly dominate the market. We expect somewhere between 40-60% of our client’s production to be assigned in the coming six months.

The benefit here is providing the bid offer savings and cash flow advantages while preserving the pricing granularity. The process has to be automated. We want to be able to keep that efficiency and remove the human error from an accuracy and risk standpoint. This is an extremely valuable execution at an extremely important time.

About MCT Marketplace

MCT Marketplace is rapidly becoming the most talked about software tool in the industry. MCT Marketplace is connecting lenders and investors in a secure bid tape environment and streamlining many arduous tasks. This platform is now being used to automate the tri-party agreement between the lender, investor and broker/dealer in AOT transactions. This new functionality within MCT Marketplace is rapidly changing the best execution landscape.

Contact Our Team to Learn More

Interested in learning more about how bid tape AOT may impact your cash flow and execution? Contact us today for a one-on-one consultation with a secondary marketing expert.