MCT Delivers for Mortgage Originators, Investors, and Partners

Profitability

$505K

Avg. Client Savings in Previous Quarter

Efficiency

12 hrs

Saved per Month

Confidence

22 yrs

Trusted Service

Knowledge

200+

Articles & Webinars

A Better Market

72

2024 Software Enhancements

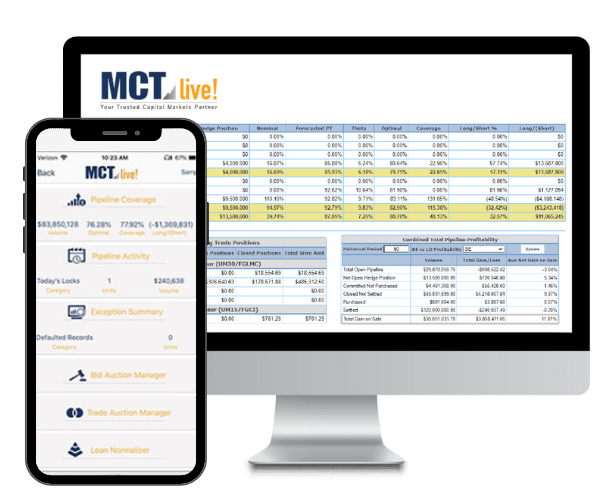

The largest provider of marketplace solutions for the secondary mortgage market

From architecting modern best execution loan sales to launching the most advanced marketplace for mortgage-related assets, MCT connects you with the collateral and counterparties you need.

%

Correspondent Sellers

%

Correspondent Buyers

%

Delegated Loans Sold

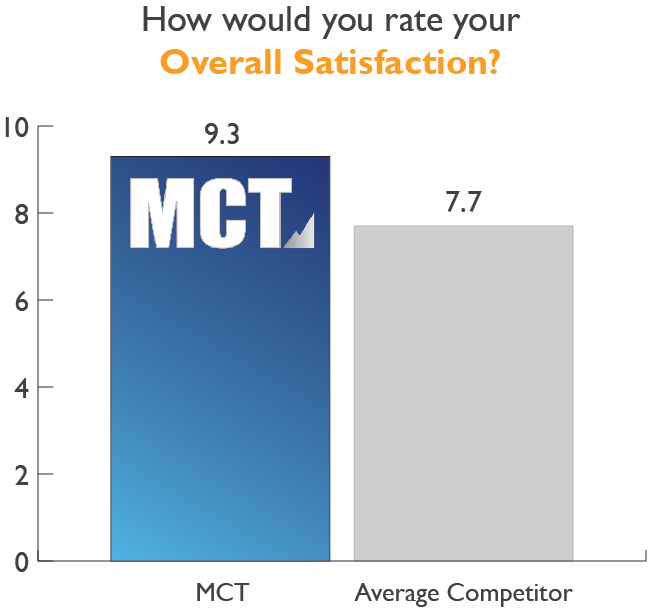

The mortgage industry’s top-rated partner for satisfaction and loyalty

When you need them, MCT experts are a click or call away – every time. And when not connecting directly, the MCT team is proactively monitoring your performance. That’s why our clients have consistently rated us as their top provider for satisfaction and loyalty.

Overall Satisfaction

Net Promoter Score

Schedule a Strategy Consultation