Mortgage Data & Analytics

Correspondent Lenders

Correspondent Investors

Zip Codes

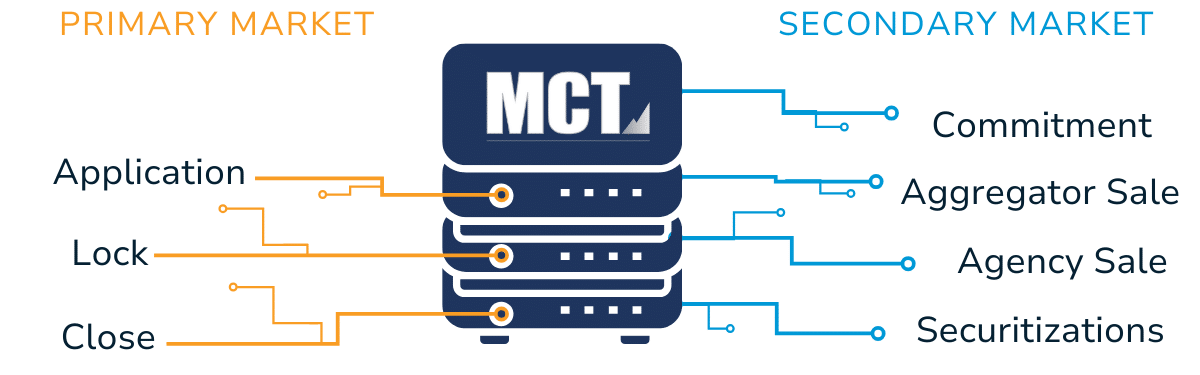

Mortgage Data Available Across the U.S. Secondary Mortgage Market

Learn more about how MCT aggregates mortgage analytics and provides access to indicative transactional mortgage data.

Representative Sample

According to investor partners, MCT represents between 22% and 30% of volume in the US secondary mortgage market.

Unique Data Types & Fields

Most data sources are limited to originations, MCT goes deep into the secondary market with commitment, purchase, and securitizations data.

Historical & Open Pipeline Data

Historical data includes the previous five years, while new lock and open pipeline data is available live to track the current market.

Broad & Diverse Network

MCT’s data is aggregated from over 50% of correspondent lenders, 95% of correspondent buyers, and spanning 33K ZIP codes.

Mortgage Data Potential Use Cases

Whether you’re performing risk analysis, forecasting market trends, or assessing a business opportunity, MCT is a one-stop shop for credible data.

Risk Management

- Assessing and managing interest rate fluctuations

- Identifying prepayment risks and credit risks

Pricing and Valuation

- Determining market value of MBS

- Informing investment decisions based on insight to accurate pricing information

Competitive Analysis

- Benchmarking rates, lock volumes, and secondary market activity against competitors

- Identifying areas for improvement and developing competitive strategies

Forecasting and Predictive Analytics

- Developing predictive models based on historical mortgage market data

- Forecasting future market trends and guiding decision-making

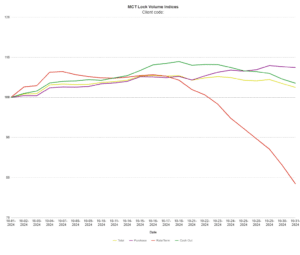

Did you know? MCT Publishes a Mortgage Lock Volume Index

MCTlive! Rate Lock Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type across a broad diversity of lenders from our national footprint. For further insights into the current mortgage market and the latest trends in lock volume, view the latest monthly lock volume indices report.

Lender Analytics

Improve Loan Sale Pickup

Track and improve performance actionable insights, investor rankings, and win rates.

Build Consensus Internally

Develop internal competence and increase decision-making autonomy.

Track Liquidity

Determine hedgeable product, manage risk, and be prepared to react quickly.

Mortgage Competitive Analysis

Analyze detailed performance reporting compared to your peer group.

Investor Analytics

MCT’s Investor Analytics provides unique reporting and visualizations designed to optimize correspondent pricing and build market share at the aggregate, lender, and loan level.

Investor Analytics Reporting & Features

- Summary Reporting, Opportunity Curves & Love/Hate Factor

- Slice & Dice by Lender, Region, Product, & More

- Interactive Web-Based Platform with 24/7 Access

Frequently Asked Questions

Explore common questions about mortgage data analytics, mortgage competitive analysis, and secondary market reporting.

How is mortgage pipeline data aggregated?

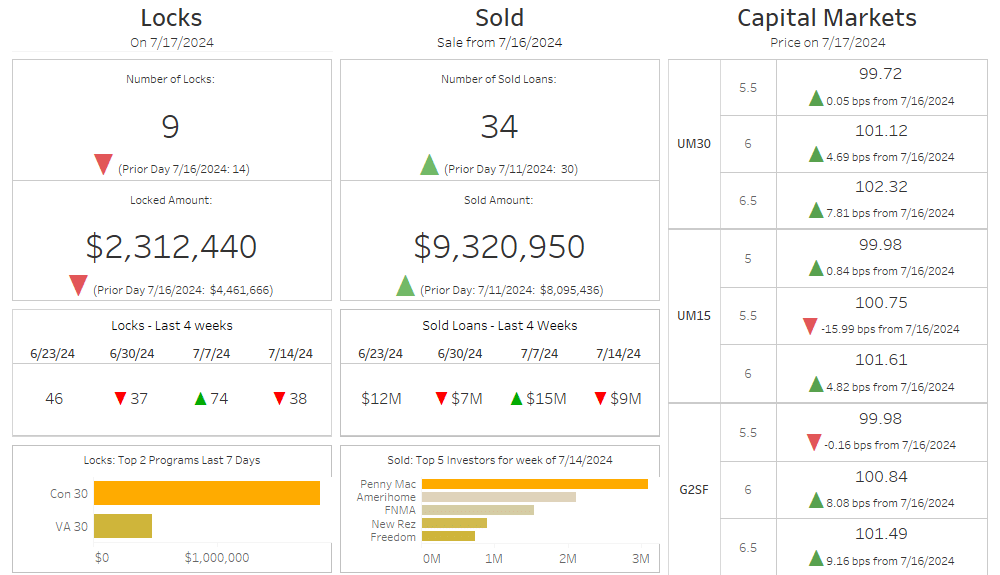

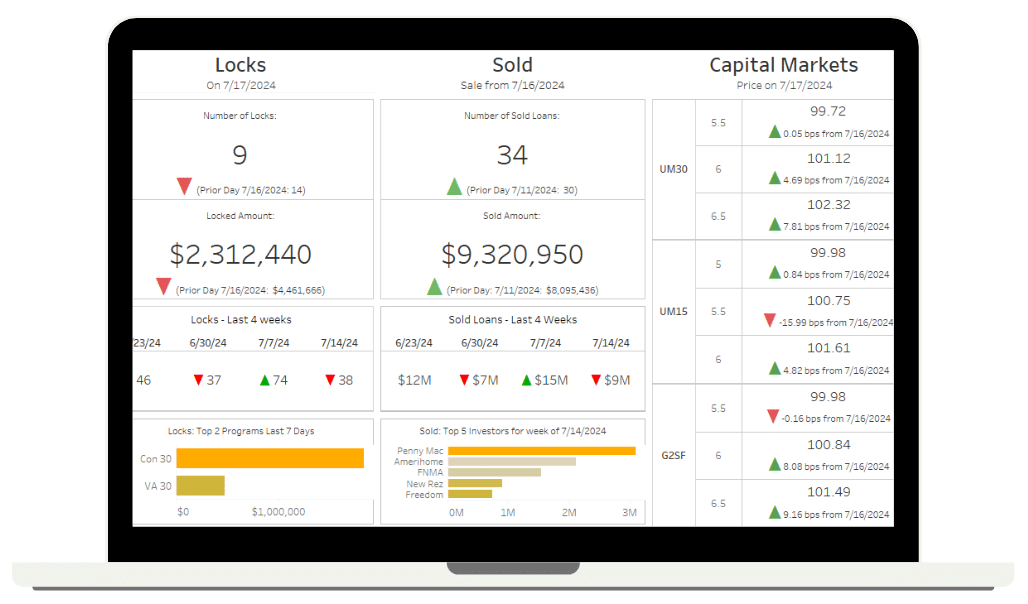

All locked, sold, and capital markets data is aggregated from the diverse MCT mortgage pipeline to give clients an in-depth view of their mortgage pipeline performance. This can be compared to peers for performance and benchmark reporting, along with best efforts to mandatory spread and agency versus aggregator comparison. All reports can be segmented and customized by Date, State, Program, Purpose, Rate, FICO, LTV, Loan Size, Peer Group and more! All peer data is anonymous.

How are mortgage data and analytics used to improve pipeline performance?

With access to reports like locked volume, daily locks, investor ranking, pricing by investor, and more, mortgage lenders can dive deep into the data for valuable insights to improve loan sale performance. Comparing pipeline performance to peers also unlocks valuable insights and opportunities to improve based on how others in your peer group are performing. By leveraging mortgage data analytics, mortgage lenders can optimize their loan sales, refine their front-end margin strategy, identify refi opportunities, and improve loan officer performance.

How should a mortgage lender begin evaluating their mortgage pipeline performance?

To get started, mortgage lenders should complete a detailed assessment of business workflows compared to your peers to ensure that you are executing at optimal performance. Reviewing your mortgage technology platforms should also be included in this review to achieve maximum return on investment. Then, monthly performance reporting should be implemented to ensure continuing success based on factors that are important to your business. This could include a review of loan sale best execution performance and investor report cards.