MSR Software &

Services

Take advantage of trusted, up-to-date, and efficient MSR valuation software and services from MCT to achieve your mortgage servicing rights portfolio goals.

%

MSR Services Growth

MCT’s MSR Services division has grown exponentially in 5 years.

Avg. Bulk Sale MSR Multiples

Bulk MSR sale clients are receiving a 5.5 average price multiple or better for the bulk packages.

Third-Party Valuations

Over 400 third-party valuations per year are distributed through MSRlive! ranging from $20MM to $70B.

Leverage Portfolio Valuations to Manage Your Asset

MCT’s MSR Valuation reports make it easy to monitor your MSR asset and provide insights that inform strategies to effectively manage your portfolio.

- Precise analysis and opinion of value

- Summary tables of major portfolio characteristics

- Sensitivity charts for key risk factors

- Monthly, quarterly, or annual MSR portfolio valuations available

- Recognized by regulators as satisfying requirements for third-party MSR valuation

1 Million Loans Valued in 10 Minutes

Faster valuations lead to better market reactions and time savings for other high-value activities.

+/- 200 Basis Points Market Effect Range

Run rate shock analysis to model and plan for the effect of market changes on your portfolio.

400+ Customizable Inputs & Assumptions

MSRlive! is the most transparent and highly customizable MSR valuation software on the market.

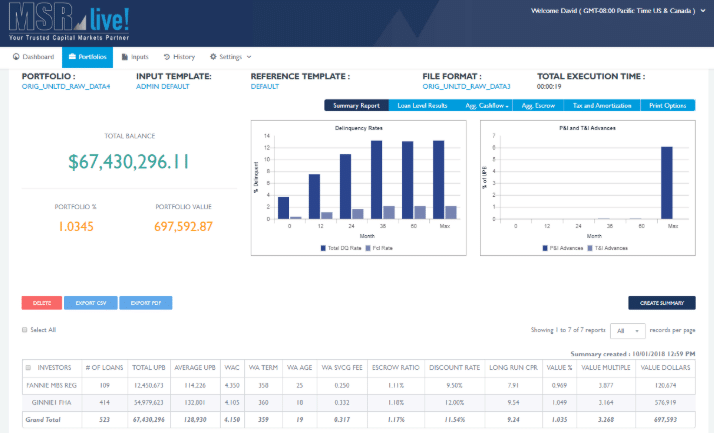

Fast, Customizable, On-Demand Valuation with MSRlive!

Discover the robust valuation, analysis, and forecasting power of MSRlive!, our cloud-based MSR valuation software.

With impressive processing speed, lenders can value their portfolio at 30 loans per second, customize a wide range of inputs, and analyze the effect of predictive market scenarios using this MSR valuation model. MSRlive! also supports multiple prepayment models including AD&Co.

Did You Know?

MSRlive! offers an API designed to arm mortgage investors with granular MSR pricing for their bidding purposes on a live, ongoing basis. Loan-level characteristics like location, FICO, LTV, and prepay scenarios are factored in to produce optimized pricing for each loan. Through superior modeling, the MSR buyer ensures they are not overpaying for these assets while improving the potential for favorable long-term profitability.

Improve Loan Sale Strategy with Enhanced Retain-Release Extension for Best Ex Analysis

MCT’s EBX solution provides real-time “live” loan level pricing from MCTlive! and MSR values from MSRlive!, equipping traders with important data for informed retain-release decisions.

- Precisely calibrate to your internal costs and yield requirements

- Adjust to account for the impact of MSR financing

- Adjust break even point to support strategic objectives

Prepare Your Portfolio

MCT will review the loans in your MSR portfolio and provide guidance to maximize returns and achieve your strategic objectives.

Collect & Evaluate Bids

MCT will evaluate the terms of the submitted bids, and advise relative to pros and cons, industry standards, objectives, etc.

Negotiate Contracts

MCT will review and negotiate the best terms for your servicing sale in order to accomplish your financial goals.

Reap the Strongest Return on Your Portfolio with MSR Brokerage Service

The decision to conduct a bulk MSR sale involves many variables including market rates, liability, asset size, note rate, and more.

MCT’s MSR brokerage team leverages technology, extensive industry experience, and a wide buyer network to ensure you get the most out of your hard-won MSR portfolio.

“MCT’s MSR team and expert resources were major contributors to us achieving the highest possible execution for our MSR sales.”

Learn More About Mortgage Servicing Rights

Frequently Asked Questions

Explore common questions about managing mortgage pipelines, optimizing profitability, and mitigating risk with our comprehensive hedging services and software.

What are Mortgage Servicing Rights (MSRs), and Why Are They Important?

MSRs are simply the right to service a mortgage loan, including collecting payments, managing escrow accounts, and handling customer inquiries. They are crucial because they generate ongoing revenue streams through servicing fees and can enhance a lender’s overall portfolio value.

As the secondary mortgage market continues to evolve, and as an individual lender grows, understanding and managing MSRs effectively is essential for maximizing profitability and optimizing capital allocation. By leveraging advanced MSR valuation and MSR brokerage services, lenders can make informed decisions that drive growth and enhance their competitive advantage.

Learn More: MSR 101: Reviewing MSR Principles, Advantages & Disadvantages, & Key Portfolio Valuation Drivers

How Does MSR Strategy Consulting and Network Services Work with MCT?

Mortgage Service Rights (MSR) clients have access to one-on-one MSR strategy consulting with MCT specialists to assist in your MSR portfolio management goals and are offered a robust network of subservicers and MSR financing institutions. The MSR team can also help with any questions around mortgage servicing rights valuation.

How can MCT’s MSR Valuation Services Benefit My Organization?

MCT’s MSR valuation services provide precise analysis and reporting, allowing your organization to understand the true value of your MSR portfolio. These services include mortgage servicing rights valuation with sensitivity charts for key risk factors and summary tables of major portfolio characteristics, enabling you to implement strategies that enhance your portfolio.

With monthly, quarterly, or annual valuations available, MCT ensures that your assessments meet regulatory requirements while maximizing your potential returns. Our expertise in MSR valuation helps clients navigate market complexities, ensuring informed decisions that align with their financial objectives.

Learn More: Why Choose MCT for MSR Services?

How Does MCT Support MSR Sales and Provide MSR Brokerage Services?

MCT provides comprehensive MSR brokerage services designed to simplify the selling process and maximize returns. Our multi-dimensional analytics integrate directly with your Loan Origination System (LOS), allowing for efficient review of your MSR portfolio. We assist in evaluating bids, negotiating contracts, and sealing deals, ensuring you receive the best terms for your servicing assets.

With a focus on personalized support and strategic insights from our MSR strategy consulting, MCT helps clients navigate the complexities of MSR transactions, ultimately saving time and enhancing profitability throughout the sales process.