Mortgage Pipeline Management: Hedging Service & Software

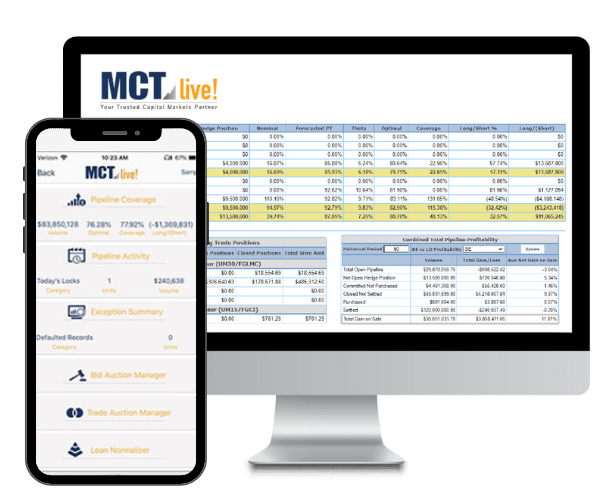

Manage loan pipeline risk, conduct electronic TBA trading, and optimize profit with our comprehensive capital markets platform, MCTlive!

Dollars/Year

BPS

BPS

Using MCTlive! for Optimal Mortgage Pipeline Management

1. Normalize and Sync Data 2. Analyze Pull-Through 3. Manage Pipeline and Report on Positions 4. Model Hedge Scenarios and Generate Recommendations 5. Trade TBAs Electronically 6. Review Reporting and Optimize Performance

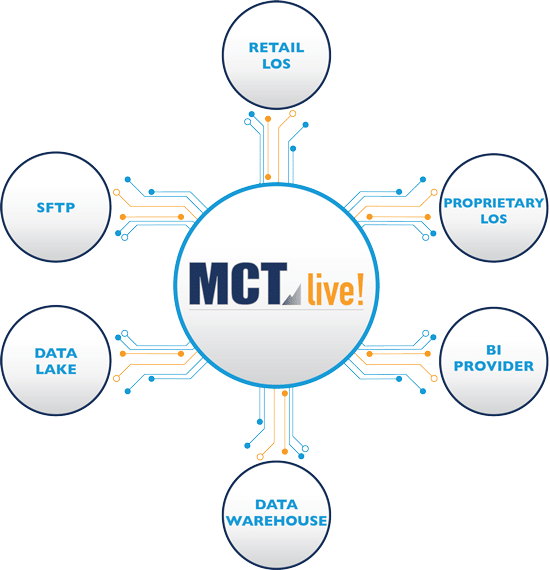

1. Normalize & Sync Data

Direct integrations enable easy setup, protect data integrity, and prevent labor-intensive rekeying. Machine learning and AI speed the process of translating and mapping your data. MCT flexes to your company’s needs and offers a wide range of options for connecting data.

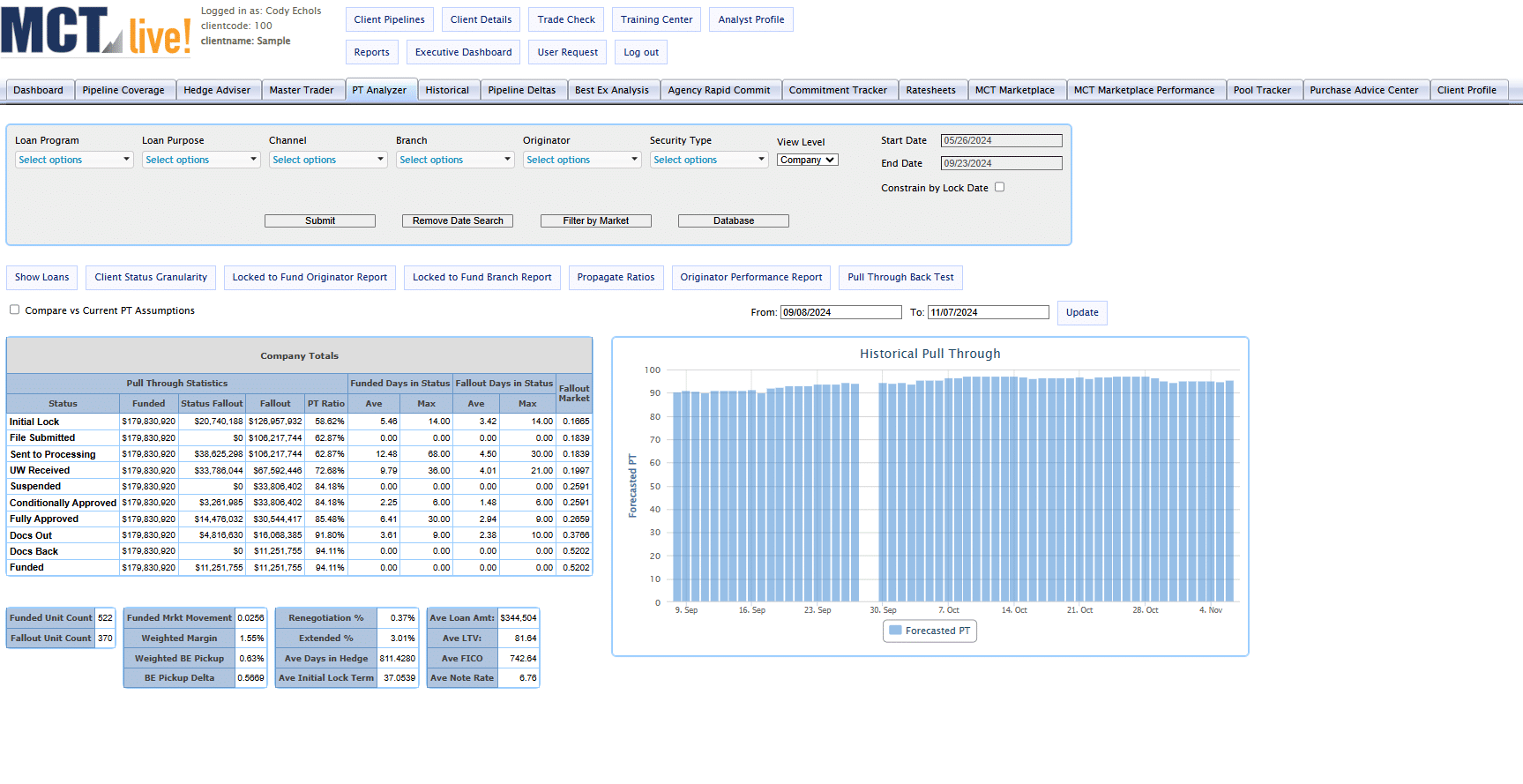

2. Analyze Pull-Through

Accurate pull-through forecasting is essential for successful hedging. Establish pull-through rates with historical regression analysis. Optimize pull-through over time with powerful reports and back-testing against historical data. Design your pull-through by:

- Program

- Purpose

- Status

- Channel

- Branch

- Originator

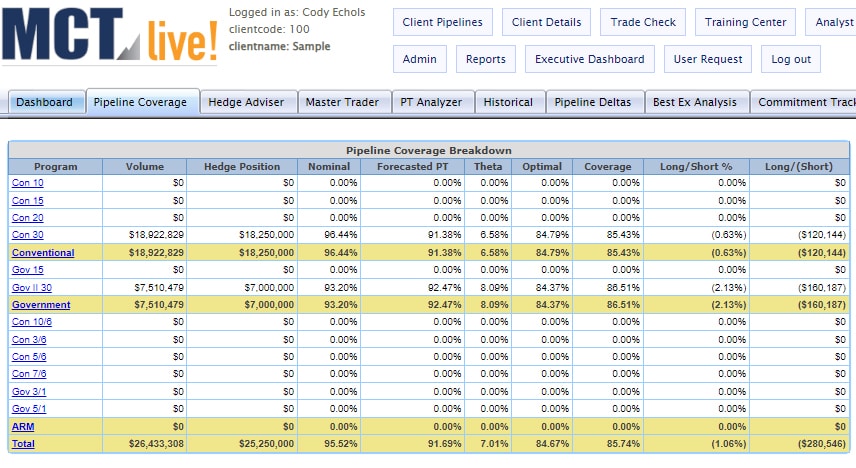

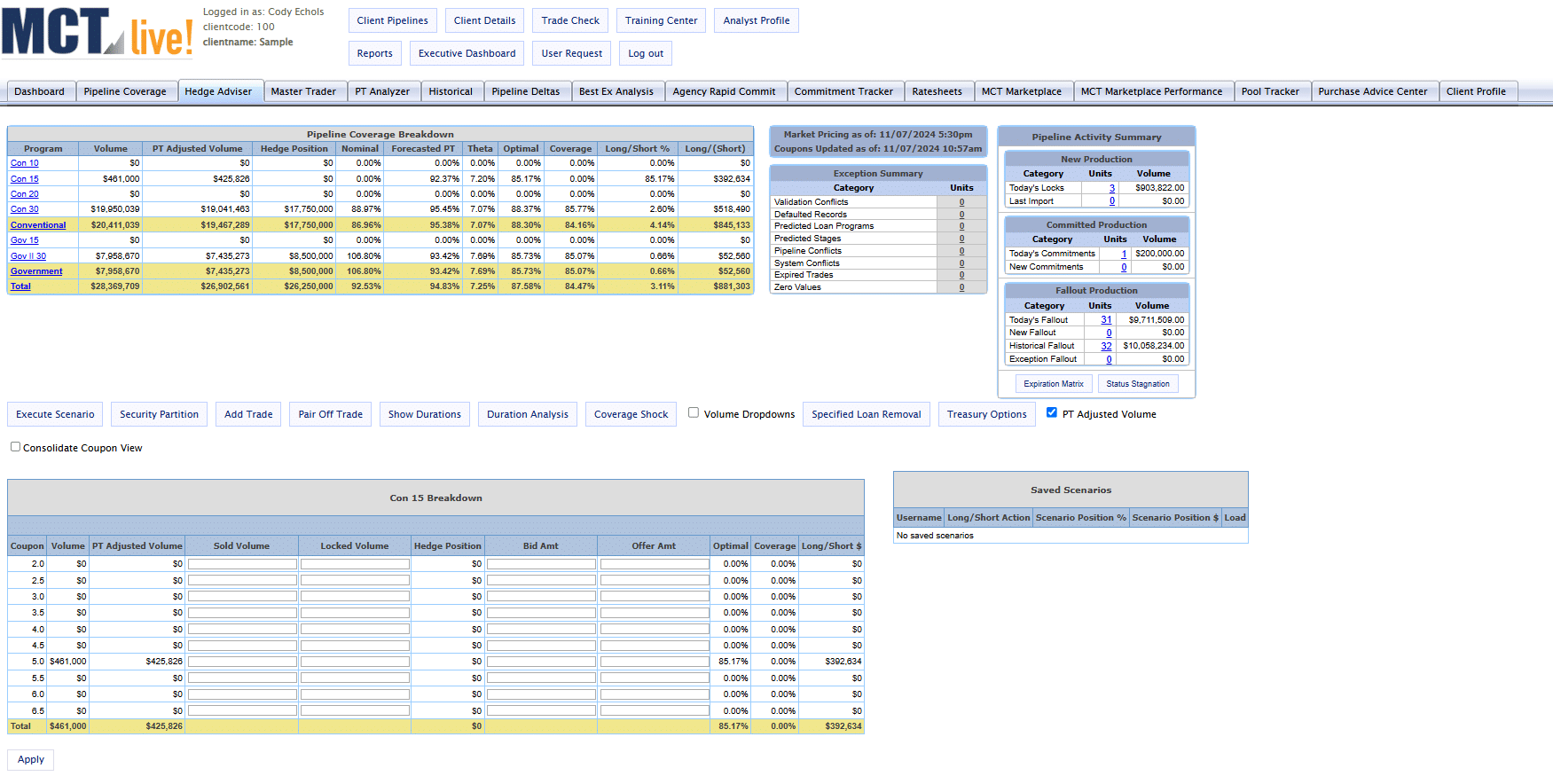

3. Manage Pipeline & Report on Positions

Easily view changes to your pipeline with the pipeline coverage dashboard to review your profitability, positions, and coverage at a glance. Take action to address missing data, stage stagnation, or changes to coverage needs within your pipeline.

- Overall position and profitability

- Segment by loan program

- Drill down to the loan level

5. Trade TBAs Electronically

MCT is the only hedge advisor with an embedded electronic TBA platform to conduct your trades, providing superior execution and efficiency compared to traditional phone-based trading.

With confidence in your hedge recommendations, get the best execution and save time on transactional phone calls for higher-value functions.

Average Pickup on Trades

%

Reduction in Transactional Phone Calls

6. Review Reporting & Optimize Performance

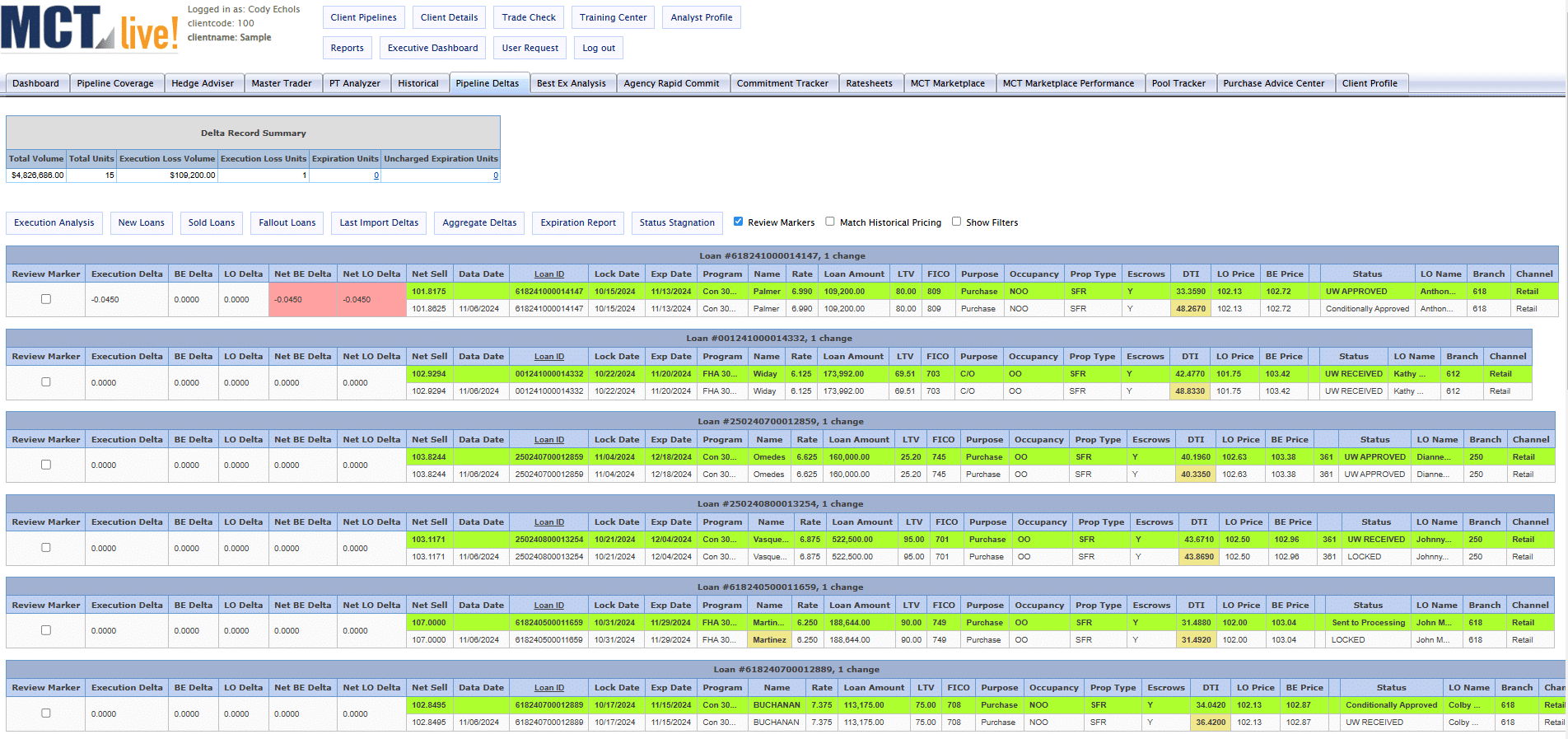

Automated reporting marks your pipeline and securities to current market pricing, available on demand or nightly with fully customizable distribution. Daily mark-to-market and monthly journal entries are generated for your accounting department thanks to accurate pricing and loan-level hedge costs.

Pipeline Deltas reporting enables you to attribute the specific changes to your pipeline or coverage that impacted your profitability, and how to optimize future performance.

Ready to Sell Loans at the Best Possible Price?

Sell with confidence knowing that MCT is the original pioneer of best execution loan sales. Evaluate every loan sale outlet and delivery method to identify your best execution. MCT Marketplace even brings in “hittable” shadow bids from a growing number of whole loan and servicing buyers. If you are selling or pooling loans, MCT Marketplace is the only platform you can trust to maximize your profits.

How Does MCT Compare to Other Hedge Advisors?

| Company 1 | Company 2 | Company 3 | Company 4 | |

|---|---|---|---|---|---|

| Loan Trading Exchange | ✓ | ✓ | |||

| Electronic TBA Trading | ✓ | ✓ | |||

| AOT Automation | ✓ | ||||

| Customized Spec Durations | ✓ | ✓ | |||

| Full Integration with GSE APIs | ✓ | ✓ | |||

| Mobile App | ✓ | ✓ | |||

| Cloud-Based Tech | ✓ | ✓ | ✓ | ||

| Client Success Group | ✓ | ✓ | |||

| AI-Enabled | ✓ | ✓ |

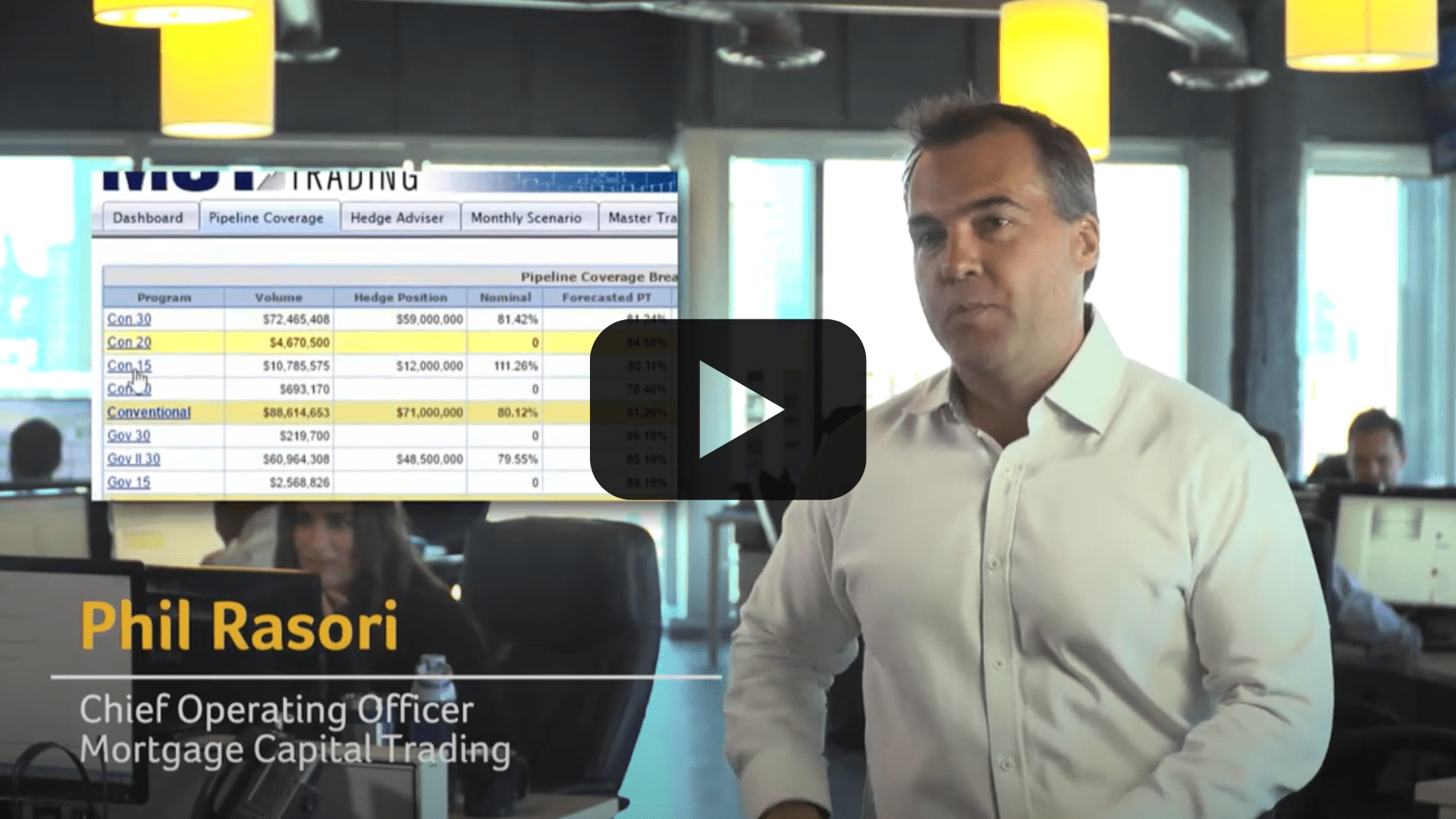

Atlas AI Powers First Live Hedge Recommendation

Watch Atlas, MCT’s generative AI advisor, make the first-ever AI generated hedge recommendation on a live mortgage pipeline.

Learn More About Mortgage Pipeline Hedging

Whitepaper

Frequently Asked Questions

Explore common questions about managing mortgage pipelines, optimizing profitability, and mitigating risk with our comprehensive hedging services and software.

What is Residential Mortgage Hedging?

Mortgage pipeline hedging is a risk management strategy used by mortgage originators to protect an asset from market fluctuations by taking an offsetting position in a similar asset.

Hedging a mortgage pipeline helps to manage the interest rate risk associated with the open mortgage rate locks and ultimately increase loan sale profitability.

Learn More: Mortgage Pipeline Hedging 101

What’s the Benefit of Moving to Mandatory from Best Efforts?

Mandatory delivery typically yields a major lift in loan sale profitability compared to best efforts. Lenders have historically experienced a 20 basis point pick-up on conventional volume and a 40 basis point pick-up on government volume. Note that a sound pipeline hedging strategy is essential to mitigate interest rate risk until the loan closes and can be confidently sold using a short-term mandatory commitment.

Learn More: Introduction to Mandatory Loan Sale Delivery

How Does Mortgage Hedge Advisory Work?

For full-service clients, your MCT trader interfaces directly with your secondary marketing professionals to create a daily cycle of disciplines for successful mortgage loan pipeline management with our mortgage hedging advisory services.

1. Lock – As prospective loans are locked with borrowers, your pipeline is automatically updated through MCT’s wide range of Loan Origination Software (LOS) integrations.

2. Coverage – Review and adjust your active hedge positions based on changes to your mortgage pipeline. Model your resulting position before you execute any trade.

3. Best Execution – As mortgages close, our industry-leading best execution analysis helps you select the optimal delivery method and destination according to your goals.

4. Report – Live and daily reporting supports transparency, optimization, and involvement for every stakeholder in your pipeline management.

Learn More: Mortgage Pipeline Hedging 201