MCT Rapid Commit for Fannie Mae

Clients of MCT can pull live note pricing and Servicing Marketplace® executions through an application programming interface (API). They can also deliver multiple commitments with one click through Rapid Commit within MCTlive!®, MCT’s award-winning best execution & loan pipeline management software. This integration has saved mutual clients on average up to 5 hours per month.* Lenders must be approved by Fannie Mae to utilize this service. MCTlive! is the first platform integrated with all available Fannie Mae Capital Markets APIs.

Features & Benefits | By the Numbers | Featured Case Studies | Technology Updates

Integration Features

Pull live note pricing and Servicing Marketplace® executions.

Deliver multiple commitments with one click

Access MCT Marketplace and Rapid Commit™ all from within MCTlive!®

Integration Benefits

Streamline pricing to improve accuracy and speed of execution — no more manual processes

Run preliminary loan analysis to determine whether loan is eligible for sale to Fannie Mae

Intelligently analyze loan characteristics to help you develop a product-specific best execution strategy

With Rapid Commit, lenders can automate Fannie Mae loan pricing and commitments with intelligent best execution capabilities through APIs. This technology pairs with MCT Marketplace to easily price and commit loans to Fannie Mae. With a few short clicks, lenders save time and reduce data errors with MCT’s Rapid Commit technology.

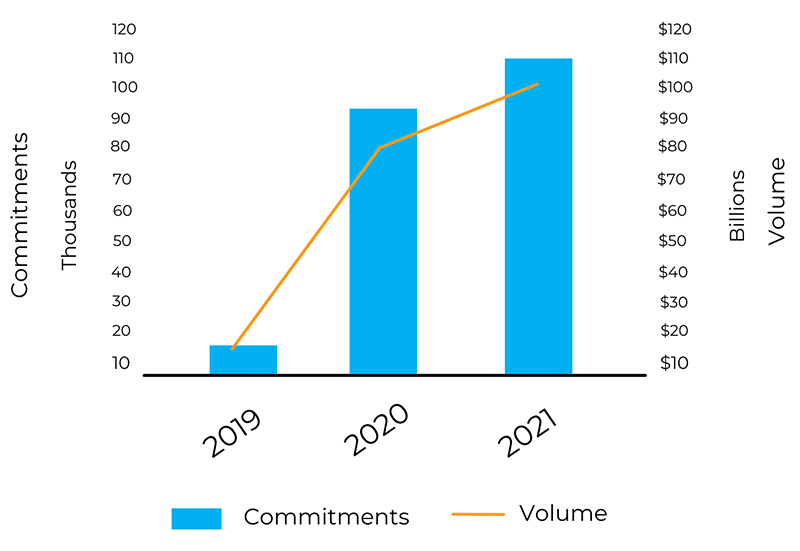

By the Numbers – MCT Clients Experience the Benefits of Fannie Mae Integrations

Our clients are increasing their usage of the integration and seeing the benefit. Highlights include:

- Volume: From 2019 to 2021, these efficiencies helped contribute to a 609% increase in volume through Rapid Commit, from $14.75 billion to $104.65 billion in just two years.

- Commitments: The growth in commitments reflects the benefit of Rapid Commit as well a 552% increase in volume that this functionality has contributed from 16,771 commitments in 2019 to 109,398 commitments in 2021.

MCTlive! and Rapid Commit are helping Ruoff Mortgage improve their best execution strategy while boosting efficiency in their loan sale process. MCT also works closely with Mr. Cassetta to ensure his experience with the technology meets the goals of the company.

MCTlive! and Rapid Commit are helping Ruoff Mortgage improve their best execution strategy while boosting efficiency in their loan sale process. MCT also works closely with Mr. Cassetta to ensure his experience with the technology meets the goals of the company.

Featured Quote: “I load it up, push a button, and within minutes they’re all committed. 54 loans, 12 different commitments, less than 3 minutes. Before Rapid Commit this process would have taken me 15-20 minutes.” – Jeffrey Cassetta, EVP, Chief Capital Markets Officer at Ruoff Mortgage

In this case study, Mr. Stringer explains how he leveraged MCTlive!®, MCT Marketplace, and Rapid Commit® to improve loan sale pickup and operational efficiencies. Read the “At a Glance” section for quick details or the full interview further below.

In this case study, Mr. Stringer explains how he leveraged MCTlive!®, MCT Marketplace, and Rapid Commit® to improve loan sale pickup and operational efficiencies. Read the “At a Glance” section for quick details or the full interview further below.

Featured Quote: “MCT Rapid Commit has saved me time and kept me from making potential mistakes. It also takes just seconds compared to before, when it would take me 20 minutes with three or four different commitments.” – Andrew Stringer, First Bank

Rapid Commit for Fannie Mae: Technology & Integration Updates

MCT has dedicated resources to integrate with all available Fannie Mae technology. In fact, MCTlive! is the first platform integrated across all available Fannie Mae Capital Markets APIs. Review the timeline of integration updates below or view the full press release for additional information.

March 11, 2022

MCT announces new integration with the Fannie Mae Connect™ Whole Loan Purchase Advice Seller API, allowing Mark-to-Market and Hedge Accounting Reports to be updated with Fannie Mae purchase data instantly.

September 26, 2019

MCT becomes the first organization to complete integration to the full suite of Fannie Mae’s Pricing & Execution – Whole Loan® APIs. The integration to Fannie Mae’s Manage Commitment API allows lenders to pair off, extend, and modify existing commitments directly within MCTlive!

January 23, 2020

MCT proudly announces that on December 18th they became the first organization to connect lenders to Fannie Mae’s Loan Pricing API via its MCT Marketplace loan trading platform.

November 7,2017

MCT announces the release of new online functionality that automates the process of product selection for MCT’s lender clients as well as their delivery of loan commitments directly to Fannie Mae.

*Average time savings data reported by MCT clients 2019 to 2021.

Servicing Marketplace® and Pricing & Execution – Whole Loan® are registered trademarks of Fannie Mae.

MCTlive!®, MCT Marketplace, and Rapid Commit™ are registered trademarks of MCT.

Meet With Us to Learn More

"(Required)" indicates required fields