Press Releases from MCT

Stay informed with our press releases, highlighting key announcements, achievements, and news shaping our story.

Filter By Solution

Filter by Topic

Filter by Learning Level

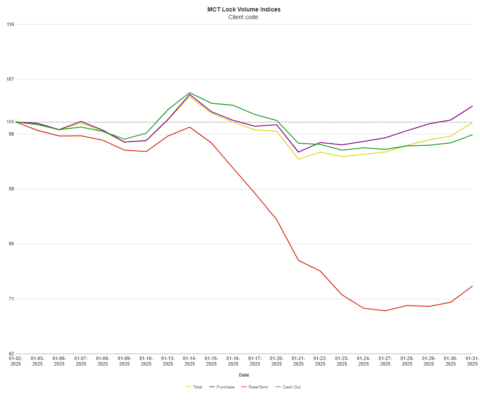

MCT reports June purchase lock volume held nearly flat, signaling steady housing demand amid high rates, as refis drop sharply due to rate volatility.

MCT’s Atlas AI becomes first generative AI to inform a live hedge execution, marking a groundbreaking step in AI-driven mortgage capital markets technology.

MCT’s May Lock Volume Indices show flat mortgage activity amid market volatility, with rate/term refis down 13% and total volume up 11% year-over-year.

MCT and Calyx launch enhanced, no-cost API integration to streamline data flow, empowering mortgage lenders with faster, more customizable connectivity.

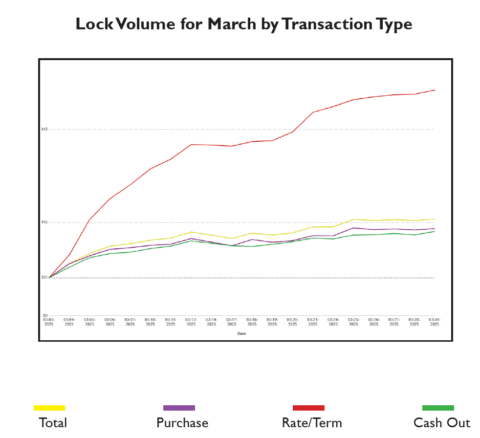

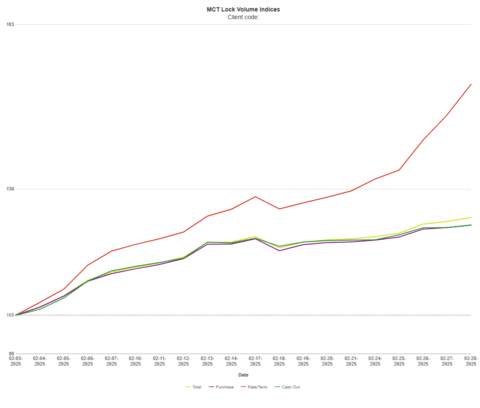

MCT reports a 17% rise in mortgage lock volume as early homebuying strengthens amid tariff concerns, low consumer confidence, and rising recession risks.

Jointly developed Loan Pricing API delivers more granular, transparent pricing for mutual clients by combining various price factors and utilizing a broader set of data (…)

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared (…)

MCT launches Atlas, a generative AI advisor in MCTlive! platform providing mortgage lenders instant access to capital markets expertise while maintaining the highest standards of (…)

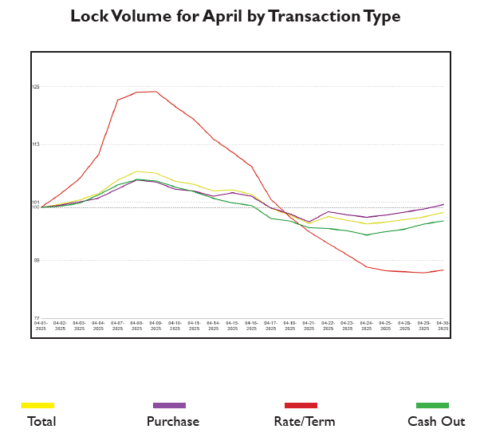

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared (…)

MCT earns spot on HW Tech100 list, recognized for capital markets technology that generated $136M in additional lender earnings through advanced analytics and automation.

MCT and MeridianLink announce enhanced API integration for mortgage lenders, improving data flow speed and control while reducing origination costs through automated processes.

MCT launches MSRlive! 4.0, enhancing its MSR valuation platform with advanced portfolio analytics and transparency features, giving mortgage servicers deeper insights into valuation drivers and (…)