San Diego, CA – September 5, 2025 – Mortgage Capital Trading ® (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the release of its September Lock Volume Indices, showing mixed performance across segments as markets anticipate Federal Reserve policy changes.

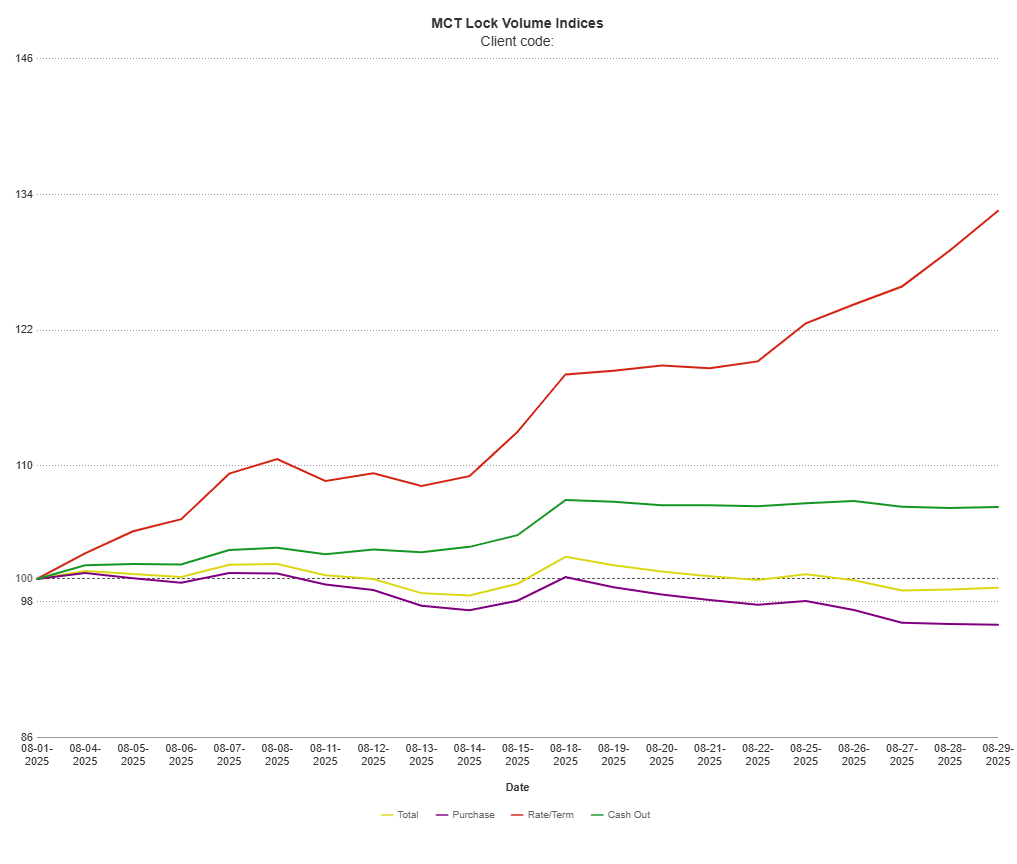

According to MCT’s data, lock volume trends for August 2025 showed some volatility, with a significant increase in rate/term refinancing month-over-month:

Month-over-month:

- Total lock volume: 0.78% decrease

- Purchase locks: 4.04% decrease

- Rate/term refinances: 32.56% increase

- Cash-out refinances: 6.35% increase

Year-over-year:

- Total lock volume: 5.32% increase

- Purchase locks: 5.35% increase

- Rate/term refinances: 14.52% decrease

- Cash-out refinances: 26.73% increase

Download MCT September Indices Report

The dramatic surge in rate/term refinance activity highlights the volatility inherent in smaller market segments, where modest volume changes can create significant percentage swings.

“It’s amazing how volatile the rate/term segment can be,” said Andrew Rhodes, Head of Trading at MCT. “It shows just how much volume we’re doing in it. A little bit moves the bucket significantly.”

Rhodes noted that the mortgage-to-treasury spread has returned to its lowest position since last September, creating a setup for potential market volatility following anticipated Federal Reserve action.

With Friday’s Non-Farm Payroll report showing only 22,000 jobs added, well below expectations, market sentiment has shifted regarding the Fed’s September 17th meeting.

While a 25 basis point cut remains the market favorite at 87% probability, futures now reflect a 12% chance of a more aggressive 50 basis point reduction. The weaker-than-expected employment data provides additional consideration for Fed policymakers and has contributed to bond market gains, with MBS prices up approximately 10 ticks on the day.

“When there’s potential for volatility, the key is to stick to basics,” Rhodes explained. “Stay conservative in your interest rate exposure position, follow your policies and procedures, and maintain disciplined risk management.”

The monthly decline in purchase activity reflects ongoing market adjustment, with annual purchase growth of 5.35% showing modest stability. However, rate/term refinances present a contrasting picture with a 32.56% monthly surge despite declining 14.52% annually.

Rhodes attributes the evolving market dynamics to borrowers adapting their expectations to current market realities rather than waiting for rates to return to previous lows.

“People are getting used to where we’re at with rates and appraisal values,” he said. “The buyer mindset is shifting toward acceptance that this is what the market looks like now.”

Looking ahead, Rhodes believes the Fed is likely to proceed with a rate cut, though the magnitude will be influenced by the jobs data miss and upcoming economic data prior to the meeting. He anticipates the market will remain range-bound until the Fed meeting, with potential for more consistent movement following policy action.

MCT remains committed to delivering expert guidance and data-driven insights. MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net