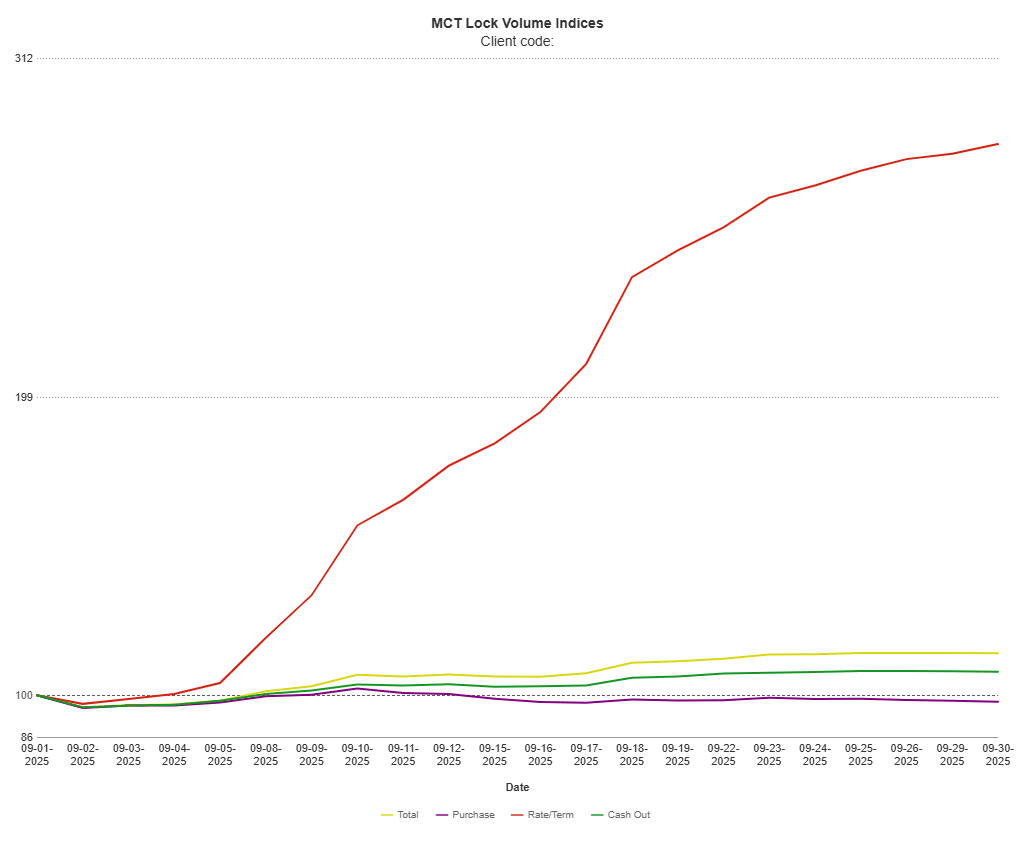

San Diego, CA – October 9, 2025 – Mortgage Capital Trading ® (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the release of its October Lock Volume Indices, showing significant growth driven by rate/term refinance activity as markets navigate Federal Reserve policy decisions amid the government shut-down.

According to MCT’s data, September demonstrated strong momentum with total lock volume up 14.03% month-over-month and 13.42% year-over-year.

The surge was driven primarily by rate/term refinances, which exploded 183.54% monthly as borrowers capitalized on the approximately 0.2% drop in mortgage rates that preceded the Fed’s September meeting.

“When rates drop, people see the opportunity to lock in a better rate and go after it,” said Andrew Rhodes, Head of Trading at MCT.

“We saw this same pattern in September of last year during a significant rate decline, and it’s playing out again.”

Download MCT October Indices Report

With the ongoing government shutdown preventing the release of key Bureau of Labor Statistics employment reports, the Federal Reserve faces its upcoming policy decisions with limited economic visibility. However, Rhodes believes this won’t derail the Fed’s rate cut trajectory.

“Without data, they’re going to stick to the consensus of what they already decided,” Rhodes explained. “They were already leaning towards three cuts for the year — September, October, and December. I think they’re going to continue on that path, which means 25 basis points in October and likely another 25 in December.”

Rhodes emphasized that even when government operations resume, the timing of data releases means the October Fed meeting will proceed without September employment figures. December’s decision could be influenced by October and November jobs data, if available in time.

“All other things being constant, if the jobs number come in better than expected, they’ll continue with the path,” he said. “If they come in worse than expected, there could be some conversation around whether to pause or adjust the approach.”

Despite a modest monthly decline in purchase locks, the segment maintains nearly 6% annual growth, reflecting continued market stability. Rhodes noted that if rates continue trending downward into year-end, winter months could see stronger activity than typical seasonal patterns, potentially setting up a strong early spring for the mortgage industry.

Despite uncertainty from the data blackout, Rhodes advised lenders to maintain disciplined risk management practices and avoid overreacting to market conditions.

“Stay the course and stick to your policies and procedures,” he said. “This round of cuts in the cycle could lead to more volatility, but the September cut has been pretty subdued. Hopefully that leads to more consistent performance through the end of the year.”

The market currently has two additional rate cuts priced in before year-end, with MBS prices sustaining around 101 on front-month coupons, a level Rhodes views as solid given current conditions.

MCT remains committed to delivering expert guidance and data-driven insights. MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net