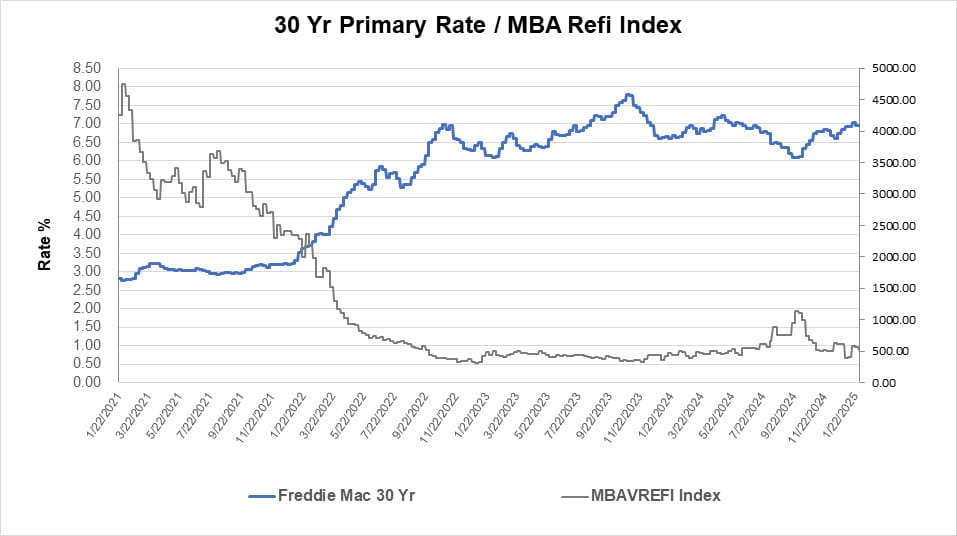

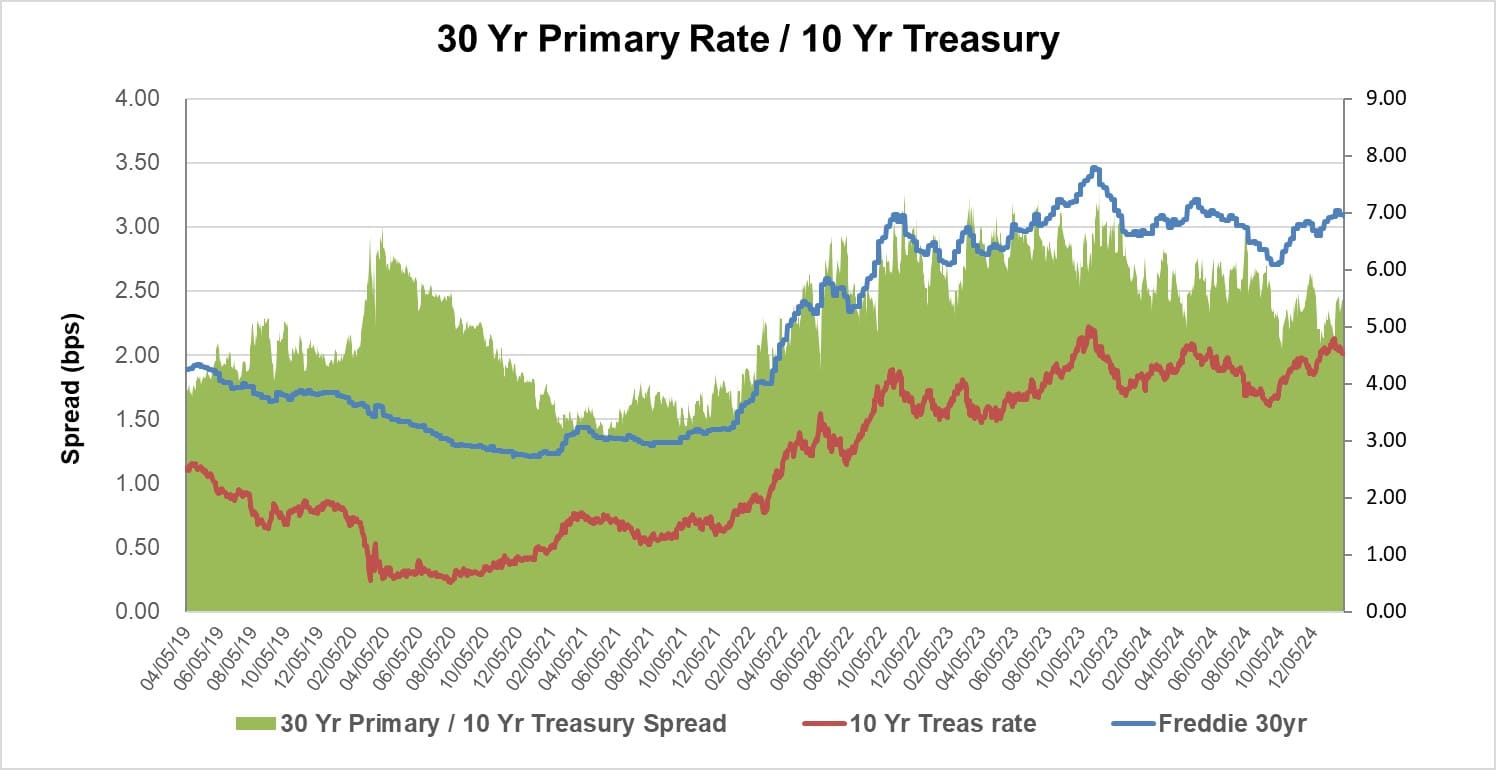

The Fed has decided not to cut the overnight rate in its recent FOMC meeting and has announced that it will pause further rate changes until the new administration presents its economic policies. Such measure was expected by the financial markets. The 10 Years Treasury rate has remained around its highest level in over a year at around 4.50% since the Fed’s December FOMC meeting. A new level of uncertainty now clouds the mortgage industry’s earlier optimistic outlook but remains hopeful about the overall rate direction during 2025. Many financial markets participants still expect mortgage rates to drop below 6.50% during the second half of 2025, barring any economic or political surprises.

On the brighter side of MSR news, mortgage servicing rights values have held steady and have recovered most of the losses that MSR portfolios experienced during Q3, 2024. The overall MSR losses during that period averaged between eight and ten (8-10) basis points. Since September 30, 2024, MSR values reflected steady increases in values month after month closing the year in a strong fashion and regained all the losses back, and in some cases even more. As we analyze January 31, 2025 portfolios, we expect MSR values to reflect a total recovery from September 30, 2024 value loss. However, we do anticipate that fair values will remain relatively flat from December 31, 2024 mark since most rate indices have remained relatively unchanged since the end of the year.

Loan production volume continued its decline after mortgage rates rose in December in addition to the seasonality impact on mortgage applications. New mortgage applications and refinancing are expected to remain low during Q1, 2025. The current SRP prices for new origination should remain as strong as they currently are as aggregators continue to purchase as many loans as possible just to maintain their book of business and market share. Many aggregators are still hoping to gain from any refinancing activity through their recapture channels which many remain optimistic that 2025 will be that year.

On the bright side, the Non-QM, HELOC, and second mortgages originations closed out the year with solid foundation heading into 2025, as many borrowers opted (for different reasons) for alternative mortgage financing. That market segment continues to expand at a double-digit rate of increases on quarterly basis and there is no slowing down in site. Many investors are entering this market and are encouraging lenders to produce such loan products. The demand is on the rise and should remain so during 2025.

Mortgage prepayments, though historically very low, continue to reflect steady and persistent upticks across all vintages. Aside from the seasonality effect, the trend continues in its upward direction. Delinquencies also continue in their upward trend as borrowers struggle with their rising debt and higher property taxes and insurance.

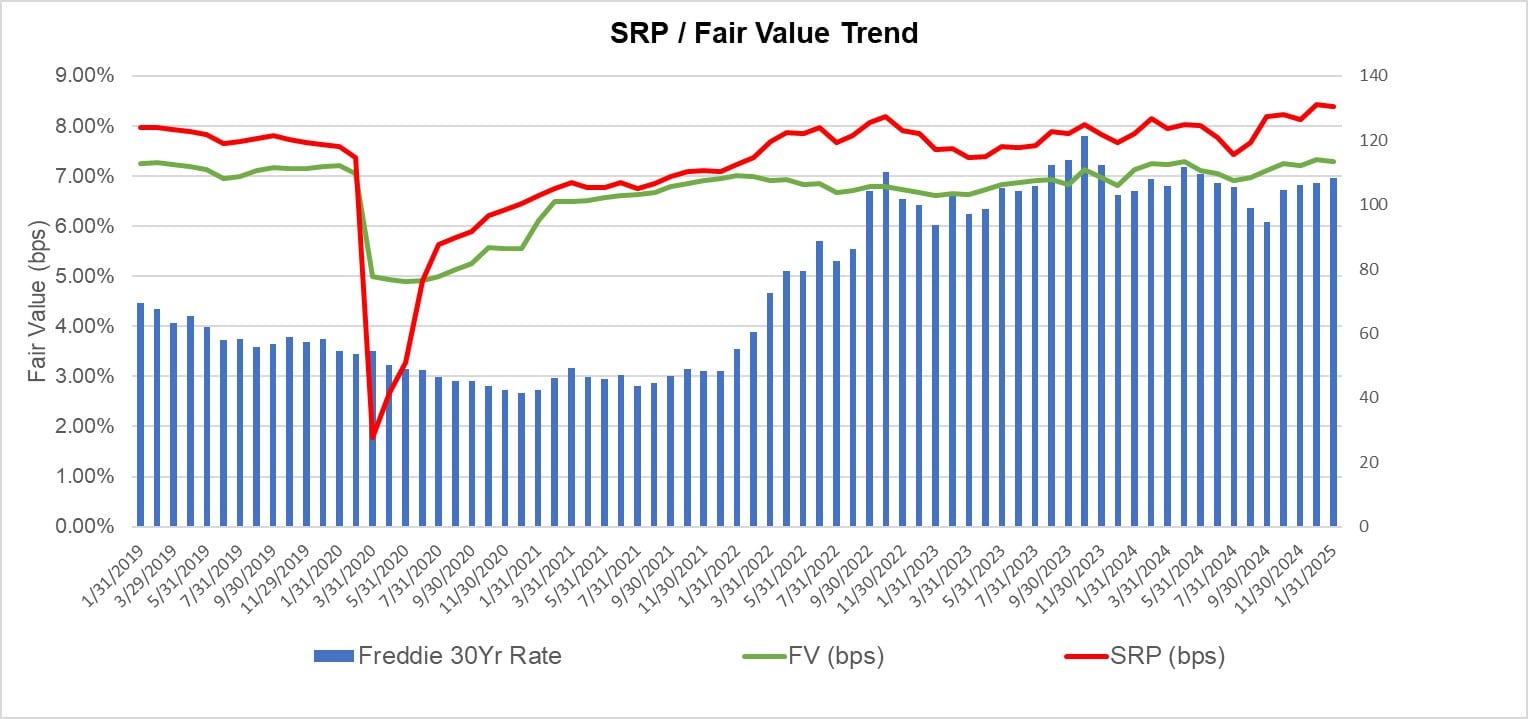

New Production Value Trends:

Current servicing release premiums (SRP) remain very strong and provide lenders with the opportunity to sell directly to aggregators rather than retain the servicing. MCT continues to observe that many lenders are now opting to retain more MSR rather than selling most of their production on a released basis to build up their existing MSR portfolios. Aggregators continue to offer very competitive prices that are hard to resist. Co-issue price levels and market share reflect the current mortgage rates situation. Co-issue usually loses its appeal among buyers when mortgage rates are elevated.

Current SRP values remain about 11-15 basis points higher than fair values, though, that spread has leveled off since December 2024. We expect the trend to continue into the foreseeable future. We continue to advocate for caution when capitalizing new MSR production at moderate price levels as the market navigates current mortgage rates uncertainties. We will continue to monitor and advise accordingly through our weekly fair value based MSR grids.

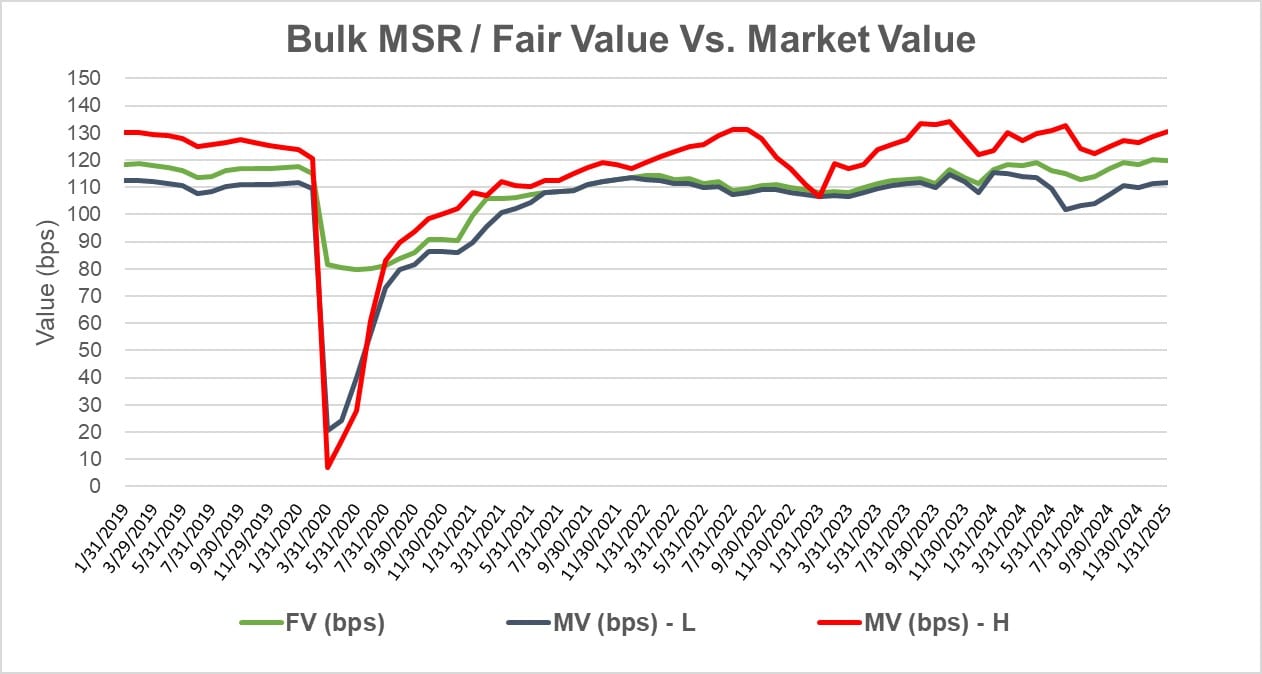

MSR Bulk Market:

Bulk MSR values seem immune to mortgage rates volatility. Bulk MSR values remain strong as many buyers, including many new investors, remain aggressive in their MSR buying strategies. The demand for MSR remains strong and market value remains very competitive due to the low MSR supply, and persistent low production volume dominates the landscape.

The number of bulk MSR trades has declined during the second half of 2024, compared to the first half of the same year. We anticipate the Bulk MSR market to remain healthy as many MSR owners are weighing different strategies to maximize the value of their MSR holdings. We are optimistic about bulk MSR prices to be robust and strong in the foreseeable future as demand for MSR persists. Recent bulk MSR trading values continue to reflect levels of 5.0x – 5.50x multiples of servicing fees for agency loans.

Non-QM and Second Mortgages Trends:

Non-QM and second mortgage originations continue to increase and dominate mortgage loans production as more institutional investors and new lenders enter this market. Investor demand for such products continues to rise as traditional agency loan products remain low.

We anticipate growth in these product segments to continue throughout the coming year. MCT continues to observe robust origination volume within these two segments, including fair values, depending on portfolio characteristics

The underlying fair values and demand for such products are very competitive; non-QM MSR products fair values are between 4.00 – 4.50 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30 – 3.25 as more high balance loans are being produced. Some lenders are offering closed-end second mortgages with balances as high as $500 K.

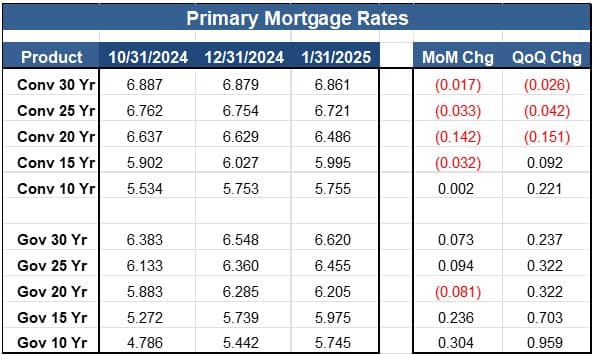

Mortgage Rates:

As of January 31, 2025, the current 30 Year base mortgage rate is 6.8614%, which represents about 1.70 basis points decrease from December 30, 2024, mark. We anticipate existing portfolio fair values to remain relatively unchanged or slightly lower by about 1-2 basis points from their December 31, 2024, mark, depending on the underlying portfolio characteristics and vintages.

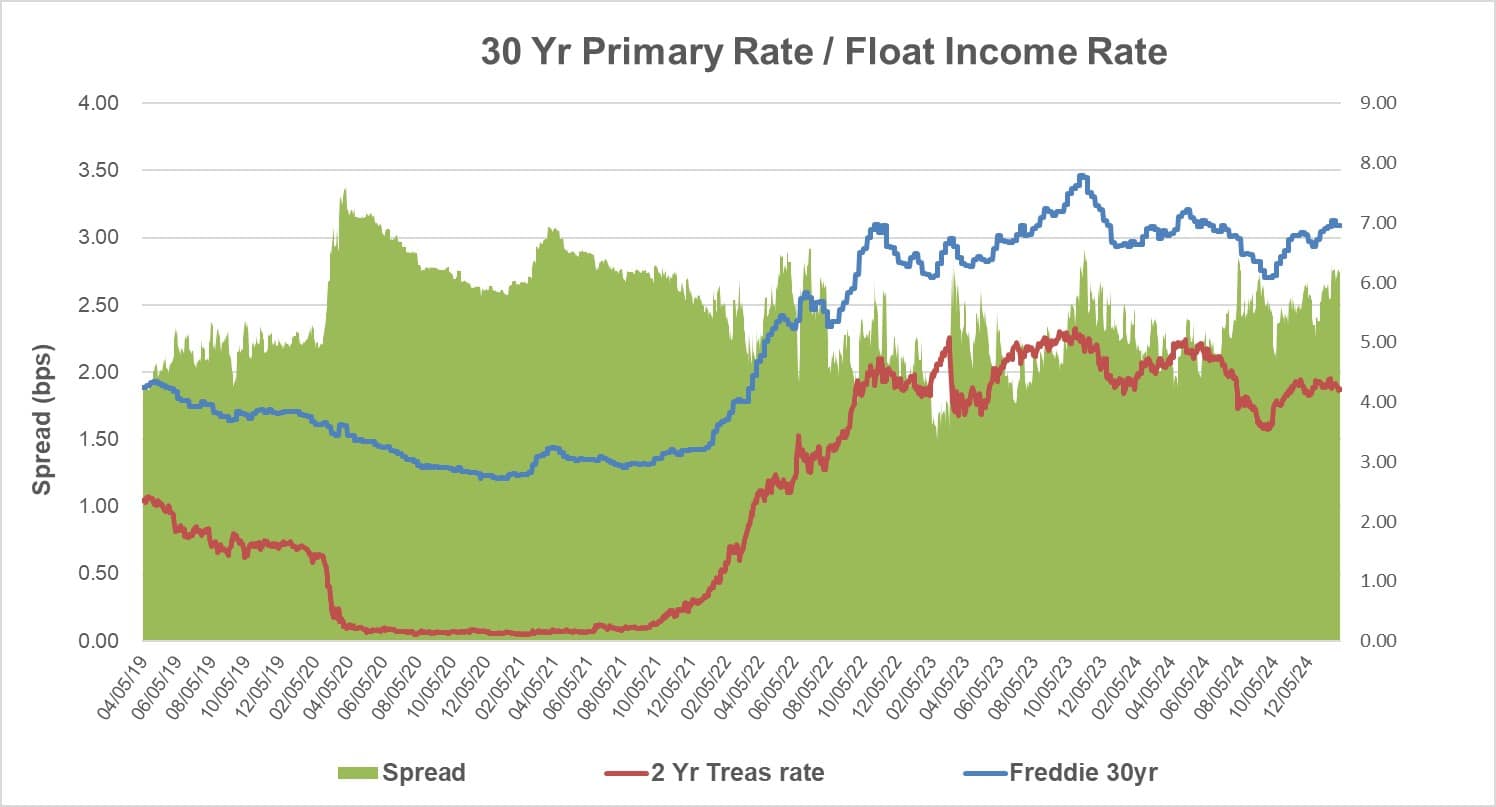

Escrows and Float Income:

Mortgage escrow values remain robust and should continue to buoy overall MSR values. It is the second largest contributor to the overall MSR value as float income rates remain high. Property values are expected to rise during 2025 by about 4%-5% which could lead to higher borrowers’ monthly tax and insurance payments. Though that would be beneficial for MSR values, it increases borrowers’ default risk.

Float income rates have remained relatively unchanged since December 31, 2024, which will result in immaterial MSR value changes derived from mortgage escrows. The current float income rates range between 4.157% - 4.201%.

Rates Indices:

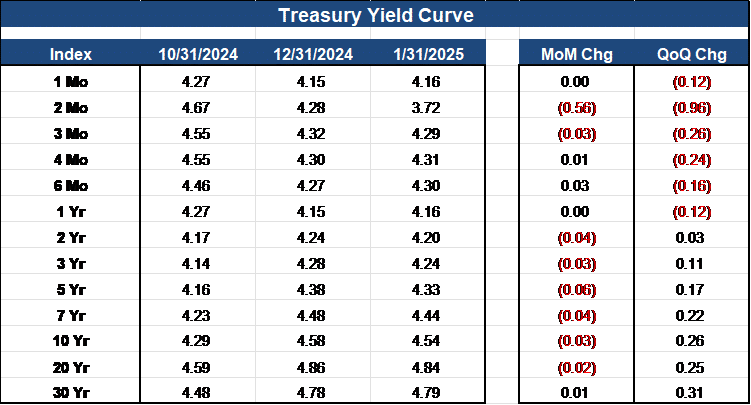

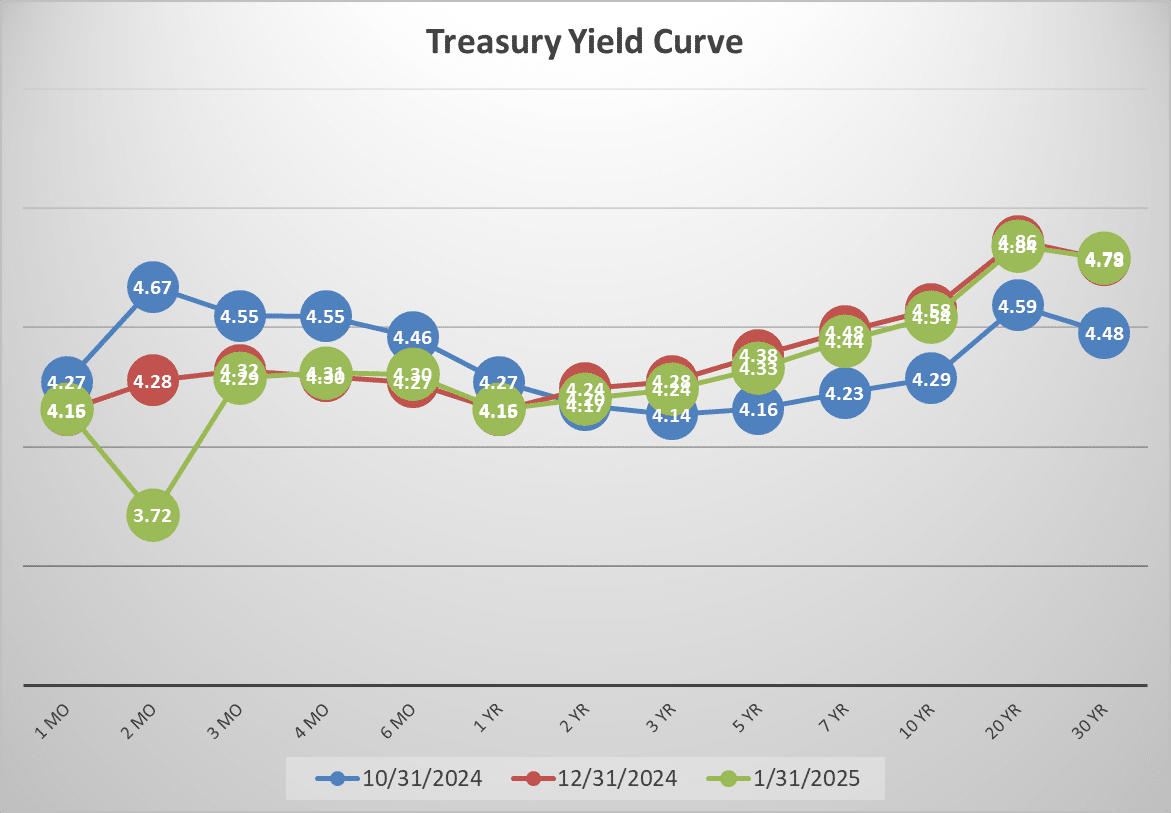

The treasury yield curve is becoming less inverted; However, it is relatively flat compared to Q3, 2024 as the financial market navigates the political and economic direction of the new administration. The yield curve continues to reflect financial market nervousness and the Fed’s next steps to combat inflation and managing rates.

The spread between the 10 Year Treasury rate and the 30 Year Primary mortgage rate has been tightening since Q3, 2024 and has been on a downward trend since Q4, 2023. The current spread stands at 241 basis points compared to 278 basis points compared to a year ago. The current spread remains higher than the normal level of about 170 basis points.

Fair Value Guidance:

Our estimate of the fair values for existing portfolios should remain relatively unchanged or decline slightly by 1-2 basis points from December 31, 2024, marks, depending on portfolio characteristics.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between 0 to -1 bps change from December 31, 2024, marks.

- Government loans between 0 to -2 bps change from December 31, 2024, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net