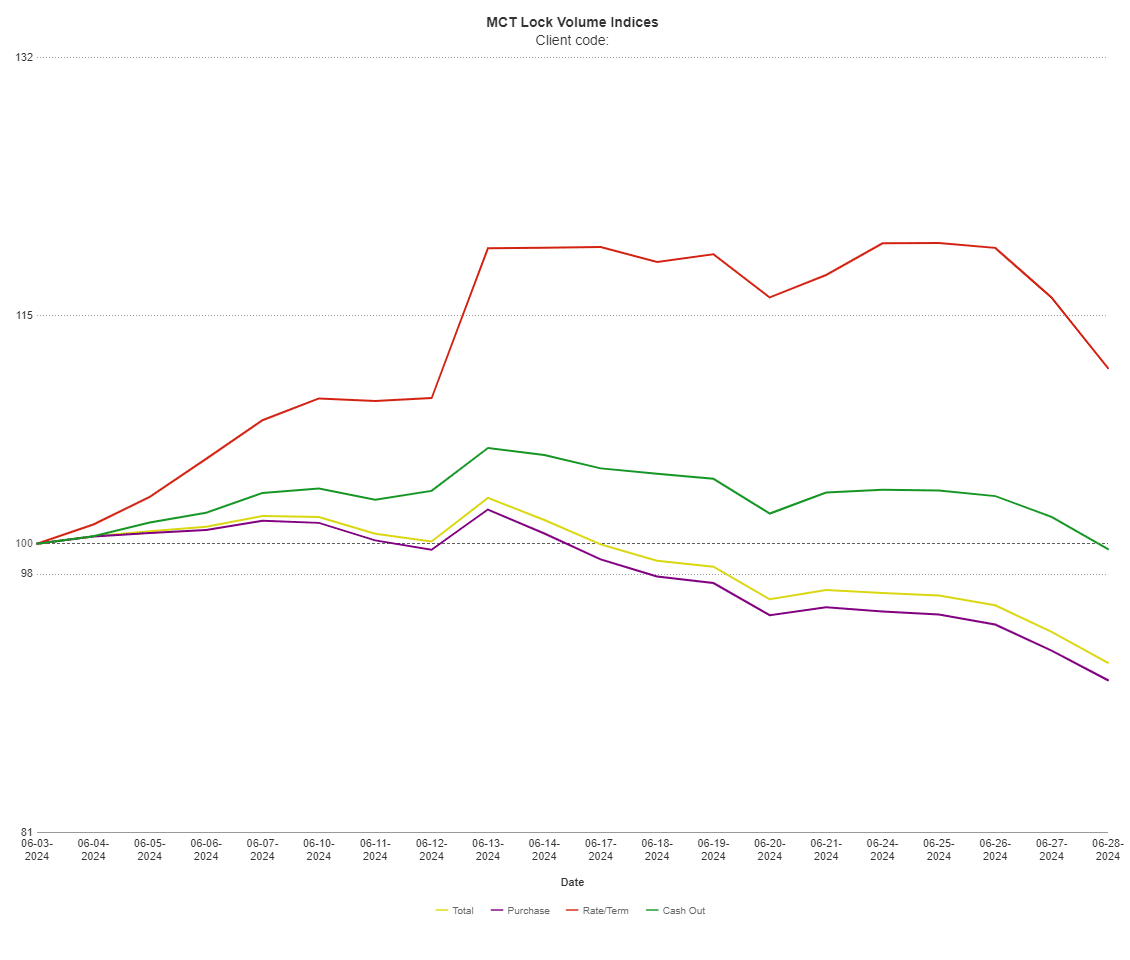

SAN DIEGO, CA – July 3, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 7.84% in mortgage lock volume compared to the previous month. This decline follows a brief uptick in volume at the beginning of the buying season, suggesting a continuing stalemate between limited housing supply and higher interest rates.

To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

The limited supply of available homes coupled with mortgage rates hovering around 7% has contributed to the observed decline in activity for June. As the market navigates these constraints, the mortgage industry anticipates a sideways trend over the next couple of months. Market supply likely peaked at the start of summer, and with rates remaining steady, significant changes in volume are not expected in the near term.

June’s economic reports are poised to play a critical role in shaping the Federal Reserve’s actions for the remainder of the year. As the Federal Reserve continues its efforts to combat inflation, upcoming data releases will be closely scrutinized. Andrew Rhodes, Senior Director and Head of Trading at MCT, emphasized the importance of these indicators, stating, “If the upcoming Nonfarm Payroll Report and Consumer Price Index (CPI) continue to align with predictions, and these economic indicators continue to show progress, we could see one or two rate cuts by the end of the year.”

Download MCT July Indices Report

To access the comprehensive insights provided by MCT’s Lock Volume Indices, interested parties are encouraged to download the full report.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net