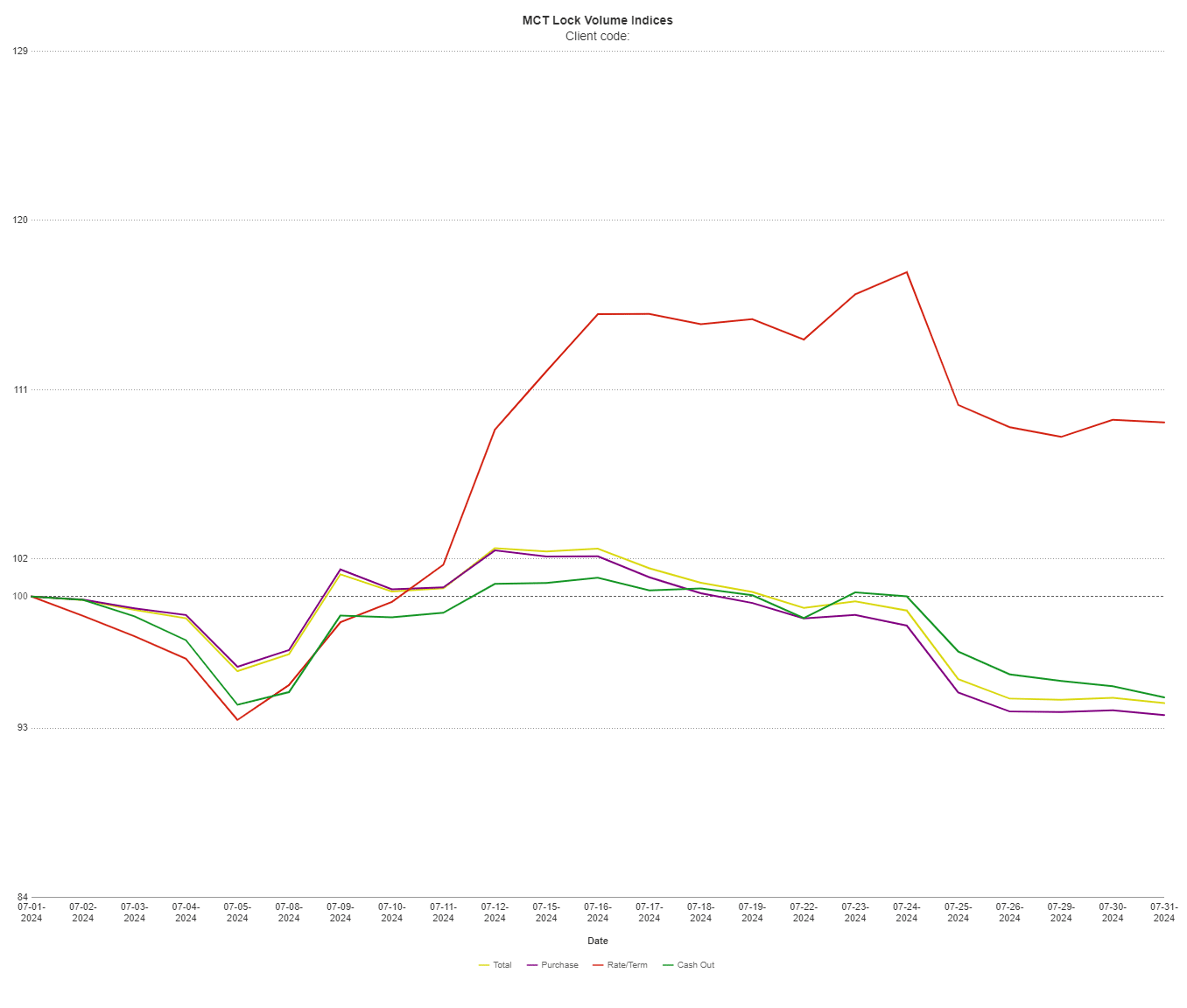

SAN DIEGO, CA – August 2, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a decrease of 5.67% in mortgage lock volume compared to the previous month. Industry professionals and enthusiasts are invited to download the complete report for comprehensive insights into the market dynamics.

Mortgage lock volume over the past eight weeks has continued to trend downward. This trend is consistent with a decrease in supply as we progress through the summer.

Looking ahead, the trend is expected to continue into the next month. Even as rates gradually decrease, many potential buyers may be holding off in anticipation of potentially better rates later in the year. Additionally, a potential September rate cut has already been priced into the market, suggesting that if the Federal Reserve does cut rates in their September meeting, it may have little effect on mortgage rates.

Andrew Rhodes, Senior Director, Head of Trading at MCT, states, “Today’s Nonfarm payroll report came in below expectations along with a higher than expected unemployment rate. If this trend continues, it is looking very likely the Federal Reserve will cut rates in their September meetings.”

Download MCT August Indices Report

To access the comprehensive insights provided by MCT’s Lock Volume Indices, interested parties are encouraged to download the full report.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net