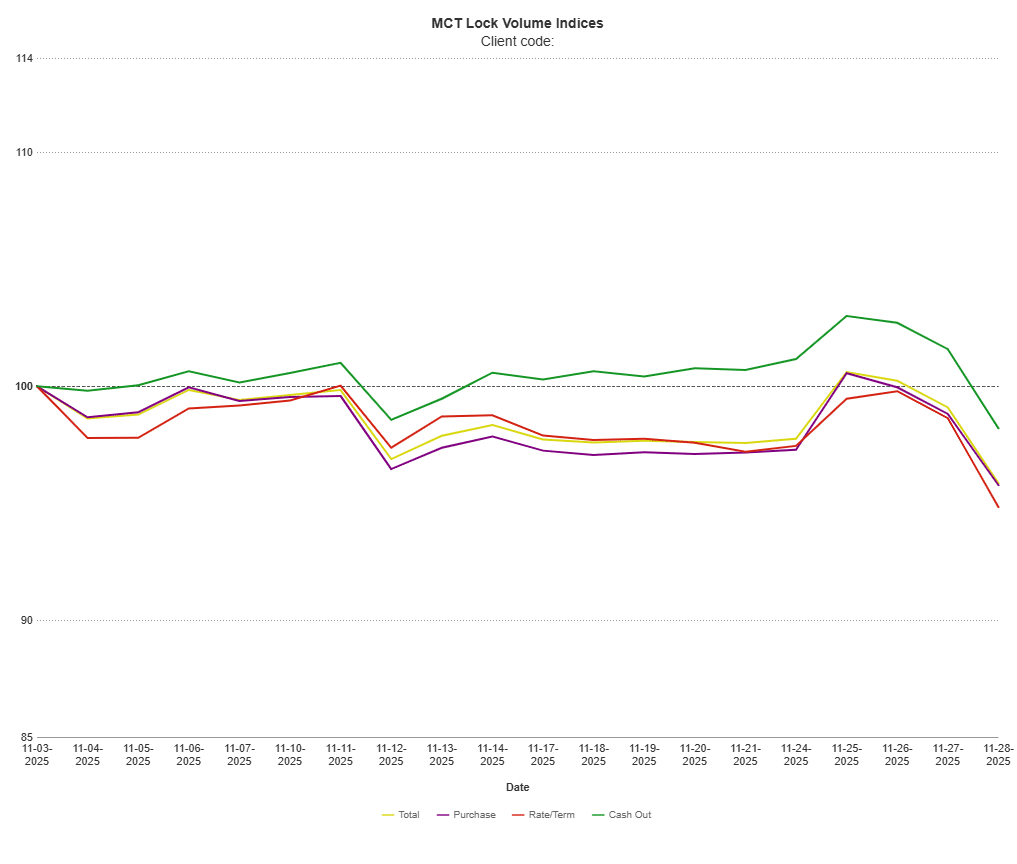

San Diego, CA – December 17, 2025 – Mortgage Capital Trading ® (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the release of its December Lock Volume Indices. November data showed a month-over-month slowdown consistent with seasonal patterns, as markets digested December’s Federal Reserve rate cut and turned their focus to upcoming labor-market data.

According to MCT’s November data, total lock volume declined approximately 4% month-over-month, with decreases across all major categories. Rate/term refinances fell just over 5%, purchase locks declined roughly 4%, and cash-out refinances proved the most resilient, slipping less than 2%.

Despite the monthly pullback, year-over-year activity remained higher, led by a sharp rebound in refinance activity and strength in cash-out volume.

Andrew Rhodes, Head of Trading at MCT, explained, “From a volume standpoint, November’s data reflects a pretty classic seasonal slowdown.”

Download MCT December Indices Report

The November slowdown followed heightened rate volatility in early Q4 and comes as markets react to the Federal Reserve’s December rate cut, alongside more cautious forward guidance. While the cut itself was widely expected, Rhodes noted that investors are now far more focused on labor-market signals to determine how aggressive the Fed may be in 2026.

“The Fed’s tone has been more neutral. It’s very much a wait-and-see approach,” Rhodes said. “If upcoming non-farm payroll numbers come in meaningfully below expectations, I think the market could rally on that pretty quickly, because it potentially puts another cut back on the map for 2026.”

Rhodes cautioned, however, that any reaction to the November jobs report could be short-lived, with December labor data scheduled to follow just weeks later.

“There’s no meeting until the end of January, so the Fed doesn’t have to say anything right away,” he explained. “That leaves the market in a bit of a holding pattern until we get more data.”

Looking toward 2026, Rhodes expects modest changes rather than a breakout year, unless rates move decisively lower.

“If the Fed’s dot plot stays consistent, 2026 could be a year of treading water,” he said. “We’re probably looking at volumes within five to ten percent of where we are now, not blockbuster growth.”

He added that meaningful upside would likely require rates dipping into the high fives, which could reignite refinance demand. Otherwise, shifts in product mix, such as greater use of ARMs or builder-subsidized rates, may play a larger role in shaping activity.

MCT remains committed to delivering expert guidance and data-driven insights. MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net