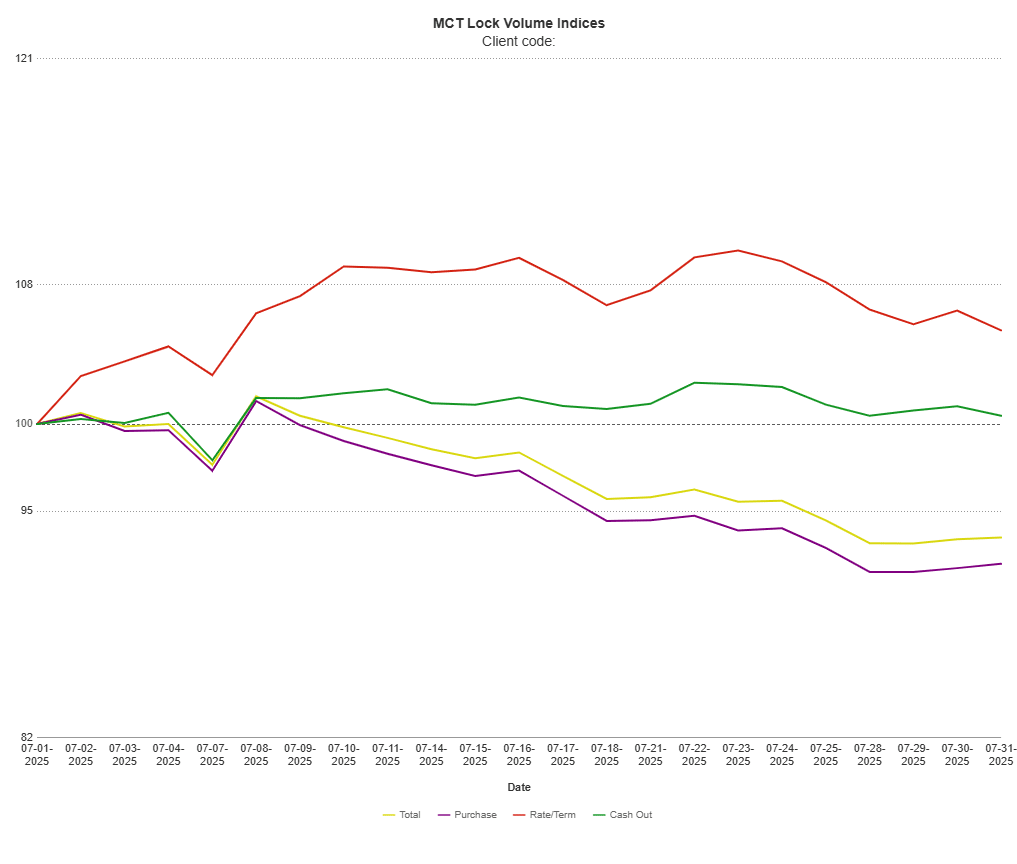

According to MCT’s data, lock volume trends for August 2025 showed modest shifts across loan types:

Month-over-month:

- Total lock volume: 6.51% decrease

- Purchase locks: 8.03% decrease

- Rate/term refinances: 5.38% increase

- Cash-out refinances: 0.48% increase

Year-over-year:

- Total lock volume: 7.28% increase

- Purchase locks: 4.13% increase

- Rate/term refinances: 27.25% increase

- Cash-out refinances: 31.89% increase

Download MCT August Indices Report

This month’s slowdown in purchase activity is likely reflective of seasonal patterns, with many homebuyers completing transactions earlier in the summer.

“It’s likely we’re seeing a seasonal slowdown after a front-loaded spring and early summer,” said Andrew Rhodes, Senior Director and Head of Trading at MCT. “Historically, homebuyers aim to move before the school year begins, so it makes sense to see volume tapering as we head into fall.”

Rhodes observed that while purchases typically drive the overall market, refinance activity has proven unexpectedly resilient in recent months.

“Rate/term and cash-out refinances are still moving, which is surprising given current rates,” he said. “But for cash outs in particular, it feels more like a necessity than a luxury. People may be pulling equity to consolidate debt or cover expenses, not because it’s the optimal time to borrow.”

He added that rate/term refis, while still volatile, are likely driven by borrowers who locked in higher rates previously and now see an opportunity to save.

With uncertainty in the labor market and economy, many are watching to see how the Federal Reserve will respond at its September meeting. The July jobs report showed just 73,000 jobs added, and revisions to May and June erased over 200,000 previously reported gains, a surprising correction that has shifted market expectations.

“The labor market was one of the main pillars the Fed was leaning on,” explained Andrew Rhodes, Senior Director and Head of Trading at MCT. “Now, with those revisions, it’s clear that footing isn’t as solid as it appeared.”

Despite the weaker labor data, Rhodes emphasized that CPI and inflation trends are more likely to drive the Fed’s decision on whether to cut rates in September.

“I believe the Fed will primarily be looking to see if inflation data shows enough softening to justify action,” he said.

The market appears to agree. CME futures reflected a sharp shift in sentiment, with the probability of a September rate cut jumping from 40% to nearly 90% following the job revisions. Markets rallied on the news, with MBS pricing improving and yields easing.

“We’re probably going to stay range-bound until the Fed meeting,” Rhodes added. “If inflation numbers stay consistent, I expect they’ll move. But we still have a few more data points to go before anything’s locked in.”

MCT remains committed to delivering expert guidance and data-driven insights. MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net