MSR Forbearance in 2020: Challenges & Recommendations…an article from the desk of Phil Laren

2020 has been a gold rush out there for those looking to maximize production profit per loan, but it has been a different story for those holding MSR (“mortgage servicing rights”). Companies that thought they would have loans on their books for years have seen those loans pay off in a matter of months, harming the value of the servicing asset.

Reviewing MSR Forbearance in 2020

First, on a broad scale, the Federal Reserve has announced that it will continue to support financial markets (and thus the economy) by buying as many treasuries and mortgage backed securities as is necessary to provide liquidity.

We were reminded of this in the Federal Open Market Committee’s statement following its latest meeting (September 15-16). Barring the announcement of an effective vaccine for COVID, we expect that overnight rates will be held at zero for at least the next couple years. This is good news for mortgage originators, but maybe not so much for servicers. Seasoned portfolios will continue to prepay at a rapid rate, keeping values on those portfolios lower.

In addition to increased financial strain on companies when in March servicing multiples went to zero, forbearance provisions in the CARES Act forced those in the industry to confront uncertainties around the policies imposed by the federal government. Smaller independent mortgage banks (IMBs) that held servicing were concerned about the impact of making advances in addition to covering for delinquent borrowers

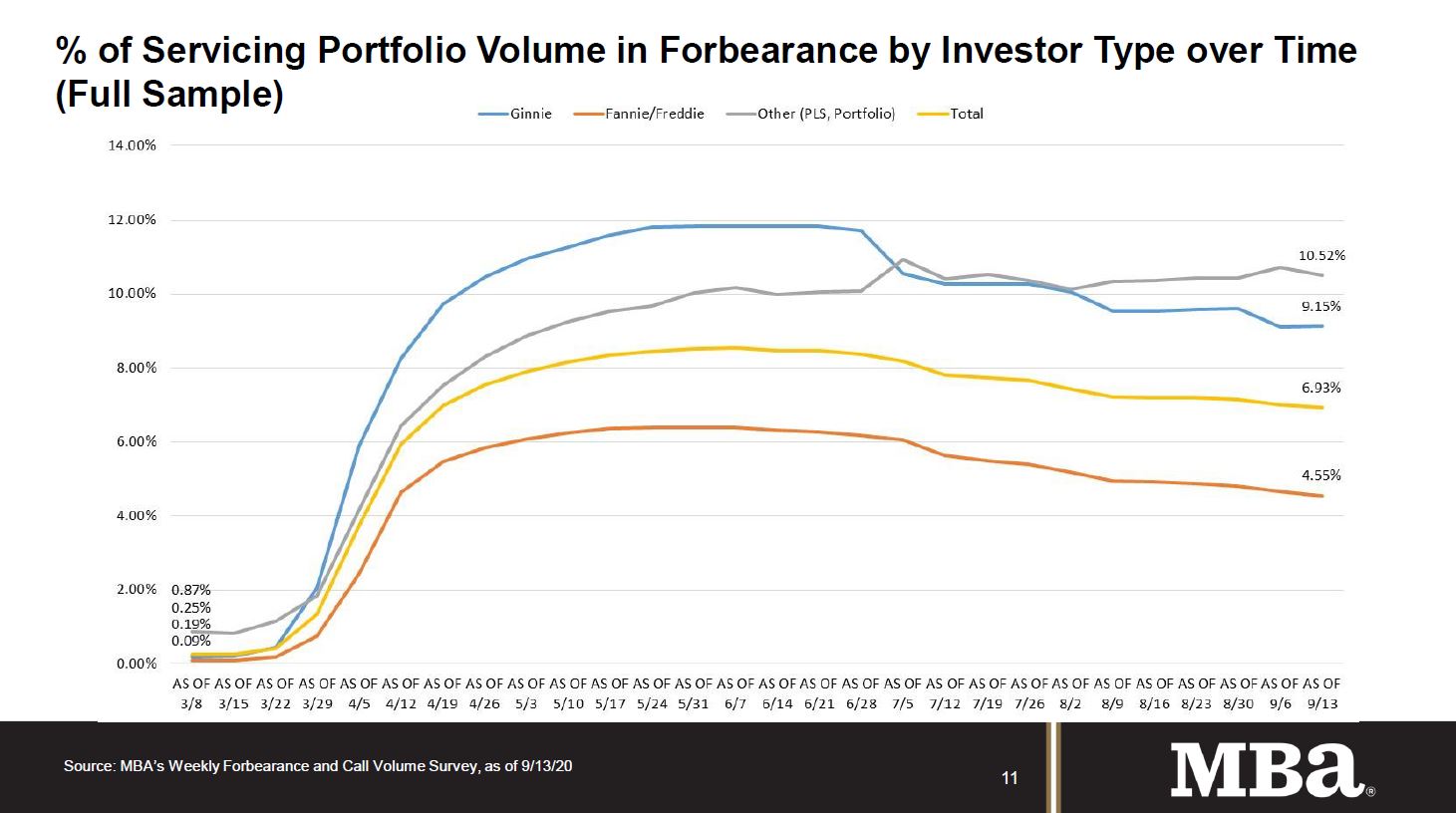

Source: MBA’s Weekly Forbearance and Call Volume Survey, as of 9/13/20

Now, much of the confusion is gone, but companies continue to wrestle with uncertainty regarding how best to navigate the forbearance waters and where it might take them. We still remain far from pre-COVID levels of market stability and certainty.

As a reminder, after the initial volatile decline in interest rates seen in March and April, rates have edged even lower throughout the summer. This has caused prepayments to remain at historically elevated levels.

In addition, escrow earning credits, which rely on short term rates, have declined as well. Finally, the fear of further declines in rates, when combined with the other factors mentioned, has led to a reduction in MSR values, both in economic terms (for those retaining) and market terms (for those selling). Servicers never like uncertainty, and this crop of forbearance, economic recovery, low rates and volatility have led to significant reductions in the price for flow and bulk transactions.

For sophisticated MSR holders, the breakdown in accurate correlations between treasury rates, MBS (“mortgage-backed securities”) pricing, and primary-secondary spreads has led to MSR valuation challenges and MSR hedging mismatches. In addition, increased delinquency rates for certain loan types have created significant increases in servicing costs and servicing advances.

Like this post? Read Phil Laren’s MSR Assumptions Q2 2020 for an analysis on MSR valuations.

Mortgage servicing rights, even in the best of times, have idiosyncrasies resulting in greater illiquidity when compared with existing MBS or TBA (“to be announced”) securities used for pipeline hedging. For comparison, in a typical year when between $1-3 trillion dollars in TBAs will be traded, or approximately $10 billion a day. In MSR land, a “good” year might see $100 billion notional trading, or about (at 1%, or a point, MSR value) $1 billion in MSR asset value. In other words, a good year for MSR transactions basically achieved in the first hour of a typical trading day hedging new locks. And it’s clear that these are not the best of times for MSR values. All of the uncertainty mentioned in the introduction have generally led to leading MSR buyers to curtail their bids and turn the MSR market off, at least for now.

Even though the market for MSR is temporarily in disruption, uncertainty and confusion have quieted down since March as the fundamental economics are still in play. Borrowers will make their payments, servicing fees will be collected, and MSRs will ultimately have value. Yes, the rates are currently low so many borrowers will be prepaying. Yes, an increased delinquency rate will cost more to service. But all of this, and more, is modeled and a value can be computed. That is how MSR values are determined currently, and that approach remains the same even in these uncertain times.

Source: MBA’s Weekly Forbearance and Call Volume Survey, as of 9/13/20

Since the bulk market is currently largely illiquid, especially now, relying on price indications from these few trades is not recommended. The continued decline in implied mortgage bond rates and the tightening of the primary secondary spread means prepayment expectations are rising again, driving MSR values down. The COVID forbearance impact was included for the first time in valuations in the second quarter of 2020, and although it reduced values, the impact is (so far) not as significant as feared.

Although the decline in mortgage rates has contributed to the stress being felt by MSR portfolio managers, on the bright side, production has been close to record pace, and with aggregator bids lacking consistency smaller originators have been selling directly to Freddie Mac and Fannie Mae, or issuing their own GNMA securities, and retaining a greater percentage of their production. We have a number of small to medium sized originators more than doubling the size of their MSR portfolio over the quarter! Because of this, the new loans, representing very low note rates, and borrowers whose employment has been verified just prior to closing (so that forbearance risk is lower than a seasoned loan), “model out” very well. We would expect higher values due to fewer forecasted payoffs and lower forbearance risk (implying lower servicing costs, and less advance risk). This has created a rather unusual result: a number of MCT’s clients have seen value increases in their portfolio, as a percent of principal balance, despite the decline in rates!

MBA Forbearance & Call Volume Survey Results

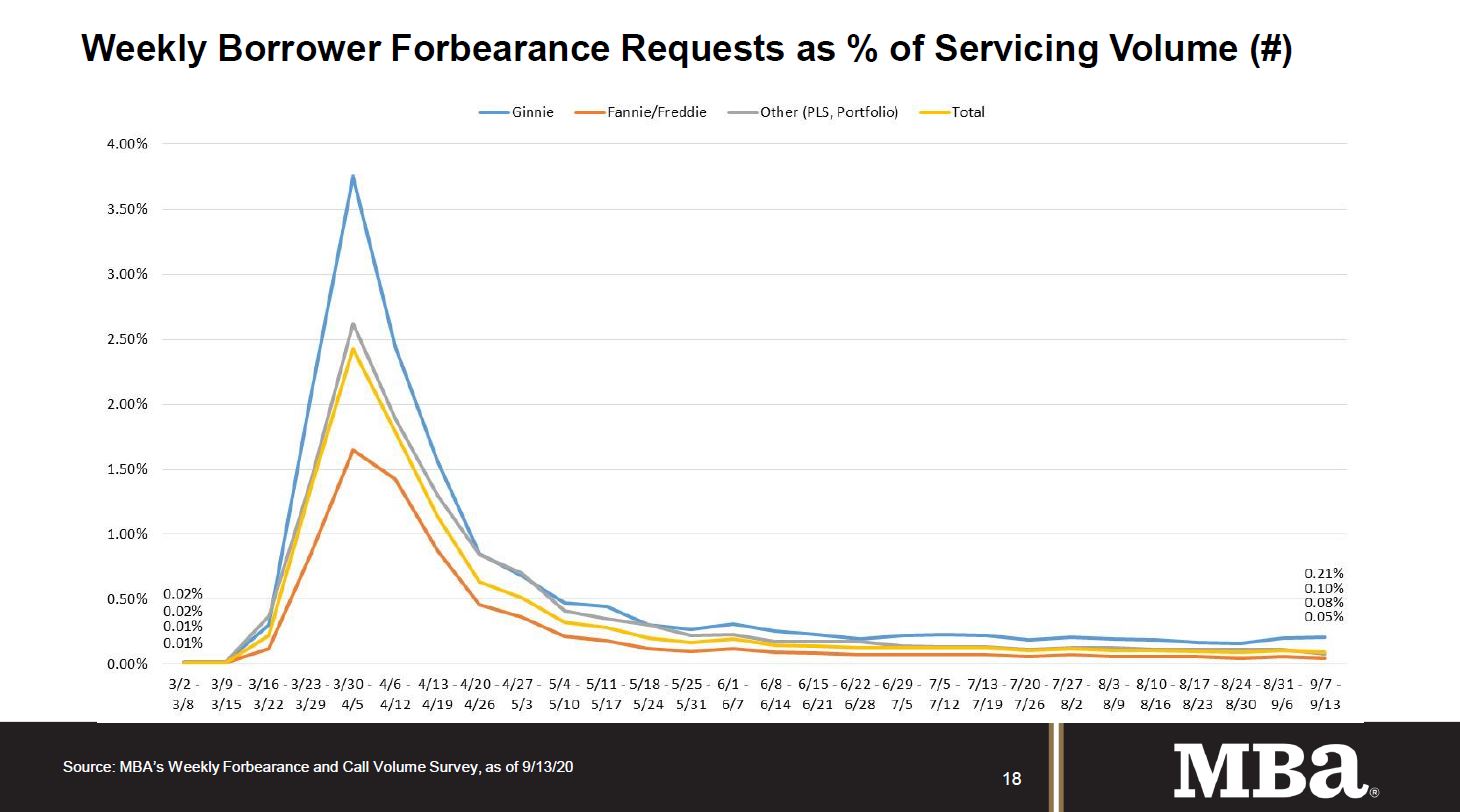

MBA’s latest Forbearance and Call Volume Survey covering the period from September 7 through September 13, 2020, and representing 74% of the first-mortgage servicing market (37.2 million loans) showed:

- Total loans in forbearance decreased by 8 basis points relative to the prior week: from 7.01% to 6.93%.

- By investor type, the share of Ginnie Mae loans in forbearance increased relative to the prior week: from 9.12% to 9.15%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 4.65% to 4.55%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior week: from 10.71% to 10.52%.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.11% to 0.10%.

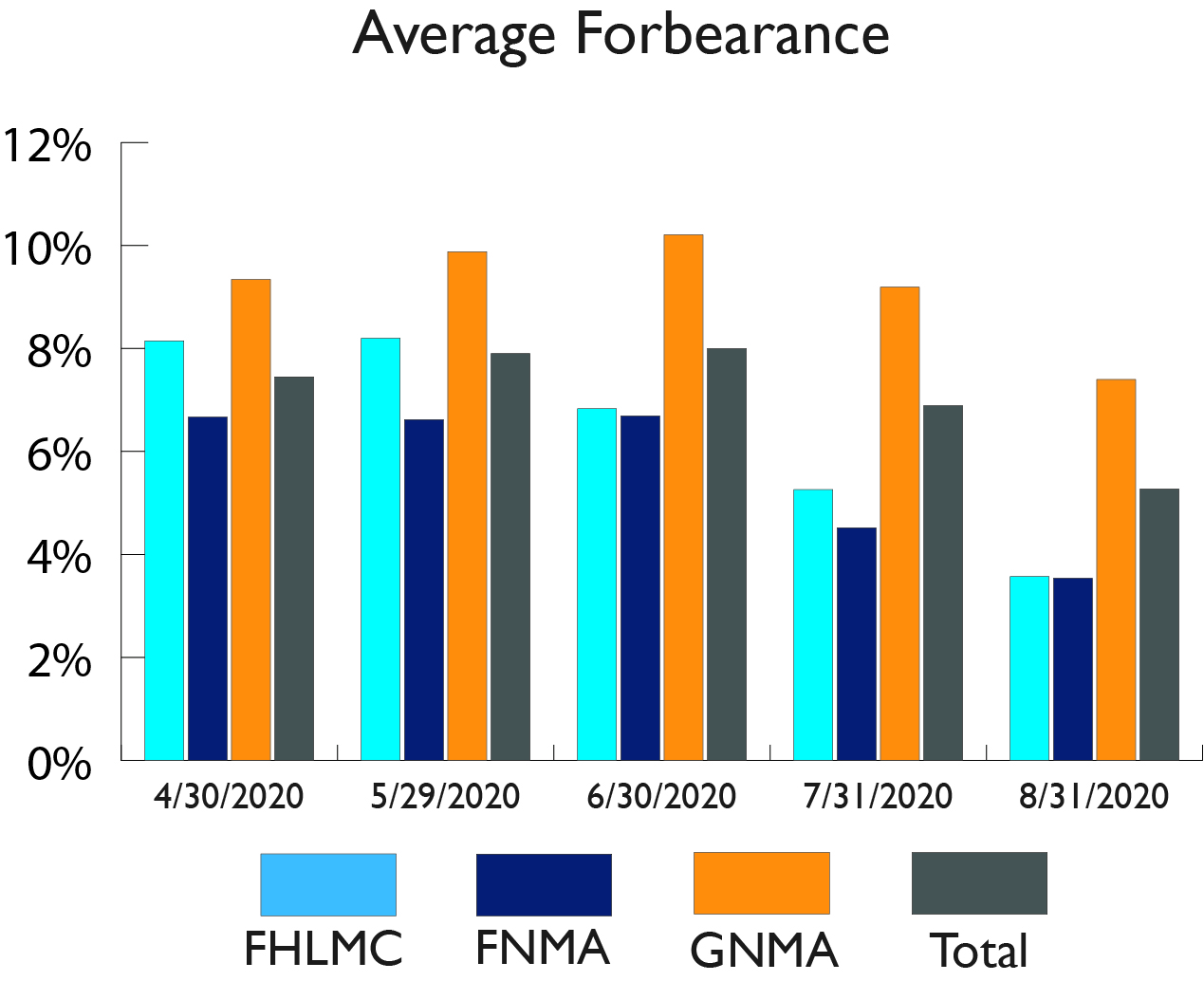

Average Forbearance among MCT’s largest clients

Loans that make up GNMA securities (e.g., FHA and VA loans) historically have had higher delinquencies than other loan programs. That has continued through the 2nd and 3rd quarters of 2020, as evidenced by the forbearance numbers. Freddie Mac figures are slightly better, and loans comprising Fannie Mae securities (conventional/conforming) have seen the lowest forbearance rates.

Fortunately, Ginnie Mae revised and expanded the Pass-Through Assistance Program PTAP to assist Issuers in their administration of borrower relief efforts, including extended forbearance, in response to the COVID-19 national emergency. The use of the program has been very limited to date because the principal and interest funds have been adequate to cover the balances for the majority of folks. Additionally, the FHFA has stated it is closely monitoring the coronavirus national emergency’s effect on the housing finance market and continues to update policies and guidance to ensure its regulated entities (Fannie Mae, Freddie Mac – the Enterprises – and the Federal Home Loan Banks – FHLBanks) are fulfilling their mission of providing market liquidity during this difficult time.

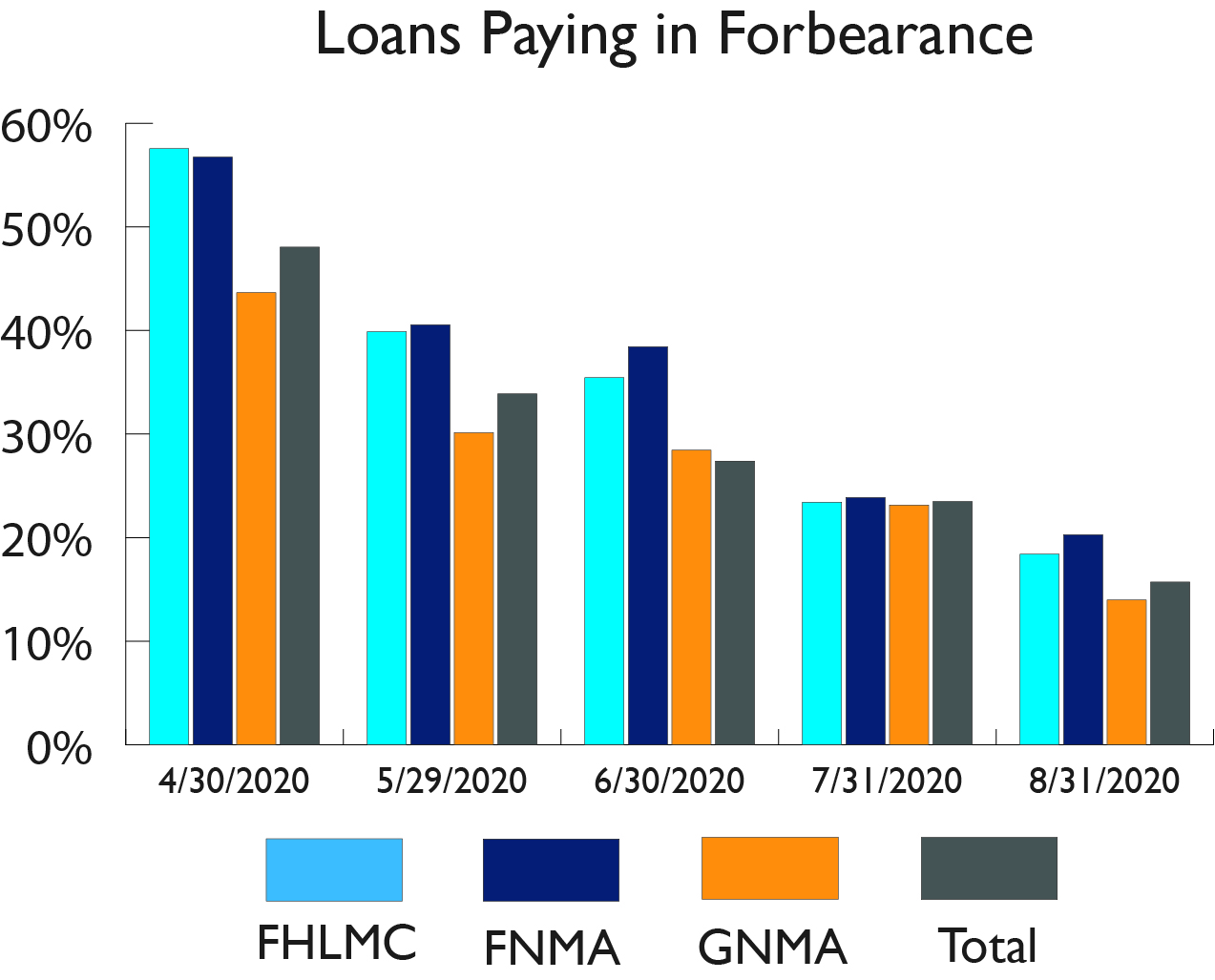

Loans Paying in Forbearance among MCT’s largest clients

Computershare Loan Services (CLS) reported that more than a quarter of its borrowers in forbearance are continuing to make their monthly mortgage payments. Computershare Loan Services’ CEO Tom Millon spoke to National Mortgage News to expand on these findings: “It’s likely that some borrowers requested forbearance in anticipation of financial difficulties which did not materialize or were not as demanding as they expected, meaning that they were in a better position to make a payment.” While one borrower segment appears to be using forbearance as a method to conserve cash, lenders and servicers should prepare for a potential delinquency spike as other borrowers face continued hardship at the end of their forbearance terms.

MCT is Helping Our Clients to Effectively Navigate this Uncertainty

No one knows how long it will be until we have a treatment or vaccine for the virus, or how deep the financial impact will be.

Forbearances influence delinquencies, which in turn influence advances. Our model has been updated to account for the market changes. Fortunately, overall forbearance trends are down a bit. MSR Services Team revisits the appropriate set of assumptions for MSR valuations every month. We continue to have more clarity around the delinquency forbearance plans, modification options, foreclosure moratoriums, etc., which allows us to utilize our model methodology to determine the subsequent return expected on servicing cash flows.

The impact of forbearance on MSR values is about a 5% reduction in value, as long as the forbearance duration and peak levels align with our current estimates. The current model contains forbearance estimates which are less than two years’ duration with foreclosure moratoriums and peak delinquency levels limited.

Summary of Forbearance in 2020

A number of our clients are retaining MSRs for the first time, and quite a few more have increased their MSR portfolios by significant amounts, and consequently are holding more servicing than ever before. Holding an asset like MSR is not in most originator’s DNA – they like to originate a loan, get it through the production pipeline, sell it to an aggregator and start the whole process again with a new loan.

Holding substantial amounts of MSRs turns the originator into an Asset Manager, the type of job usually assigned to banks. In addition, this asset requires something most Bank Asset Managers don’t have to worry about – it requires operational management to make sure borrowers and investors expectations are met and regulatory and statutory requirements are met. This requires skill in servicing, or skill in subservicing oversight.

Do you Need Help Managing your MSR Portfolio?

MCT’s MSR Services team wants to help you manage this asset both financially and operationally. We have the experience and we have the software to aide in your MSR decisions, starting from optimizing your retained/released decision to valuing your portfolio to analyzing the risks of MSR ownership, including interest rate and credit market exposure, to finally buying or selling your MSRs.

We’re here to help and we look forward to continuing to serve your MSR management and valuation needs.

Questions or comments should be directed to the MSR Services Group, David Burruss, dburrus@mctrade.net, Phil Laren plaren@mctrade.net, Susi Schlenk, schlenk@mctrade.net, or Natalie Martinez, nmartinez@mctrade.net.

About the Author: Phil Laren, Director of MSR Services, MCT

MCT’s mortgage servicing software, MSRLive!, was created by industry veteran Phil Laren.

Mr. Laren has more than 30 years experience in Capital Markets, predominantly in servicing. He is experienced in all aspects of servicing, modeling, pricing, trading, negotiating, hedging, risk analysis, accounting analysis and operations. He is also very experienced building teams and managing traders & analysts.

Mr. Laren holds Advanced degrees in statistics and econometrics.