Freddie Mac Integrations for Mutual Clients

MCT’s Rapid Commit application programming interface, or API, with Freddie Mac allows mutual clients to retrieve loan-level pricing to save time and improve data accuracy. Users access this integration through MCT Marketplace within MCTlive!®, which combines bid tape management with a powerful loan pipeline management platform.

Benefits of Integration | By the Numbers | Recent Content | Technology Updates

Benefits of API Integration for Mutual Clients

Obtain Loan-Level Pricing

Loan populations of any size receive loan-level, characteristic-based pricing.

Improve Efficiency

Mutual clients are reducing their commitment process time – and corresponding exposure to market moves – by expediting the loan sale setup process.

Ensure Data Accuracy

Direct API integration reduces data entry errors.

By the Numbers – Mutual Clients Experience the Benefits of Freddie Mac Integrations

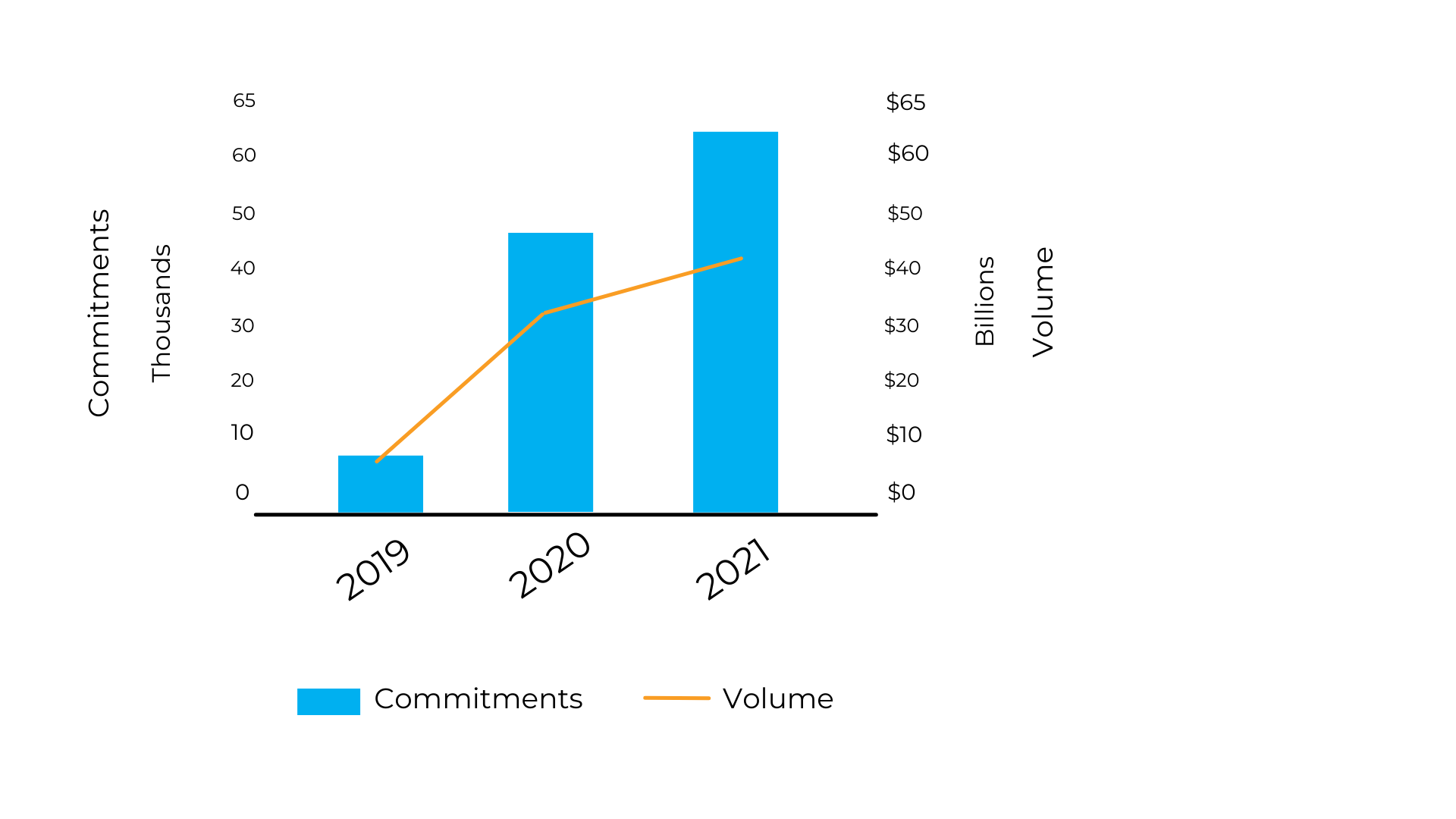

MCT clients are seeing the benefit of MCTlive! and its integrations as more mutual clients continue to leverage the integrations.

MCT Client Highlights Include:

- Volume: From 2019 to 2021, these efficiencies helped contribute to a 524% increase in transaction volume through Rapid Commit, from $6.7 billion to $41.8 billion in just two years.

- Commitments: The growth in commitments reflects the benefit of Rapid Commit, as well as this functionality, which has contributed to a 607% increase in transaction volume, from 8,731 commitments in 2019 to 61,764 commitments in 2021.

With Rapid Commit, lenders can automate Freddie Mac loan pricing and commitment with intelligent best execution capability through API. This technology pairs with MCT’s MCT Marketplace to easily price and commit loans to Freddie Mac. With a few short clicks, lenders save time and reduce data errors with MCT’s Rapid Commit technology.

With Rapid Commit, lenders can automate Freddie Mac loan pricing and commitment with intelligent best execution capability through API. This technology pairs with MCT’s MCT Marketplace to easily price and commit loans to Freddie Mac. With a few short clicks, lenders save time and reduce data errors with MCT’s Rapid Commit technology.

Recent Content by MCT & Freddie Mac

MCT & Freddie Mac Present: Ensuring Efficiency and Accuracy Through Integrations

How can you ensure efficiency and accuracy through technology integration? Join Freddie Mac and MCT as we talk technology integration and the importance of those integrations to support rate sheet and hedging accuracy – plus the benefits you can realize in your pricing, committing and accounting activities

Freddie Mac & MCT Present – Selling Guarantor: Ensuring a Successful Transition

In this webinar, Freddie Mac and MCT explore the execution, operations, and costs lenders should analyze when considering the move from cash to guarantor. Topics include:

• Deciding whether moving from cash window to guarantor is right for you

• Analyzing and preparing for the impact on execution and operations

• Servicing options with guarantor (co-issue and retained) and what a decision to retain MSR can mean (whether in-house or sub-serviced)

• Freddie Mac guarantor tools and training resources

MCT & Freddie Mac Present: MSR Management in a Volatile Market

In Part 1 of this video series, Freddie Mac and MCT’s MSR division discuss strategies for managing a MSR portfolio in a volatile market. View Part 1 of the series below as the panel reviews leveraging MSR options in your execution strategy. Topics include:

- Leveraging MSR transaction options in a volatile market

- Using tools for granular pricing considerations

- How servicing programs, cost structures, and capacity filter into best execution

View the Freddie Mac White Paper – Non-Price Considerations in Your Best Execution Analysis

In this whitepaper, MCT teams up with Freddie Mac to identify unexpected costs associated with your loan sales to improve profitability. Topics include:

- Operational efficiencies to consider when choosing a buyer

- Identifying hidden costs of new investor approvals

- Seller relationship and optimizing loan sale processes

Contact us today to learn how these API integrations can revolutionize your pipeline management processes.

MCT & Freddie Mac API Technology Updates

MCT has dedicated resources to integrate with all available Freddie Mac technology. Through our technology integrations, our clients continue to save a substantial amount of money and valuable time. Review the timeline of integration updates below or view the full press release for additional information.

Jan 24, 2023

MCT is pleased to announce it is the first secondary marketing platform to integrate with Freddie Mac’s Income Limits application programming interface (API) created for the first-time home buyer area median income (AMI) limits. Income Limits allow for the accurate pricing of Credit Fee in Price (Exhibit 19, or “Credit Fees”) waivers.

October 10, 2019

MCT® is proud to announce the addition of the Freddie Mac Cash-Released XChange browse price API to the integration between Freddie Mac and the MCTlive!® platform. Leveraging the browse price API, MCTlive! lenders can now accurately and conveniently utilize Freddie Mac Cash-Released XChange in their best execution analysis.

August 18, 2022

MCT’s award-winning capital markets platform, MCTlive!, is the first to integrate with Freddie Mac’s Cash Settlement Purchase Statement API. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Freddie Mac purchase data directly, instead of waiting to run reports through a Loan Origination System (LOS).

August 17, 2018

MCT announced new functionality that delivers real-time pricing and automates loan committing for Freddie Mac clients. MCT’s lender clients receive the pricing information seamlessly via its integrated capital markets technology platform, MCTlive! MCT is the first vendor to have successfully completed the first commitment via Freddie Mac’s new API technology.

Meet With Us to Learn More

"(Required)" indicates required fields