Weekly Technology Improvement Series:

Cash-Window APIs

Published 8/18/2021

With MCTlive!, all your bids are tied directly to the cash window through our live, on demand, APIs with Fannie Mae and Freddie Mac. Once posted, live pricing from Fannie/Freddie is available with the click of a button.

Even if the market moves between pricing and hitting the bid, you don’t have to worry about delayed rate sheet updates or a dislocation between TBAs and cash window price changes.

A full browse price integration to ALL cash window executions provides assurance that you are receiving the most up to date pricing for your best execution and front-end pricing.

This live browse with the agencies feature allows you to pull in a base price, SRP, spec, and LLPAs, for an accurate all in price, to make retained or released decisions, with SMP (Fannie), CRX (Freddie), and CTOS (Freddie).

Once a best ex analysis is completed (fee adjusted and eligibility included), a lender can easily commit to all of the cash window iterations available.

The ability to select commitment pricing directly from the cash window helps maximize profit and save time in the process of selling loans. MCT® is continually optimizing our capital markets software to keep up with the current market space.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT’s CMO Ian Miller Designated a 2019 ‘Top 40 Most Influential Mortgage Professionals Under 40’ by NMP

SAN DIEGO, Calif., March 15, 2019 – Mortgage Capital Trading, Inc. (MCT) a leading mortgage hedge advisory and secondary marketing software firm, announced that its Chief Marketing Officer, Ian Miller, was recognized by National Mortgage Professional...

Webinar: Navigating the Waters of MSR Sales

Join webinar to learn how to determine which MSRs to sell, how to evaluate bids you receive, and tips for negotiating a contract. Topics will also include expected challenges, purchase terms, and timing of the sale.

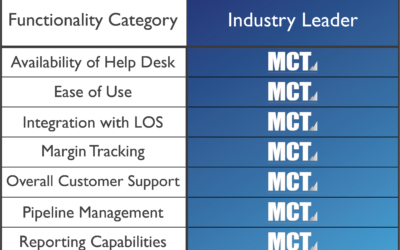

MCT Scores High Marks in Overall Satisfaction, Lender Loyalty, and Functionality Effectiveness According to Recent Study

SAN DIEGO, Calif., February 18, 2019 – Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that the 2018 STRATMOR Technology Insight Study rated MCT as the leader in overall satisfaction, lender loyalty,...

5 Strategies for Improving Profitability in the Current Market

Register and attend on February 20, 2019 at 11AM Pacific for actionable tactics that address both short and long-term profitability. The webinar will be moderated by Chris Anderson, CAO of MCT, and feature panelists James Deitch, CEO and Co-Founder of TeraVerde, and Bill Berliner, Director of Analytics at MCT.

First Bank Realizes Increased Profitability by Moving to Mandatory Loan Sales

Learn the details of how Andrew Stringer at First Bank leveraged MCTlive!, Bid Auction Manager (BAM), and Rapid Commit to improve loan sale pickup and operational efficiencies.

MCT Announces Bid Pricing on Open Pipelines in Collaboration with Leading Investors

Lenders using MCT’s loan pipeline management software, MCTlive!, received bid tape pricing at the loan level on their open pipeline in year-end mark-to-market reports, a major improvement over the rate sheet and direct trade pricing typically used for this purpose and the first step in addressing a recent crisis in derivative asset pipeline valuation.

MCT’s Danyel Shipley Honored as one of Mortgage Banking’s Most Powerful Women for 2018 by NMP Magazine

SAN DIEGO, Calif, Nov. 30, 2018 – MCT announced that Danyel Shipley was named to National Mortgage Professional Magazine’s (NMP) 2018 list of Mortgage Banking’s Most Powerful Women. Honorees were selected based on their accomplishments where they were instrumental to a major industry innovation, overcoming some seemingly insurmountable obstacle in their career to rise to the top, blaze new trails, and how connected they are.

MSR Valuations in Today’s Market

View the webinar on MSR valuations using MSRlive!, a mortgage servicing rights software built to help MSR professionals manage their portfolio.

MCT Marketplace Webinar

Core Features of MCT Marketplace (MCT Marketplace®) The MCT Marketplace webinar has concluded. Sign up for our newsletter to join upcoming MCT webinars. Join our Newsletter for...

MCT® Moves to Secure Sensitive Borrower Data Exposed in 90 Percent of Secondary Market Transactions

SAN DIEGO, Calif., Nov. 7, 2018 – MCT announced that it is incorporating the company’s patent-pending geocoding technology into its Bid Auction Manager™ (BAM) whole loan trading platform in order to shield borrower addresses from being shared with non-buying entities throughout the whole loan bidding process.