Weekly Technology Improvement Series:

Cash-Window APIs

Published 8/18/2021

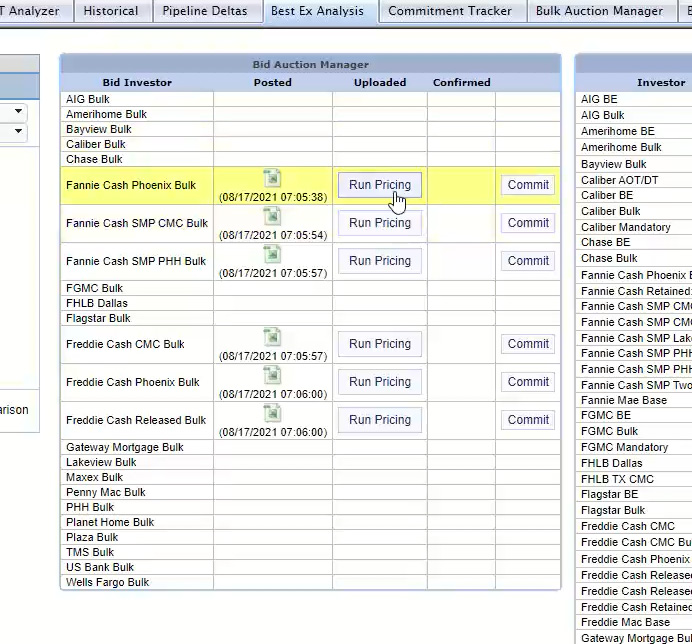

With MCTlive!, all your bids are tied directly to the cash window through our live, on demand, APIs with Fannie Mae and Freddie Mac. Once posted, live pricing from Fannie/Freddie is available with the click of a button.

Even if the market moves between pricing and hitting the bid, you don’t have to worry about delayed rate sheet updates or a dislocation between TBAs and cash window price changes.

A full browse price integration to ALL cash window executions provides assurance that you are receiving the most up to date pricing for your best execution and front-end pricing.

This live browse with the agencies feature allows you to pull in a base price, SRP, spec, and LLPAs, for an accurate all in price, to make retained or released decisions, with SMP (Fannie), CRX (Freddie), and CTOS (Freddie).

Once a best ex analysis is completed (fee adjusted and eligibility included), a lender can easily commit to all of the cash window iterations available.

The ability to select commitment pricing directly from the cash window helps maximize profit and save time in the process of selling loans. MCT® is continually optimizing our capital markets software to keep up with the current market space.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Pull-Through Model Enhancements for Agency Refi Fees | Rasori’s Relentless Releases Ep. 1

Phil discusses the delay of the Adverse Market Refinances Fees and how new functionality in MCTlive! can be used to manage the changes.

Uncertainty Due to Short-Notice FHFA Directive Amplifies Harm to Borrowers

MCT analyzed the potential effect of Wednesday’s fifty basis points worsening in prices paid by Fannie Mae and Freddie Mac for most mortgage refinances.

Pipeline Pull-through Rate Analysis Explained

In this article, we’ll explain the key concepts related to pull-through rate analysis and discuss its importance in deriving an accurate hedge recommendation.

MCT Client Webinar: MCTlive! User Workshop Level 1

This MCT client-exclusive webinar is based on the MCTlive! Level 1 User Guide and will provide a comprehensive overview of features and reports in the platform. The webinar will also analyze how to improve loan sale profitability and reduce leakage using MCTlive!.

MCT Industry Webinar: Advanced Hedging Strategies

View the webinar recording and slidedeck from this webinar on July 16th at 11AM PT to learn why advanced hedging strategies lenders to achieve greater profitability.

MCT Industry Webinar – Power of Bid Tape AOT ft. Wells Fargo

In this webinar from July 7th at 11AM PT, MCT’s Phil Rasori teamed up with Wells Fargo’s SVP of Correspondent Pricing, Greg Vacura, to discuss recent AOT enhancements.

MCT Industry Webinar – Deciphering GNMA Approval & Delivery

View the webinar recording and slidedeck from this webinar on June 25 at 11AM PT, where MCT experts discuss the processes for Ginnie Mae approval and delivery.

MCT Whitepapers: Ginnie Mae Field Guide Part 1 & 2

With “Ginnie Field Guides – Parts 1 and 2,” we hope to alleviate some of the nervousness surrounding this unique delivery method and to jump-start your confidence on the subject matter. In these “cliff notes” of the Ginnie Manual, helpful hints are provided by an MCT expert that has had first-hand experience with the nuances of delivering with Ginnie Mae.

MCT Industry Webinar – MSR Management through Market Disruption

In this webinar from May 28th at 11AM PT, MCT’s Phil Laren and Bill Berliner discussed current MSR market conditions, cash management and forbearance strategies.

5 Operational Best Practices for 2020 Market Volatility

COVID-19 has affected more than just people’s health; it has affected people’s ability to work and pay their mortgage. In this blog post, learn five best practices for secondary and operations managers to manage risk and succeed in times of market volatility.