Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

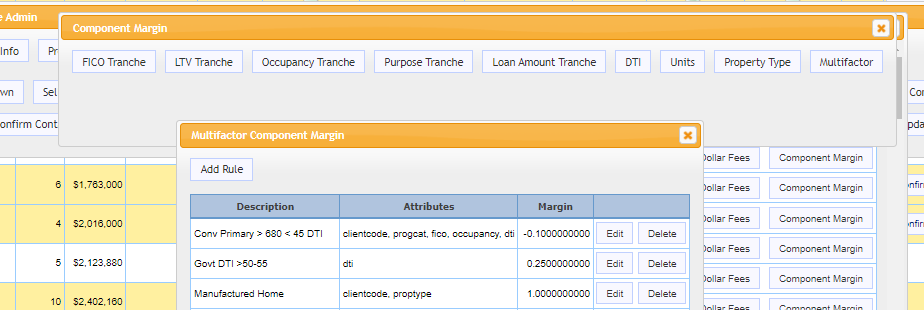

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT’s AI Blueprint for the Future of Mortgage Capital Markets Technology

Learn how MCT is extending its legacy of innovation and technology stewardship by sharing its assessment of both the promise and the perils of this new revolutionary technology for the capital markets.

MCT Strengthens Integration with MeridianLink to Improve Secondary Marketing Processes for Mortgage Lenders

MCT and MeridianLink announce enhanced API integration for mortgage lenders, improving data flow speed and control while reducing origination costs through automated processes.

MCTlive! Quarterly Release Notes in Q4 2024

Described below within relevant tabs, you’ll find a listing of our Q4 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

MCT Client Webinar – Implementing AI in the MCTlive! Platform

Discover MCT’s strategic AI implementation journey and learn how they’re enhancing the MCTlive! platform while prioritizing data security and user experience.

MCT® Unveils MSRlive!® 4.0 — Offering Ground-Breaking Enhancements to MSR Reporting and Transparency

MCT launches MSRlive! 4.0, enhancing its MSR valuation platform with advanced portfolio analytics and transparency features, giving mortgage servicers deeper insights into valuation drivers and risk exposure.

MCT Reports 16% Decrease in Mortgage Lock Volume Amid Market Dynamics

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month.

MSR Market Monthly Update – January 2025

The Fed has announced another 25 basis points reduction in the overnight rate after their December FOMC meeting. The reduction was in line with what the financial markets were expecting. The surprise came when the Fed announced that they will only reduce rates twice during 2025 and not the anticipated four times as they have previously indicated.

MSR Market Monthly Update – December 2024

The financial industry is awaiting the much-anticipated rate announcement by the Fed after their December FOMC meeting. The market is expecting the Fed to lower the overnight rate by another 25 basis points. The 10 Year Treasury rate has risen sharply during the month of November heading towards 4.50% which most economists deem risky for the economy.

MCT and FICO Collaborate to Bring Predictive FICO® Score 10 T to Secondary Mortgage Marketplace

FICO® Score 10T begins trading early on MCT Marketplace, delivering real-time insights that enhance pricing precision, credit risk analysis, and secondary market performance.

Leslie Winick of MCT Honored Among Mortgage Banking’s Most Powerful Women in 2024

Leslie Winick, MCT’s Chief Strategy Officer, earns a spot on Mortgage Banker Magazine’s 2024 Powerful Women in Mortgage Banking list for leadership and innovation.

Leslie Winick, MCT’s Chief Strategy Officer, earns a spot on Mortgage Banker Magazine’s 2024 Powerful Women in Mortgage Banking list for leadership and innovation.