Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

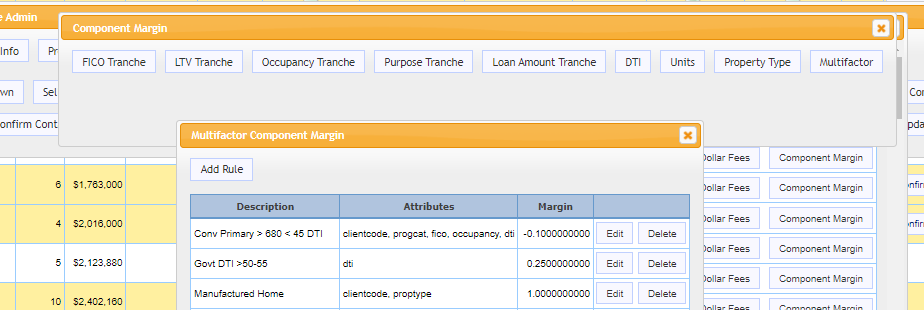

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Aggregated Structural Equations (ASE) Model: An Alternative View of Value and Risk – Part 1

In this issue of Servicing Insights, we will describe our methodology of determining MSR values and quantifying and monitoring MSR risk. Our approach to modeling the different market interest rates is to statistically model a set of structural relationships between the interest rates, as well as other variables which cause them to change.

MCT’s CMO Ian Miller Designated a 2019 ‘Top 40 Most Influential Mortgage Professionals Under 40’ by NMP

SAN DIEGO, Calif., March 15, 2019 – Mortgage Capital Trading, Inc. (MCT) a leading mortgage hedge advisory and secondary marketing software firm, announced that its Chief Marketing Officer, Ian Miller, was recognized by National Mortgage Professional...

Webinar: Navigating the Waters of MSR Sales

Join webinar to learn how to determine which MSRs to sell, how to evaluate bids you receive, and tips for negotiating a contract. Topics will also include expected challenges, purchase terms, and timing of the sale.

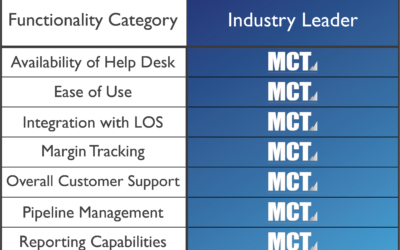

MCT Scores High Marks in Overall Satisfaction, Lender Loyalty, and Functionality Effectiveness According to Recent Study

SAN DIEGO, Calif., February 18, 2019 – Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced that the 2018 STRATMOR Technology Insight Study rated MCT as the leader in overall satisfaction, lender loyalty,...

5 Strategies for Improving Profitability in the Current Market

Register and attend on February 20, 2019 at 11AM Pacific for actionable tactics that address both short and long-term profitability. The webinar will be moderated by Chris Anderson, CAO of MCT, and feature panelists James Deitch, CEO and Co-Founder of TeraVerde, and Bill Berliner, Director of Analytics at MCT.

First Bank Realizes Increased Profitability by Moving to Mandatory Loan Sales

Learn the details of how Andrew Stringer at First Bank leveraged MCTlive!, Bid Auction Manager (BAM), and Rapid Commit to improve loan sale pickup and operational efficiencies.

MCT Announces Bid Pricing on Open Pipelines in Collaboration with Leading Investors

Lenders using MCT’s loan pipeline management software, MCTlive!, received bid tape pricing at the loan level on their open pipeline in year-end mark-to-market reports, a major improvement over the rate sheet and direct trade pricing typically used for this purpose and the first step in addressing a recent crisis in derivative asset pipeline valuation.

MCT’s Danyel Shipley Honored as one of Mortgage Banking’s Most Powerful Women for 2018 by NMP Magazine

SAN DIEGO, Calif, Nov. 30, 2018 – MCT announced that Danyel Shipley was named to National Mortgage Professional Magazine’s (NMP) 2018 list of Mortgage Banking’s Most Powerful Women. Honorees were selected based on their accomplishments where they were instrumental to a major industry innovation, overcoming some seemingly insurmountable obstacle in their career to rise to the top, blaze new trails, and how connected they are.

MSR Valuations in Today’s Market

View the webinar on MSR valuations using MSRlive!, a mortgage servicing rights software built to help MSR professionals manage their portfolio.

MCT Marketplace Webinar

Core Features of MCT Marketplace (MCT Marketplace®) The MCT Marketplace webinar has concluded. Sign up for our newsletter to join upcoming MCT webinars. Join our Newsletter for...