Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

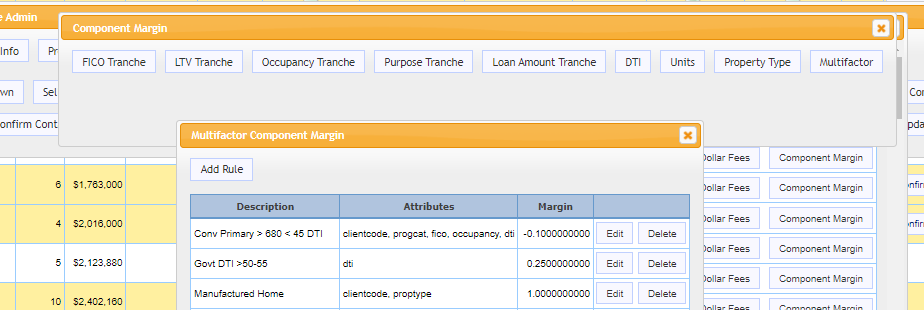

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Rate/Term Refis Surge Over 180% as Industry Advised to ‘Stay the Course’ Amid Shutdown

Rate/term refinances surged 183% as borrowers capitalized on lower rates, with MCT advising lenders to stay disciplined amid a data blackout and Fed rate cuts.

Introduction to Mandatory Loan Sale Delivery

Mandatory delivery in mortgage capital markets impacts pricing, risk, and profitability. Discover when to use it and how it can unlock greater profits.

MSR Market Monthly Update – September 2025

All eyes are on the Fed upcoming meeting this month in anticipation of the highly anticipated rate reduction announcement. Read the full release for the September 2025 MSR update.

MCT September Indices: ‘Batten Down the Hatches’ as Markets Await Fed Decision

MCT’s September Lock Volume Indices show mixed performance as markets hold steady ahead of imminent Fed rate decision. Total volume down 0.78% monthly amid cautious positioning.

Unlocking Growth with MCTlive!® and MSR Services: NOLA Lending Group’s Story

NOLA Lending Group relies on MCT’s hedging, loan sale execution, MSR services, and overall client experience to drive performance.

MSR Market Monthly Update – August 2025

Mixed economic signals are causing many economists to remain cautious, even as U.S economic growth rebounded to 3.0 percent in Q2 after a Q1 contraction. Read the full release for the August 2025 MSR update.

Loan Delivery Methods: Turning Process into Profit

Unlock hidden revenue with smarter loan delivery. Discover how the right strategy can optimize operations, reduce risk, and boost margins.

Refinance Volume Exceeds Expectations in August Despite Broader Market Slowdown

MCT’s August Lock Volume Indices shows surprising growth across all refis, while corrected jobs report data alludes to a potential September rate cut.

MCT Empowers Vellum Mortgage with Efficiency, Automation & Autonomy

Discover how Vellum Mortgage leverages MCT’s automated trading platform to scale volume, reduce risk, and operate efficiently with a lean secondary team.

Ask ChatGPT

MCTlive! Quarterly Release Notes in Q2 2025

Described below within relevant tabs, you’ll find a listing of our Q2 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Data & Analytics tools.