Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

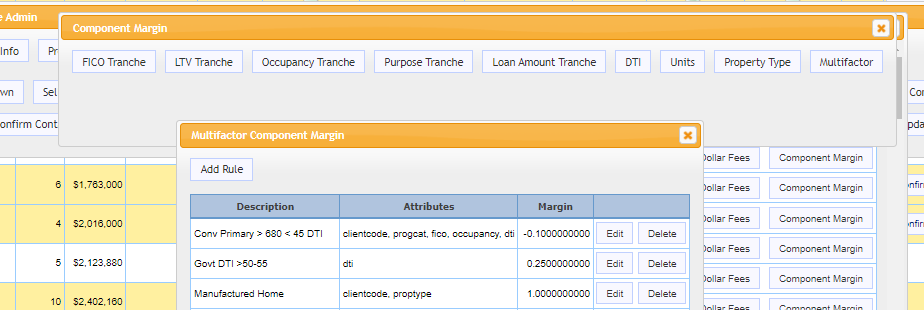

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

New MSR Technology Empowers MSR Buyers with Live Loan-Level Pricing

Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technology for mortgage servicing rights (MSR) buyers to produce more granular pricing for mortgage servicing. The feature leverages an application programming interface (API) to connect MSRlive!, MCT’s state-of-the-art MSR valuation platform to clients’ systems for more precise and accurate loan-level pricing in real time.

MCT Whitepaper: Six Unique Ways to Increase Your Profitability Despite Market Headwinds

Despite the current environment, MCT® helped clients earn an extra $230,000,000 in Q1 2022, or $750,000 in additional profits per client on average. MCT leverages unique software and services like BAM Marketplace, bid tape AOT, and Trade Auction Manager to help clients squeeze every basis point from their best execution loan sale strategy.

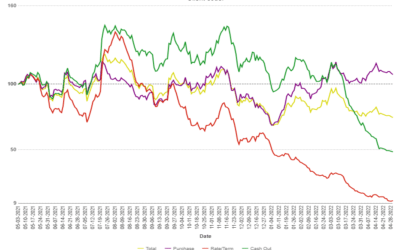

MCTlive! Lock Volume Indices: May 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from May 1 through May 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Case Study: Michigan First Credit Union Adds Efficiency Through MCTlive!

In this case study, MCT sits down with Mr. Sugg to hear how the MCTlive! integration has added efficiency to their loan selling process.

Taper Tantrum 2: Mortgage Market Selloff Deja Vu?

In this article, we will discuss the similarities and differences between the market selloffs in 2013 and 2022. 2022 has had the benefit of a much more orderly move and a healthier marketplace.

MCT Client Exclusive Webinar – Current Market Roll Costs and Their Effect on Loan Sale Execution

In this webinar, MCT’s Phil Rasori, Justin Grant and Andrew Rhodes discussed increased roll costs, the importance of a short commitment period at the time of loan sale, and both front and back end implications.

MCTlive! Lock Volume Indices: April 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from April 1 through April 30, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

Fannie Mae Purchase Advice API – Paul’s Tip of the Week

In Paul’s Tip of the Week, we look at how MCT completed the first integration to Fannie Mae’s new API for loan sale purchase advices.

Improve Profitability to Counter Market Headwinds | MCT Industry Webinar

In this webinar, MCT’s Phil Rasori, Justin Grant, and Andrew Rhodes explain how MCT is helping clients Bring BPS Back and improve profitability to counter market headwinds.

2022 HW Tech100 Mortgage Award Announces MCT as Leader in Innovation

MCT® was announced as a 2022 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award recognized the most innovative and impactful technology companies serving the mortgage industry and forever changing the home sales process.