Weekly Technology Improvement Series:

Pricing Granularity

Published 9/10/2021

MCT Marketplace features recent improvements on both the buy side and the sell side.

One of the primary functionality enhancements is in the Autobid software, which has new features for granularity on pricing and margins on bids.

For certain types of loans, investors can now easily manage pricing for sellers via new margining features on loans with specified value payups that allow the user to define in either bps or as a % of the total payup.

For example, maybe you want 50 bps and 50% of the spec payup on a particular loan.

Specs for Fannie, Freddie, and GNMA are handled in different ways and the new functionality in MCTlive! provides users the ability to load their own spec payup grid or use the derived payups to margin off of.

You can now build out your own programming rules. So, for example, on a Freddie cash retained loan, you can now choose from all applicable spec values and get as granular as you want on the filters.

It will recalculate daily pickup as the spec values get updated. It will also display a hit to price on a global level, such as for a low loan amount, and can adjust on a client level for loan attributes.

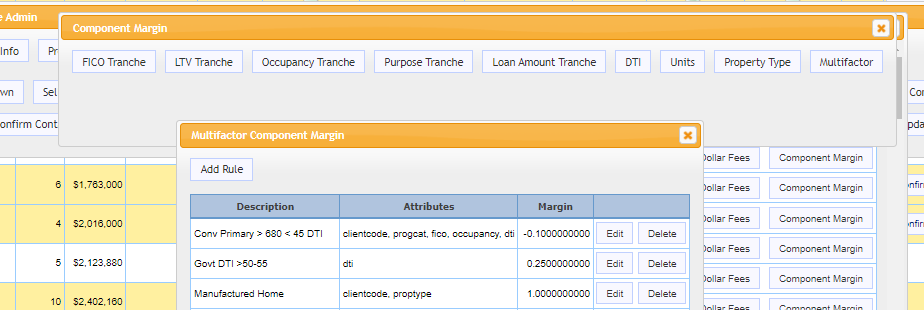

Our new multifactor rule builder for margins and overlays really drives home your point of being a self-managed, very sharp pricing tool for buyers.

This tool allows you to combine any attribute to define when a rule should apply. So, if you want a 5pt hit on loans with a PIW, TX, < 640 FICO, > 80% LTV, MH, for 5 of your sellers. You can do that!

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Mortgage Women Magazine Names Natalie Arshakian as a 2022 Mortgage Star

National Mortgage Professional’s Mortgage Women Magazine selected Natalie Arshakian, Senior Director and Head of Lock Desk Operations at MCT, to its annual 2022 Mortgage Star Awards. This year’s award recognizes 31 women who rise above the rest to do more for their clients, serve as better mentors, and are committed to making the industry more welcoming through both traditional and creative ways.

MCTlive! First to Integrate with Freddie Mac’s Cash Settlement Purchase Statement API

MCT’s award-winning capital markets platform, MCTlive!, is now integrated with the Freddie Mac’s Whole Loan Purchase Advice Seller API. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Freddie Mac purchase data instantly, instead of waiting to run reports through a Loan Origination System (LOS).

MCTlive! Client Profile Tab – Paul’s Tip of the Week

In Paul’s Tip of the Week, we look at the Client Profile tab in MCTlive!, which brings some basic information in an easily accessible spot within MCTlive!

MCT Client Webinar – Hedge Advisory Strategy for Current Rate Environment

In this webinar, MCT’s Kristen McCarthy, Andre Pollesel and Paul Yarbrough discuss hedge considerations in a volatile market, review current hedging best practices, and lock desk policy recommendations.

Mortgage Professionals of America Magazine Names Natalie Arshakian to List of Elite Women For 2022

Natalie Arshakian has been selected to Mortgage Professional America (MPA) magazine’s list of Elite Women in Mortgage for 2022. The annual awards, now in their sixth year, celebrate 67 successful women who are taking on gender inequality in leadership by continuously challenging societal expectations

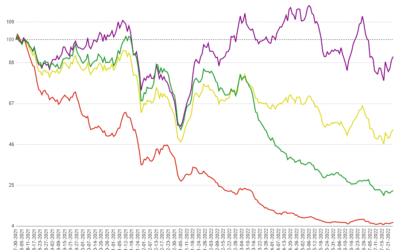

MCTlive! Lock Volume Indices: July 2022 Data

MCTlive! Mortgage Lock Volume Indices covers the period from July 1 through July 31, 2022, and represents a broad and balanced cross section of several hundred lenders of various sizes and business models in the mortgage industry across retail, correspondent, wholesale, and consumer direct channels.

MCT & LendersOne Webinar – Strategies to Improve Profitability in the Current Market

This webinar provided a current market overview and include actionable insights and recommendations. Attendees received key lock desk, mortgage servicing rights (MSR) and trading recommendations, as well as how to leverage technology and automation for improving profitability and efficiency.

Strategies For Mitigating Risk in a Volatile Market

In this article, we will discuss strategies for mitigating risk in a volatile market. The type of volatility that has been experienced by mortgage bankers in 2022 due to a widening basis.

Mortgage Banker Magazine Names Curtis Richins on Legends of Lending List

Curtis Richins, President of MCT, has been selected to Mortgage Banker Magazine’s inaugural “Legends of Lending” list. The magazine’s inaugural class was compiled to highlight the most talented, ambitious, and legendary individuals who are achieving excellence and making a difference in the mortgage industry.

Features Overview: Fannie Mae Purchase Advice API – Rasori’s Relentless Releases

In MCT’s latest installment of Rasori’s Relentless Releases, Phil Rasori covers the new Fannie Mae purchase advice API. View the episode to get the scoop on these timely updates.