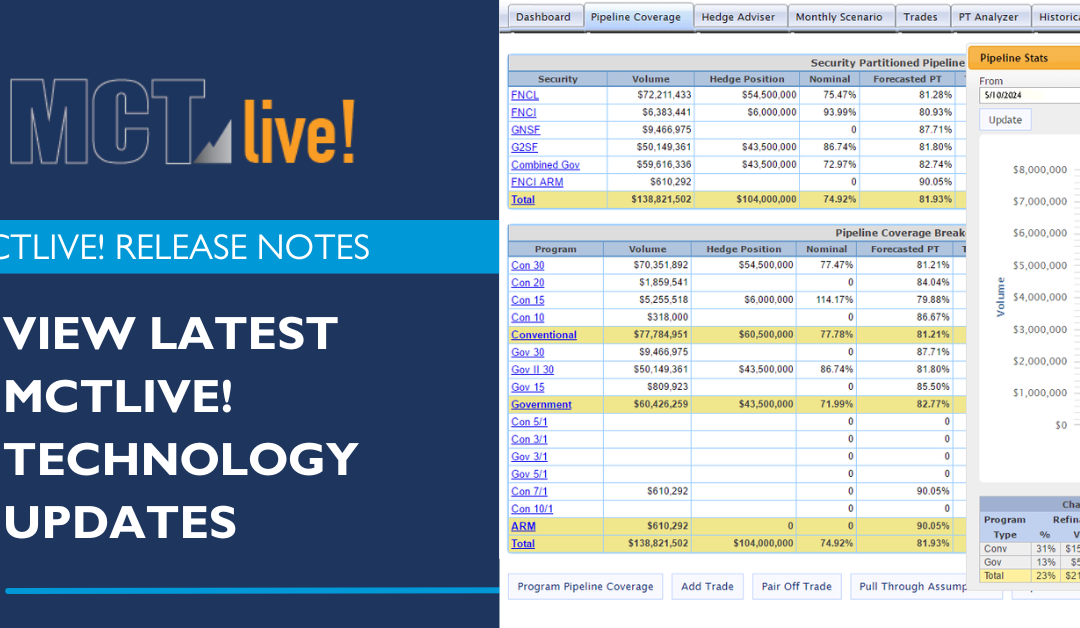

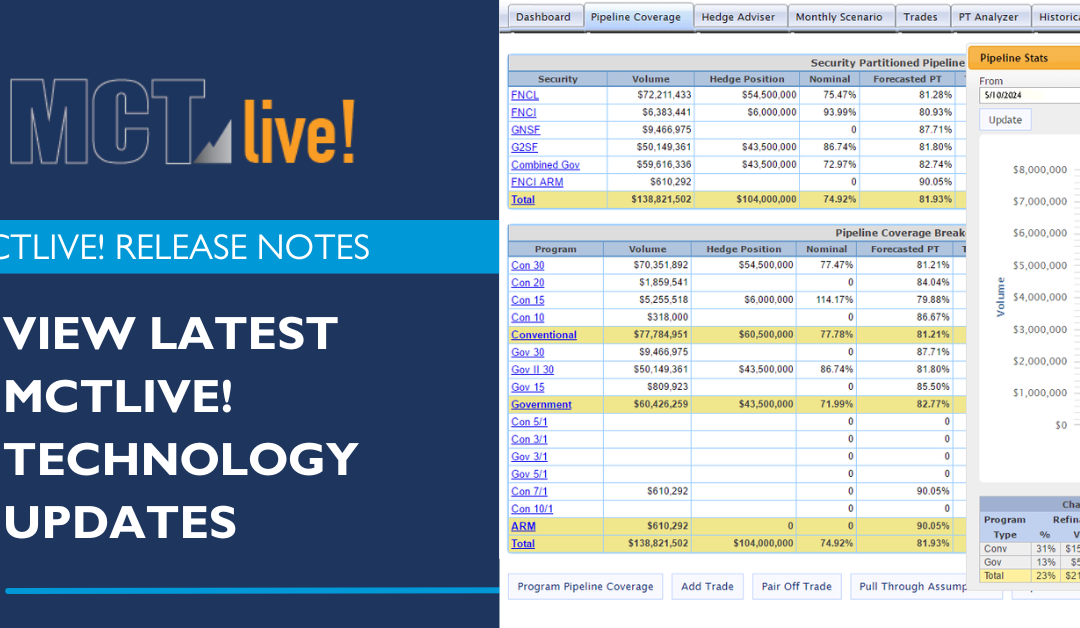

MCTlive! Quarterly Release Notes in Q1 2025

Described below within relevant tabs, you’ll find a listing of our Q1 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

Described below within relevant tabs, you’ll find a listing of our Q1 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools.

On April 2nd, 2025, the President announced reciprocal tariffs on 186 countries ranging from 10% to 50%. Global equity and bond markets were swift and punishing. Read the full release for the April 2025 MSR update.

Mortgage rates continued their downward trend during the second half of February. Freddie Mac’s weekly primary 30-year fixed rate closed the month at 6.76% after stubbornly hovering around 7% for several weeks.

Discover how MSRlive! 4.0’s enhanced reporting delivers deeper MSR insights with portfolio analysis, loan-level trends, valuation drivers & cash flow tracking.

In this video, MCT’s Justin Grant, Senior Director, Head of Investor Services, discusses how to overcome what was historically a very high barrier to entry and how you can now broadcast your bid price across the entire seller base to be more efficient and run lean with a small sales team.