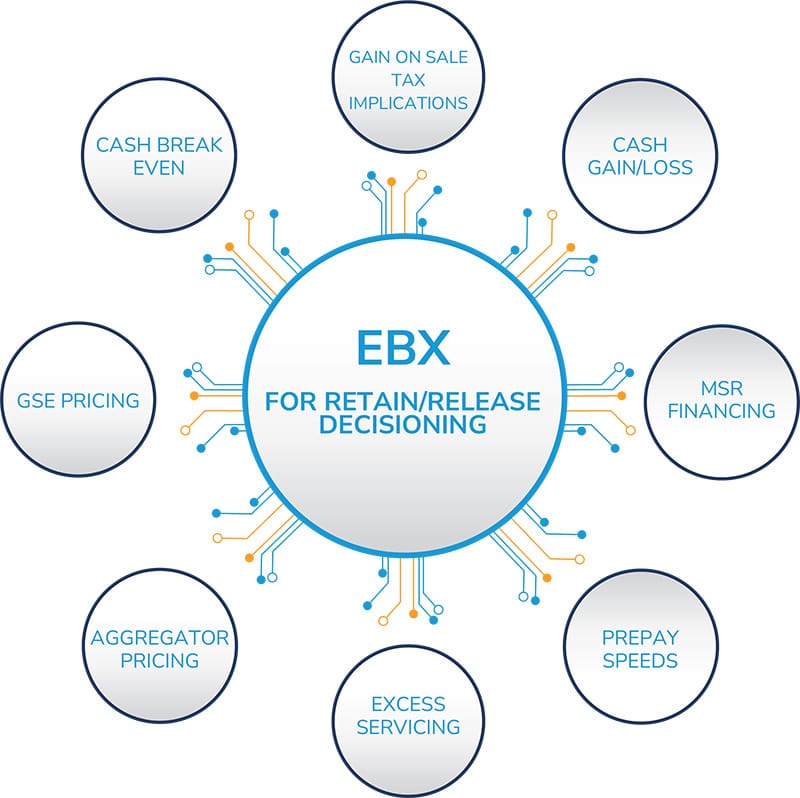

MCT’s Enhanced-Best-Execution (EBX) tool is the most comprehensive tool on the market for helping secondary market (MSR portfolio) managers determine which loans to retain or release.

MCT has automated the data reconciliation process to seamlessly transfer (via API) information between MCTlive! (Hedging Platform) and MSRlive! (MSR Platform).

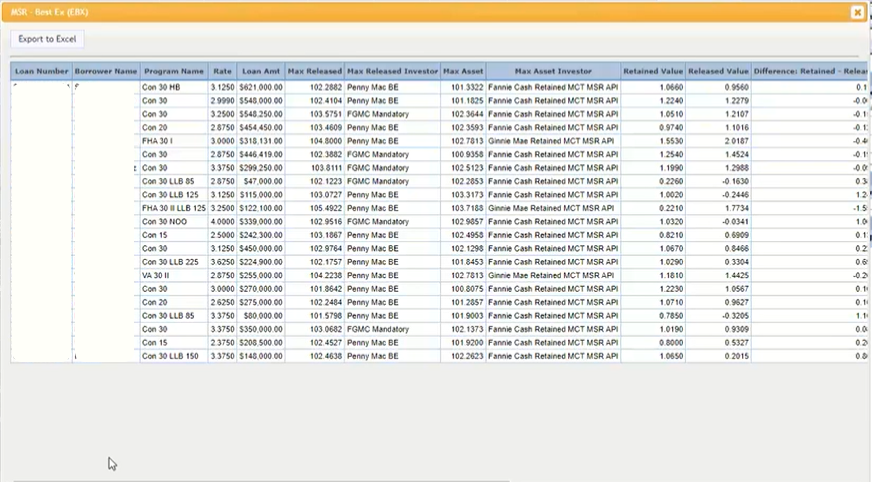

EBX acts as a “real-time” bridge between MCTlive! (live whole loan/SRP execution) and MSRlive! (loan level MSR valuation). With this tool, MCT clients have accurate insight into how loans are trading and what investors are paying along with the intrinsic servicing value to enhance the retained vs. released decisioning process. What was once a manual and time consuming exercise is now completely automated with EBX, making all of the essential execution data elements accessible with the click of a button. Contact us today for a live demonstration of the EBX tool!

EBX Retain vs. Release Analysis & Data

Contact us today for a demonstration of the Enhanced Best-Execution tool!

Features of MSR Retain-Release Decisions with EBX

The EBX Tool enables clients to make loan level strategic decisions regarding their servicing portfolio using their internal data, while new automation quickly pulls critical execution information for informed decision making. Clients using this tool gain valuable insight into retain vs. release decisions that:

- Are precisely calibrated to your internal costs and yield requirements.

- Adjust cash impact for MSR financing transactions.

- Adjust for the cash impact of a transaction by:

- Reflecting tax advantages of retention vs. release.

- Identifying client specific cash breakeven month required for retention.

- Showing actual gain/loss in cash from different retention strategies or decisions specific to individual loans.

“The automation of our EBX functionality is instrumental to ensuring our clients can quickly make the most informed and strategic retain-release decisions, especially critical during times of market volatility.” – Bill Shirreffs, Head of MSR Services, MCT

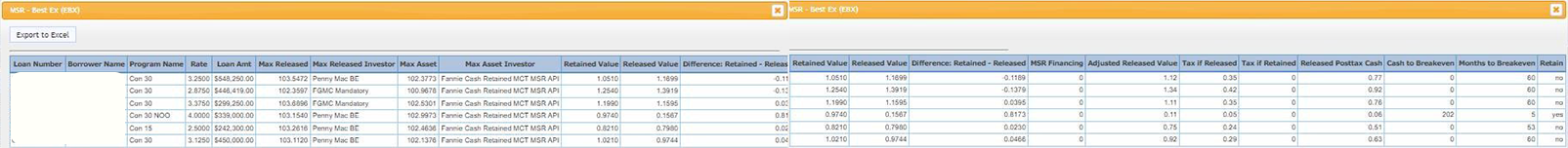

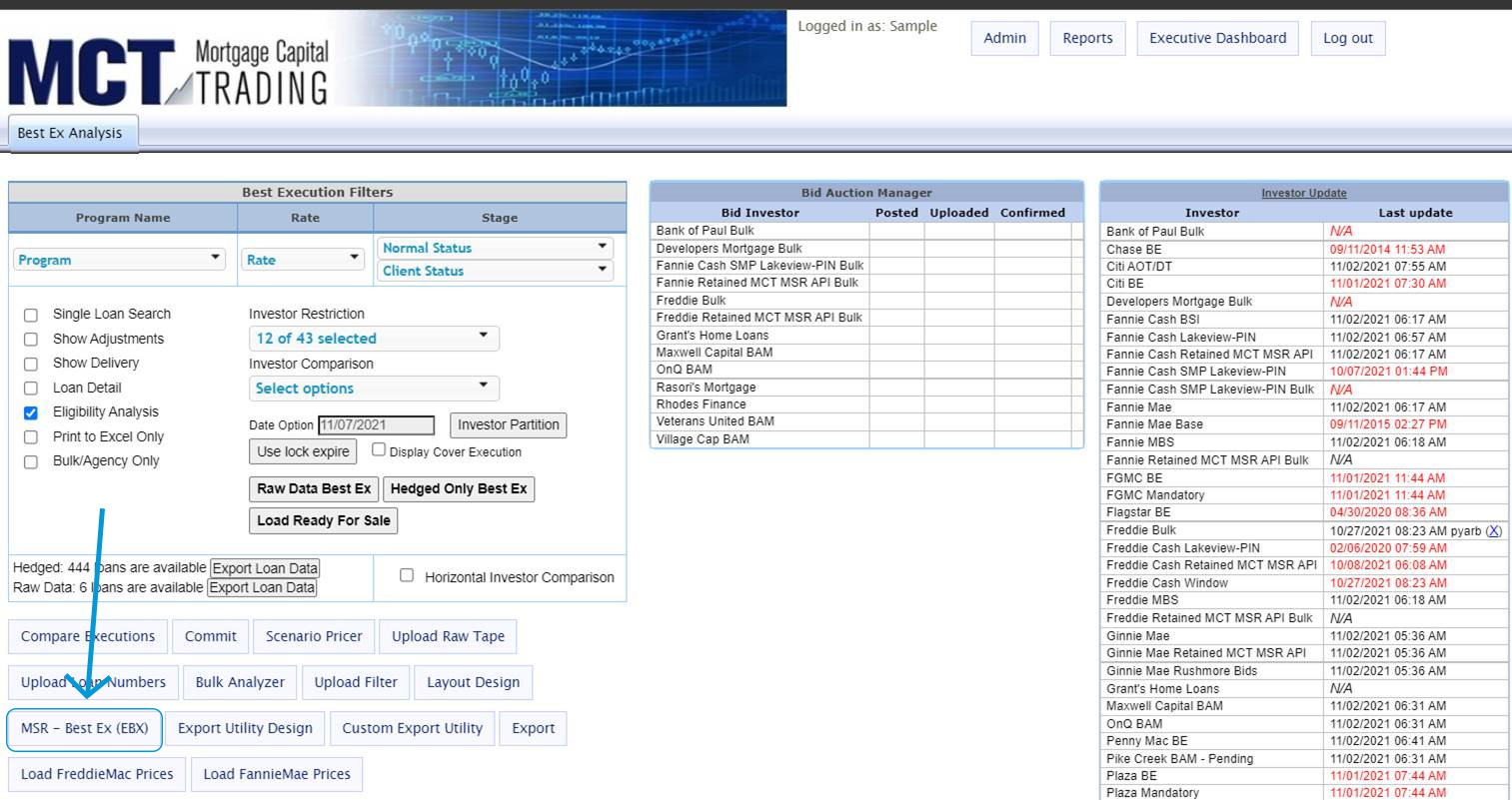

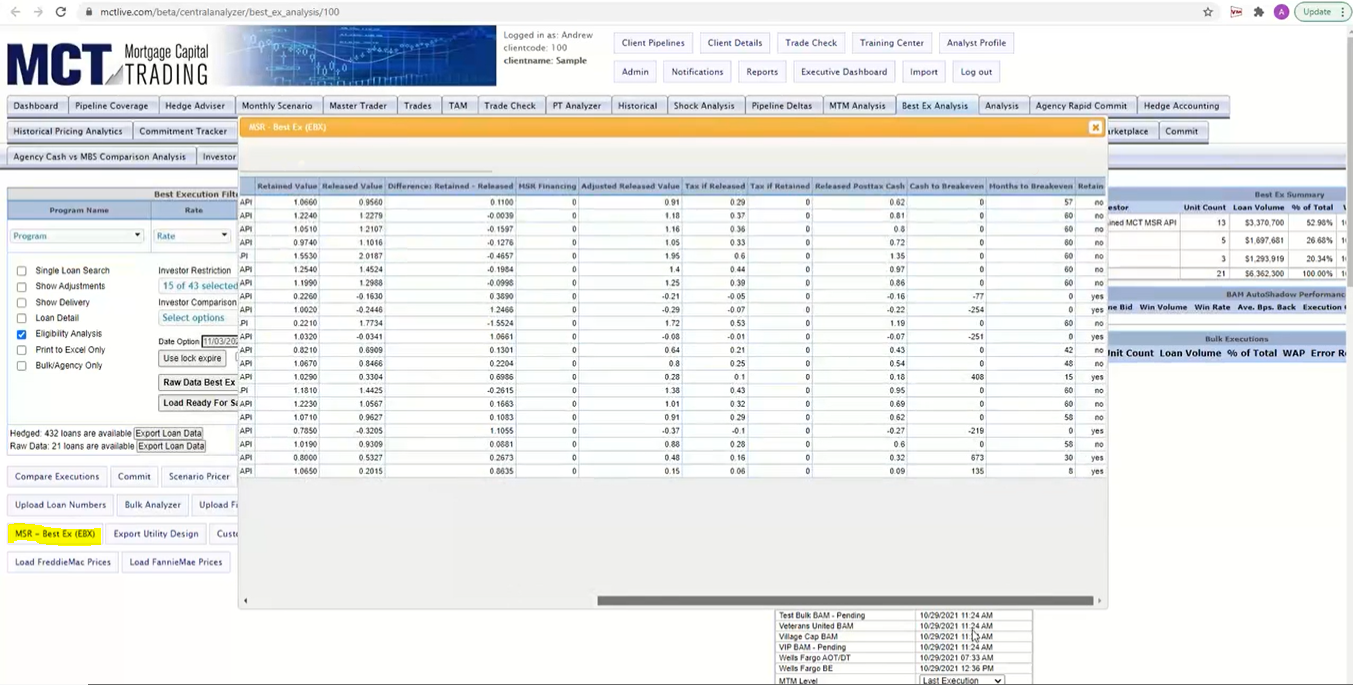

Leveraging EBX For Retain-Release Decisions

Reviewing your MSR portfolio has never been easier with EBX! Simply click on the MSR – Best Ex (EBX) button within MCTlive! to get started. Users can leverage EBX to make the following decisions:

- A client is able to set their specific desired cash flow breakeven month then EBX will then determine which loans to retain and in addition to the overall cash impact.

- The economic value, while important, does not take into account the tax effect of selling released (SRP) or the cash advantages provided by financing. MCT’s EBX is able to also factor these into the analysis.

- If the client felt better about their cash position and current balance sheet liquidity, they could also extend the number of months to breakeven and retain additional servicing.

For the first time, EBX leverages the extensive execution data available in MCTlive!, in addition to the critical MSR valuation information from MSRlive! EBX can be customized to help you achieve your strategic objectives relative to your MSR portfolio and your overall corporate objectives. View screenshots of the platform by clicking on the images below, or contact us today for a live demonstration of the EBX tool!

For the first time, EBX leverages the extensive execution data available in MCTlive!, in addition to the critical MSR valuation information from MSRlive! EBX can be customized to help you achieve your strategic objectives relative to your MSR portfolio and your overall corporate objectives.

Learn More About MCT’s EBX

The ability to make MSR retain-release decisions on a moment’s notice, understanding the impact on your retained portfolio, cash drain, and tax impacts are what make EBX a gamechanger for MCT clients. Especially invaluable during times of increased market volatility, EBX is just one of the many tools that MCT offers in addition to support and a dedicated client services team.

For more information on EBX, and how it can help you create the optimal servicing portfolio, please contact your MCT sales representative for a demo.