Economic Update

On April 2nd, 2025, the President announced reciprocal tariffs on 186 countries ranging from 10% to 50%. Global equity and bond markets were swift and punishing. Initially, the 10 Year Treasury rate declined by about 21 basis points, but that has reversed since Friday, April 4th, 2025. As of this writing, the 10 Year Treasury rate has regained all lost ground and added an additional 16 basis points. The current 10 Year Treasury stands at 4.36%. Mortgage rates have reacted accordingly, dropping during the first two days after the tariff’s announcement, but have reversed course since Monday, April 7th, 2025. Current 30 Year fixed rate is ranging between 6.50% and 7.00%.

While tariffs are on everybody’s mind, attention is needed to the potential breakdown occurring within the overall economic and geopolitical orders. Those breakdowns could have a significant impact on global economies and global debt.

Caution is warranted, the financial markets are still trying to grasp the potential economic fallout of the tariffs and are adding layers of uncertainties across the globe. Economists are now predicting that the U.S. economy, and global economies as well, could experience a recession during 2025. In the meantime, it is critical that lenders remain diligent and not react to the ever-changing financial news. Sometimes, it is better to do nothing while monitoring financial indicators closely to ensure that the financial markets are on sound footing before making significant business decisions.

It is difficult to predict the direction of mortgage rates and other financial indices during such volatile conditions, so we caution that we could be entering a period where MSR values could change suddenly without warning. We are monitoring all indicators and will advise accordingly.

Current MSR Market Update

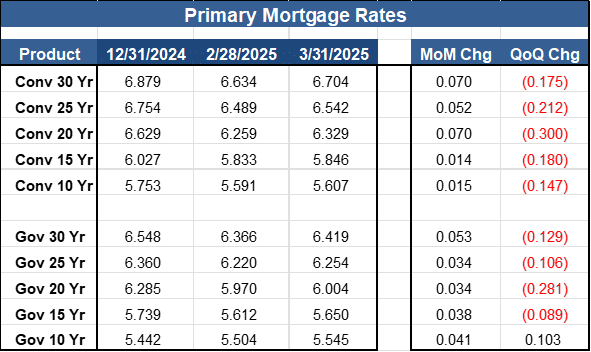

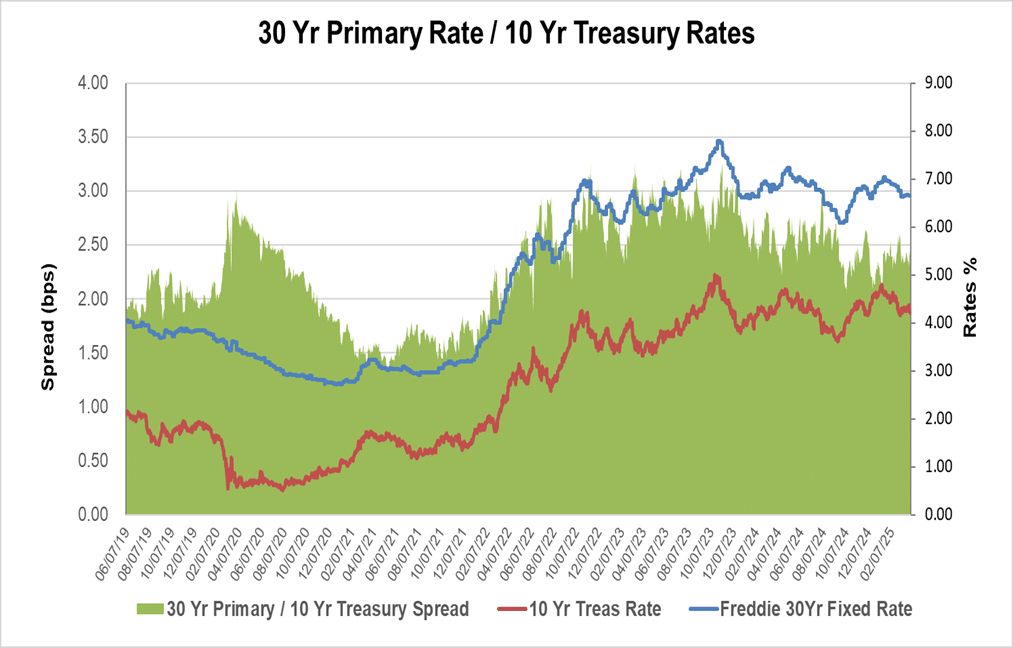

Mortgage rates continued their moderate volatility during the month of March. MCT’s mortgage rates model reflected a slight increase in mortgage rates of about seven (7) basis points, on average. MCT’s current primary 30-year fixed rate closed the month at 6.70%. The current mortgage rates levels should bear good news for the real estate market as the industry approaches the spring homebuying season. However, recent sentiment among consumers and the administration’s tariffs and possible resurgence of inflation could negatively impact the economy and the housing market 2025 season.

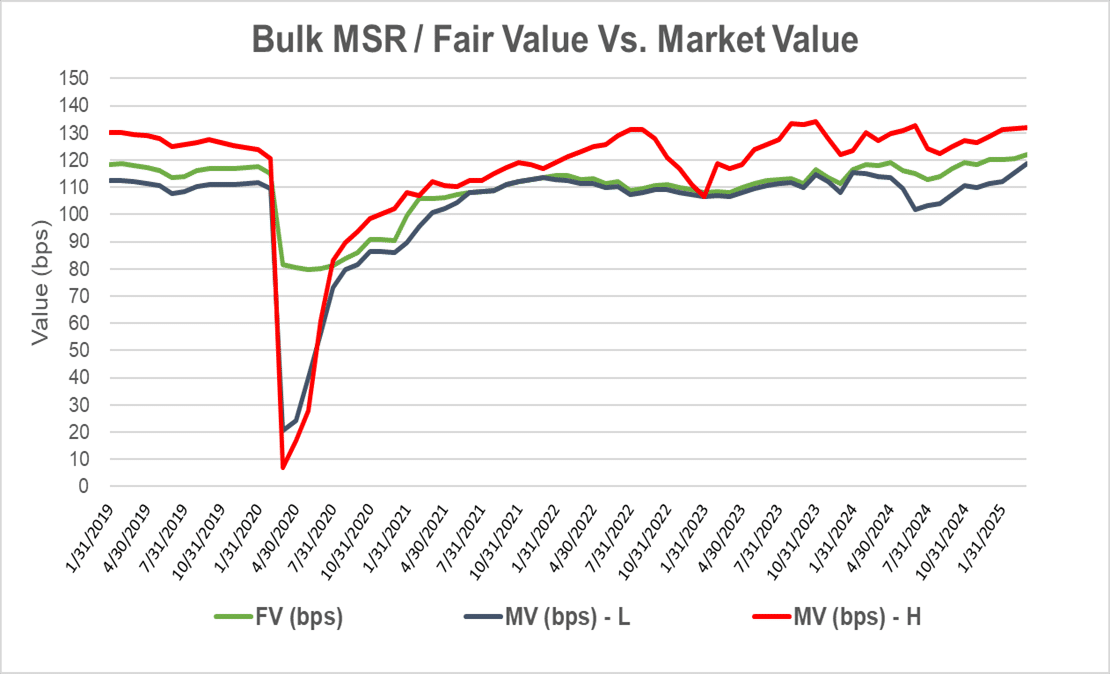

MSR values, so far into 2025, have held steady and is reflecting a resilient MSR market in the face of several uncertainties. The auctioned bulk MSR trading activities have been largely muted during Q1, 2025 but did not prevent some MSR holders from trading directly among themselves. MSR fair market prices remain strong as demand for such assets is very robust. As we analyze March 31, 2025, portfolios, we expect MSR values to remain robust and attractive.

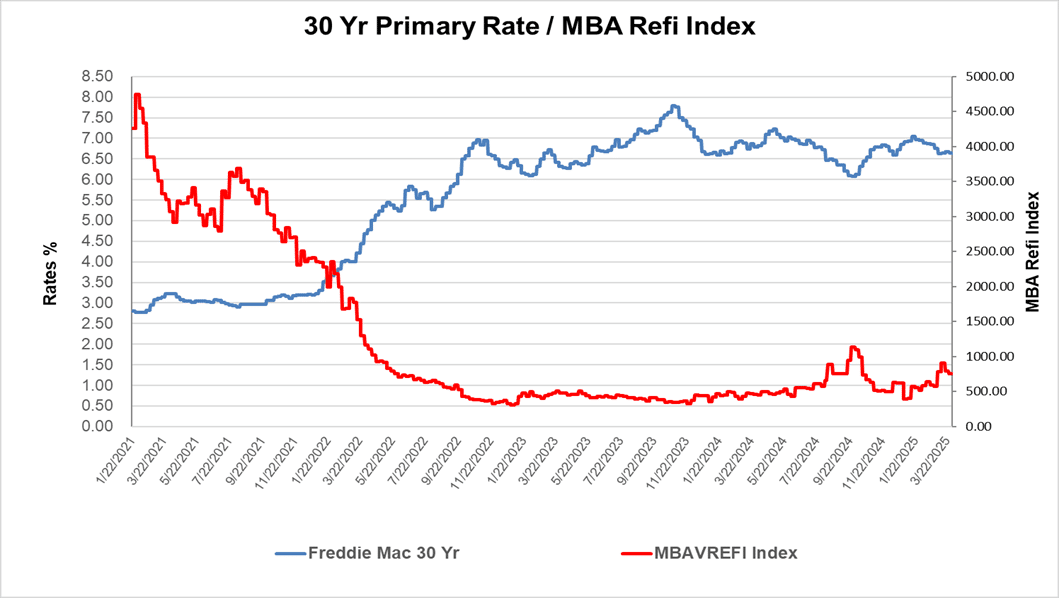

Loan production volume remained relatively weak during the month of March, however, there were minor surges in applications when mortgage rates trended lower; We anticipate loan applications to fluctuate as mortgage rates change in this uncertain market environment. Recent trends did reflect borrowers’ demand for loans even with just the slightest drop in mortgage rates. However, we do not anticipate a refi boom on the horizon. However, we do anticipate some periodic upticks in prepayments as borrowers take advantage of those periodic mortgage rate decline.

Demand for Non-QM, HELOC, and second mortgages originations continue to grow as more borrower’s knowledge and comfort in obtaining those loan products increase. Lenders and investors continue to expand their footprint in these loan segments as demand for such loans increases.

Mortgage delinquencies continue their upward trend as borrowers continue to struggle with their rising debt and higher property taxes and insurance. The concern lies in the 90+ days delinquency category as more borrowers fall behind on their mortgage payment obligations. Mortgage prepayments are also rising but remain in the 5%-7% range. Most prepayments are currently concentrated in vintages prior to 2020.

New Production Value Trends

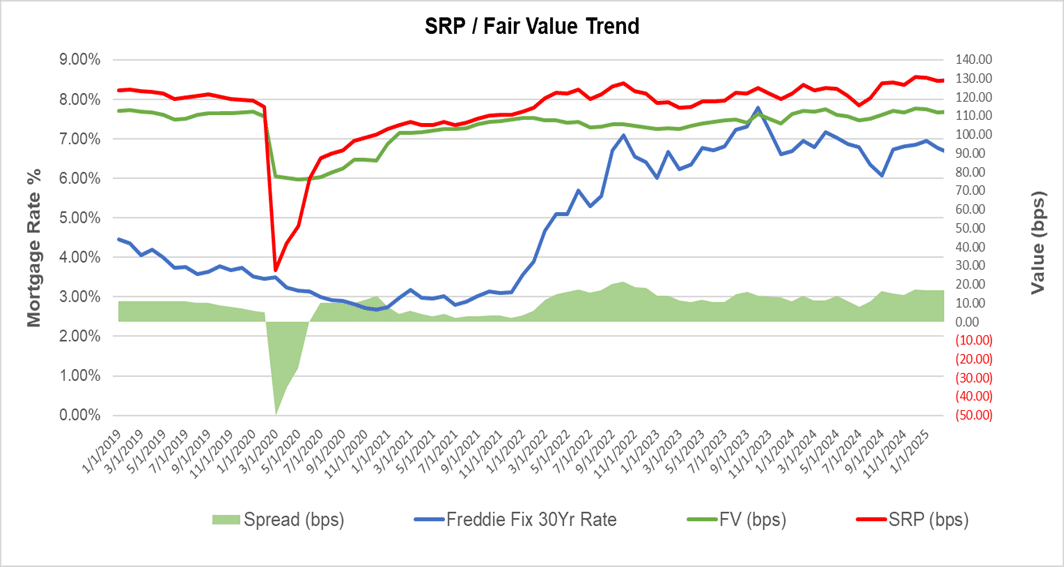

Recent servicing release premiums (SRP) remain very strong due to low new loan production volume. The SRP prices are very attractive and offer much-needed financial support for many lenders. Many MSR holders have started to retain more loans to offset their declining MSR balances. Current retention levels range between 20% and 30%, on average.

SRP values continue to be about 10-15 basis points higher than fair values, though, that spread has leveled off during Q1, 2025. We expect the trend to continue for the foreseeable future. We continue to advocate caution when capitalizing new MSR production at moderate price levels as the market navigates current mortgage rates uncertainties.

MSR Bulk Market

Auctioned Bulk MSR activity have been muted during Q1, 2025. However, values remain robust and attractive for many buyers and sellers alike. MCT anticipates that bulk MSR activities will remain relatively low due to the many uncertainties tied to mortgage rates and other macro-economic factors. Recent bulk MSR trading values continue to reflect levels of 5.0x – 5.50x multiples of servicing fees for agency loans and 3.65 x – 4.10 x for government loans with underlying vintages from prior to 2023.

Non-QM and Second Mortgage Trends

Demand for NonQM and second mortgage originations has restarted after a slow start during January 2025. The NonQM and Closed-end second mortgage originations are expected to increase by about 10%-15% over 2024 origination volume levels. Investor demand for such products and securitization continues to rise as traditional agency loan products remain low. MCT continues to observe robust origination volume within these two segments, in addition to strong fair values, depending on portfolio characteristics.

The underlying fair values and demand for such products are very competitive; NonQM MSR product’s fair values are between 3.90 – 4.50 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30 – 3.25 as more high balance loans are being produced.

Mortgage Rates

As of March 31, 2025, the current fixed 30 Year mortgage rate is 6.704%, which represents about a seven (7) basis point increase from their February 28, 2025 mark.

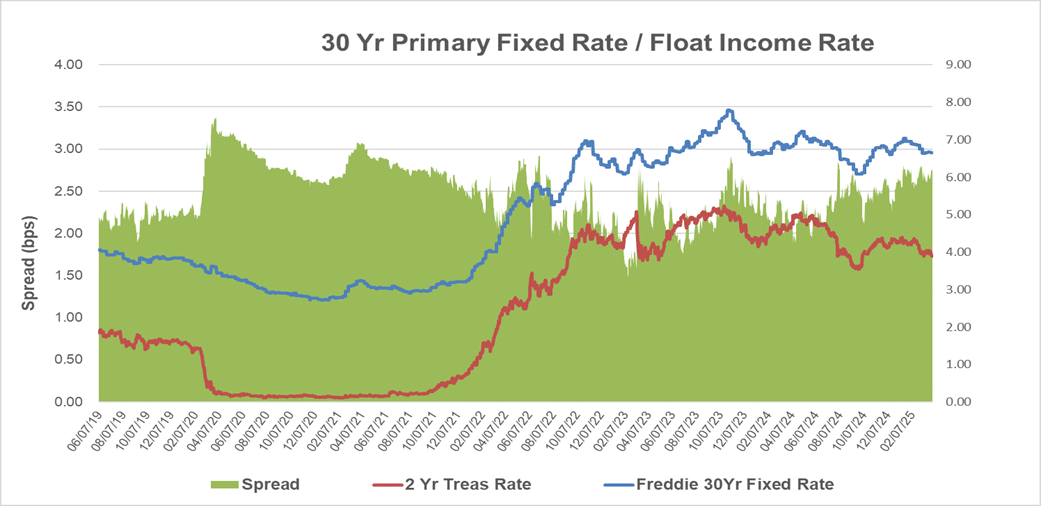

Escrows and Float Income

Mortgage escrow values remain robust and should continue to buoy overall MSR values. It is the second largest contributor to the overall MSR portfolio value as float income rates remain high. Property values are expected to continue to rise during 2025 by about 4%-5% which could lead to higher borrowers’ monthly tax and insurance payments. The increase in the monthly escrow payment could have a potential negative impact as it might increase borrowers’ default risk.

Float income rates have decreased by about 10-12 basis points as many rate indices have declined during the month of March.

Rates Indices

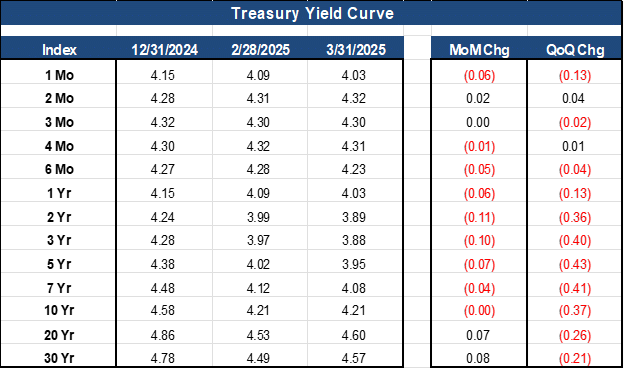

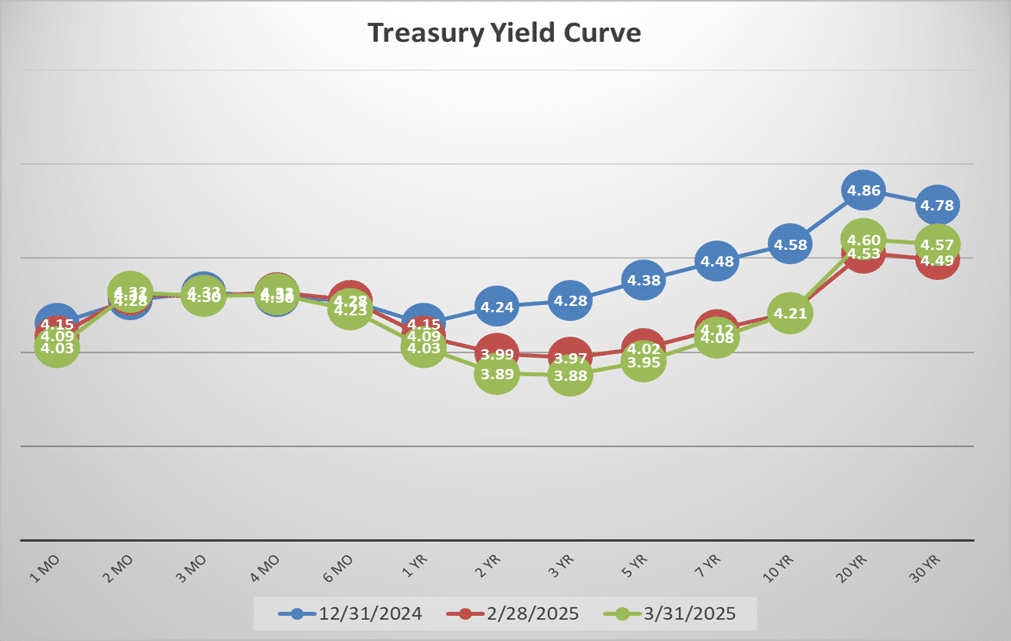

The current Treasury yield Curve is reflecting current economic uncertainty as investors sought the safety of Treasury bonds and gold. The new administration policies are creating some anxieties among investors as they try to determine what lies ahead.

The current spread between the 2 Yr Treasury rate and the 10 Yr Treasury rate has flattened, which could mean some economic challenges are ahead. Many economists are predicting a 40%-50% likelihood of a recession during 2025.

Fair Value Guidance

Our estimate of the fair values for existing portfolios should remain relatively unchanged compared to their February 28, 2025, marks. The increase in mortgage rates should negate the decrease in fair value, which is attributed to the decline in the float income rates. Although, the underlying fair value is dependent on the portfolio characteristics.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between -1 to +1 bps change from February 28, 2025, marks.

- Government loans between -1 to +1 bps change from February 28, 2025, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net