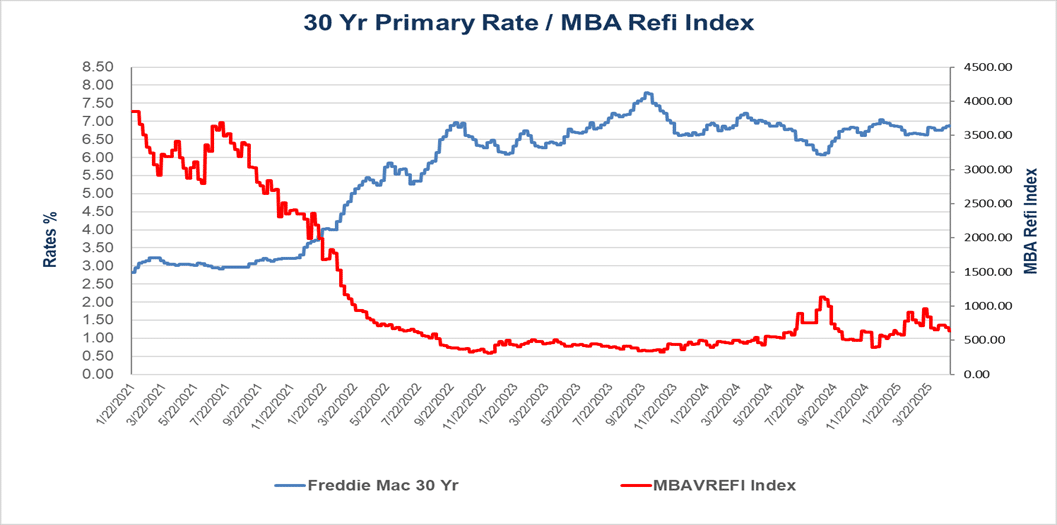

The originations market struggled over the last few weeks while mortgage rates continued to hover around 7%, but now some relief is in sight. Interest rates on mortgages started a downward trend during the second half of June 2025. MCT’s current primary 30-year fixed rate closed the month at 6.65%, a 22 basis points decline since May 31, 2025. However, the current political and economic climate is generating uncertainty and directional inconsistencies. Mortgage rate fluctuations offer a possible relief for the mortgage lending industry in terms of increased home purchase activity and a possible increase in mortgage refinancing activity.

According to the Census Bureau and the Department of Housing and Urban Development, sales of new single-family homes declined by 13.7% on a monthly basis in May, and sales were down 6.3% compared with May 2024. We may see better results in June as mortgage rates declined during the latter part of the month.

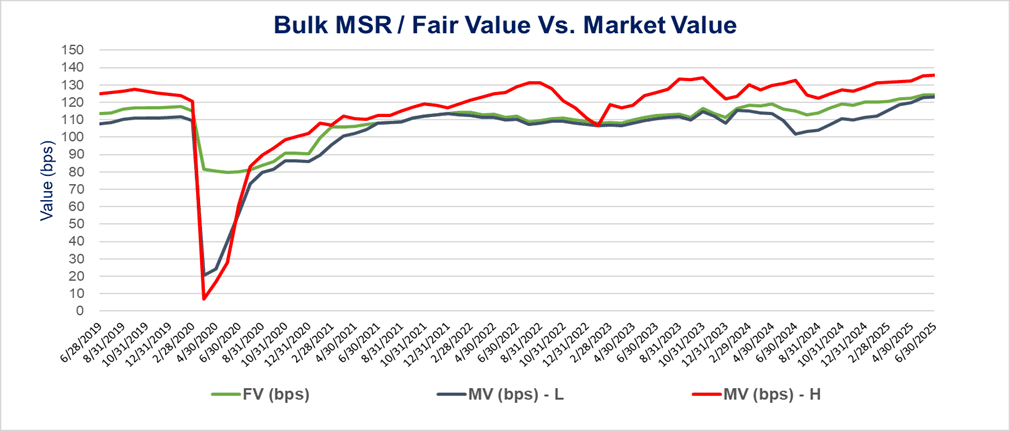

MCT bulk MSR trades have shown strong prices paid for MSR portfolios. Many buyers continue to shrug off mortgage rates volatility and economic uncertainties to acquire MSRs as we enter the second half of 2025. Persistent low overall mortgage production volume is the biggest driver behind the elevated prices.

The housing market remains under pressure in many parts of the country as there are more sellers than buyers. Affordability is the main driver behind the current real estate market stagnation. With the real estate buying season well underway, and with a declining mortgage rate, there is a possibility of a mild increase in purchasing and refinancing activity during Q3, 2025. Of course, barring significant macroeconomic surprises.

MCT continues to observe a slow upward trend in mortgage delinquencies as more borrowers are falling behind on their mortgage payments. This trend is more evident with Ginnie Mae loans. Mortgage early buyouts continue to rise as well, and the pace has increased during Q2, 2025.

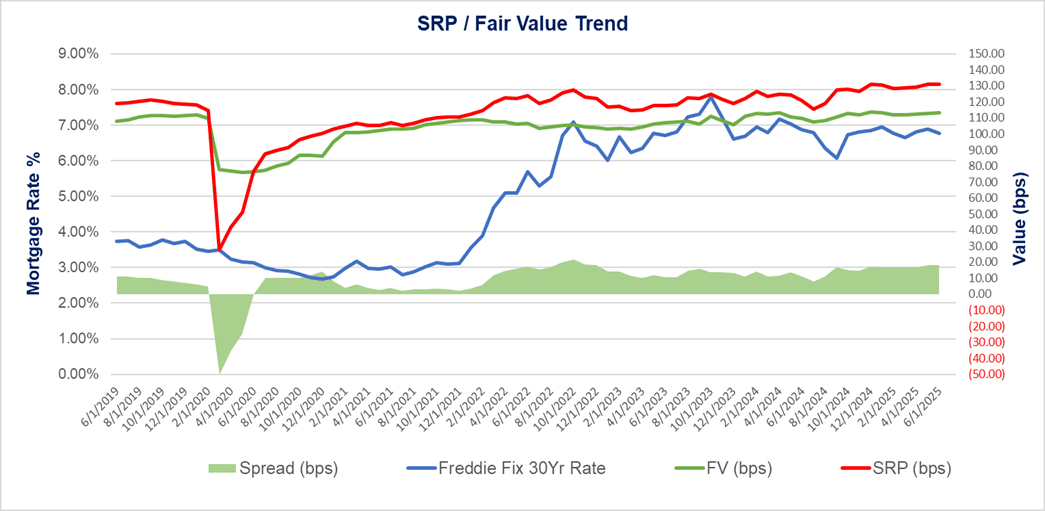

New Production Value Trends:

June’s production levels were down after a weak May production volume. Refinancing activity did increase during the latter part of June as mortgage rates started their downward trend, which is currently closing in on the 6.50% mark.

Borrowers continue to struggle as home price affordability issues persist due to high home prices and actions by the current administration have increased uncertainty. Both issues have kept home ownership out of reach for many for the time being.

Recent servicing release premiums (SRP) remain very strong due to low new loan production volume and have actually increased with some aggregators. The SRP prices remain very attractive and offer much-needed financial relief for many lenders. The average SRP price is now about 15-25 basis points higher than the average fair value. Many lenders with servicing portfolios are faced with tough choices related to retaining some of their loan production or selling their loan production on a servicing release basis. We continue to advocate caution when capitalizing new MSR production at moderate price levels as the market navigates current mortgage rates uncertainties.

Bulk MSR Market

The Bulk MSR activity has overall been somewhat mild during the month of June. Higher mortgage rates and other rate indices have led to higher price offerings for bulk MSR packages.

Bulk MSR trades ranged between 134 to 142 basis points (5.36 – 5.68 multiple of servicing fees). The constantly low mortgage production volume continues to lead to more demand for bulk MSR portfolios and, in turn, higher prices.

MCT anticipates bulk MSR trading activities to be moderate during Q3, 2025.

Non-QM and Second Mortgages Trends

The acquisition of non-QM lenders has been on the rise during the first half of 2025. The interest in non-QM is beyond depository institutions and has extended beyond traditional financial institutions. Anticipated yields and returns on investment from non-QM products are materially higher than conforming agency loans, resulting in growing interest.

Delinquencies, just as in conforming loans, are slowly rising as well, particularly within higher interest rate ranges. Prepayments, on the other hand, have been muted due to current high mortgage rates. Loans with DSCR (debt service coverage ratio) of one or higher tend to perform better than the loans with a DSCR lower than for obvious reasons. The latter category is where the concerns are as their performance naturally worsens over time.

HELOCs continue to dominate the home equity loan origination volume. New HELOC commitments accounted for more than 80.6% of the HEL lending during Q1, 2025. The market should expect similar results for Q2, 2025 as mortgage rates edged closer to 7% during the same period. Almost 86% of the total outstanding HEL balance was funded by depository institutions.

The bulk MSR market for these two segments remains low. Underlying fair values for non-QM MSR products remain between 3.65 – 4.40 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30x and 3.25x multiples of servicing fees.

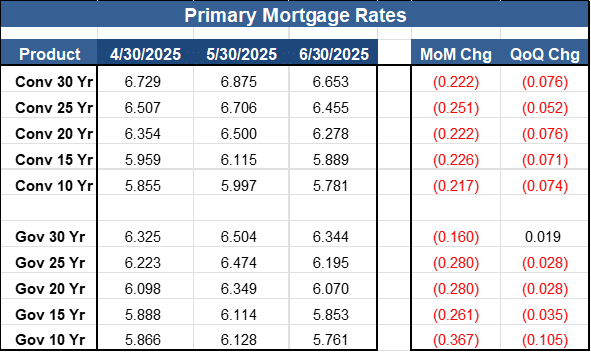

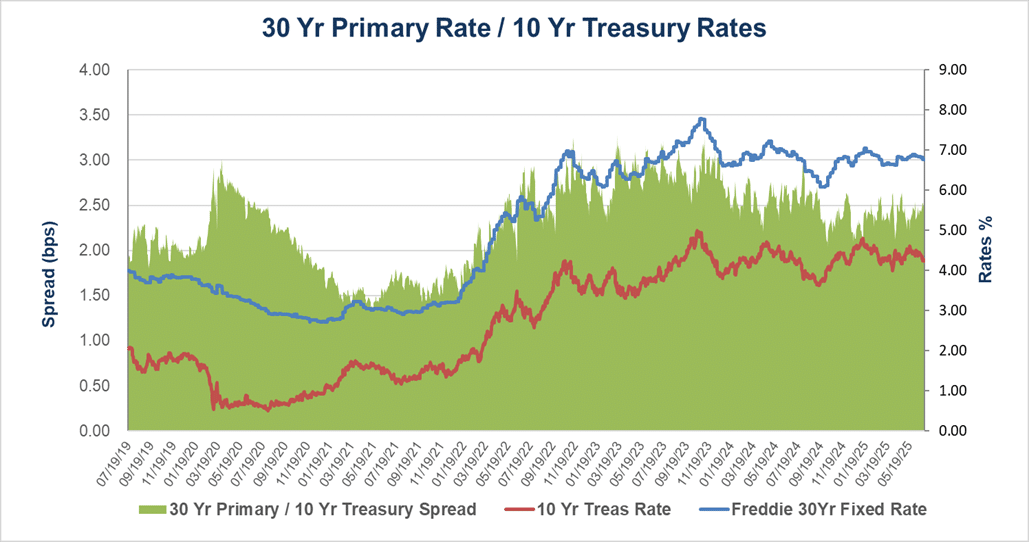

Mortgage Rates

As of June 30, 2025, the current fixed 30 Year mortgage rate is 6.653%, which represents about 22 basis points decrease from May 31, 2025, mark.

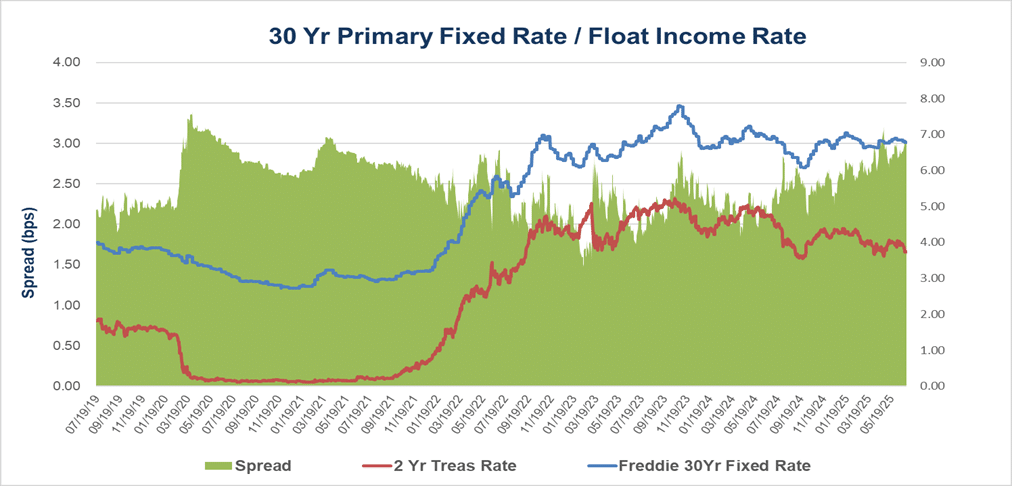

Escrows and Float Income

Mortgage escrow values have retreated from their May 31, 2025, marks due to the decline in float income rates, which dropped by about 14 to 18 basis points during the month of June 2025. The decrease in float income rates unfortunately erased all the gains in value increases that MSR portfolios experienced during the month of May. Escrow values are the second largest contributor to the overall MSR value.

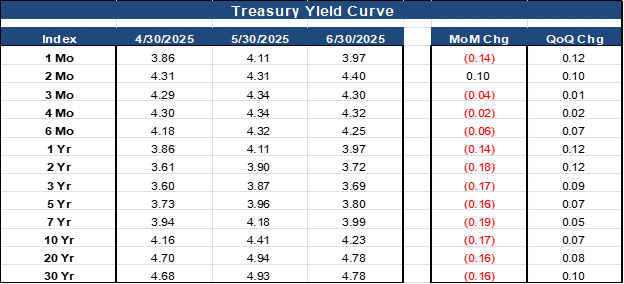

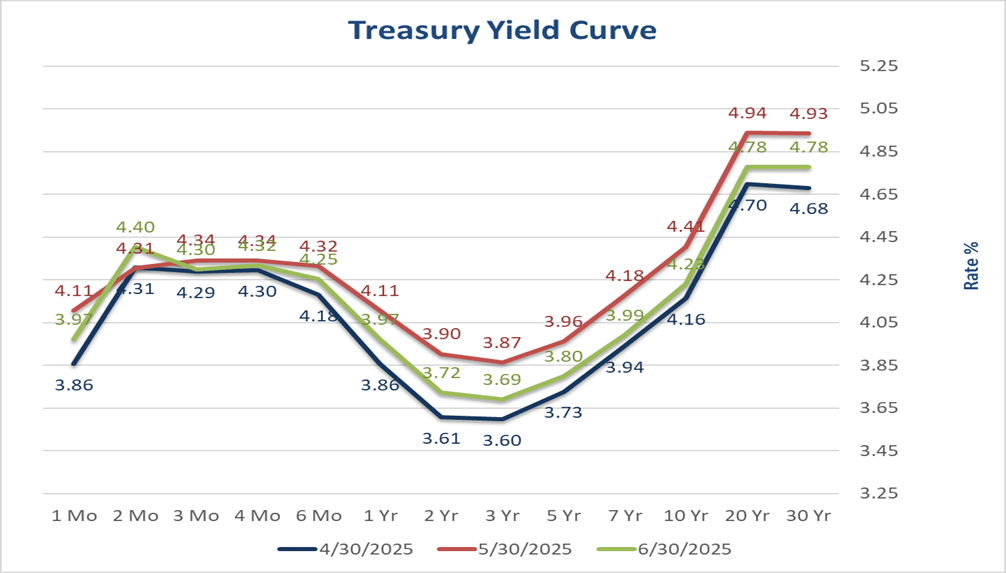

Rates Indices

The current Treasury Yield Curve continues to reflect some economic distress and future economic uncertainties. The new administration’s policies are creating some anxieties for investors as they try to determine what lies ahead.

The yield on the benchmark 10-year Treasury was at 4.23%, the lowest it’s been since early May.

The current spread between the 2 Yr Treasury rate and the 10 Yr Treasury rate is on a trajectory that is similar to the time immediately following the pandemic, which could signal some economic challenges are ahead.

Fair Value Guidance

Our June 30, 2025, fair values estimate for existing portfolios should decline from their May 31, 2025, marks. Changes in MSR values will be dependent on the percentage of escrowed loans and the amount of monthly escrow payments that are collected due to the significant increase in float income rates. The decrease in mortgage rates will increase the prepayment forecast which will have a negative impact on fair values.

MSR holders should expect a decrease in fair values ranging from one (1) to four (4) basis points, primarily because of the declines in mortgage and float income rates.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between -1 to -3 bps change from their May 31, 2025, marks.

- Government loans between -1 to -4 bps change from their May 31, 2025, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net