As the leader in capital markets software and services, MCT supports more lenders with hedging and pipeline management solutions than any other single provider. This privileged position allows us to aggregate and analyze a meaningful population of data and translate it into macro trends and insights.

MCT-collected statistics are unique to the industry given the diversity of lenders (e.g., sizes, products/services offered, business models) across our national footprint.

MCT’s rate lock activity indices are based on actual locked loans, not applications, and are therefore a more accurate indication of industry lock activity than other potential stats. Especially in a tight purchase market, we firmly believe our methodology of using actual loans locked (rather than applications) is a more reliable metric. Why? There is a higher likelihood of having multiple applications per funded loan, and pre-qualifications do not convert at as high of a rate in the current market as has historically been the case – especially when applications are counted at the early stage of entering a property address.

As mentioned, our stats represent a broad and balanced cross section of several hundred lenders across retail, correspondent, wholesale, and consumer direct channels. The lock volume indices break out data by transaction type (purchase, rate/term refinance, and cash out refinance), and the below charts also include year-over-year breakdown of rate lock activity.

January 2023 Rate Lock Data

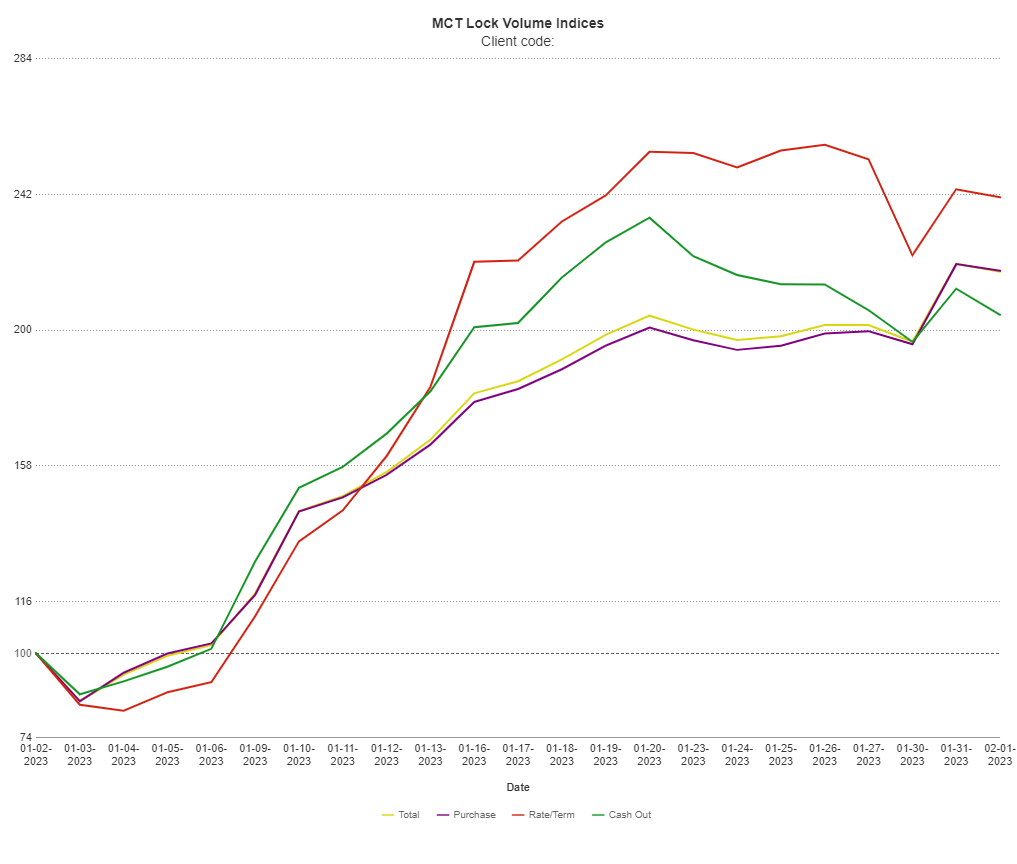

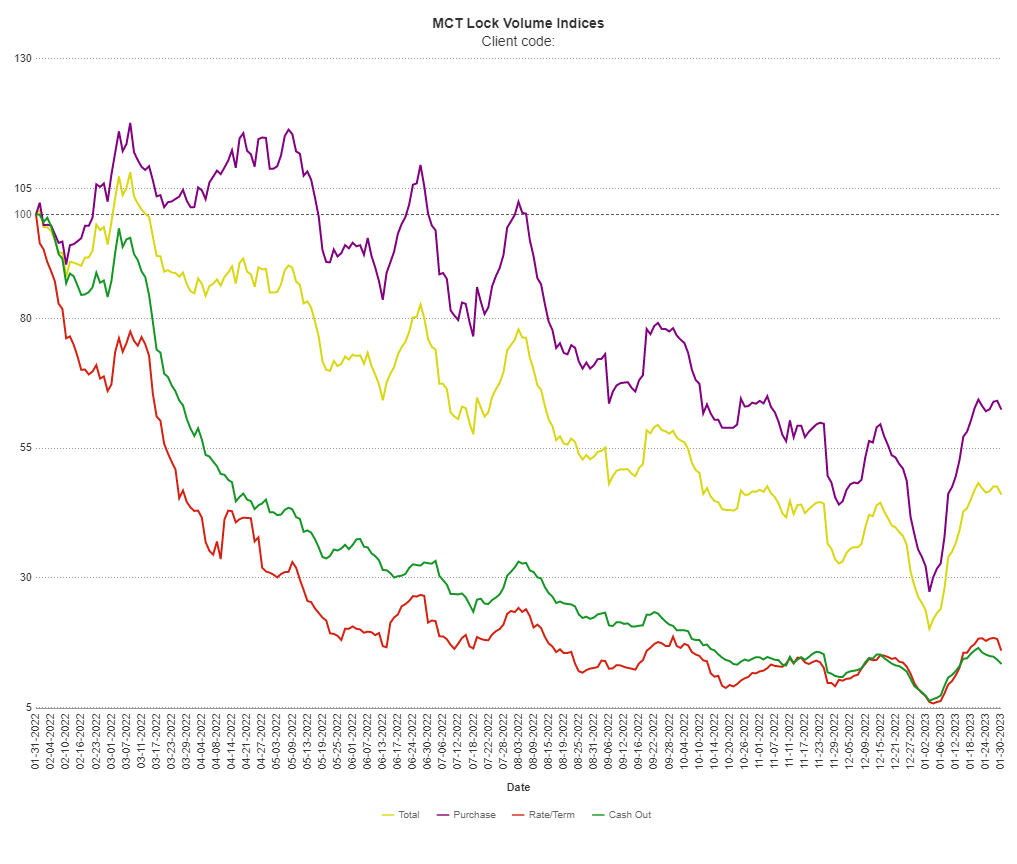

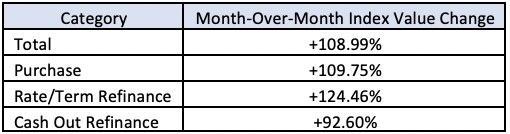

January MCTlive! Lock Volume Indices show that lock volume increased across the board for the month. Purchase lock activity was up nearly 110% compared to December, rate/term refinance volume was up 124%, and cash-out refinance volume was up 93%. Lock activity in total was up 109% versus December. Though December lock activity is traditionally low, with many people focused on the holidays during the final week of the month, the lock figures for January clearly show some positive rate elasticity.

As the Fed reaches its terminal fed funds rate for this cycle, we should see downward pressure on mortgage rates, which will only help increase origination activity. For added context, total lock activity is still down 54% from one year ago. That is mostly due to a drop off in refinance demand, as purchase lock activity sits 36% lower than at the same point last year. Rate and term refinance volume is down 84% from one year ago, and cash-out refinance volume is down 86% over that same period. Please note that, for the first time, MCT is including composite volume across lock type. Purchase locks accounted for 88% of total lock volume for the month, cash-out refinances comprised 8%, and rate/term refinances continue to display dismal volume, registering at 4% of total locks.

MCT supports more lenders with hedging and pipeline management solutions than any other single provider. MCT’s privileged position allows it to aggregate and analyze a meaningful population of data and translate it into macro trends and insights. MCT-collected statistics are unique to the industry given the diversity of lenders (e.g., sizes, products/services offered, business models) across its national footprint.

It is important to note that MCT’s rate lock activity indices are based on actual dollar volume of locked loans, not number of applications. Especially in a tight purchase market, MCT believes its methodology (using actual loans locked vs. applications) is a more reliable metric. There is a higher likelihood of having multiple applications per funded loan, and prequals do not convert at as high of a rate in the current market as has historically been the case – especially when applications are counted at the early stage of entering a property address.

About MCT

Founded in 2001, Mortgage Capital Trading, Inc. (MCT) has grown from a boutique mortgage pipeline hedging firm into the industry’s leading provider of fully integrated capital markets services and technology. MCT’s offerings include mortgage pipeline hedging, best execution loan sales, business intelligence and analytics, outsourced lock desk solutions, MSR valuation, hedging, and bulk sales, and the world’s first, truly open marketplace for loan sales. MCT supports independent mortgage bankers, depositories, credit unions, warehouse lenders, and correspondent investors of all sizes within its award-winning digital platform, MCTlive!. Headquartered in sunny San Diego, MCT also has offices in Healdsburg, CA, Philadelphia, PA and Texas. For more information, visit https://mct-trading.com/ or call (619) 543-5111.

- Growing for Your Needs – Since 2001, MCT has grown from a pipeline hedging services specialist into a fully integrated provider of capital markets services & software.

- Capital Markets Expertise – Through a combination of unparalleled industry experience and relentless focus on data, MCT is pioneering the future of capital markets technology. From MCTlive!, to MSRlive!, to our award-winning MCT Marketplace – MCT pushes the envelope to exceed client expectations.

- Clients & Employees Agree – MCT delivers unparalleled customer service and prides itself on being a regular winner of San Diego’s “Best Place To Work” Award.