When mortgage bankers sell their loans on the secondary market, most begin using the best efforts loan sale delivery method. As volume begins to pick up, mandatory loan sale delivery becomes attractive for the increased profits.

When mortgage bankers sell their loans on the secondary market, most begin using the best efforts loan sale delivery method. As volume begins to pick up, mandatory loan sale delivery becomes attractive for the increased profits.

But how do lenders manage the risk?

Lenders who implement robust risk management frameworks achieve execution improvements of 10-50 bps over best efforts.

In this post, Ron Happell, Senior Trader at MCT, explains the sophisticated hedging strategies and precise pull-through rate calculations required to mitigate risk and optimize profit margins when moving to mandatory delivery.

While the spread between Best Efforts and Mandatory differs by investor, historically, we can expect a 10-50 basis point pickup when switching to mandatory. This improvement is dependent on market conditions, investor relationships, and operational efficiency.

Table of Contents

What’s the Difference Between Best Efforts and Mandatory Delivery?

In best efforts delivery, lenders commit to deliver loans to investors only if the loans successfully close, transferring fallout risk to the investor in exchange for lower pricing. Mandatory delivery requires lenders to guarantee loan delivery regardless of whether individual loans fund, shifting market and fallout risk to the lender while offering higher execution prices.

| Best Efforts Delivery | Mandatory Delivery | |

| Requirements | – Low net worth requirements – No minimum volume – Accessible for smaller lenders | – Higher net worth requirements – Hedging capabilities – Operational sophistication |

| Risk Profile | – Limited market risk exposure – Fallout risk transferred to investor | – Market risk requires hedging – Lender assumes fallout risk |

| Pricing | – Lower execution pricing | – 10-50 bps over best efforts – Access to premium investors as volume grows |

| Commitment | – Delivered only if loans close – No penalties for non-delivery | – Guaranteed delivery at locked rate – Penalties for non-delivery |

Lenders may move from best efforts to mandatory to manage interest rate risk, streamline processes, manage cash flow, etc. However, most originators make the switch from a best efforts delivery model to mandatory delivery for improved execution.

While the spread between Best Efforts and Mandatory differs by investor, historically, lenders can expect a 10-50 basis point pickup. This improvement depends on market conditions, investor relationships, product mix, and operational efficiency.

Whatever the inherent spread is, the goal of the hedge is to protect that spread, not create it.

Managing Risk with Pipeline Hedging

The two primary risks to consider with mandatory loan sales include market changes and loans that are promised but not delivered. To combat market changes, mortgage bankers hedge their pipeline of open loan applications, often using to-be-announced (TBA) securities. Mortgage bankers managing and measuring loan fallout can rely on the accuracy of their pull-through rate to manage risk.

“One thing to keep in mind is whatever the inherent spread is, the goal of the hedge is to protect that spread, not create it.”

– Ron Happell, AMP, Senior Trader, Mortgage Capital Trading

Make Mandatory Commitments Only on Completed Loans

Lenders want the pickup for mandatory commitments and loan sales, but what if the borrower walks away? They would incur a financial penalty from the investor, who may also adjust future pricing due to non-delivered loans.

The key is to wait to make the mandatory commitment until after the loan has been completed, and there is 100% confidence in delivery. But this also means originators need to manage the risk of market changes in-house, rather than offloading that risk to the investor with an earlier commitment.

Hedge the Mortgage Pipeline with TBAs

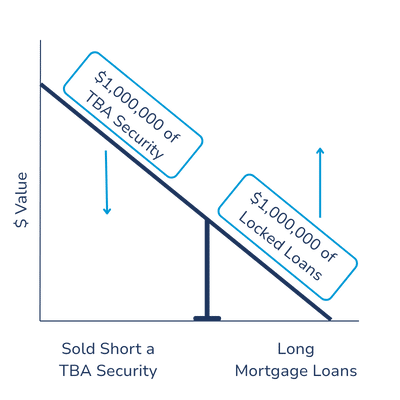

Interest rates can change between the time a borrower locks their interest rate to when the loan is actually funded, which leaves lenders at risk.

Hedging the loans in a mortgage pipeline using to-be-announced (TBA) mortgage-backed securities (MBS) protects them from interest rate fluctuations.

For example, an increase in rates after the loan is locked will decrease the value of that loan. However, since the TBA trade was shorted/sold, the mortgage banker can buy back the TBA trade at a discount to what they originally sold it for.

The mortgage banker would lose on the loan sale, but gain on the hedge, netting out the influence of market changes.

Measure Pull-Through Rates & Hedge Appropriately

Mortgage bankers who work with borrowers understand that some loans never fund. To ensure TBAs aren’t used for loans that don’t fund, originators need to calculate and hedge using their pull-through rate.

The pull-through rate is an estimate on how many loans are expected to close and fund. If the rate is 80%, for example, then a lender needs to hedge 80% of the total dollar amount in their pipeline.

A highly accurate pull-through forecast will ensure a lender isn’t over- or under-protected.

MCT specializes in calculating, measuring, and optimizing pull-through rates at the loan level. Learn more about pull-through in The Mortgage Professional’s Handbook, Vol.3 Ch.3 by Phil Rasori.

Maximizing Loan Sale Profitability

Adding mandatory loan delivery to a lender’s toolkit helps them earn more on their loan sales and offers another option in the best execution analysis.

When delivering mandatory loans, there are additional tactics lenders can use to make sure they’re maximizing profitability, including increasing accuracy, number of investors, and pipeline evaluation.

Ron Happell explains that once lenders decide to hedge and take advantage of the better pricing that comes with mandatory loan sales, it’s important to understand the costs involved.

“Factors like inconsistent pull-through, renegotiations, and other issues, what we call ‘leakage’, can reduce the pickup over best efforts,” he describes.

Happell emphasizes that operational discipline is critical for success. “That’s why it’s essential to track and adjust pull-through regularly,” he notes. “Using cost-saving tools like Assignment of Trades (AOTs) and working with a broad set of investors can help lenders maintain and even increase their lift over best efforts.”

Conduct Loan Sale Best Execution Analysis & Take Advantage of the Mandatory Pickup

The pickup over best efforts is the primary metric used by lenders to measure the success of their mandatory loan sales.

Phil Rasori, COO at MCT, shares from his experience over the years that typical lenders will see a “Twenty basis point pickup on Conventional volume and a forty basis point pickup on Government volume.” Adding mandatory loan sales to their best execution analysis will have a direct and immediate impact on loan sale profitability.

Optimize Your Investor Set

The number of best efforts and mandatory investors that a lender is approved to sell to is another important factor in maximizing profitability. The more buyers a lender has competing for their loans, the more likely they are to receive a better price.

Furthermore, some investors are willing to pay more for certain characteristics of a loan. If the investor set is not tailored to the characteristics of a lender’s portfolio, they may be leaving money on the table.

Average bps pickup from investor set optimization

According to Happell, having a strong and flexible investor base is essential for maximizing execution. “New investors come into the market and existing investors can be axed for certain types of loans,” he explains. “Having a price discovery tool like MCT Marketplace and Lender Analytics allows lenders to see undiscovered investors’ pricing before their competition does.”

Happell notes that the impact on profitability is measurable: “On average, clients who use these tools can expect to pick up an additional 10-12 bps.”

Evaluate Pipeline and Market Conditions Daily

Evaluating the current market conditions will also help you earn more on your mandatory loan sales. Daily monitoring can help you identify trends that could affect profitability expectations and manage pull-through during interest rate cycles. This monitoring will also help you reduce the time in a hedge position, which reduces costs.

Keep in mind, you don’t need to “time the market” for your loan sales if you’ve implemented a successful pipeline hedging strategy.

Learn More

Operational Changes Needed for Mandatory Delivery

When switching to mandatory, there are several key operational changes to consider. The fundamental changes will affect the lock desk, underwriters, and accountants.

Contact us for a flawless transition from best efforts to mandatory.

Lock Desk

Adding mandatory loan sale delivery to your toolkit is only as good as a lender’s best execution analysis. Teams need to determine which loans to sell through best efforts and which to sell through mandatory delivery.

Underwriting

Delivering a best efforts loan to a single investor means that a lender was only underwriting to the investor who purchased the loan. When loans are sold through mandatory delivery, the underwriting team needs to underwrite those loans to all eligible investors.

Accounting

The accounting department is affected by the buying and selling of TBAs and needs to implement fair-value accounting practices. Fair-value accounting uses the market price of an asset, or similar assets, to keep records of TBAs on the books.

Trader Guidance When Moving to Mandatory Delivery

Making the move from Best Efforts to Mandatory is a major transition that can come with pitfalls. However, with the right approach it can lead to stronger margins and greater control.

Ron Happell has helped countless lenders navigate the move to mandatory delivery. The key areas he advises lenders to refine as they take on the more advanced execution strategy include:

- Track Pull-Through: “Every basis point matters,” says Happell. “If your pull-through assumptions are off, you’ll either be overhedged or underhedged, and both can cost you. Use historical data to get as accurate as possible, and revisit your assumptions regularly.”

- Maximize Investor Eligibility: “Work with your operations and underwriting teams to ensure loans are originated to multiple investor guidelines. The more investors you can sell to, the better your execution options and the more pricing power you have,” explains Happell. “Having a great relationship between Capital Markets and Underwriting ensures maximum profitability.”

- Establish Robust, Flexible Policies: “Things like rate renegotiations and lock extensions are inevitable. What separates successful lenders is having clear policies that can flex when needed, without exposing the company to unnecessary risk.”

Summary – How Mandatory Loan Sales Increase Net Profitability

By hedging a mortgage pipeline and understanding how market changes affect the pull-through rate, lenders are better protected from the risks associated with mandatory loan sales.

Improvements in the accuracy of the pull-through rate, optimizing the investor set, and monitoring the mortgage pipeline helps lenders earn more on loan sales when done correctly.

Average net bps pickup when switching to mandatory

Mandatory loan sale delivery requires operational changes in the business. By blending these strategies and implementing necessary changes, lenders can increase profitability on their loan sales.

Want to Learn More?

Discover how different loan delivery methods impact profitability, risk, pricing, and investor relationships in the whitepaper, Loan Delivery Methods: Turning Process into Profit. Learn the crucial differences between loan delivery strategies, key execution factors, and when to use each method to achieve the best results.

Download the Whitepaper: