In the realm of mortgage trading, Assignment of Trades (AOTs) has emerged as a pivotal strategy, revolutionizing how originators, investors, and broker dealers navigate the market landscape through tri party agreements.

AOTs offer a myriad of benefits for investors, from capitalizing on TBA trading economics to leveraging back office efficiencies. The transition from legacy AOT processes to automated systems has been transformative, eliminating tolerance limits and expanding opportunities for lenders of all sizes.

In this blog, MCT’s Justin Grant, Senior Director, Head of Investor Services explains how AOT automation is paving the way for a new era of efficiency and profitability in mortgage trading, especially with the help of MCT Marketplace. Read on to see how AOT can benefit investors and sellers alike.

By the Numbers: AOTs by MCT Clients in 2023

Avg. Bid/Offer Spread (BPS)

Total Assigned Trade Volume

Number of Lenders Assigning

AOTs are rising in popularity and MCT is leading the charge to automate the entire process for originators, investors and broker dealers, to make this execution even easier to leverage. So why are AOTs are a strategy worth thinking about? AOTs allow originators to better manage their cash flows on loans being sold, while investors can pass through their sharper TBA trading economics to sellers, allowing them to increase market share without sacrificing margin. In 2023 alone, MCT clients executed over 20 billion worth of AOTs, and 2024 is off to a hot start with double the assignment volume compared to the same period last year.

As market volatility remains elevated, AOTs are a critical tool for sellers in the loan sale process, and an offering which buyers can’t afford to live without if they wish to maximize their correspondent market share.

The explosion in the popularity of AOTs was Wells Fargo’s introduction in 2018 of the hybrid AOT, or the bid-AOT. There are some key differences in what we call the legacy AOT, or Assignment of Trade, that existed before that. In an old-school assignment of trade, the investor would have a tolerance, usually plus or minus 2%, and you had to stick to the exact product and coupon for the loans that were being assigned. This really limited the availability of the assignment of trade to the largest lenders out there.

It was also a challenge considering how a typical pipeline at any point in time is spread out amongst different products and note rates. If you wanted to assign a half million-dollar trade, for example, you would have to have exactly the right loans in a product and coupon that added up to somewhere between 490 or 510 thousand. This was a very specific process and difficult to implement due to these limitations.

With the introduction of the hybrid AOT, we have done away with tolerance limits. Now, any combination of loans can be assigned to some sort of trade volume number. All we are doing is taking the gain and loss of that trade being assigned and applying it to those loans. Therefore, if you have a trade that’s one point in or out of the money, but you are assigning several loans that total more than the trade volume, then that BP adjustment will be lower than one point and vice versa. If you are going to underdeliver, you will have a BP adjustment that’s larger than one point. We can reassign, and we can apply the gain loss on the hedge to any number of loans, which opens up the utilization for the AOT. It has leveled the playing field for even the smallest of lenders, allowing buyers to make an impact on more loans bid from more sellers.

AOT Benefits for Buyers

- Allows buyers to be more competitive relative to their peers who do not accept AOTs, without having to lower margins

- Sellers place a premium on investors who offer AOT due to the cash benefits in both rising and declining rate environments

- Complete automation of the tri-party agreement helps to streamline the back-office process

AOT Benefits for Seller

- Allows sellers to largely avoid the bid/ask spread on their hedge positions, thus reducing their overall hedge cost

- Creates one cash experience at the time of sale which provides for better cash flows in both rising and declining interest rate environments

- Reduces the need to cross-hedge less-liquid coupons and take on added risk

First, to start, there are certain parameters or rules in the system a buyer needs to consider. These would include your broker-dealer list from whom you want to take assignments with, your minimum loan and trade volumes that you are going to accept, if you plan to blend coupons and products or if you will stick to like product and coupon, if you will allow under delivery on an assignment and if so by how much. These items are worked into our system to set up guardrails for buyers to have optimal success and ensure there are no assigned trades that end up not being wanted.

Next, the seller executed triparty is posted in MCT along with the requested commitments that the buyer is already used to. Once the buyer uploads their confirmation file, MCT Marketplace will update the triparty agreement with their signature as well. Auto Bid tools are essential to this process if you need help with the math or automation of pricing adjustments that need to occur to facilitate the AOT. For sellers, no extra setup is required, making the AOT transaction experience for all parties on MCT Marketplace that much more attractive. As soon as a seller gets approved for AOT by a buyer, eligible trades are automatically displayed during the commitment process.

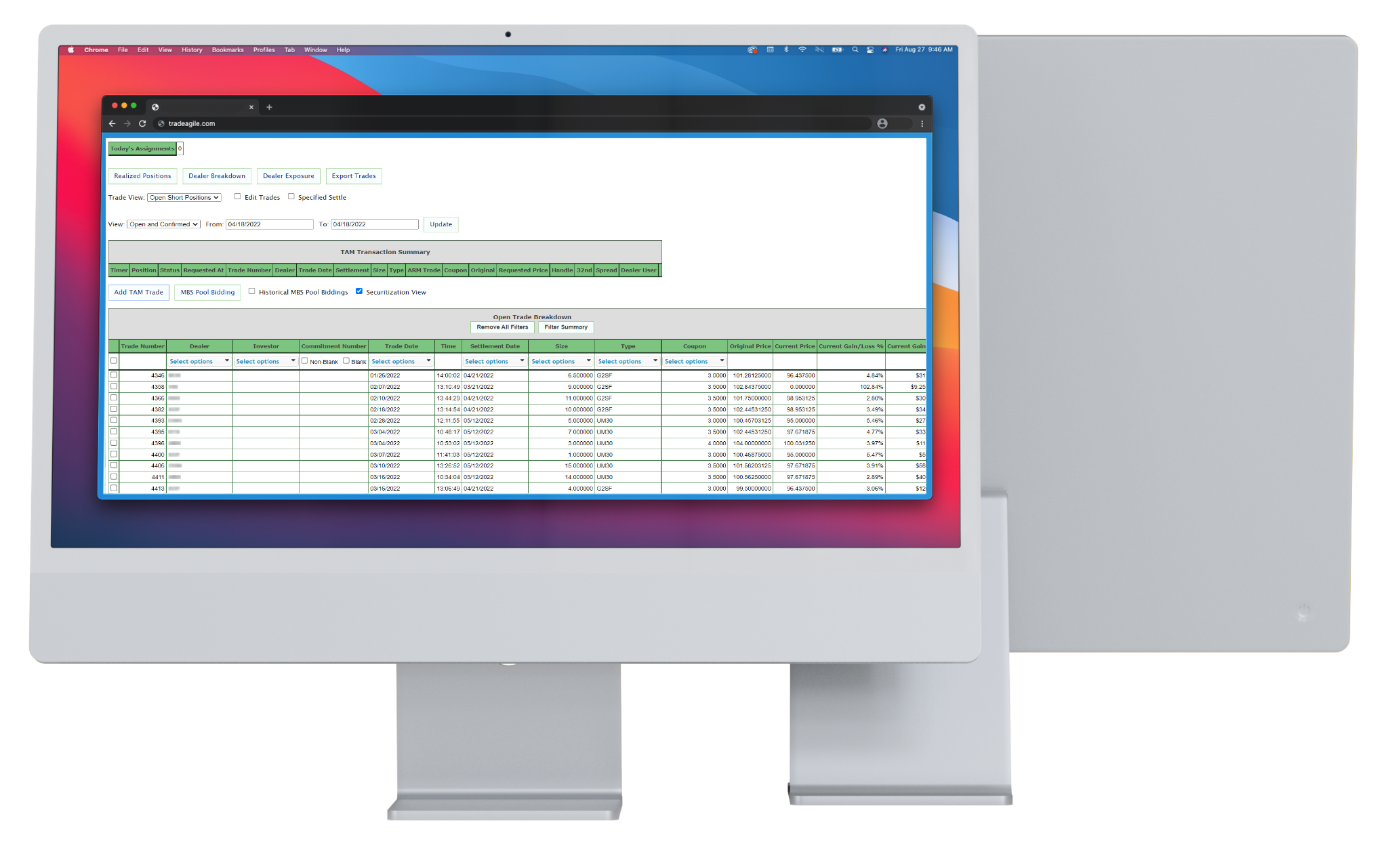

On top of that, MCT now offers a new UI within MCTlive! that can help track the complete tri-party process from the other two parties, being the buyer and the broker dealer. This new technology helps monitor and ensure all three parties are on the same page about which trades are being assigned.

The main competitive advantage for sellers is the bid ask spread savings. However, for buyers, many times when pooling their loans they’re able to avoid that cost by trading on swap and the AOT allows them to leverage those economics and pass them along to the seller. Given higher market volatility in recent years, this often equates to anywhere from 1-6 ticks, and in many cases, even higher on illiquid coupons. In MCT Marketplace, we automatically factor in those savings and incorporate them into the seller’s best ex. Now the buyer’s price, if offering AOT, is going to be biased back up relative to all the other investors who aren’t offering AOT.

This is a way for investors to improve their bid by anywhere from one to six ticks, or even more on some illiquid coupons, making them more competitive without having to lower their margins. Essentially, the buyer should see improved win rates with this strategy and the MCT Marketplace platform. On top of savings, the triparty agreement is completely automated. All signatures from both seller and buyer are digitally transmitted on the triparty within the platform and sent off automatically to the broker-dealer on the trade, creating a seamless automated process.

With Agile’s incorporation in MCT Marketplace, MCT has been able to bring the broker-dealer into the platform. Now all three parties that are required for an assignment of trade coexist on one platform, allowing the process to be fully automated. This not only makes the process more efficient but also allows for fewer errors and keeps all of a buyer’s assignments organized in one place.

How Agile Supports MCT’s AOT Automation

AOT executions on MCT Marketplace are supported by Agile, a platform that brings lenders and dealers of all sizes together to digitize the historically phone-based communication processes of TBA trading and MBS pooling.

Automated broker-dealer execution of lender-generated tri-party agreements

Trade blotter for tracking and managing assigned trades

Centralized database of record increases data integrity and reduces errors

As we mentioned previously, for sellers the big advantage of utilizing AOTs is saving that bid ask spread. When they assign a trade to an investor, they are no longer responsible for pairing out of the position, which means they won’t incur that spread as well as any additional spread their broker dealer would charge on the trade. To quantify this savings we utilize our AOT spec payup matrix. This basically looks at the current bid ask spread by product and coupon at the time of the loan sale and is put into the best ex at the loan level so the net adjusted price is taking into account the savings.

On top of the monetary savings, the cash flow benefits to sellers are also very attractive so utilizing the buffer feature we have within best ex where you can favor the investor and the execution by whatever the amount is.

The price savings alone with AOTs have the spotlight and rightfully so in this market; in the last year and a half, bid ask spreads have been wider than average. There are also a lot of non-price benefits that can be applicable in both types of markets: In a market like we had during COVID, where trades were really far out of the money, or a market like we saw last year in 2023, where conversely, rates shot up and trades were very much in the money, the AOT helps sellers to stabilize their cash flows month to month.

One of the biggest benefits to take note of is the cash flow implications. With a typical loan sale for someone who is hedging you hedge the loan and when a loan funds, you sell the loan, and if the market has rallied since the time of the lock, they’re going to sell the loan for a higher price. In this case, then you’re going to go in and pair out of a trade that is losing money. What you essentially have is two pieces and it is the net of the two that determines your total profitability. With assignment of trade, because you’re assigning that hedge position to the investor, you’re effectively wrapping the gain loss of the hedge position into the price of your loan.

One of the ancillary benefits of the AOT is that in a market where your trades are vastly out of the money and you are worried about margin calls with your broker-dealers when you’re assigning trades, you’re also constantly taking some of those positions off and helping to relieve that potential pressure or breach of your margin threshold that a broker-dealer can come to you out of your trades and call margin. This is one way you can leverage the assignment in that type of market.

In the opposite market where rates have gone up and you’re selling loans for a loss or you had priced in when the loan was locked, you are going to have a hedge position that offsets it. However, you might have to wait three or four weeks until settlement to get paid from the broker-dealer. If you can assign the trade, you’re now effectively getting that gain on the hedge position into the price of your loan and now you only have to wait as long as it takes for the investor to purchase the loan, which might take a week.

Both scenarios tighten up the cash flows into one event, which is just the sale of the loan.

![justin-grant-1[2]](https://mct-trading.com/wp-content/uploads/2022/10/justin-grant-12.jpg)

“During a time of extreme pressure on profit margins industry-wide, we’re proud of the impact AOT automation has had for our lender and investor clients,” shared Justin Grant, Senior Director, Head of Investor Services at MCT. “Based on our conversations with investors who offer AOTs, we estimate MCT lenders represent around ninety percent of AOT executions in the market today.”

Bid tape AOT transactions are conducted in MCT Marketplace, the largest mortgage exchange for the U.S. secondary market. MCT Marketplace was born out of a need for security in bid tapes and moving away from emails. In this context, it’s provided a strong platform to work with investors to automate the AOT process. There are pieces like the tri-party and the transmission of the trade that are resource-intensive and can also be problematic from a human error standpoint. MCT is proud to be the first organization to automate the tri-party process, as AOTs are providing liquidity and efficiency to the market at a crucial time.

MCT Marketplace connects buyers and sellers in a unique, digital auction regardless of counterparty approval status. Through patented technology, sellers have access to the most robust set of take-outs, while buyers are seamlessly connected to the largest community of sellers in the U.S. This platform is now being used to fully automate the tri-party agreement between the lender, investor, and broker/dealer in AOT transactions. AOT automation within MCT Marketplace is rapidly changing the best execution landscape.

In closing, the evolution of automated AOTs through MCT Marketplace has provided a shift in mortgage trading, empowering stakeholders with unprecedented efficiency and profitability. By leveraging automated solutions, originators, investors, and broker dealers alike can navigate the complex market landscape with confidence and ease. The incorporation of real-time tracking mechanisms ensure seamless transactions and optimal outcomes for all parties involved. Moreover, the significant cost savings and cash flow benefits further showcase the value of AOT transactions in today’s dynamic capital markets environment. As we look ahead, the continued innovation and integration of advanced technologies at MCT promise to further enhance the AOT experience, driving greater success and resilience across the capital markets ecosystem.

MCT’s Investor Services division offers a software suite of tools for correspondent investors that facilitate offering and automating an AOT channel, and is here to offer support with AOT or other investor related inquiries.

Contact Our Team to Learn More

Interested in learning more about how bid tape AOT may impact your cash flow and execution? Contact us today for a one-on-one consultation with a secondary marketing expert.

Related Articles

- Housing Market Predictions 2024: Will House Prices Go Down in 2024?

- MCT Whitepaper: Mortgage Pipeline Hedging 101

- How the 10-Year U.S. Treasury Note Impacts Mortgage Rates