Paul’s Tip of the Week:

“Can’t Go” and “Must Go” Investors

Published on 02/11/2022

Through Custom Eligibility and Ready For Sale Identification a user can streamline their best ex in MCTlive!

Paul's Tip of the Week

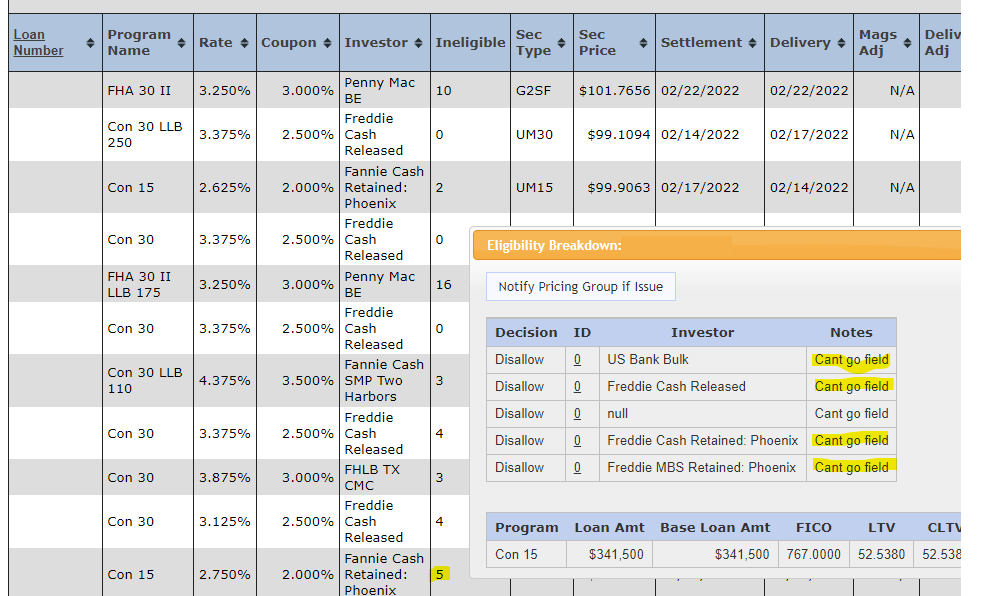

A user can identify data points in their LOS that can be used to develop “Can’t Go” and “Must Go” investors. The functionality in MCTlive! is flexible to accommodate several different value types (e.g., populated, empty, operator driven, combination of fields, etc.).

Once this has been setup in MCTlive! the user can then cruise through their best ex with more efficiency and confidence knowing if a loan has been designated as ineligible for a specific investor, that has already been factored in.

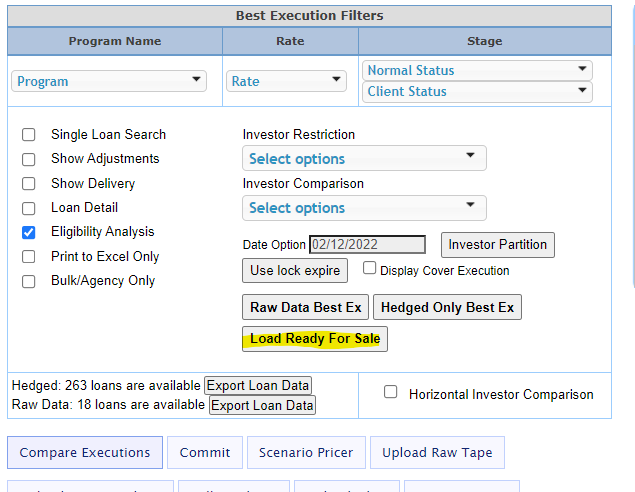

In addition to this, MCTlive! can take datapoints to identify a “READY FOR SALE” loan. As an example, if a lender did not want to commit a loan until it has been funded and the collateral has been received, once programmed, MCTlive! can pick up on those datapoints to identify the loan is Ready For Sale. With the click of one button, those loans are prepared for MCT Marketplace and the loan sale.

Contact the Client Services Group (csg@mctrade.net) or your trader to get this set up.

In an effort to inform you of the latest enhancements from MCT, this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

About MCTlive! – Pipeline Management Software

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

About the Author

Paul Yarbrough, Director of Client Success Group

Secondary marketing expert Paul Yarbrough joined San Diego-based MCT to oversee new client on-boarding, manage the company’s secondary marketing technology and implement necessary solution training.

He has detailed knowledge on how to leverage secondary marketing technology to proficiently run capital markets functions. He plays an important role in implementing and training lenders on MCT’s secondary marketing technology platform MCTlive!, as well as ancillary solutions. Mr. Yarbrough has a BA in Finance from West Texas A&M with a minor in Economics.