Weekly Technology Improvement Series:

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

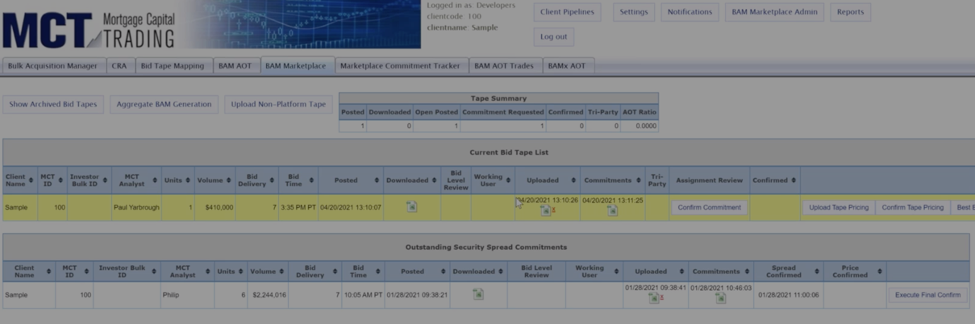

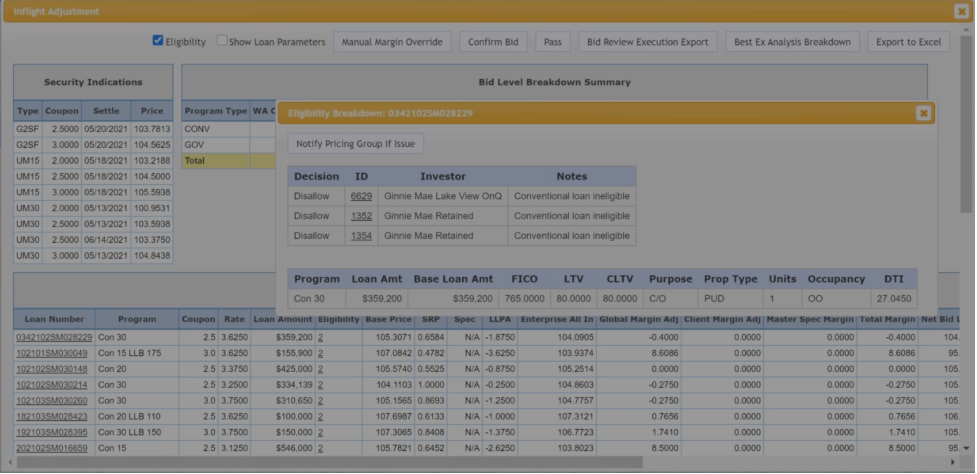

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

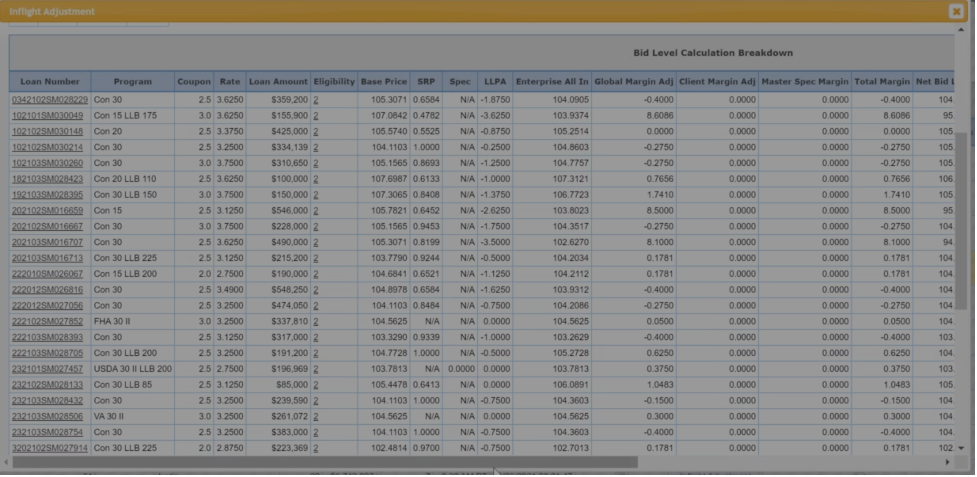

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

MCT Reports 16% Decrease in Mortgage Lock Volume Amid Market Dynamics

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month.

MSR Market Monthly Update – January 2025

The Fed has announced another 25 basis points reduction in the overnight rate after their December FOMC meeting. The reduction was in line with what the financial markets were expecting. The surprise came when the Fed announced that they will only reduce rates twice during 2025 and not the anticipated four times as they have previously indicated.

MSR Market Monthly Update – December 2024

The financial industry is awaiting the much-anticipated rate announcement by the Fed after their December FOMC meeting. The market is expecting the Fed to lower the overnight rate by another 25 basis points. The 10 Year Treasury rate has risen sharply during the month of November heading towards 4.50% which most economists deem risky for the economy.

MCT and FICO Collaborate to Bring Predictive FICO® Score 10 T to Secondary Mortgage Marketplace

FICO® Score 10T begins trading early on MCT Marketplace, delivering real-time insights that enhance pricing precision, credit risk analysis, and secondary market performance.

Leslie Winick of MCT Honored Among Mortgage Banking’s Most Powerful Women in 2024

Leslie Winick, MCT’s Chief Strategy Officer, earns a spot on Mortgage Banker Magazine’s 2024 Powerful Women in Mortgage Banking list for leadership and innovation.

Leslie Winick, MCT’s Chief Strategy Officer, earns a spot on Mortgage Banker Magazine’s 2024 Powerful Women in Mortgage Banking list for leadership and innovation.

MCT Reports a 15% Decrease in Mortgage Lock Volume Amid Higher Rates

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 15% decrease in mortgage lock volume compared to the previous month.

Case Study: Lincoln Federal Boosts Accuracy Despite 288% Volume Fluctuation with MCT’s Lock Desk

Lincoln Federal achieved 99.9% accuracy despite 288% volume fluctuation, saving $12K annually with MCT’s full-service Lock Desk.

MCT Announces 2.5% Increase in Mortgage Lock Volume Despite October Market Volatility

San Diego, CA – November 15, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, reported a 2.5% increase in mortgage lock volume compared to the previous month.

What is MSR Valuation? Mortgage Servicing Rights 101

Discover the fundamentals of Mortgage Servicing Rights, their benefits, risks, accounting methods, and key valuation drivers for long-term profitability.

CRA Acquisition & Correspondent Channel Tools from MCT Marketplace

In this webinar, MCT’s Justin Grant, Head of Investor Services, will discuss MCT Marketplace, an open loan exchange software that optimizes whole loan and co-issue mortgage transactions in the secondary market, offering clear investor benefits. Key tools to improve acquisition strategies include AutoBid for automating live bids, AOT automation for tri-party agreements, the Open Pipeline Viewer & CRA Marketplace for sourcing investor CRA and product needs, and AutoShadow for automated shadow bidding, along with analytics and rate sheet support.