Weekly Technology Improvement Series:

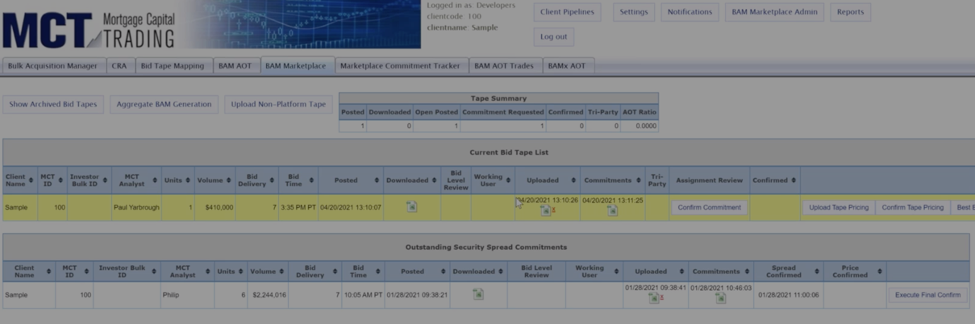

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

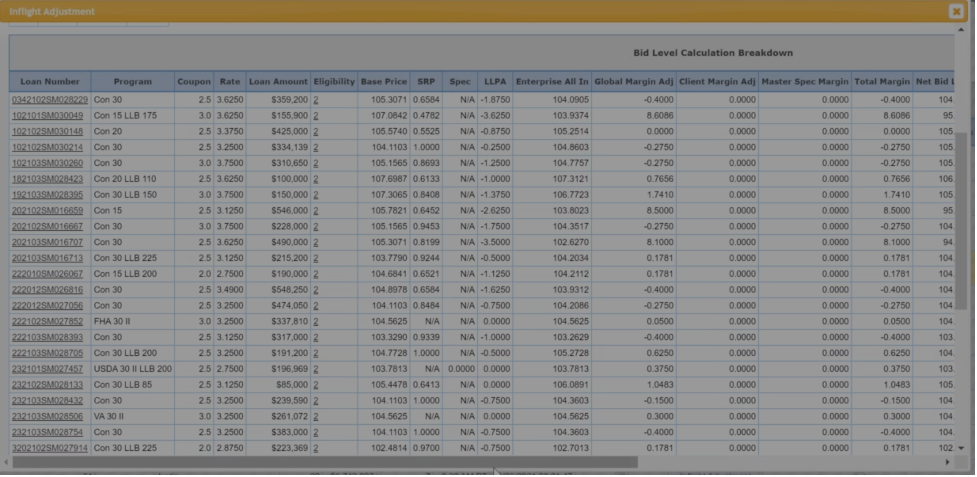

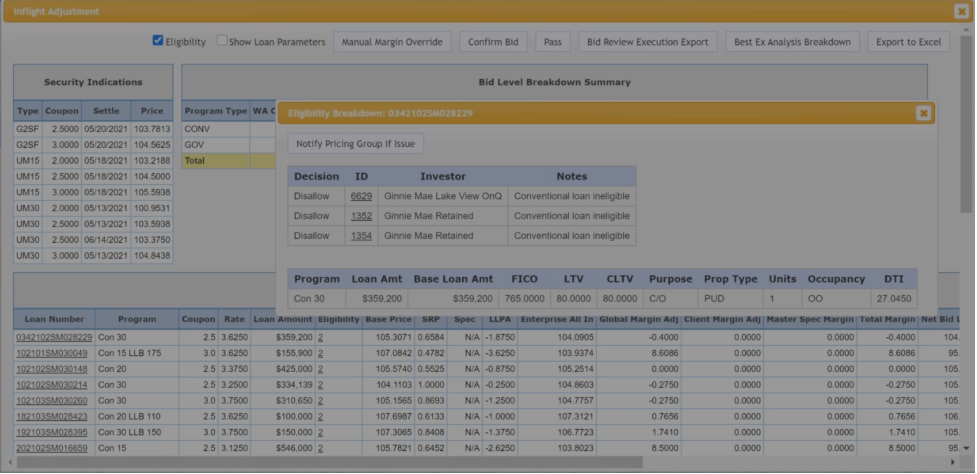

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

Loan Delivery Methods: Turning Process into Profit

Unlock hidden revenue with smarter loan delivery. Discover how the right strategy can optimize operations, reduce risk, and boost margins.

Refinance Volume Exceeds Expectations in August Despite Broader Market Slowdown

MCT’s August Lock Volume Indices shows surprising growth across all refis, while corrected jobs report data alludes to a potential September rate cut.

MCT Empowers Vellum Mortgage with Efficiency, Automation & Autonomy

Discover how Vellum Mortgage leverages MCT’s automated trading platform to scale volume, reduce risk, and operate efficiently with a lean secondary team.

Ask ChatGPT

MCTlive! Quarterly Release Notes in Q2 2025

Described below within relevant tabs, you’ll find a listing of our Q2 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Data & Analytics tools.

Why FNBO Chose MCT for Efficiency, Value, and Exclusive Integrations

Discover why FNBO chose MCT for an efficient, cost-effective platform with exclusive integrations and responsive support.

Reacting to Mortgage-Backed Securities (MBS) Market Movement

Learn how to respond to mortgage-backed securities market movement and how to protect margins during volatility using tools in MCTlive!

Rate/Term Refis Surge Nearly 10% as Purchase Activity Steadies in MCT’s July Lock Volume Indices

MCT’s July Lock Volume Indices show steady growth across all loan types, with rate/term refis up 9.89% and surprising market stability after a strong jobs report.

MSR Market Monthly Update – July 2025

The originations market struggled over the last few weeks while mortgage rates continued to hover around 7%, but now some relief is in sight. Read the full release for the July 2025 MSR update.

Mortgage Equity Partners Chooses MCT for Strategic Growth and Trusted Partnership

Discover how Mortgage Equity Partners improved execution and scaled efficiently through their partnership with MCT’s secondary marketing platform and support.

Efficiency and Customized Support from MCT for a Growing IMB

MCT helps Waterstone Mortgage scale efficiently with custom support, responsive service, and a true partnership tailored to their unique IMB-bank structure.