Weekly Technology Improvement Series:

Bid Tape Mapping for Non-Platform Tapes

Published 9/17/2021

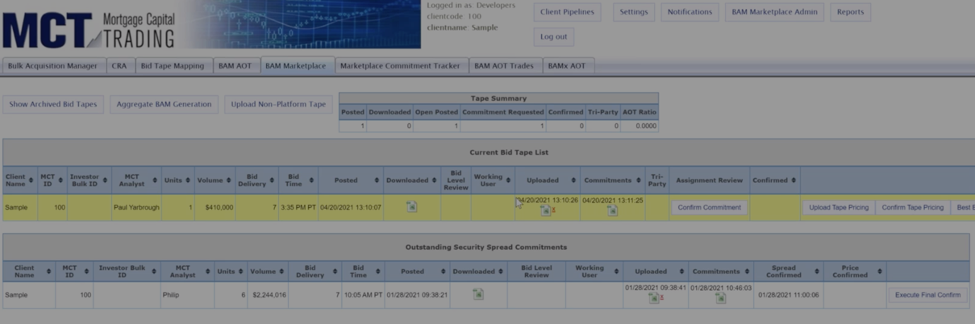

We aren’t naïve. Sellers use other services than ours, such as Resitrader, to sell loans.

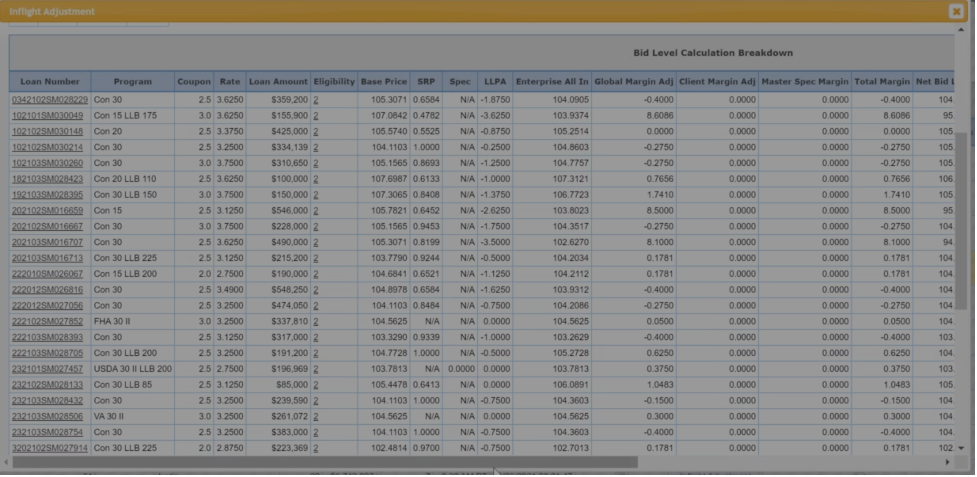

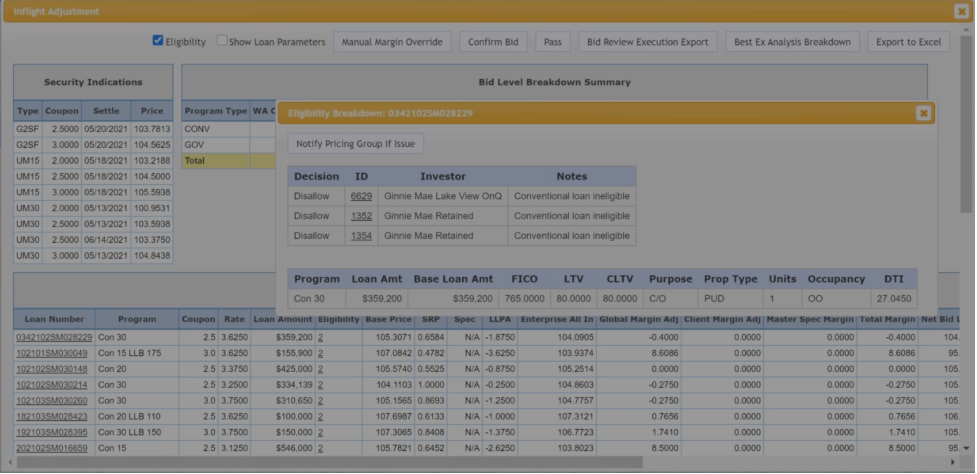

With our easy and robust tape mapping tool that includes eligibility breakdown, we map and normalize tapes for you.

Pull rules that make a loan ineligible for a particular pricing institution. It is a quick and easy way to see eligibility that lets you get as granular as you like.

We also provide a pricing breakdown, which tells you exactly what you need to pay for a loan.

Autobid generates pricing once you hit a button, but you don’t actually need to hit a button.

You can employ Autoprice, which also has controls surrounding tape size, etc.

Price every loan without extra work, providing you with a massive time savings.

Have confidence in the ability to turn tapes without a secondary employee watching it all day.

In an effort to inform you of these real time enhancements this series will review the latest MCTlive! innovations and functionality updates. Join our newsletter to be updated on new releases.

This series focuses on technology updates to MCTlive!, MCT’s award-winning loan pipeline management software.

MCTlive! Features include:

- 100% Cloud-Hosted, Web-Based, Real-Time Functionality

- Multidimensional Pull-Through Analytics

- MCT Marketplace loan trading exchange

- Electronic TBA Trading

- Rapid Commit for Agency Delivery

View All Rasori’s Relentless Releases

FNBO Achieves 25 BPS Profitability Lift Through Strategic Execution and Integrations within MCTlive!®

Learn how Tyler Anderson at FNBO drove a 25 BPS lift in profitability by leveraging MCTlive! for AOT automation, competitive TBA trading, and strategic execution shifts.

MCT Debuts Next-Generation MBS Pool Optimizer, Powered by GPU-Accelerated Computing

MCT unveils upgraded MBS Pool Optimizer using CUDA GPUs to deliver real-time, large-scale execution analysis and maximize profitability.

MCT Industry Webinar – Best Practices for Pool Optimization

Learn best practices for pool optimization. Join MCT’s experts as they explore spec pay-ups, prepayment behavior, pricing, and hedging strategies.

MSR Market Monthly Update – February 2026

The average 30-year primary mortgage rate is currently at slightly above 6%. Just one year ago, the rate averaged about 6.86%. Mortgage rates appear to be holding steady since the start of 2026 as economists and investors wait for more news

Lock Volume Rebounds in January Following December Pullback, Highlighting Consumer Sentiment Fragility

January mortgage lock volume rebounded 8.7% after a weak December, showing fragile consumer sentiment and refinance activity lifted by modest rate dips.

MCT® Receives HousingWire’s 2026 Tech100 Award for AI-Powered Capital Markets Innovation

MCT wins HousingWire’s 2026 Tech100 Award for AI-powered capital markets innovation, honored for Atlas AI driving secure, real-time hedge decisions.

MCT Industry Webinar – Introduction to Trending Credit Scores for Capital Markets

Learn how trending credit scores like FICO® Score 10 T impact mortgage capital markets in this MCT & FICO webinar on March 10 at 11AM PT.

MCTlive! Quarterly Release Notes in Q4 2025

Described below within relevant tabs, you’ll find a listing of our Q4 2025 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Data & Analytics tools.

MSR Market Monthly Update – January 2026

Even though the Federal Reserve cut interest rates by 25 basis points in December, the third time since September 2025, consumer confidence dropped to recession levels in December.

MCT Industry Webinar – MCTlive!® Q4 2025 Platform Updates & Releases

This live session provides an inside look at the Q4 2025 MCTlive! technology/platform releases, featuring new capabilities designed to improve efficiency, visibility, and automation across secondary marketing operations.