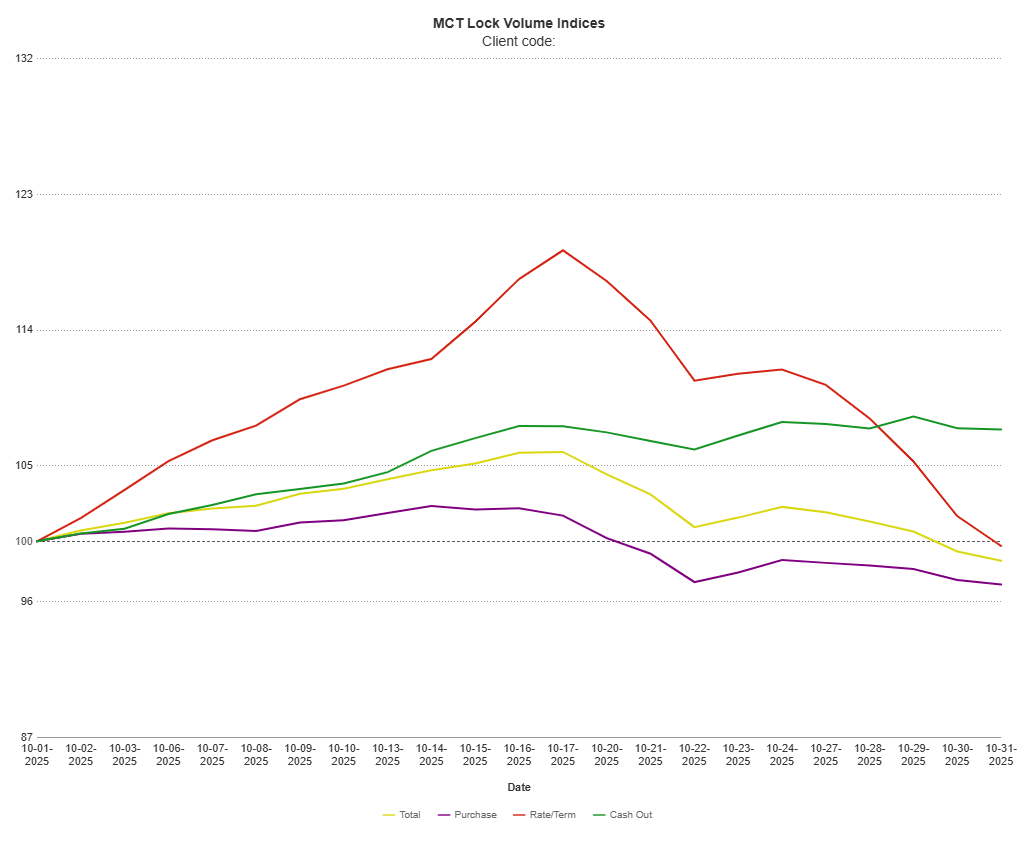

San Diego, CA – November 6, 2025 – Mortgage Capital Trading ® (MCT®), the de facto leader in innovative mortgage capital markets technology, announced the release of its November MCTlive! Lock Volume Indices. October data showed modest declines across most segments, even as markets began adjusting to shifting Federal Reserve expectations near the end of the month.

According to MCT’s data, total lock volume decreased 1.3% month-over-month in October, led by a 2.86% drop in purchase locks and a 0.31% dip in rate/term refinances. Cash-out refinances rose 7.41%, representing the only category with positive monthly growth.

On a year-over-year basis, the story remains one of resilience: total volume is up 15.34%, driven by a 103.37% increase in rate/term refinance activity and 33.76% growth in cash-out refinances, while purchase locks held nearly flat at 0.14%.

Andrew Rhodes, Head of Trading at MCT, explained that the market had already priced in a second 25-basis-point cut before Powell’s announcement on October 28, when he said a December cut was “not a foregone conclusion.”

Download MCT November Indices Report

Mortgage pricing dropped after Powell’s commentary but the market bounced back in the next couple of sessions.

The ongoing government shutdown, now the longest on record, continues to delay critical economic reports the Fed relies on.

Rhodes cautioned that even if the government reopens soon, the delayed employment and inflation data may not reach policymakers in time for the December meeting.

“Even if the government came back online tomorrow, we’d still see a two- to three-week lag before labor data is published,” Rhodes said. “That means the Fed could have to make its December decision without a full picture of the economy.”

Looking ahead, Rhodes expects seasonal patterns to continue through year-end, but with improving conditions as rates stabilize and refinance activity normalizes.

“My expectation going into Q4 was another 25-basis-point cut in December,” he said. “Now that looks less certain, but regardless, I think we’re set up for a better winter than we’ve seen in several years.”

He added that if the Fed holds rates steady in December, a January or early-2026 cut could still maintain the market’s easing trajectory.

“Even if the next move doesn’t come until early next year, we’re trending toward lower rates overall,” Rhodes said. “That creates opportunity heading into spring.”

MCT remains committed to delivering expert guidance and data-driven insights. MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net