San Diego, CA – May 7, 2025 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, released its latest Lock Volume Indices for May, showing minimal change in mortgage activity month-over-month amid continued market uncertainty.

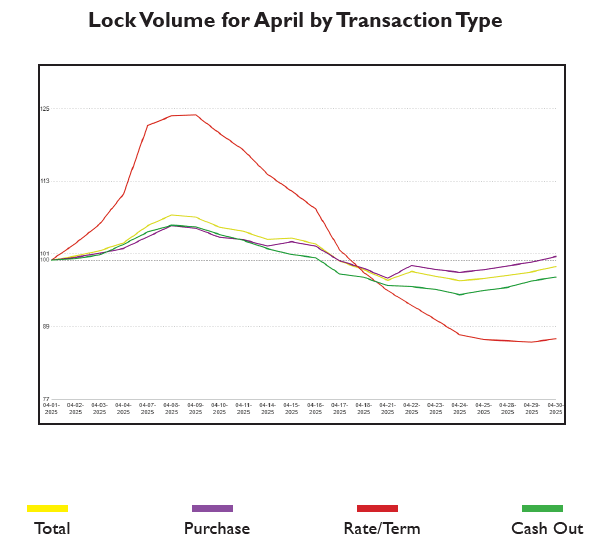

Total lock volume decreased slightly by 1.07% compared to April, with purchase locks essentially flat at 0.59%. Rate/term refinance activity saw a notable dip of 13.02%, while cash-out refinances declined 2.83%. Year-over-year trends remain strong, however, with total volume up 11.03% and rate/term refinances posting an impressive 196.19% increase from May 2024.

“These numbers are pretty much in line with what we anticipated going into May,” said Andrew Rhodes, Senior Director and Head of Trading at MCT. “Early April started strong with a brief dip in rates, but volatility returned by mid-month, pushing rates higher and muting new volume. It’s basic market behavior, but it’s being driven by an unusually high level of uncertainty right now.”

Download MCT May Indices Report

Rhodes emphasized that ongoing tariff developments, foreign investment hesitation, and geopolitical tensions are feeding broader market instability. “You can’t put the toothpaste back in the tube,” he added. “There’s lingering residue from global policy moves that’s making investors nervous, keeping rates elevated, and limiting borrower appetite.”

While GDP came in slightly negative for Q1 and labor markets remained solid, Rhodes noted that the Federal Reserve is likely to stay data-dependent. “I don’t expect drastic rate moves in the near term unless we see deeper economic deterioration.”

Looking ahead, Rhodes expects summer origination volumes to hold relatively steady, barring any major economic shocks. “Unless there’s a clear signal, like another quarter of negative GDP or sharp unemployment changes, we’ll likely continue to see this kind of tepid, sideways movement.”

MCT remains committed to delivering expert guidance and data-driven insights. For a more in-depth look at market dynamics, industry professionals can access the full report on MCT’s website.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net