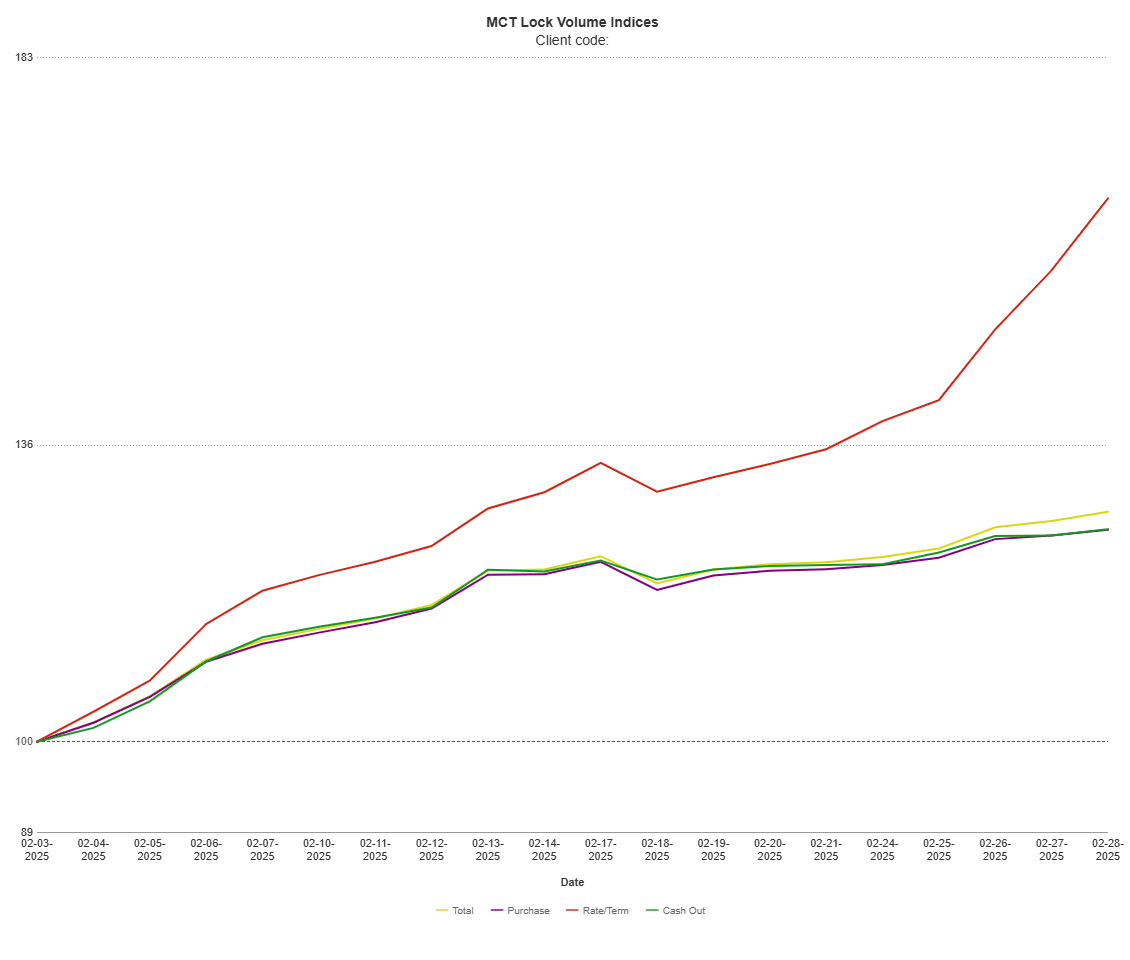

San Diego, CA – March 11, 2025 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared to the previous month. Industry professionals and stakeholders are encouraged to download the full report for a detailed analysis.

The increase in volume follows the typical seasonal pattern, rebounding from the December and January winter lull. As the housing market transitions into the Spring homebuying season, this positive movement suggests improving market activity. However, recent trends indicate that total volume may rise further in March and April before tapering off as early-season buyers finalize their purchases, leading to decreased demand in the deeper summer months.

External economic factors also remain a key area of focus. The potential impact of tariffs and possible retaliatory trade measures could introduce volatility into the broader economy, which may, in turn, affect mortgage rates. Market participants are watching these developments closely as they navigate lending and investment decisions.

Andrew Rhodes, Senior Director and Head of Trading at MCT, shared his perspective on the current financial landscape: “The expectation is that the Federal Reserve will likely hold the line on rates in March and May, with markets anticipating a likely rate cut in June. Economic performance given impending tariffs, Nonfarm Payroll, and the Consumer Price Index (CPI) will continue to be the biggest factors influencing rate decisions as we move into the summer months.”

Download MCT March Indices Report

As mortgage lenders and capital markets participants prepare for evolving conditions, MCT remains committed to delivering expert guidance and data-driven insights. For a more in-depth look at market dynamics, industry professionals can access the full report on MCT’s website.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net