MCTlive! Release Notes – Q3 2024

Published 10/18/2024

Welcome to MCT’s Quarterly Release Notes!

Described below within relevant tabs, you’ll find a listing of our Q3 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development.

As a company, MCT consistently seeks to expand communication and transparency with our clients and partners. Should you have questions or comments about our latest releases, please reach out to your MCT representative.

- Savings Data Now in MCTlive!: Clients now have access to data outlining their savings related to bid tape assignment-of-trade (AOT), On Swap savings, and to-be-announced (TBA) MBS trading. [View Screenshot]

- Indication Functionality Update: First to market electronic indication functionality now includes offers, rolls, and specs!

- Pool Selection for Move to Pool Tracker: The Add Pool popup on the Best Ex Analysis tab now allows for a selection of which pools to push to the Pool Tracker.

Data Updates:

- Updated Active Users Report: Active User Report now includes current access levels, user email, user phone number, and last login for each active user.

- Updated Dealer Exposure Summary – Open Trades Report: Added % Used and % Overall to the Dealer Exposure Summary – Open Trades Report. [View Screenshot]

- Mission Score Report: This new report shows the current hedge pipeline and the Mission Score associated with each loan. [View Screenshot]

- New Summary Report: Clients now have access to a New Monthly Entry Investor Summary report using the BE Price benchmark. [View Screenshot]

- Fallout Reports: Clients can now access new reports applying the mark-to-market investor restrictions to fallout reports.

- MTM Reports: MCTlive! now has the ability for a user to choose an alternate date to lock expiration for the purpose of selecting a delivery date in the mark-to-market reports.

Business Intelligence Updates:

- Workbook Organization: Workbooks have been reorganized by adding a new top-level project called “Investor Rankings.” A few workbooks from other locations have been moved into this project to allow clients to find these ranking views more easily. Namely, those moved into “Investor Rankings” are “Best Efforts Loans,” “Sold Loans- Investor Monthly Rankings w/ BE,” and “Sold Loans- Investor Rank by Win Percent.” [View Screenshot]

- Additional Filtering Options: State, County, Property Type, Normalized Rate, Purpose, Occupancy, and Channel have all been added as new filtering options to the dashboards in the “Best Effort Loans” workbook. [View Screenshot]

- New Filter Added: A “Program Low” filter has been added to the dashboards in the “Loan Sale Color + Opp Curve” workbook. [View Screenshot]

- Employment Type Normalization: Clients now have the ability to combine multiple fields and normalize the data for employment type.

- Loan Amount Normalization: MCTlive! now has the ability to map to an alternate field for UPB if populated in a client’s data.

- Spec Margin Report: This new functionality generates a report that shows all current spec margins and currently saved spec holdbacks.

- Update Spec Margins: Clients can now update all Spec Margin Holdback margins for all products and all ratesheets with a single click of a button. NOTE: It is highly recommended that users consistently monitor spec pickups at the product level.

- Global Investor Addition: This gives users the ability to add an investor across multiple products with a single click.

- Uniform Ratesheet Set Up: This new functionality allows a Base Rate Generator user to set up all products for a given rate sheet within a single Ratesheet Product Addition popup. All product parameters must initially be uniform, however they can be adjusted later using the Edit functionality.

- Execution Driven Rate Stack: This gives users the ability to control the generated rate sheet rate stack by execution instead of defining an absolute rate range.

- Custom Filename Export: This new functionality allows users to customize the exported rate sheet file name.

Learn more about how MCT’s Base Rate Generator allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions.

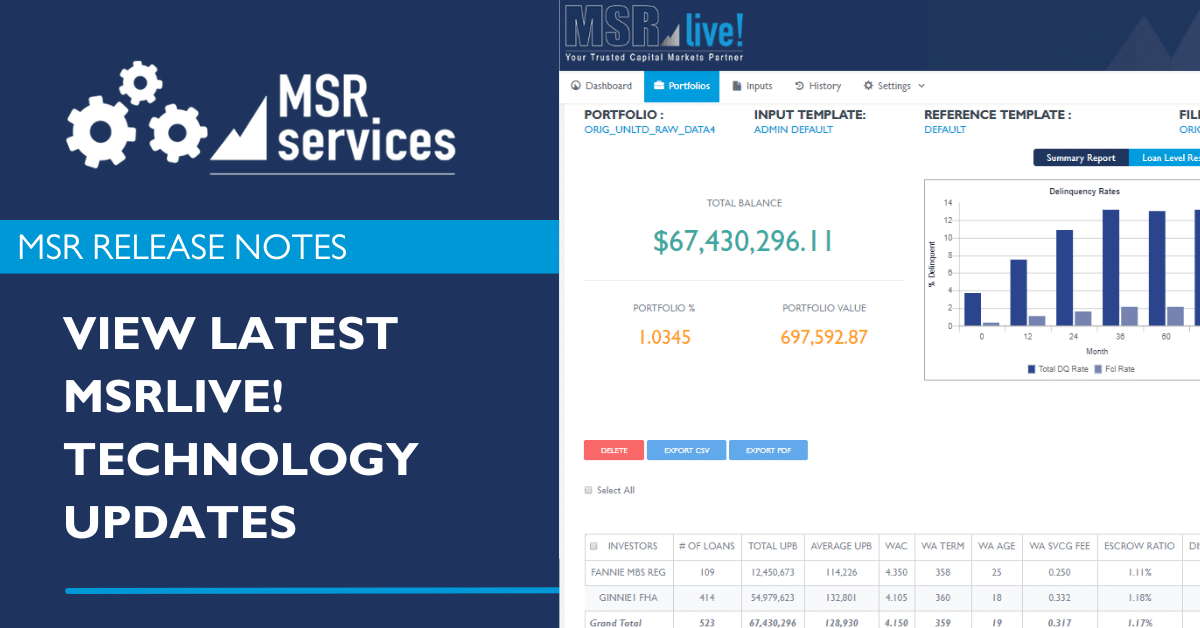

MSRlive! & Business Intelligence Release Notes

In addition to providing quarterly MCTlive! Release Notes, MCT’s MSR and Business Intelligence teams also provide technology updates and release notes for users of the platforms. View the most recent MSRlive! and Business Intelligence releases below.

MCT’s MSR division will continue to produce monthly release notes specific to MSRlive!. MSRlive! is a robust mortgage servicing rights valuation tool used to manage servicing portfolios.

The following is a listing of the most recent MSRlive! releases:

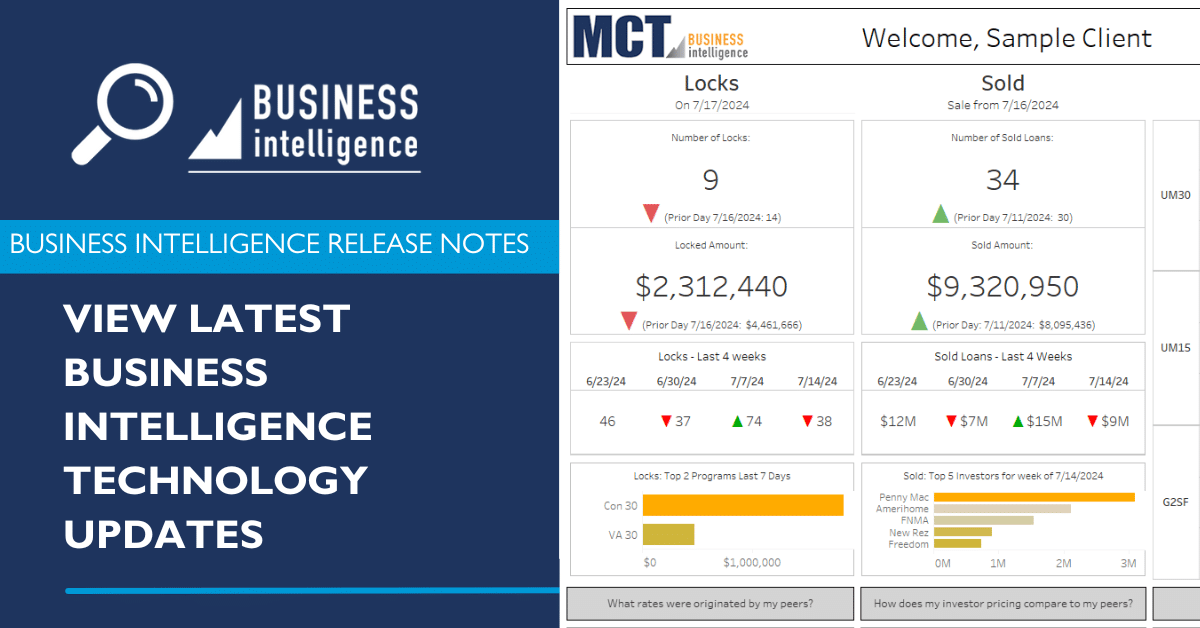

MCT’s Business Intelligence division will continue producing quarterly release notes specific to the Business Intelligence tool. With this tool, lenders are empowered to understand the market, optimize their loan sales, and improve performance relative to their peers.

The following is a listing of the most recent Business Intelligence releases:

- Workbook Organization: Workbooks have been reorganized by adding a new top-level project called “Investor Rankings.” A few workbooks from other locations have been moved into this project to allow clients to find these ranking views more easily. Namely, those moved into “Investor Rankings” are “Best Efforts Loans,” “Sold Loans- Investor Monthly Rankings w/ BE,” and “Sold Loans- Investor Rank by Win Percent.” [View Screenshot]

- Additional Filtering Options: State, County, Property Type, Normalized Rate, Purpose, Occupancy, and Channel have all been added as new filtering options to the dashboards in the “Best Effort Loans” workbook. [View Screenshot]

- New Filter Added: A “Program Low” filter has been added to the dashboards in the “Loan Sale Color + Opp Curve” workbook. [View Screenshot]

“From July through September 2024, eleven enhancements to MCTlive! were released to improve execution, efficiency, and experience for clients.”

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

About the Author:

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

Steve Pawlowski contributes over three decades of expertise in mortgage and capital markets space to MCT. Steve is a strategic and highly accomplished Transformation Executive with a progressive record of success leveraging analytical capabilities, an entrepreneurial mindset, and innovative thinking to drive emerging technology advancements through process improvements and new business development.

Before joining MCT, Steve was the Senior Vice President and Head of Single-Family Products & Solutions, overseeing the design, development, and integration of Single-Family’s digital products and services across the residential mortgage loan life cycle. He was also responsible for fostering the integration of Fannie Mae’s technology and business infrastructure with its clients, facilitating their growth and value creation within the market landscape.

Prior to this, Steve served as the Senior Vice President and Head of the Capital Markets Journey in Single-Family, steering the development of products for the conduit and capital markets sector. He was responsible for the provision of execution tools, business solutions, and services, employing customer engagement, design thinking, innovation, and agile methodologies to deliver exceptional outcomes.