MCTlive! Release Notes – Q2 2024

Published 7/22/2024

Welcome to MCT’s Quarterly Release Notes!

Described below within relevant tabs, you’ll find a listing of our Q2 2024 technology developments. This update also includes technology release notes for MCT’s MSRlive! and Business Intelligence tools. Improvements span general platform maintenance, feature and function enhancements, and entirely new development.

As a company, MCT consistently seeks to expand communication and transparency with our clients and partners. Should you have questions or comments about our latest releases, please reach out to your MCT representative.

- Commit Loans Window – “Best Ex Dropdown” Option: Created a button in the best ex analysis tab for the MSR EBX function. This streamlines the investor restriction process to allow for the proper results to be displayed back to the user.

- Pipeline Coverage View Update: Loan Purpose and Channel added to main loan breakdowns popup

- Reporting Update: MCTlive! is now archiving implied Agency Cash Window spec payups.

- Pool Tracker Update: Pool Tracker screen now has the ability view and manage archived pools.

- Agency PA Reconciliation: Gives a user the ability to reconcile a purchase advice from Fannie Mae to the commitment pricing created at the time of commitment in MCTlive! via Rapid Commit.

- Savings Data Now in MCTlive!: Opening up client access to the AOT, digital TBA trading, and On Swap savings data points previously only available to MCT Staff.

- MChaT Conference Link: Will allow MCTlive! Chat users to invite clients to MChaT conferences regardless of whether or not the given client is a participant in the chat.

- Agency PA Center Updates: Now Populating SRP for Loans sold to Freddie CRX.

- Purchase Advice Center Update: Now Populating SRP and Servicer Name for Loans sold to Freddie CRX.

- Best Ex Analysis Update: Gives a user the ability to upload additional payups to any execution on a loan level.

- Pricing Breakdown Based Investor Selection: When this option is selected in the Commit Window, the investor dropdown is sorted from best to worst along with showing a pricing delta to the best price.

- Commitment Summary: New functionality that streamlines investor selection when doing a deeper dive in pricing breakdown window. When doing a deeper dive review of pricing in the Pricing Breakdwon window, we created a hyperlink for each investor. When clicking on this investor, the hyperlink will update the Investor in the Commit Window and close down the Pricing Breakdown window.

- Updated SMP Data Points: Following the updates from Fannie on the SMP Loan Pricing API, we’ve added DTI and number of borrowers to the API call from MCTlive!

- Rapid Commit Update: Allows a user to commit Fannie/Freddie within one screen of MCTlive!

- Pricing Breakdown Popup – Collapsed View: More concise view of the Pricing Breakdown popup window on Best Ex Analysis.

- Commitment Summary: High level overview of commitments based upon the user defined dates.

- Best Ex Update: Added an export to the Best Ex Analysis that will transpose the output.

- Attribute Restriction Update: Updated rule creation for Number of Borrowers in Attribute Restrictions.

- Add Pool Sorting and Filtering: Add Pool screen now includes the ability to sort and filter the displayed columns.

- Best Ex Analysis Update: Adds the ability to cap SRP/MSR by servicing fee.

MCT Marketplace Seller Updates:

- Warning Alert – Not Yet Approved with Investor: In an effort to reduce erroneous commitments to investors, sellers will now see a popup appear when trying to commit loans to an investor who does not have them turned on as an approved counterparty in MCT Marketplace. Sellers will still have the option of proceeding with the commitment to the flagged investor(s) by hitting the Proceed Anyway button, or they can hold off by selecting the “Don’t Commit” button. In this case, only the loans with approved investors will be committed. This change applies to loans committed via the Request and Execute Commitments button in the Commit Loans popup of the Best Ex Analysis tab in MCTlive.

- Remove Approved Investors from MCT Marketplace Shadow Performance Tables: Approved investors will no longer appear in the shadow performance tables of the best ex analysis and MCT Marketplace performance tabs. This will help to reduce any confusion with regards to investor approvals, while simultaneously providing shadow bid information for new investor opportunities.

Data Updates:

- Reporting Update: Gives MCT the ability to customize the Benchmark title names for reporting purposes.

- Reporting Update: New Report that shows open long positions.

- New Report – Pipeline MTM – Implied Spec: Created an additional Full Pipeline MTM – Component Details report with the addition of an implied cash spec payup column. This will include the implied spec payup derived from agency cash window pricing.

Business Intelligence Updates:

- SMP: Volume Rank: Ranks Fannie SMP co-issue buyers by volume committed. This compliments the existing SMP price rank dashboard. The report can be found in the Business Intelligence site: Explore/Cash Execution SRP/MSR Color/FNMA: Cash Execution SRP/MSR Color/SMP: Volume Rank.

- Best Efforts Loans: A new BI workbook containing several dashboards that illustrate the top investors buying non-hedgable products (e.g., ARMS, Jumbos, Non-Q.M., and HELOC/2nds). The workbook can be found in the Business Intelligence site: Explore/Lock Data/Best Efforts Loans.

- Investor Rank by Win Percentage: A new BI workbook Illustrating investor ranking based on the percentage of bids won. This view helps demonstrate how newer investors are performing. Of note: The existing investor ranking view (Sold Loans – Investor Monthly Rankings w/ BE) is ranked based on committed volume. That view can favor investors who have been around for a while and have many lenders submitting bids. The new workbook is located in the Business Intelligence site: Explore/Sold Data/Sold Loans- Investor Rank by Win Percent.

- No FICO Normalization: MCTlive! now includes the ability to consume NO FICO loans and normalize them into a value that is compatible with MCTlive’s best ex engine.

- Income Normalization Update: Added a multiple for income normalization.

- Base Rate Generator Pricing Update: Allows rate sheet user to generate SMP based pricing without any SRP LLPA adjusters.

- Spec Margin Holdback: Allows lenders to holdback a specified percentage of a given Spec Payup in the form of additional margin.

- Margin Breakdown: Exports a report breaking down all of the margin components for given products in a ratesheet.

- Historical Investor Ratesheet Access: Gives lenders direct access to their specific source investor ratesheet (current and historical) in MCTlive!

- Spec Margin Holdback Report: Provides a report of all current spec margin holdback margins, given the current spec vs base program execution.

- Differentiate by Execution – Spec Margin Holdback: Allows a lender to differentiate the percentage spec holdback by current spec execution level.

- Custom Ratesheet Price Rounding: Allows a lender to specify the number of decimal places to which the ratesheet execution is rounded.

- Rate Adjuster Margin Functionality: Allows a lender to add margin using a rate adjuster.

Learn more about how MCT’s Base Rate Generator allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions.

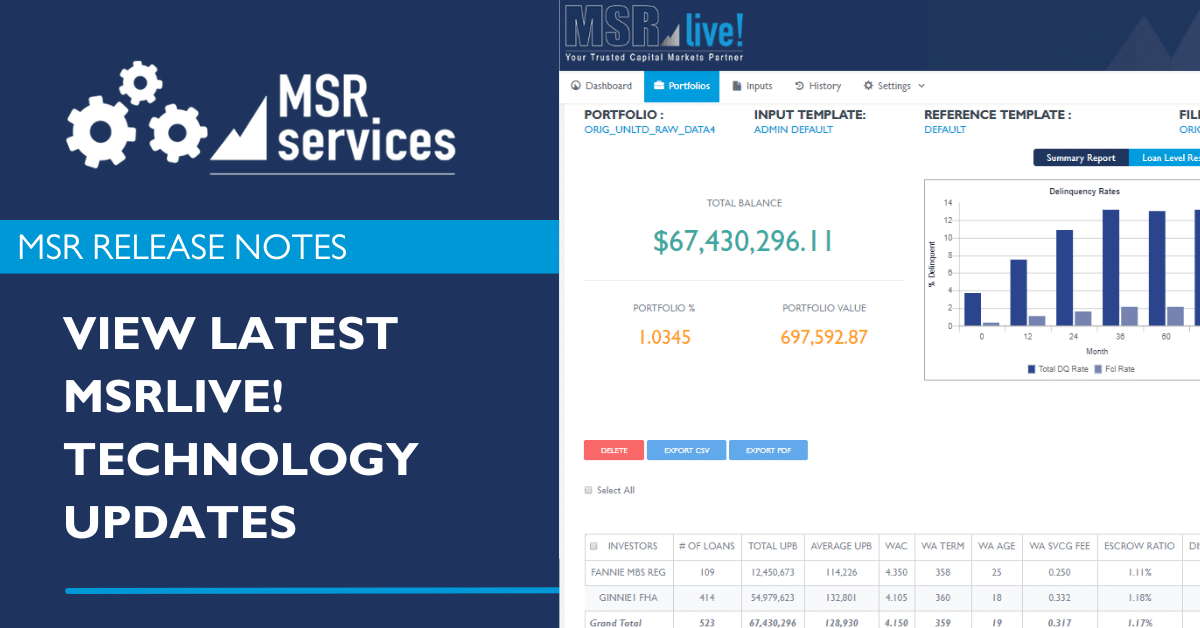

MSRlive! & Business Intelligence Release Notes

In addition to providing quarterly MCTlive! Release Notes, MCT’s MSR and Business Intelligence teams also provide technology updates and release notes for users of the platforms. View the most recent MSRlive! and Business Intelligence releases below.

MCT’s MSR division will continue to produce monthly release notes specific to MSRlive!. MSRlive! is a robust mortgage servicing rights valuation tool used to manage servicing portfolios.

The following is a listing of the most recent MSRlive! releases:

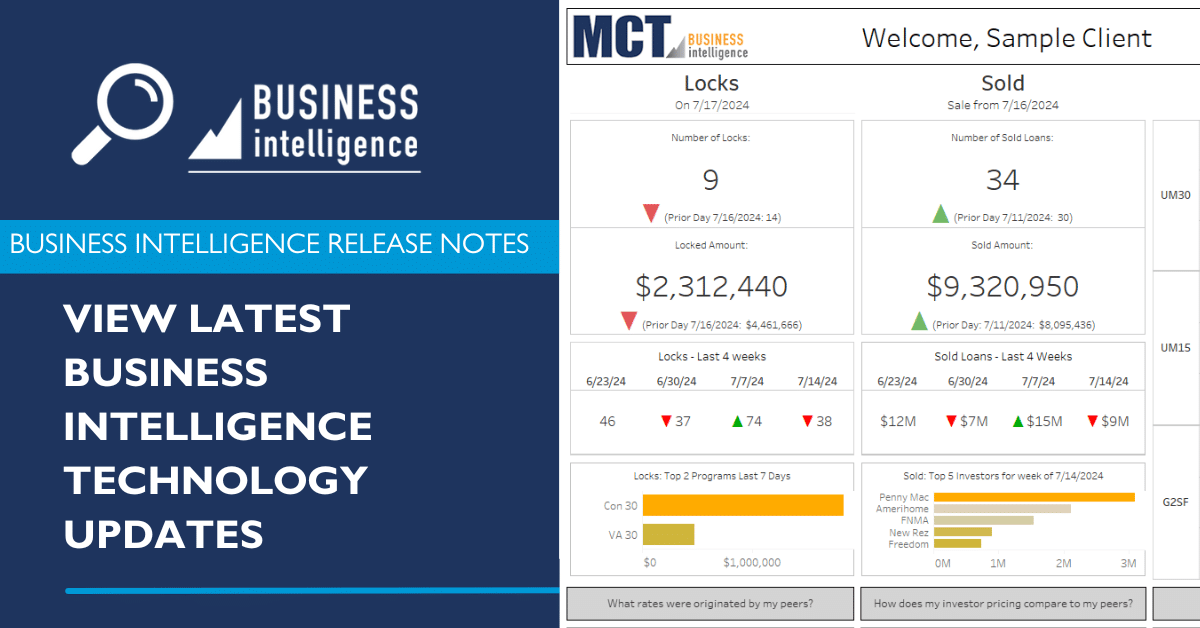

MCT’s Business Intelligence division will continue producing quarterly release notes specific to the Business Intelligence tool. With this tool, lenders are empowered to understand the market, optimize their loan sales, and improve performance relative to their peers.

The following is a listing of the most recent Business Intelligence releases:

- SMP: Volume Rank: Ranks Fannie SMP co-issue buyers by volume committed. This compliments the existing SMP price rank dashboard. The report can be found in the Business Intelligence site: Explore/Cash Execution SRP/MSR Color/FNMA: Cash Execution SRP/MSR Color/SMP: Volume Rank.

- Best Efforts Loans: A new BI workbook containing several dashboards that illustrate the top investors buying non-hedgable products (e.g., ARMS, Jumbos, Non-Q.M., and HELOC/2nds). The workbook can be found in the Business Intelligence site: Explore/Lock Data/Best Efforts Loans.

- Investor Rank by Win Percentage: A new BI workbook Illustrating investor ranking based on the percentage of bids won. This view helps demonstrate how newer investors are performing. Of note: The existing investor ranking view (Sold Loans – Investor Monthly Rankings w/ BE) is ranked based on committed volume. That view can favor investors who have been around for a while and have many lenders submitting bids. The new workbook is located in the Business Intelligence site: Explore/Sold Data/Sold Loans- Investor Rank by Win Percent.

“From April through June 2024, twenty eight enhancements to MCTlive! were released to improve execution, efficiency, and experience for clients.”

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

About the Author:

Steve Pawlowski, Managing Director, Head of Technology Solutions, MCT

Steve Pawlowski contributes over three decades of expertise in mortgage and capital markets space to MCT. Steve is a strategic and highly accomplished Transformation Executive with a progressive record of success leveraging analytical capabilities, an entrepreneurial mindset, and innovative thinking to drive emerging technology advancements through process improvements and new business development.

Before joining MCT, Steve was the Senior Vice President and Head of Single-Family Products & Solutions, overseeing the design, development, and integration of Single-Family’s digital products and services across the residential mortgage loan life cycle. He was also responsible for fostering the integration of Fannie Mae’s technology and business infrastructure with its clients, facilitating their growth and value creation within the market landscape.

Prior to this, Steve served as the Senior Vice President and Head of the Capital Markets Journey in Single-Family, steering the development of products for the conduit and capital markets sector. He was responsible for the provision of execution tools, business solutions, and services, employing customer engagement, design thinking, innovation, and agile methodologies to deliver exceptional outcomes.