Lock Desk Services: Centralize Your Lock Desk

Increase productivity, improve data integrity, and gain full control over mortgage rate lock management by outsourcing some or all of your centralized lock desk functions to our established team of secondary market analysts.

Annual Savings

Average cost savings from improved data integrity and fewer exceptions.

%

Accuracy Rate

Gain confidence in mortgage rate locks and avoid costly errors.

%

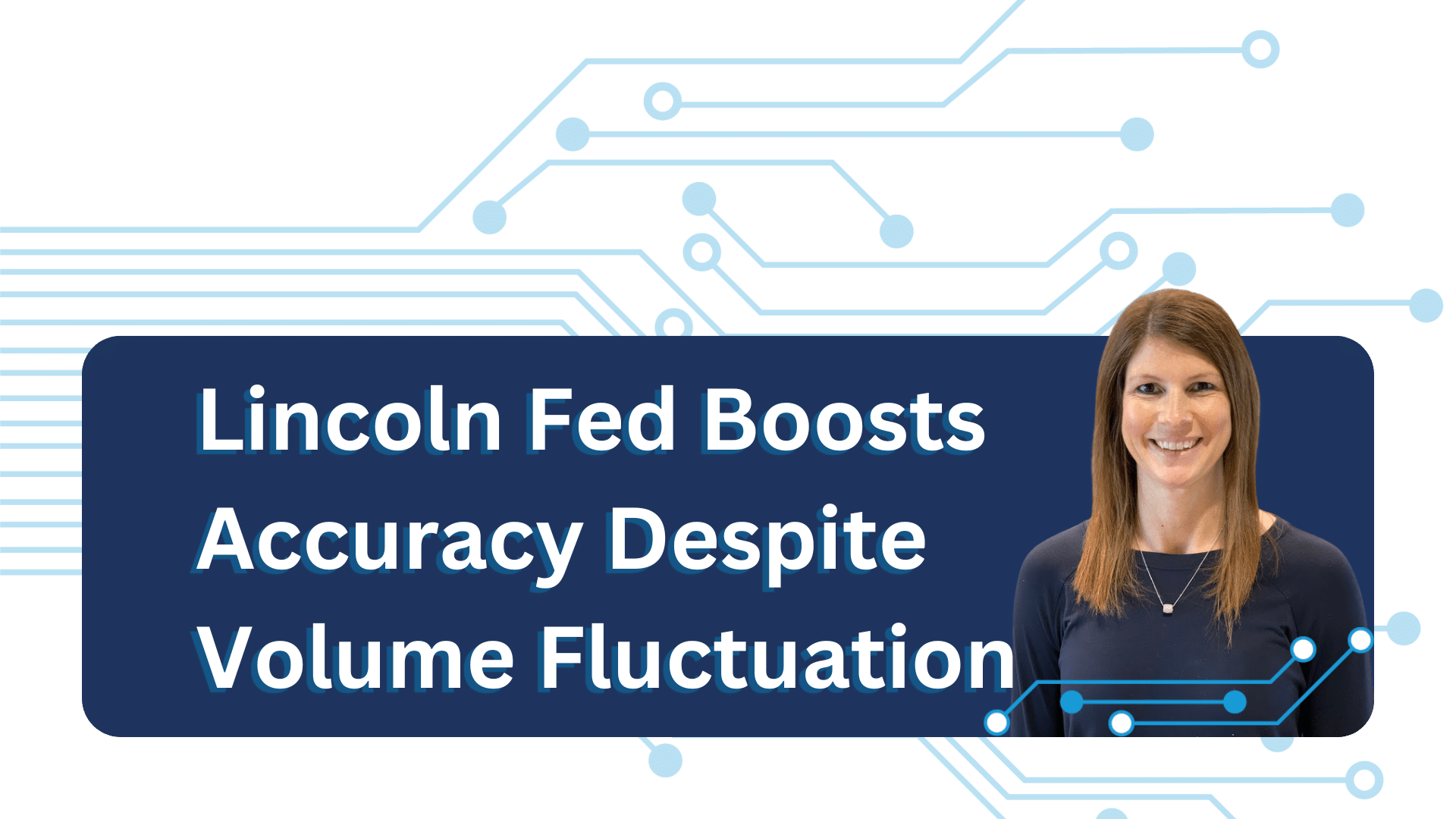

Volume Fluctuation

Avoid staffing upswings and downturns with support when you need it.

Proven Lock Desk Model with Experienced Team of Secondary Analysts

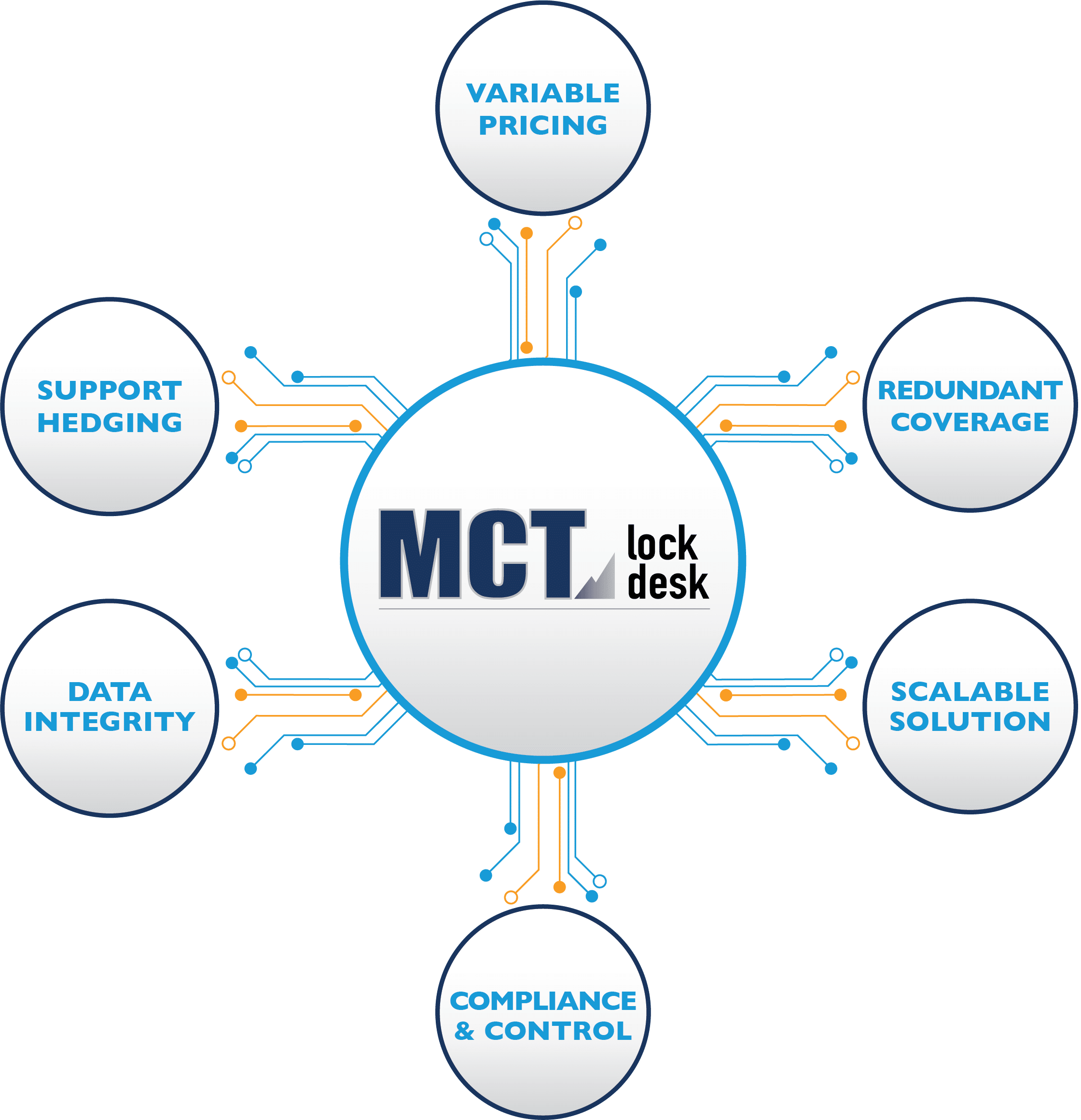

Our variable pricing model allows you to select from a menu of customizable service levels and only pay for the services you need. This solution enables you to grow your volume without the hassle of recruiting and training staff.

Supplement or Outsource Your Lock Desk

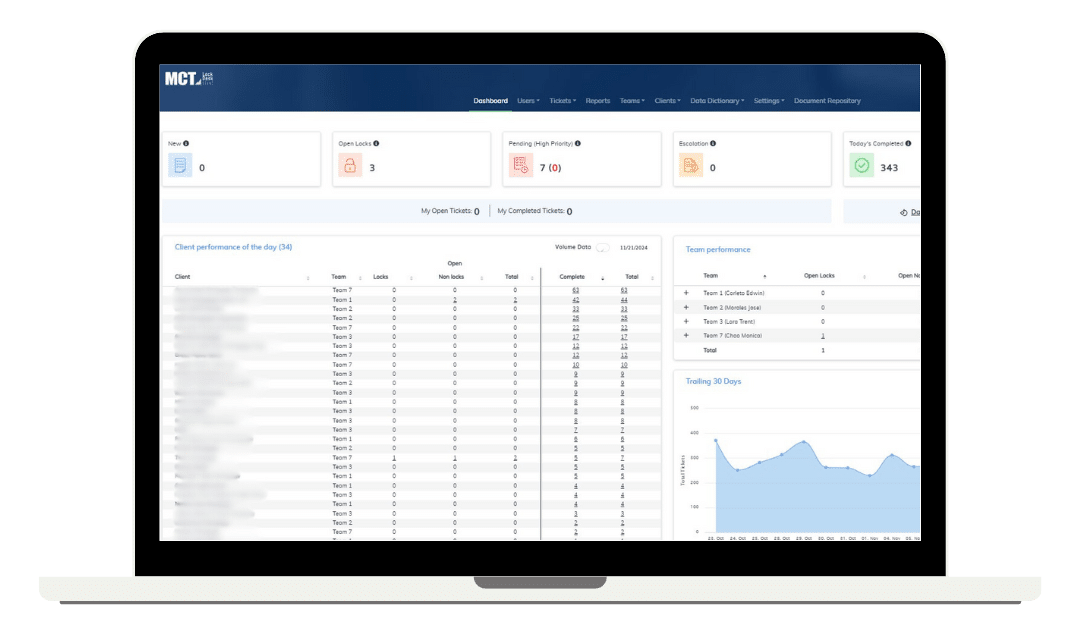

MCT’s Lock Desk Management Services boast the best client-to-employee ratio in the industry and provide the most responsive customer service from a dedicated team of mortgage lock desk service analysts.

Whether you choose to use the lock desk team to support your existing staff or completely outsource your lock desk, MCT’s cross-training and team-based service will ensure your lock desk is covered no matter the volume.

Lock Desk Management Services

Offering a customizable model to scale as your business grows, MCT’s Lock Desk Management Service provides access to a full suite of services including:

- Best practices, technology recommendations, and lock desk documentation

- Staff redundancy with experienced lock desk personnel

- Optimized workflows to support data integrity and rapid scalability

- Detailed tracking, reporting, and internal auditing strategies

- Expertise in all major LOS, PPE’s, and investor websites

Benefits of an Outsourced Lock Desk

Our professional lock desk services let your secondary staff focus on core tasks while MCT analysts handle loan locking with 99.9% accuracy.

Flexible and reliable, our lock desk services scale with your needs, ensuring compliance, data accuracy, and real-time support to streamline your operations as your business grows.

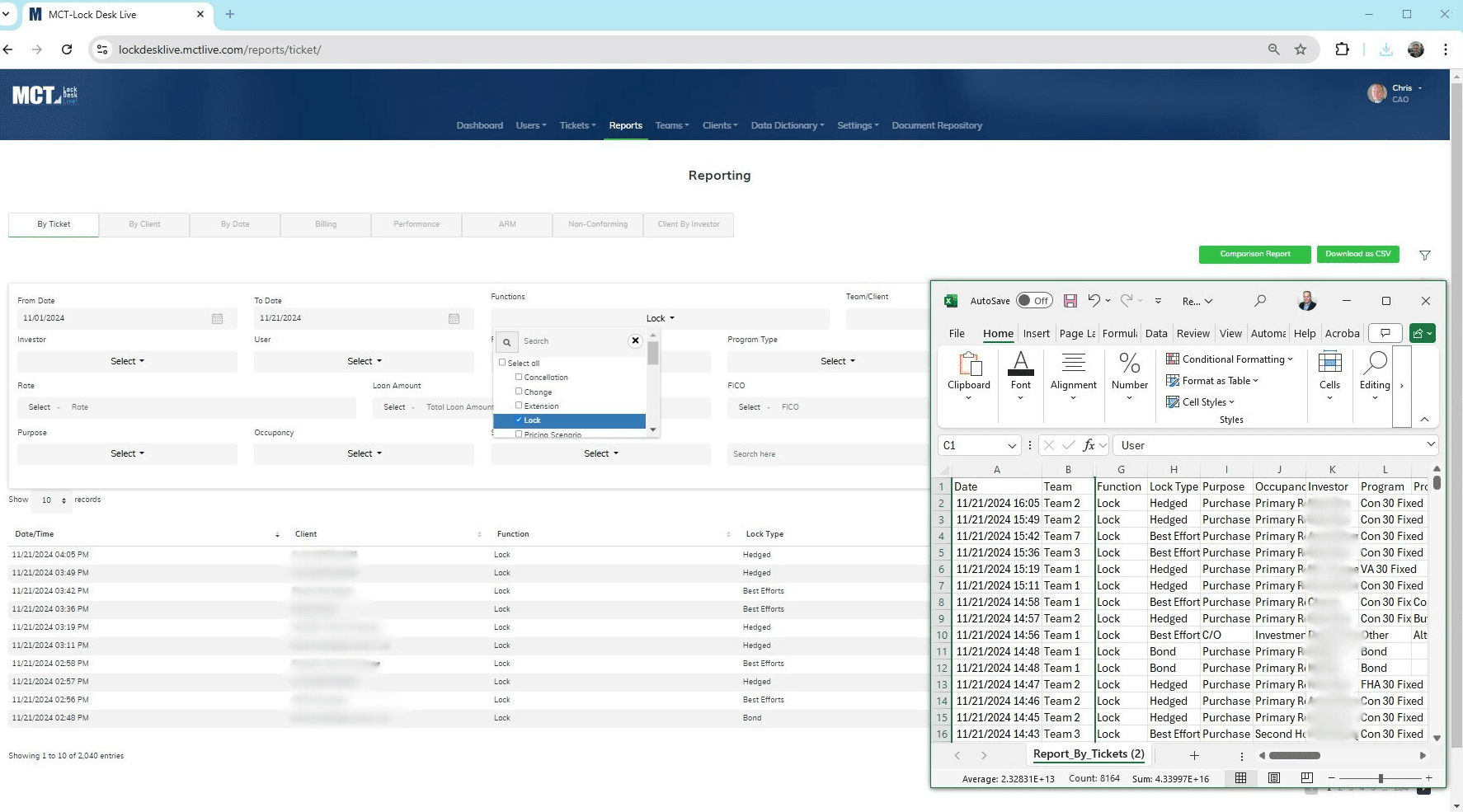

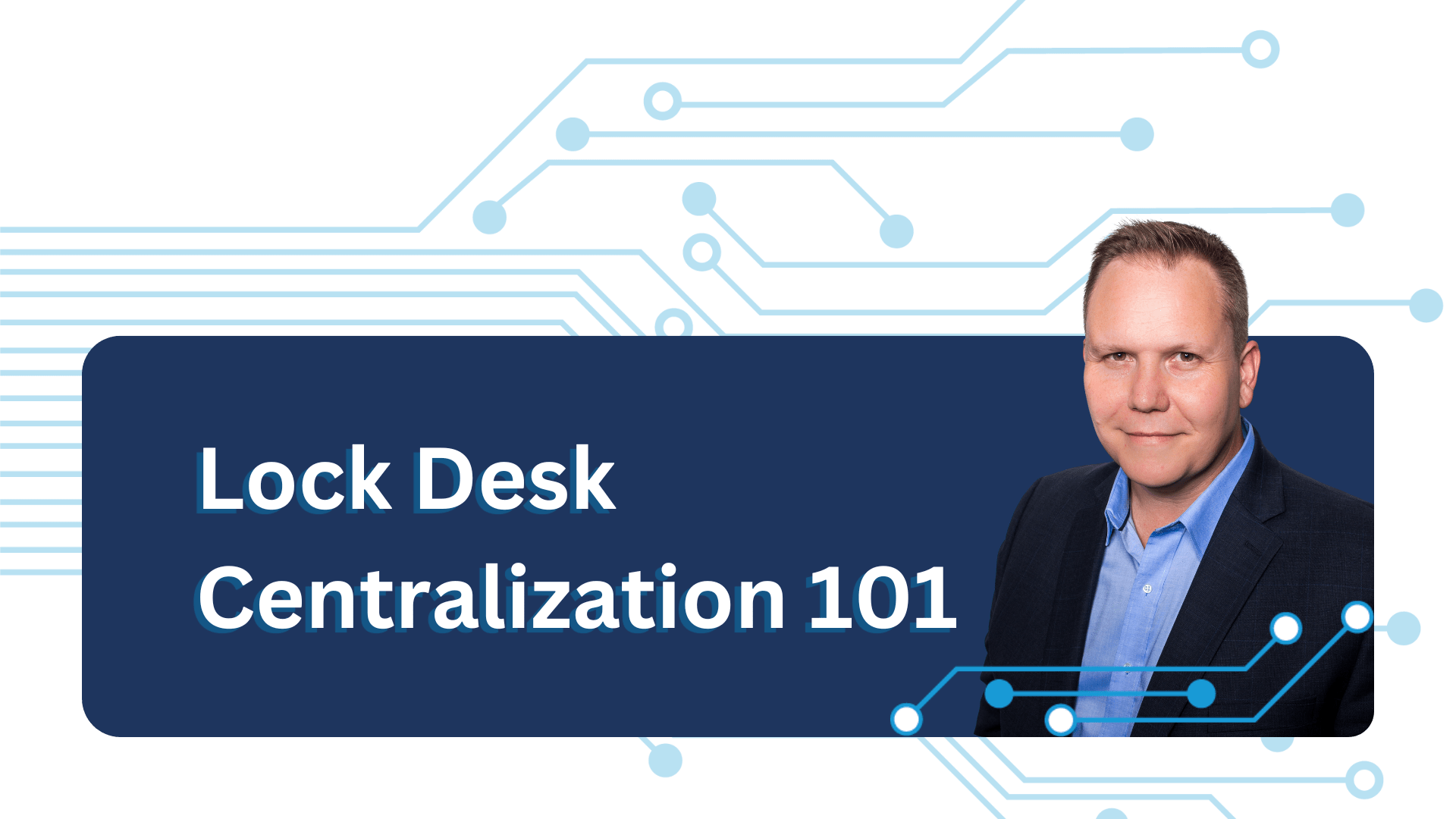

Learn More About Lock Desk Management & Centralization

Whitepaper

Frequently Asked Questions

Understand common questions about rate locks and the locking process in mortgage transactions.

What is a Mortgage Lock Desk?

Learn More: Lock Desk Centralization 101

What Does a Lock Desk Analyst Do?

What Does a Lock Desk Manager Do?

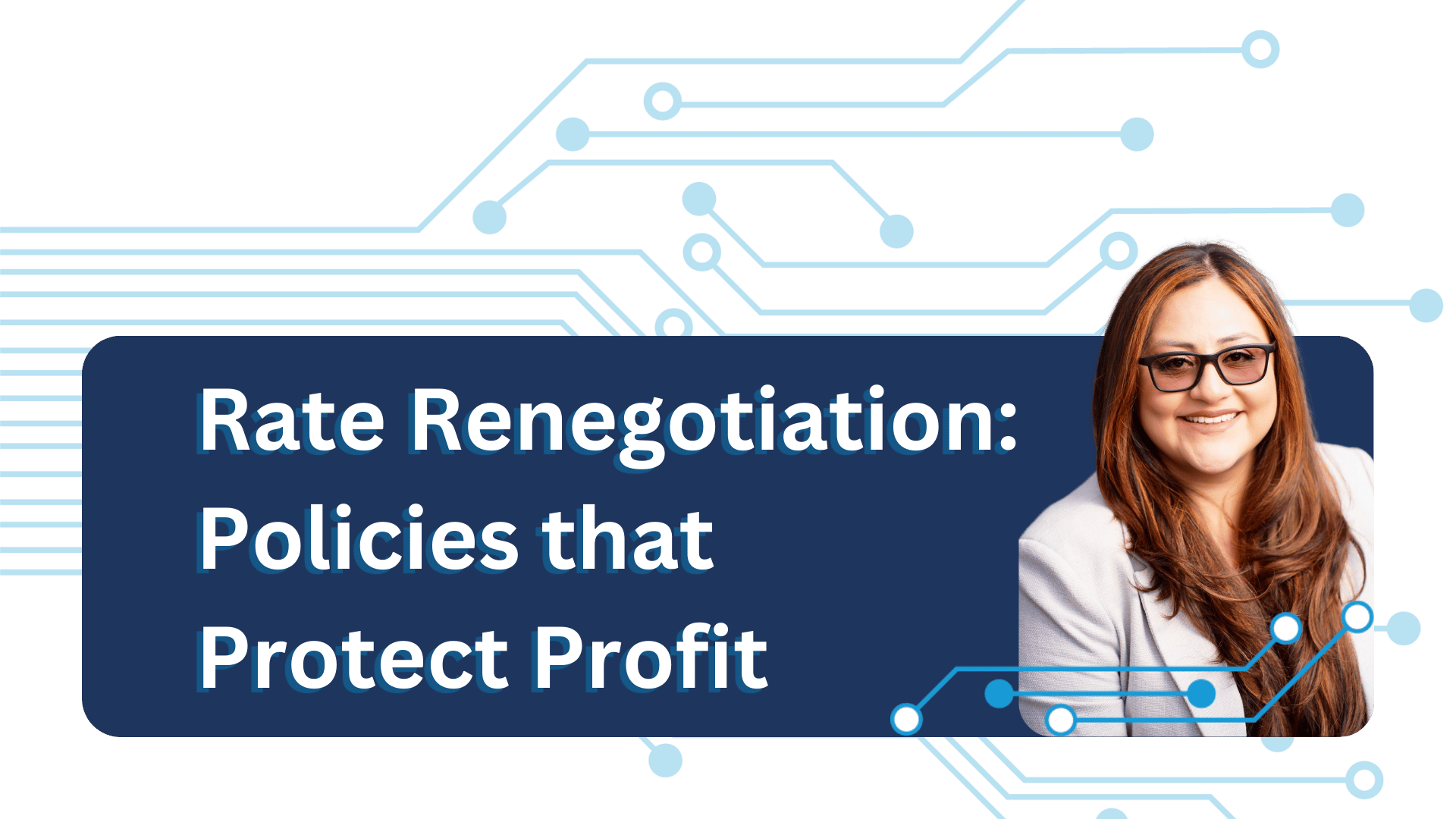

Why Should You Outsource Your Lock Desk?

- Supports Hedging: Real-time communication with trading staff and accurate data entry.

- Redundant Coverage: A dedicated team of cross-trained analysts ensures redundant coverage.

- Increased Productivity: Free up existing secondary employees to focus on additional responsibilities.

- Scalable Solution: The only solution that allows you to grow your volume without hassles of recruiting, training, and costs of adding staff.

- Experienced Team: Staff regularly works with over 100 Secondary Market Outlets and Correspondent Lenders, using every major LOS and PPE in the industry.

- Data Integrity: In-depth auditing and quality control ensures more accurate reporting and better business intelligence.