Core Features of MCT Marketplace

(MCT Marketplace®)

The MCT Marketplace webinar has concluded. Sign up for our newsletter to join upcoming MCT webinars.

Join our Newsletter for

First Access to Webinars

This webinar has concluded. Please sign up for our newsletter list to receive upcoming webinar notifications.

Contact us if you would like access to a previous webinar recording.

MCT Marketplace integrates with existing lender and investor processes to encrypt bid tapes so they can be securely and efficiently priced by investors. Our bid auction management tool features a new tri-party automation for loan investor bid tape assignment-of-trade (AOT) executions.

Investor Approved

MCT Marketplace has achieved 100% adoption among investors participating in the bulk bid tape channel. Lenders can also use shadow bidding to explore potential pickup with unapproved investors.

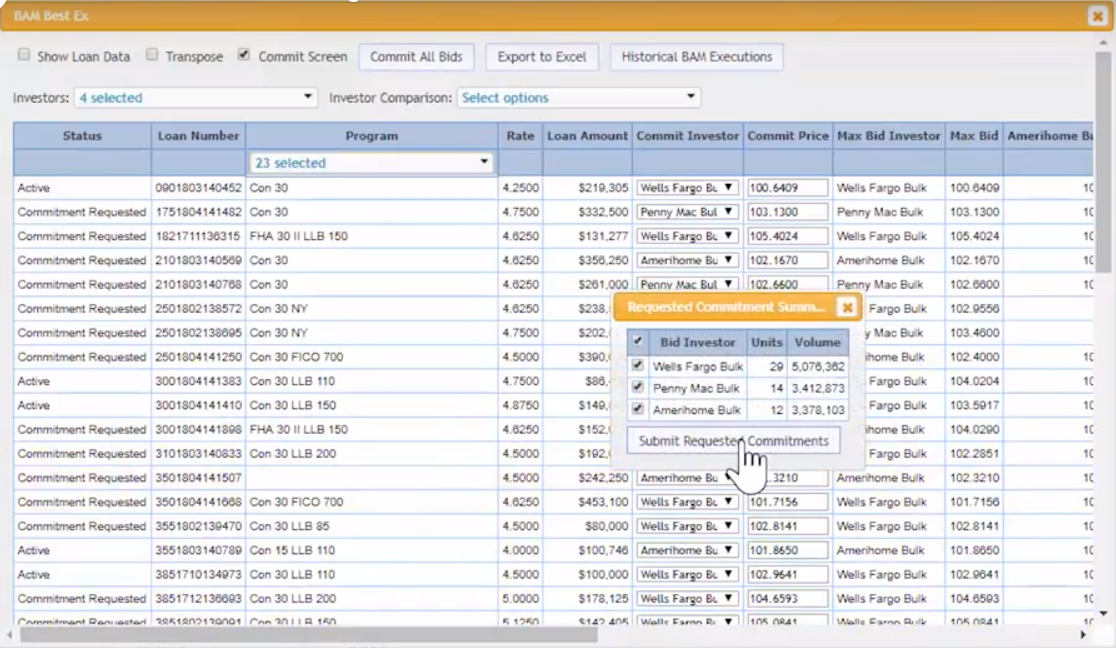

Best Execution Engine

Use MCT Marketplace to review or export a prioritized list of possible executions, commit to investors, and receive confirmations easily. Information found in bid tapes is secured and never transmitted via email.

Information Accuracy

Data writeback into your LOS avoids data entry errors and saves time through automation. One organized location for counterparties to reference the original bid tape for discrepancies in price upon delivery.

To view new MCT Marketplace features, register for our webinar on November 29th at 10AM PT

MCT Marketplace is a platform within MCTlive!® that integrates with existing lender and investor processes to encrypt bid tapes. Join our webinar on November 29th at 10AM PT to learn from our experts.

- How bid tape management and the best execution engine ensure you're receiving the best price possible for your loans

- Why information accuracy and shadow bidding help you reach new heights in your loan sale process

- Which new features, such as the tr-party automation, are revolutionizing the loan sale execution process

Join our webinar to learn more about MCT Marketplace!

"Using MCT Marketplace saves us two to four hours every time we do loan sales. The convenience of communication and analysis has encouraged us to send bid tapes to our full set of investors. Working with MCT, I feel like we’re in this together - reducing risk and achieving best execution."

Timothy Ieyoub, SVP of Capital Markets at Eustis Mortgage

About the Webinar Presenters:

Phil Rasori, COO & Hedge Advisory Lead

Mr. Rasori is a recognized thought-leader in capital markets operations within the mortgage banking community. His areas of expertise include complex financial modeling, computational dynamics, and linear programming for operational optimization. He developed the ground-breaking mortgage pipeline hedging algorithms that form the foundation of MCT’s HALO Program today. He has also pioneered several metrics that have become standard industry parlance, including “beta pull-through” factors. In addition to banking clients, Mr. Rasori has consulted with GSE agencies and the US Government on hedging best practices for community banks. Mr. Rasori has functionally led MCT operations since 2005 and ascended to his current role as COO in 2007.

Paul Yarbrough, Director of MCTlive! Deployment

Yarbrough has 13 years of experience operating in the secondary marketing divisions at Evolve Bank and Trust, Willow Bend Mortgage, Nationstar, Service First Mortgage and Realty Mortgage. Further, Yarbrough has detailed knowledge concerning how to leverage secondary marketing technology to proficiently run capital markets functions. “Paul will play an important role in implementing and training lenders on our secondary marketing technology platform MCTlive!, as well as ancillary solutions,” says Curtis Richins, president of MCT.

To learn more about MCT Marketplace's newest features, register for our webinar.