MCT Industry Webinar:

Building a Correspondent Channel with MCT Marketplace®

In this invite-only webinar, MCT takes a deeper dive into the MCT Marketplace platform to help buyers understand how best to utilize the platform for their profitability and growth.

View the recording from Wednesday, June 23rd at 10AM PT as we conduct an in-depth review of buyer features and benefits of the platform, including a demonstration of MCT AutoBid.

This webinar has concluded. Please view the recording below.

Join our Newsletter for

First Access to Webinars

This webinar has concluded. Please sign up for our newsletter list to receive upcoming webinar notifications.

Contact us if you would like more information about our webinars.

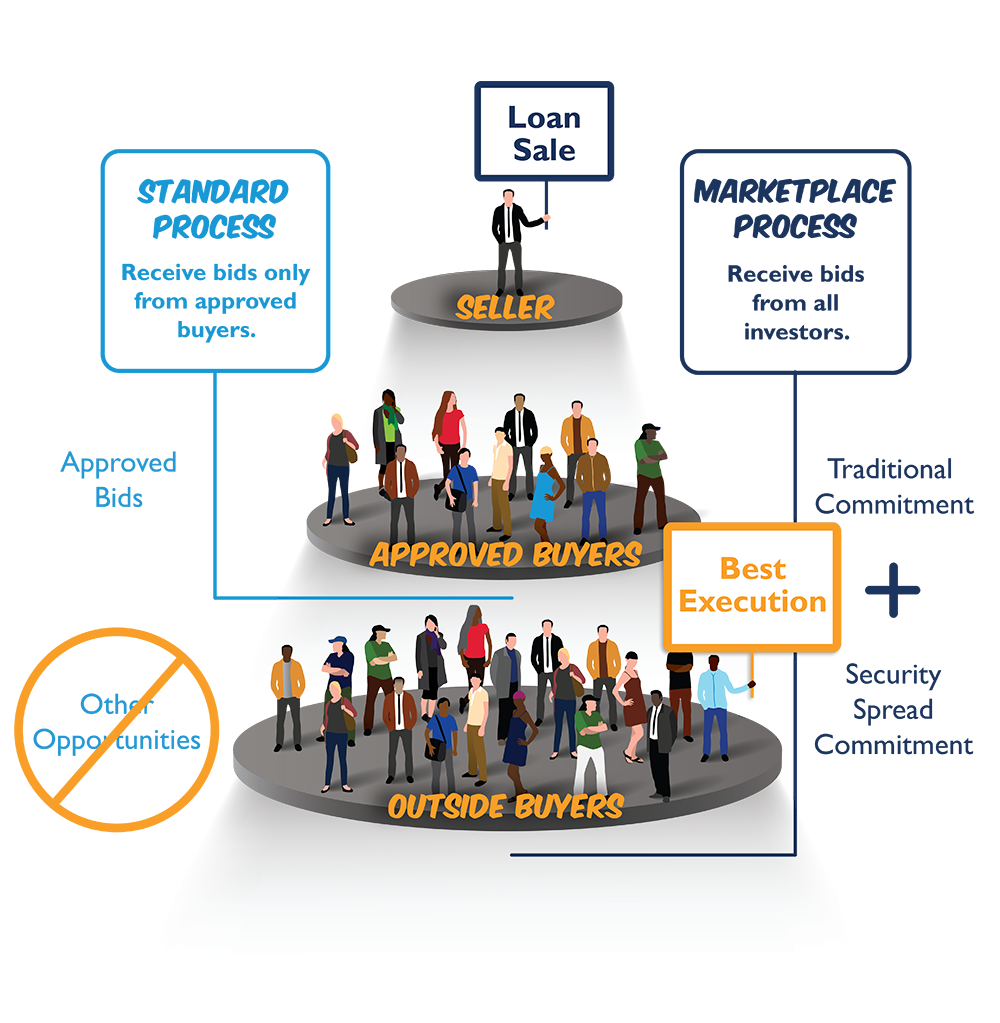

MCT MarketplaceTM is the world’s first truly open loan exchange, where buyers can bid regardless of approval status, and sellers receive automated live pricing from every buyer on the platform. Additionally, MCT’s AutoBidTM bid tape pricing solution supports every MCT Marketplace buyer, allowing them to provide automated, algorithm-based live pricing that can be fine-tuned to each seller and loan characteristic.

View the MCT Client-Exclusive webinar recording below or download the slidedeck.

About the Webinar:

In this webinar, MCT's leading technology innovators, Phil Rasori and Justin Grant, will provide an overview of MCT's MCT Marketplace for a buyer-exclusive audience.

Webinar topics include:

- What are key functionalities and benefits of MCT Marketplace for buyers?

- What is the process of buying loans on MCT Marketplace?

- How does MCT AutoBid support every MCT Marketplace buyer, allowing them to provide automated, algorithm-based live pricing that can be fine-tuned to each seller and loan characteristic?

Register for the webinar today!

“By extending the MCT Marketplace, MCT has unlocked additional liquidity and created a turn-key, digital purchasing solution. Proprietary, patent-pending functionality enables immediate access to ‘biddable’ loan collateral offered by MCT’s client base—the largest in the industry.”

Phil Rasori, Chief Operating Officer, Mortgage Capital Trading

Webinar Presenters:

Phil Rasori, Chief Operating Officer, MCT

Mr. Rasori is a recognized thought-leader in capital markets operations within the mortgage banking community. His areas of expertise include complex financial modeling, computational dynamics, and linear programming for operational optimization. He developed the ground-breaking mortgage pipeline hedging algorithms that form the foundation of MCT’s HALO Program today. He has also pioneered several metrics that have become standard industry parlance, including “beta pull-through” factors. In addition to banking clients, Mr. Rasori has consulted with GSE agencies and the US Government on hedging best practices for community banks. Mr. Rasori has functionally led MCT operations since 2005 and ascended to his current role as COO in 2007.

Mr. Rasori is a graduate of University of California, San Diego, and holds a B.S. in Management Science.

Justin Grant, Director, Investor Services, MCT

Mr. Grant began his career with MCT in 2006 as a junior trader and has quickly ascended the ranks to his current position as SVP of Capital Markets, which he was promoted to in January of 2014. During this period, he has been responsible for overseeing the risk management and loan sale execution for many of MCT’s clients and specializes in those that are federally chartered banks. Mr. Grant was also the creator of MCT’s first robust back end pricing engine that would power the fair market valuations for all of its clients. Mr. Grant’s areas of expertise include pipeline hedging, pull through analytics, SAS reporting, MSR valuations, MBS issuance and risk management.