Base Rate Generation & Back-End Mortgage Pricing Engine (PPE)

Inform your front-end rate sheet pricing with your back-end capital markets executions, then leverage reporting to determine maximum profitability using MCT’s back-end focused product and pricing engine.

Loans Priced Daily for MTM Purposes

Dollar Amount of Volume Priced Daily for MTM Purposes

Improve Margins & Performance of Rate Sheet Pricing

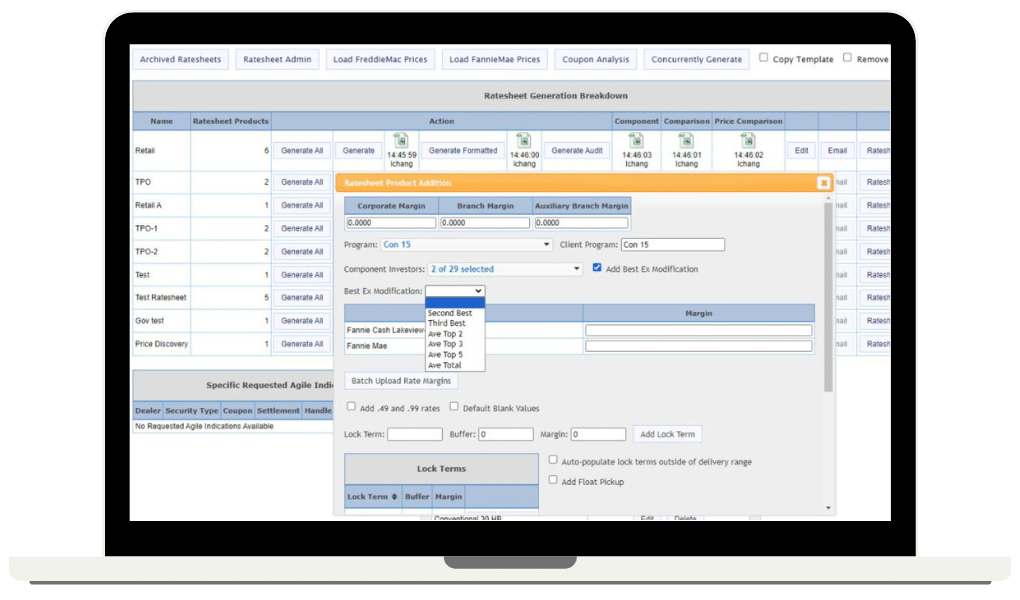

The Base Rate Generator is an industry-changing solution that allows mortgage lenders to directly inform their front-end rate sheet pricing with their back-end capital markets executions. Combine live agency API connections, co-issue executions, aggregator pricing, spec holdbacks, and custom TBA indications to improve margin management and competitive performance.

Features of the Base Rate Generator:

- Connects Front-End with Back-End Pricing

- Enables Direct Control

- Creates Opportunity and Profitability

Pricing Features for Mortgage Lenders

MCT’s product and pricing tools were built based on over twenty years of subject matter expertise and extensive collaboration with clients, ensuring the features available are exactly what mortgage lenders need to optimize and improve rate sheet pricing.

Supports All Types of Lenders

- Agency securitizing

- Agency non-securitizing

- Aggregator only

Ease of Pricing

- Generate base rates for PPE upload

- Generate formatted rate sheets

- Best execution blending

Optimize Your Margins

- Preserve day-one margin by connecting front-end rates to back-end execution

- Spec margin holdback

- Float carry calculations

Data Analytics

- Agile TBA indications

- Analyze & adjust security pricing

- Audit and archive features

Back-End Product and Pricing Engine

While MCT does not currently offer a stand-alone front-end product and pricing engine, our back-end PPE offers complete loan-level pricing for every client, investor, and channel, driving loan trading performance for both lenders and investors on MCT Marketplace.

This back-end mortgage pricing engine calculates pricing options and generates different loan pricing scenarios with varied rate options. Daily compilation of loan level pricing and eligibility is used for both Mark-to-Market and Best Execution Analysis purposes for all available delivery methods.

Learn More About the Base Rate Generator

Custom Rate Sheets – Why Now?

Chris Anderson, CAO & Head of Pricing Services, MCT

Key Features

Luke Chang, Director, Product and Pricing Division, MCT

How to Use the Base Rate Generator

Rob Barnhill, Interest Rate Risk Hedge Analyst, MCT