Mortgage Lock Volume Indices

MCT’s rate lock activity indices are based on actual locked loans, not applications, and are therefore a more accurate indication of industry lock activity than other potential stats. MCT-collected statistics are unique to the industry given the diversity of lender sizes, products/services offered, and business models across our national footprint.

Filter By Solution

Filter by Topic

Filter by Learning Level

January mortgage lock volume rebounded 8.7% after a weak December, showing fragile consumer sentiment and refinance activity lifted by modes (…)

Steeper-than-expected December mortgage lock volume drop as seasonality, shutdown uncertainty, and stubborn rates keep borrowers cautious.

Lock volume fell 4% MoM on seasonal trends, while YoY gains persisted as markets await jobs data to guide rates and Fed policy into 2026.

MCT’s November Indices show mortgage pricing dip after Powell’s comments, steady October lock activity, and signs of rate stabilization (…)

Rate/term refinances surged 183% as borrowers capitalized on lower rates, with MCT advising lenders to stay disciplined amid a data blackout (…)

MCT's September Lock Volume Indices show mixed performance as markets hold steady ahead of imminent Fed rate decision. Total volume down 0.7 (…)

MCT’s August Lock Volume Indices shows surprising growth across all refis, while corrected jobs report data alludes to a potential Septemb (…)

MCT’s July Lock Volume Indices show steady growth across all loan types, with rate/term refis up 9.89% and surprising market stability aft (…)

MCT reports June purchase lock volume held nearly flat, signaling steady housing demand amid high rates, as refis drop sharply due to rate v (…)

MCT’s May Lock Volume Indices show flat mortgage activity amid market volatility, with rate/term refis down 13% and total volume up 11% ye (…)

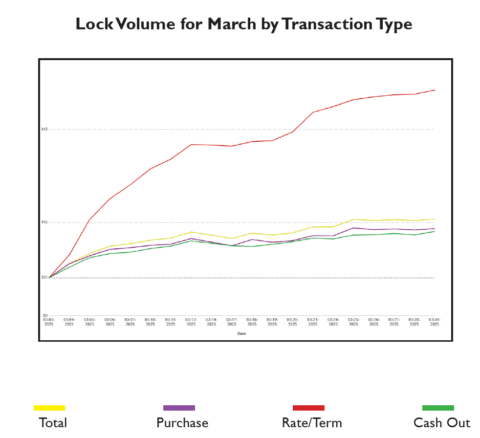

MCT reports a 17% rise in mortgage lock volume as early homebuying strengthens amid tariff concerns, low consumer confidence, and rising rec (…)

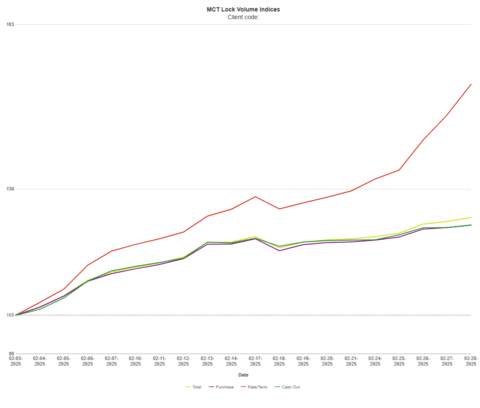

Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% incr (…)