In this post, we have included the latest market updates and the in depth details from our live webinar recordings on April 8th and May 21st. Learn our perspective about the correspondent lending crisis and an overview of current market conditions facing the mortgage industry. If you have questions, please contact our team.

Developments driven by the pandemic have upended correspondent lending. Everyone agrees about the importance of supporting borrowers during this time of crisis, but developments thus far have created uncertainty, reduced options for potential borrowers, and may seize up the mortgage market – all completely antithetical to the goal of assisting borrowers.

Update 04/22/20 | Loans in Forbearance Agency-Eligible with LLPA’s

This morning, another major announcement from the FHFA was published supporting the mortgage market in light of increasing requests for forbearance from borrowers impacted by the pandemic. The announcement, along with Fannie Mae and Freddie Mac lender letters, detail the conditions under which loans in forbearance are eligible for delivery to the agencies as well as the Loan Level Price Adjustments (LLPA’s) that will be applied to such loans.

Key Details

- 500 BPS (5%) LLPA for loans to first-time homebuyers

- 700 BPS (7%) LLPA for all other qualifying loans

- Note dates must be on or after 2/1/2020 and on or before 5/31/2020

- Loans may be delivered starting May 1, 2020

- Cash-out refinances are generally excluded from eligibility

- Mortgage defined as “in forbearance” from the time that the borrower “requested forbearance and attested to or otherwise informed the Seller or Servicer that, after the Note Date, he or she suffered financial hardship caused directly or indirectly by COVID-19”

This comes in the wake of yesterday’s FHFA announcement limiting servicer advance obligations to a maximum of four months for agency loans in COVID-19 related forbearance. Further, loans in forbearance will remain in MBS pools for the duration of COVID-19 forbearance and be treated similar to a natural disaster event. Taken together these announcements address two of the primary challenges to correspondent lending resulting from the recent crisis, and should increase stability and liquidity in the secondary market. What remains to be seen is how quickly correspondent aggregators, many of whom have recently expanded repurchase requirements related to COVID-19 forbearance, will adjust their policies accordingly. Should an investor not make adjustments, this would likely impact the individual investor buffers (Love/Hate Factor) set as part of best execution analysis by MCT sellers. We will continue to provide updates about the latest developments in these key areas as soon as they are available.

Update 04/21/20 | FHFA Announces 4-Month Limit on Servicer Advance Obligations

This morning the FHFA has released an announcement limiting servicer advance obligations to a maximum of four months for agency loans in COVID-19 related forbearance. Further, loans in forbearance will remain in MBS pools for the duration of COVID-19 forbearance and be treated similar to a natural disaster event.

While this good news addresses one of the primary current challenges to correspondent lending, servicer liquidity in light of increased forbearance, it does not confirm that loans in forbearance or with forbearance inquiries remain agency-eligible, another primary challenge to the smooth functioning of the secondary market.

We have clarified this distinction with the agencies but remain hopeful that forbearance eligibility will be addressed with a further announcement/facility this week. Review the Primary Challenges in Correspondent Lending for more information. We will continue to provide updates about the latest developments in these key areas as soon as they are available.

Update 04/16/20 | Latest on Primary Challenges to Correspondent Lending

Disconnect in Aggregator & TBA Pricing

- Aggregator pricing for agency product is showing signs of improvement. MCT client Best Execution Analyses this week have shown a 50 BPS tightening to cash window execution compared to last week.

- Despite this good news, some lenders and loan characteristics (i.e. low-FICO Gov) are still experiencing significant execution issues.

- To support liquidity in these segments, MCT is connecting clients through a new program called MCT Marketplace introduced in a client-exclusive webinar on April 16.

Unprecedented Aggregator Capacity Issues

- India’s national lockdown has been extended to May 3.

- Despite continued lockdowns influencing productivity, we have been hearing some positive recent comments around aggregators working through their capacity issues.

- An unfortunate but unavoidable decrease in purchase activity means remaining capacity issues are likely a short-term problem.

Non-Depository Servicer Liquidity Concerns

- Last Friday, Ginnie Mae provided additional details on the Pass-Through Assistance Program

- Treasury Secretary Steven Mnuchin offered reassurances about the mortgage market on Monday, “We’re going to make sure that the market functions properly.”

- Despite that reassurance, no major changes have occurred since FHFA Director Calabria’s comments and MBA President Robert Broeksmit’s response.

- The MBA is still pushing for a government liquidity facility for servicers.

Forbearance Impacting Delivery

- Fannie Mae and Freddie Mac are still compelled by their guidelines such that any mortgage for which repayment of the debt is in question, such as one in forbearance or with a forbearance inquiry, is ineligible to be purchased.

- We have heard from the agencies that they hope to provide additional clarity related to forbearance next week.

- In addition to an eligibility policy change, we are still hoping for increased clarity on questions from MCT clients.

- Review recommendations for mitigating risk including operational and secondary marketing best practices.

View Webinar Recordings – Challenges & Solutions to Correspondent Lending in Crisis Part 1 & 2

Correspondent Lending in Crisis: Part 1

Webinar Date: April 8, 2020

Panelists: Phil Rasori, COO, MCT; Bill Berliner, Director of Analytics, MCT; Ben Coll, Director of Product & Pricing, MCT; Ben Itkin, Managing Director, MCT

In this webinar recording, MCT’s experts uncertainty in the market, the options for potential borrowers and the impact on the mortgage market.Topics included:

- Unresolved Systemic Issues

- Actions by GSE’s & Aggregators

- Impact on Originators & Pricing

- Potential Solutions & the Path Forward

View the recording or download the webinar slidedeck.

Correspondent Lending in Crisis: Part 2

Webinar Date: May 21, 2020

Panelists: Phil Rasori, COO, MCT; Bill Berliner, Director of Analytics, MCT

In this webinar recording, MCT’s experts discuss pricing, capacity and liquidity concerns in the current market. Topics included:

- Latest data on aggregator, agency and to-be-announced (TBA) mortgage-backed security (MBS) pricing

- Review of hedging and mandatory delivery strategies that minimize risk in current conditions

- Updates on aggregator capacity and the effect on correspondent lenders

- Current forbearance & non-depository servicer liquidity concerns

- Recent tightening of credit and criteria in the secondary market

View the recording or download the webinar slidedeck.

Table of Contents – Correspondent Lending in Crisis

This post is meant to serve as a guide to help correspondent lenders navigate through these challenging times. The table of contents reflect the slidedeck from the webinar on Challenges & Solutions for Correspondent Lending in Crisis and will be updated to reflect updates to current conditions.

Primary Challenges in Correspondent Lending

Based on continuous conversations, these are the primary challenges facing correspondent lenders.

1. Unprecedented Aggregator Capacity Issues – Aggregators have been hit with their own blend of problems. In the midst of record pipeline volumes, some aggregator operation centers have been negatively affected by lockdowns in Asia.

2. Non-Depository Servicer Liquidity Concerns – The pandemic has caused liquidity concerns primarily driven by Payment Moratoriums. Recession fears create additional downward pressure on servicing values. Additionally, FHFA Director Mark Calabria’s comments regarding mortgage servicers have made matters worse.

3. Forbearance Impacting Delivery – Recent conditions and government efforts to provide borrowers assistance have led many borrowers to not pay their mortgages. Loans in forbearance, or with forbearance inquiries, are not eligible for agency delivery.

4. Aggregators Taking Advantage – In some cases, aggregators have taken advantage of the combination record volumes and capacity issues with their competition.

“We have 135 forbearances already on a portfolio of 3000 loans (4.5%). They are trying to downplay the problem they created. His comments about “bigger more reputable players” are offensive. Bottom line, he does not care if small servicers fail.”

Summary of Volatility Timeline

The recent market volatility driven by the pandemic has put considerable strain on correspondent lenders. To put this in perspective, please view the timeline of events starting with February 19th, 2020, when the S&P 500 reached its all-time high.

Feb 19 – S&P 500 reaches all time high

Feb 28 – First MCT® Market Volatility Webinar

March 9 – UM30 2.0s reach 103 and then violently retreat

March 11 – First “cracks” in MBS markets reported by dealers

March 15 – Fed makes first MBS purchase statement

March 17 – MCT Fed Action/Road Ahead Webinar

March 19 – Fed adds two more purchase tranches –doesn’t satisfy markets

March 20 – MCT Immediate Client Webinar

March 20 – Fed announces massive addition to buying program

March 23 – Fed announces purchasing in “amounts needed” –QE Unlimited

March 26 – Government Product Tightening Begins

March 27 – Passage of the CARES Act

March 31 – MCT MTM Strategies Webinar

April 3 – Aggregator Purchase Eligibility & Repurchase Changes Begin

So much has happened in the last two months. February 19th saw equities at an all time high and no one was thinking there were any issues. Then from there things start to catch steam and get more volatile. On March 15th the fed came in with $200 billion of MBS then on March 23rd they announced unlimited purchasing to ease market deterioration. This response caused a liquidity crisis for correspondent lenders.

Federal, Aggregator & Agency Reaction to Crisis

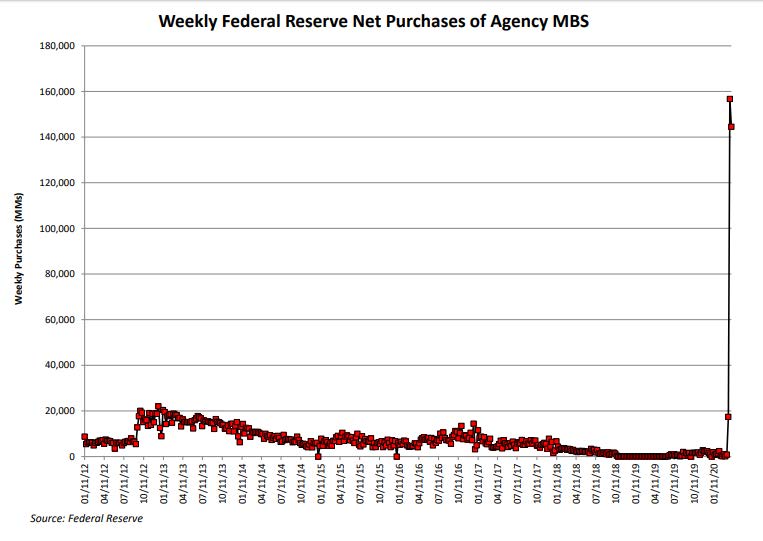

The action of the federal reserve to increase net purchases of agency MBS has contributed to pricing disconnects for agencies and aggregators.

This section shows how each has reacted to the current market in crisis.

Fed Purchasing Over Time

This chart shows the Fed’s weekly MBS purchases since they began buying the product in 2012. The graph highlights the change in scale of the Fed’s purchases—they had never bought more than about $22 billion a week, but by the week that ended on Wednesday 3/25 they had purchased $156 billion….off the scale of the chart.

Aggregator Pricing Disconnect

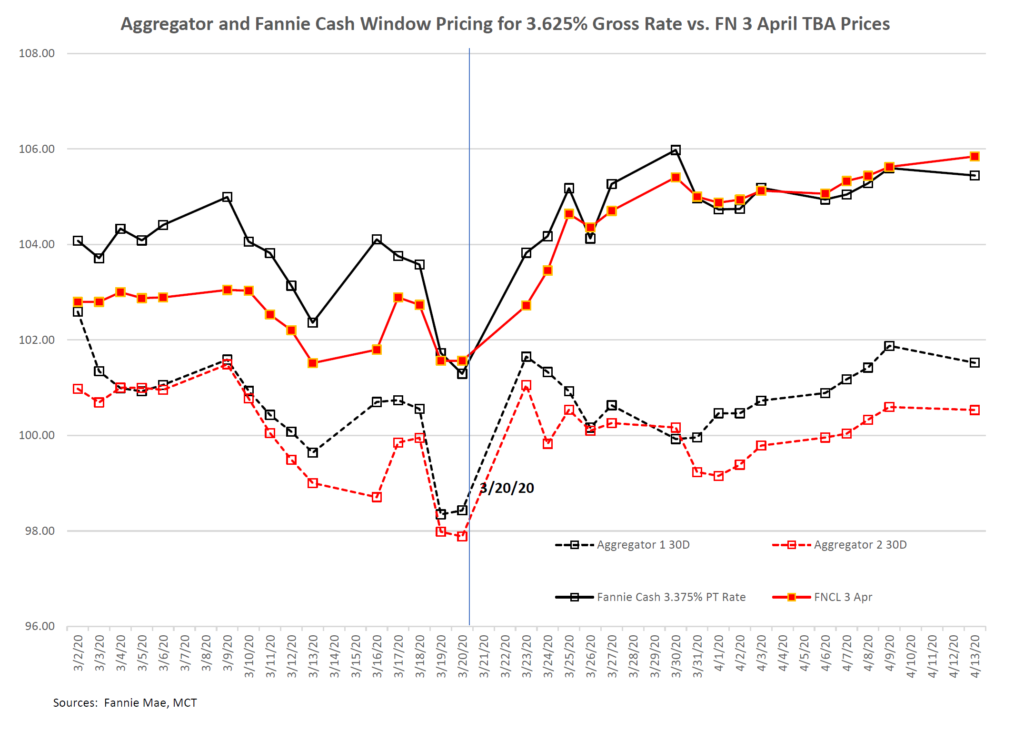

This chart highlights the decoupling of FHA loan prices versus Ginnie Mae TBAs that the market experienced in late March. As with Fannie pricing, the pricing from the aggregator was fairly stable until around 3/19. After that, TBA prices rose sharply due to the Fed’s massive purchases, while loan prices actually dropped toward the end of the month, reflecting factors including the implications of the payment moratoria imposed by the Federal and state governments.

Agency Pricing Disconnect

This chart highlights the shrinking price differential between Fannie cash window pricing and TBA prices. There was a fairly stable relationship between the two through February, but in March the prices of the two related but different assets diverged, as Fannie was forced to add margin to their prices in order to control volumes and manage increased uncertainty.

Agency Eligibility Concerns

In lieu of FHFA guidance, agencies are handcuffed by their guidelines, “An investment quality Mortgage is a Mortgage that is made to a Borrower from whom repayment of the debt can be expected.” –FHLMC Guide 4201.1. Because of the lack of structure and prioritization around Federally-mandated borrower forbearance, lenders have significantly increased repurchase risk.

Forbearance & Forbearance Requests

A recent influx of forbearance and forbearance requests have made many loans agency-ineligible. At the same time, it is unclear whether post-forbearance loans are eligible. This has spurred aggregator policy changes and left many lenders with no choice but to turn to a saturated scratch and dent market.

Recent Questions from MCT Clients:

- What constitutes a forbearance request?

- Can forbearance be requested before payment is 31 days late?

- If a loan is currently deemed ineligible by agencies due to forbearance, will it be eligible post forbearance period?

- Prior to the loan being sold to the agencies, does the CARES Act apply to that loan?

Join Newsletter For New Updates

"*" indicates required fields

How MCT Clients are Mitigating Risk

Operational Best Practices

- Push Locking Later into Mortgage Process

- Implement Day of Funding Verbal Verification of Employment (VVOE), including a push for a full VOE day of funding

- Increase UW Vigilance Outside Critical Infrastructure Sectors, including checking of web pages and social accounts

- Know Your Borrower & State/Local Stay-at-Home Orders, including Essential vs. Non-Essential business orders

- Early Communication of Loan Manufacturing Bottlenecks

Secondary Marketing

- Increase Minimum FICO on Government Production

- Increase Loan Sale Frequency

- Improve Pull-Through Forecasting & Communication

- Faster turn times reduce forbearance repurchase risk. Fund to Purchase Windows:

- Aggregator Best Efforts –15+ days

- Aggregator Mandatory –15+ days

- Agency Cash Window –3 to 4 days

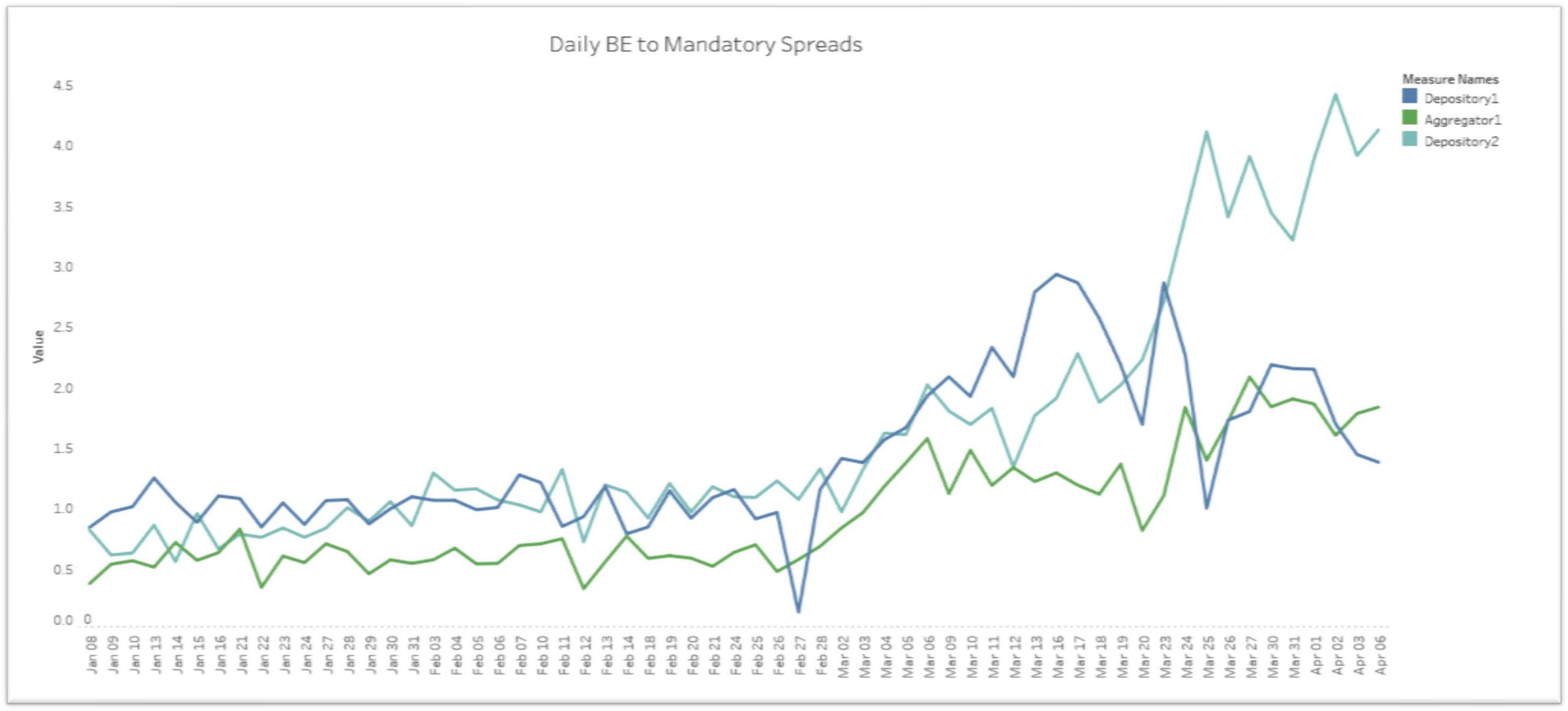

Actual Client Bid Tape Spreads

The current crisis has cause significant changes in best-efforts to mandatory spreads across MCT’s client base. Pricing volatility has continued to increase through April. The chart below shows actual client bid tape spreads for aggregators and depository clients.

Considerations to Start/Resume Hedging & Mandatory Delivery

ADDED

LIQUIDITY

Considering recent Fed-induced rally and your volume.

GOVERNMENT LOANS

Lock lower FICO’s BE and watch this space based on servicer liquidity concerns.

LENDING IN HOT ZONES

Virus tracking functionality available by request in MCTlive!

INCREASED MARGIN

Volatility and issues have created additional risks to lending and you must be compensated accordingly.

LOCK

POLICIES

Holding off on locking until full UW approval is recommended and increasingly standard practice.

Solutions to the Correspondent Lending Crisis

Increased clarity from FHFA & Agencies on forbearance.

Improvement of servicer liquidity concerns.

Operational capacity increases.

Aggregators pricing disconnect from agencies closes.

The MCT Story –“Moving to Mandatory”

Advocacy Efforts & Resources

To help correspondent lenders navigate these tough times, MCT has put together a list of resources.

View the list of servicer liquidity and forebearance resources below for industry related content and services.

Servicer Liquidity

- MBA Letter 1 & Letter 2

- Treasury Secretary Announces Task Force

- GinnieMae Efforts

- FHFA Director Interview – No Liquidity Facility on the Way & MBA President Response

- PennyMac Announcement

Forebearance

- CFPB Video – “Ask Your Servicer”

- HUD CARES Act Mortgage Relief Announcement

- MBA Form Letter: Prioritize help for consumers with the greatest need

Where are We Now? “Unintended Consequences”

- Noble Federal and State efforts to support homeowners through forbearance

- Limited or denied access to borrowers from socio-economic groups that typically require government loans

- Increased aggregator margins, elimination of products, modifications to loan level price adjusters resulted in lower prices to lenders

- Small to Mid-Sized Lenders (with fewer than 100 employees) bare the brunt of lower prices in loans sales

- Important Fed effort to stabilize MBS through purchasing actions

- Unprecedented level of Broker Dealer margin calls on Small to Mid-Sized Lenders putting them in a cash crunch while they were simultaneously making less on every loan sale

Are You Getting the Guidance You Need?

As your trusted capital markets partner, MCT provides laser-focused guidance on market changes and their potential impact to lending businesses during times of market volatility.

As your trusted capital markets partner, MCT provides laser-focused guidance on market changes and their potential impact to lending businesses during times of market volatility.

It is our duty to serve your needs as a hedge advisor as we weather these challenges together. If you are not currently getting the guidance you need, please contact us for any questions or concerns. We are ready to assist you, whether or not you are an MCT client.

To stay abreast of current market updates, sign up for MCT’s newsletter.