Mortgage Investor Solutions

Increase your market share, streamline your process, or launch your correspondent channel with MCT’s mortgage investor solutions and analytics on the largest U.S. residential loan trading exchange.

Average Volume/Month

Investor/Seller Approvals in Past Year

%

Increase in Bid Tapes Received

Seller Sign Up Rate

Considering Mortgage Assets for Your Portfolio?

MCT specializes in helping private institutional investors diversify their portfolio into mortgage assets. These non-traditional mortgage investors are an increasingly impactful force in the secondary market, reaping the benefits of both strong returns and diversification. Schedule a consultation about leveraging MCT’s mortgage investor expertise, network, and software.

Instantly Bid on Every Loan & Seller in MCT Marketplace

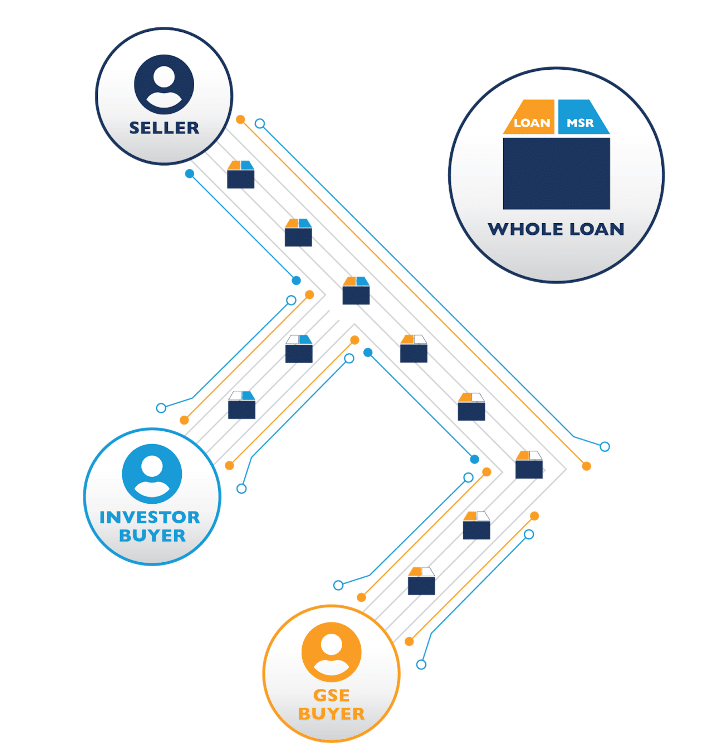

Through MCT Marketplace, the world’s first truly open loan trading exchange, a mortgage investor can bid regardless of approval status, and sellers receive pricing from every buyer on the platform.

MCT Marketplace facilitates bids between unapproved counterparties using MCT’s patented Security Spread Commitment. With MCT Marketplace, both established and new investors now have an out-of-the-box solution that drives efficiency and scale to the loan, MSR, or CRA acquisition process, maximizing their chances of success.

Grow Your Servicing Portfolio Through Co-Issue on MCT Marketplace

MCT Marketplace offers a more efficient way for any mortgage investor to buy co-issue. MCT’s mortgage investor solutions support buyers operating in either agency co-issue framework or allow them to buy MSR on a flow directly from MCT Marketplace sellers.

With flow co-issue MSR transactions centralized within MCT Marketplace, the process of MSR price discovery is more convenient, flexible, and transparent. MCT Marketplace co-issue transactions support SRP pricing grids or live, loan-level MSR pricing.

- MSR pricing shown for both approved and unapproved sellers

- Deliver MSR pricing with standard grid-based or loan-level bid tape formats

- Buyers not on agency co-issue exchanges fully supported

Win More Business by Offering & Automating AOTs

AutoAOT automates bid tape AOT pricing, loan sale delivery, and the tri-party agreement required between lenders, investors, and broker-dealers during AOT transactions.

Launch, automate, and manage your bid tape AOT delivery channel. The benefits of bid tape AOT for sellers have made it a significant opportunity for mortgage investors to win more business. MCT has removed the nuances of paperwork, complexities of calculation, and back-office processing which can be a challenge for investors looking to offer this delivery method.

Price Calculation

Simplify the process of expanding your standard pricing for the AOT channel.

No Trade Tolerances

Eliminating trade tolerances and blending over/under deliveries helps win more loans.

Automatic Blending

Accept a combination of smaller trades with a weighted average price.

Immediate Acceptance

Provide originators with greater certainty of their position after a sale.

Tri-Party Automation

Automated between all three parties which saves time while reducing data errors.

- One secure and centralized pricing and loan trading platform – no more spreadsheets or emails

- Granular and low-maintenance margin management

- Fast and accurate pricing with built-in controls and automation

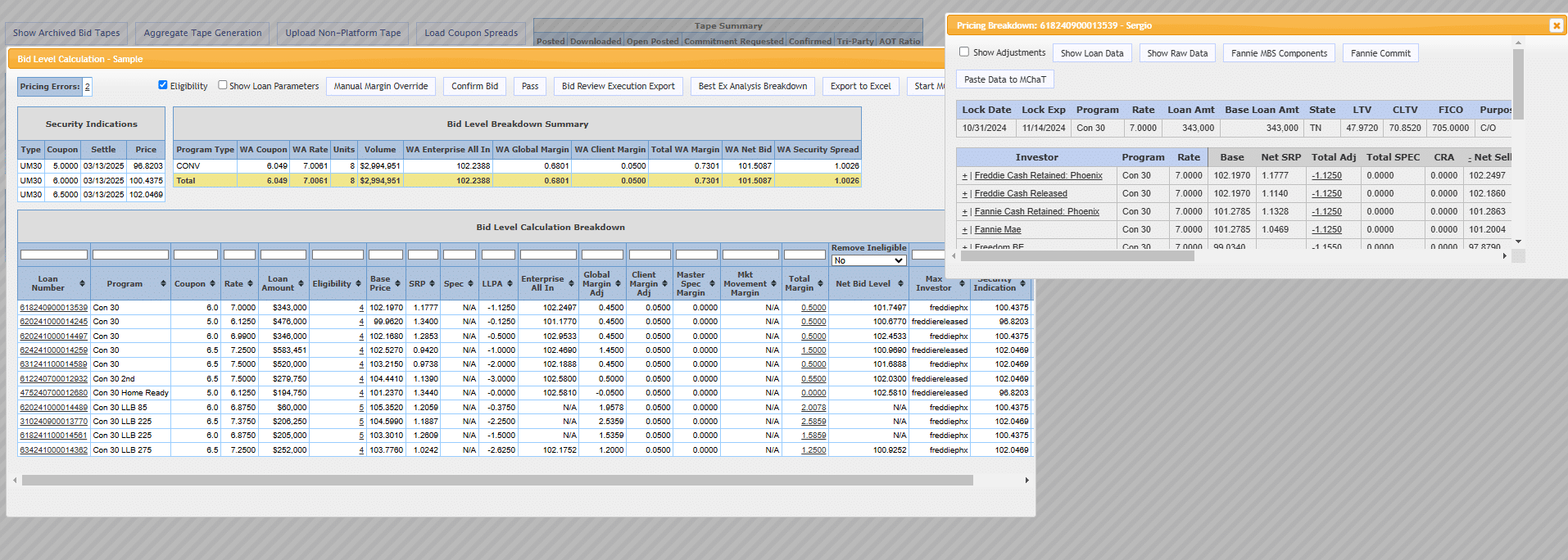

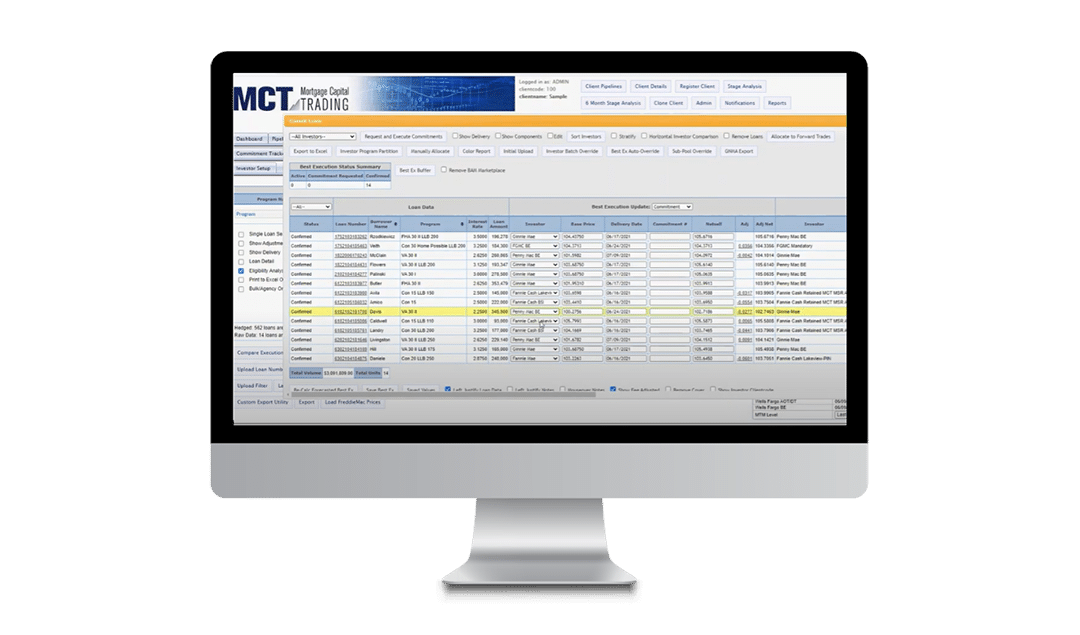

Build Market Share with AutoBid: MCT’s Next Generation Bid Tape Pricer

AutoBid automates the process of pricing bid tapes and accepting commitments. No more organizing, normalizing, pricing, or returning bid tapes and commitment requests via spreadsheets and email.

As a highlight of MCT’s bid tape trading services, industry-leading AutoBid software allows investors to leverage agency API connections with granular margin and restriction functionality to accurately generate bid pricing on the types of loans they want to buy.

With full support for spec pay-ups, MSR values, and CRA identification, investors can ensure they’ll be generating the most accurate bid at any point in time. Investors can also choose from several common loan characteristics to margin and restrict by, or leverage the multifactor functionality to set up more complex rules.

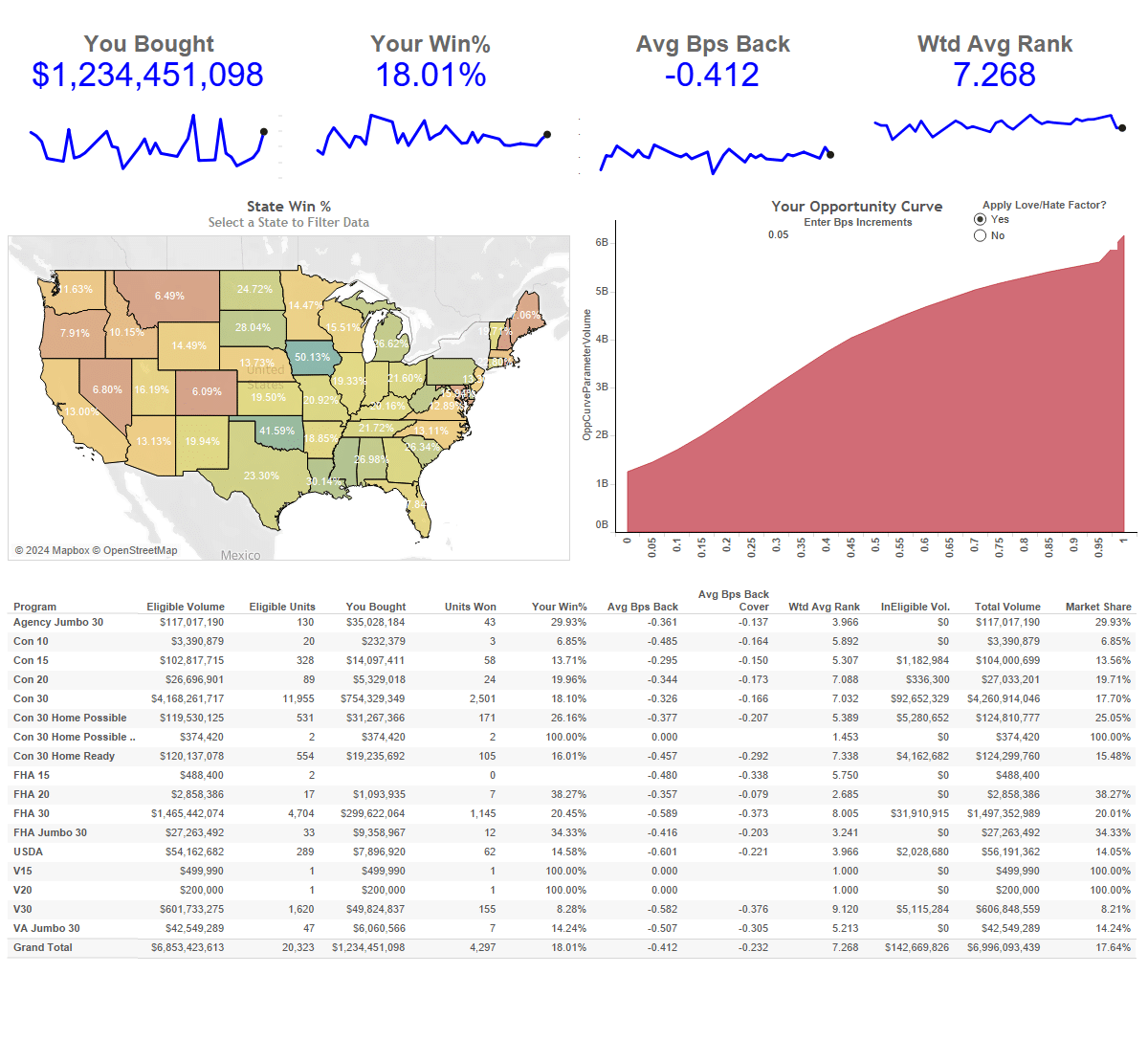

Mortgage Investor Analytics Optimize Performance and Uncover Opportunities

MCT’s mortgage investor solutions include Investor Analytics, a proprietary historical database of best execution analysis and loan sales, featuring unique reporting and visualizations designed to optimize correspondent pricing while building market share at the aggregate, lender, and loan level.

- Summary Reporting, Opportunity Curves, & Love/Hate Factors

- Slice & Dice by Lender, Region, Product, & More

- Interactive Web-Based Platform with a Variety of Export Capabilities

Learn More About Investor Services

Frequently Asked Questions

Explore common questions about mortgage investors, correspondent investing, and CRA loans with our open loan trading exchange and other investor services.

What is a Mortgage Investor?

A mortgage investor buys mortgages or mortgage-backed securities (MBS) as an investment to earn income from borrower interest payments, mortgage-servicing rights cash flows, or eventual sales to other investors. Mortgage investors typically do not deal directly with borrowers but purchase mortgages from originators or invest in pools of mortgages. The main types of mortgage investors include individual investors, correspondent aggregators, institutional investors (pension funds, insurance companies), government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, and private equity firms or hedge funds that may focus on distressed or high-yield mortgage assets.

What are Mortgage Investor Solutions?

Mortgage investor solutions provide tools to help investors evaluate, buy, and manage these mortgage assets successfully. Bid tape trading services allow investors to assess and bid on large volumes of loans for purchase. By purchasing mortgages, these investors provide liquidity to the housing market, enabling mortgage originators to free up capital for new loan origination, contributing to the stability of the mortgage ecosystem.

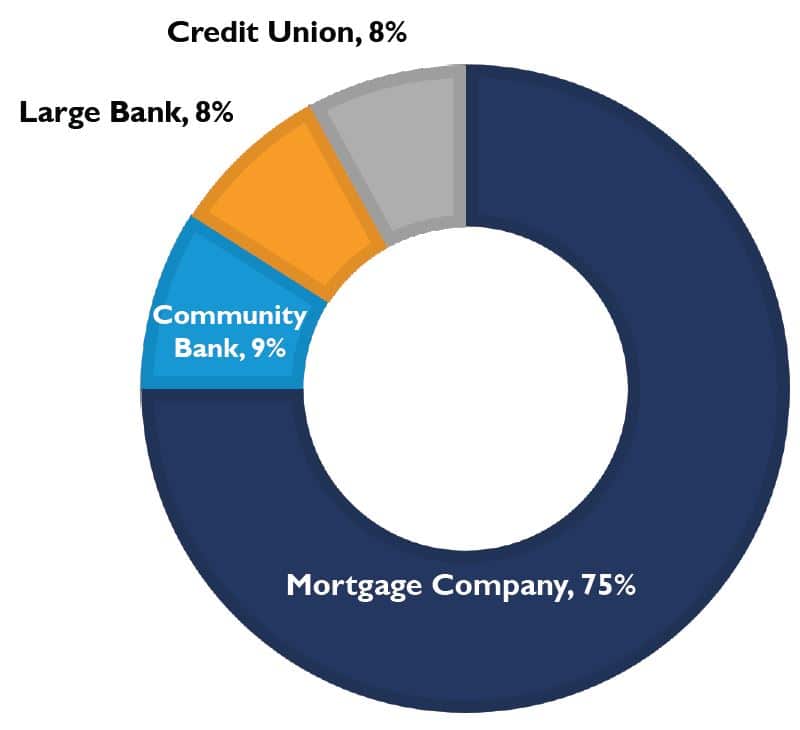

How Does Correspondent Investing Work?

Correspondent investing allows mortgage investors to buy loans from a base of correspondent sellers, typically small to midsize independent mortgage bankers, community banks, and credit unions. These sellers originate loans following guidelines from the correspondent investor, then sell them shortly after closing. Investors acquire loans without direct borrower interaction, ensuring efficient capital deployment and risk management.

Through bid tape trading services, correspondent investors, also known as correspondent aggregators, can access detailed information about loan pools to bid on, targeting specific loan characteristics and optimizing returns. After acquiring the loans, correspondent investors may pursue a variety of strategies according to their goals, such as holding the loans in portfolio, holding the MSR but selling the loan, or acting as a subservicer on behalf of a different end investor.

What are CRA Loans and How Do I Find Them?

CRA (Community Reinvestment Act) loans help mortgage investors satisfy regulatory requirements while supporting low- and moderate-income communities. Mortgage lenders originate CRA-eligible loans which can then be sold to other institutions in order to meet their CRA obligations. Mortgage investor solutions include partnering with CRA originators and leveraging bid tape trading services to access these loans.

Investors can also monitor CRA loan portfolios for sale, participate in CRA loan pools managed by investment groups, and work with loan brokers who specialize in sourcing CRA loans, such as MCT. These strategies provide mortgage investors access to loans that align with their financial goals while fulfilling community development requirements.

Learn More: CRA Acquisition & Correspondent Channel Tools from MCT Marketplace

What is a Bid Tape Pricer?

A bid tape pricer is a tool used by mortgage investors and correspondent investors to evaluate and price pools of loans while managing their margins. A bid tape contains details about loans, such as interest rates, borrower credit scores, and loan-to-value ratios. Bid tape pricers help investors process this data, determine the right price to bid, and optimize their margins and portfolios.

Bid tape pricers assign pricing based on loan characteristics, market conditions, and risk factors. They allow correspondent investors to assess large volumes of loans quickly, automate the bidding process, ensure their bids are competitive, and minimize risk from human error. For investors engaged in whole loan trading, bulk loan sales, or working with correspondent lenders, a bid tape pricer, such as MCT’s AutoBid, is an essential part of their mortgage investor solutions toolkit.