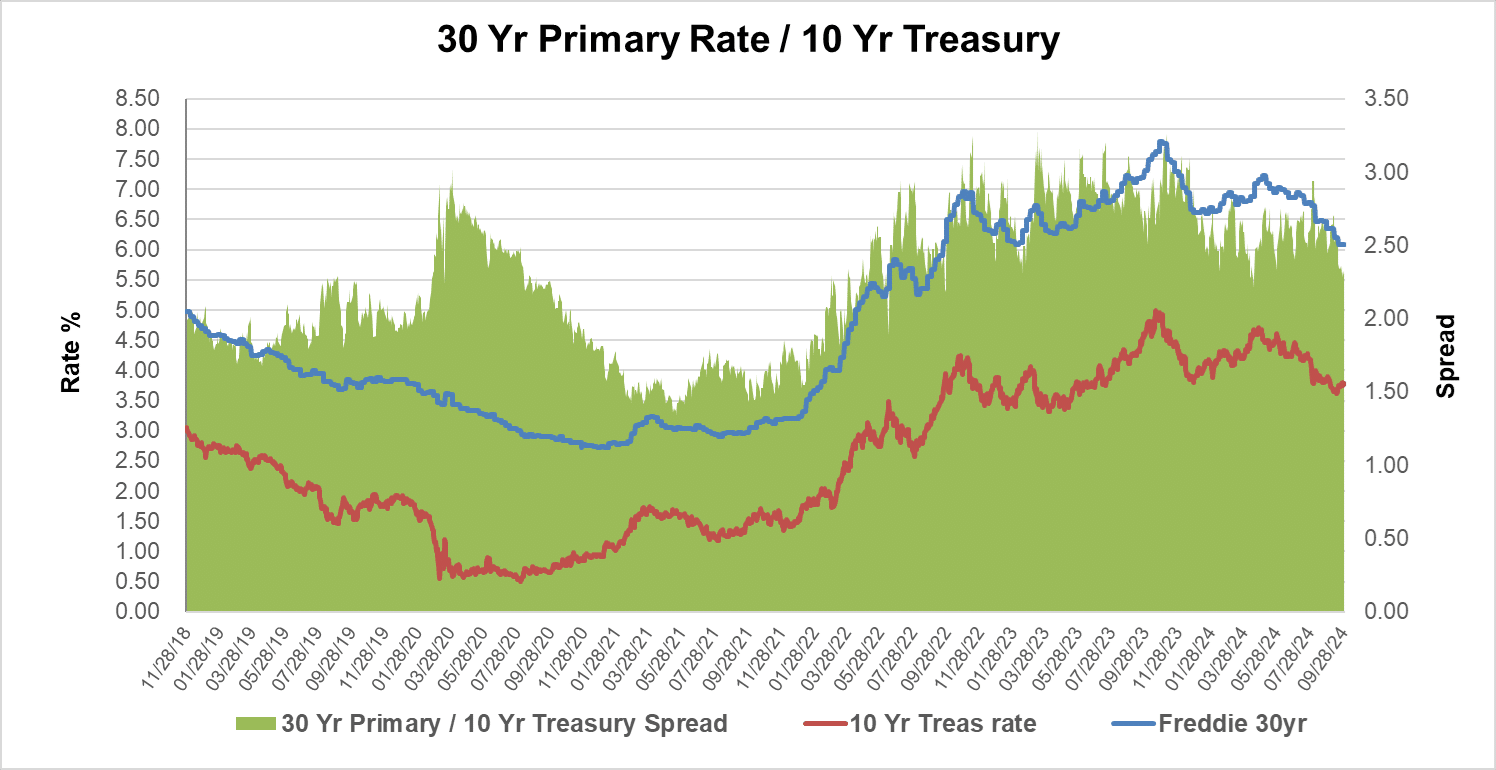

The Fed has finally cut the overnight rate by 50 basis points, a larger cut than what was anticipated. The mortgage market had already built in the rate cut in their offerings; Mortgage rates continued their downward trend during the month of September; However, mortgage rates seem to have stabilized during the last week of September. Mortgage rates have dropped by another 17 bps since August 31, 2024. The industry has already experienced some robust refinancing activity since August 2024 which could as we head into Q4, 2024. The Fed showed some confidence that inflation is abating, however, the concerns now shift towards the employment rate. Economists are awaiting the Fed’s next move in November.

As I indicated in our prior month’s newsletter, the impact from lower mortgage rates and float income rates will have a varying impact on fair values. For certain, MSR fair values are expected to retreat from the previous month’s values. However, those changes are slower than what the market has experienced in prior month.

Mortgage prepayments, though historically very low, continue to reflect steady and persistent upticks across all vintages. We remain diligent and continue to monitor prepayments and delinquency trends, and we estimate that they will remain relatively low and manageable for the remainder of 2024. However, with mortgage rates potentially heading closer to 6.00% or lower, we estimate that agency loans’ prepayment levels will probably start rising at a faster pace and could increase over the next six months by 20%-40% from a current national average of about 5%.

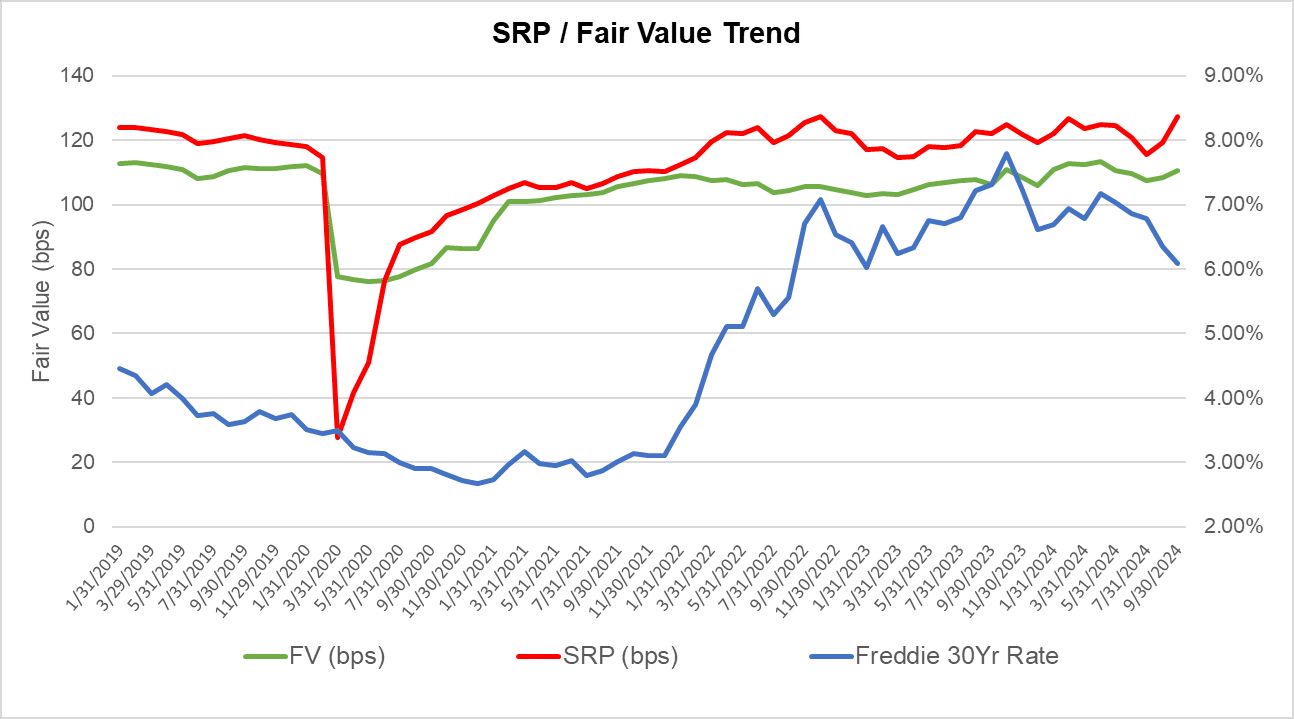

New Production Value Trends:

Refinancing activity have increased during the month of September, however, total refinancing applications amounted to about 30% of all applications. Mortgage rates have bottomed recently at about 6.08% which led to some robust new mortgage application levels.

However, mortgage production remains weak, but persistent low rates may lead to higher production activity as the industry navigates through the last quarter of 2024. A possible second rates cut by the Fed could push the primary mortgage rate to lower than 6% towards the end of 2024, if not sooner. New agency loans pricing remains competitive due to lower production levels. A brief decline in SRP prices in mid to late August was short lived as aggregators were awaiting Fed’s decision which was announced later in September. Current SRP prices are back to competitive level at about 5.0 multiple of servicing fees for current coupon production. This represents about one half of one multiple higher than current fair values for the same loans. We estimate current SRP and fair value levels to remain at current marks for the remainder of 2024.

As mortgage rates retreat, we continue to advocate for our clients to capitalize their retained MSRs at moderate values to avoid potential balance sheet exposure. Fair values are stable and are not as volatile or sensitive as market values are. Aggregator prices are market prices and represent the aggregators’ willingness to pay premium prices that are much higher than fair values for newly originated loans. There is a risk in using those same price levels to capitalize retained MSR assets at those high prices. Our weekly MSR grids are fair value based and the values are designed to mitigate potential market volatility and will ultimately produce higher returns if lenders choose to sell their MSR in the future. Capitalizing retained loans at higher multiples of servicing fees could result in potential future losses stemming from selling bulk MSR.

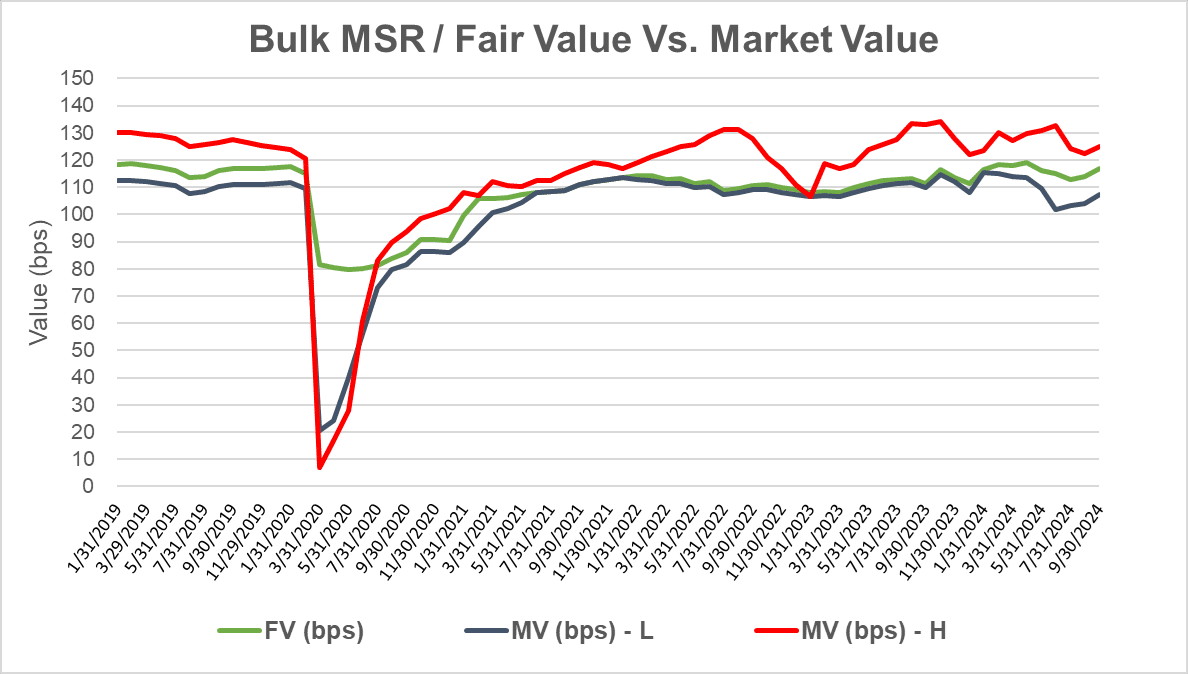

MSR Bulk Market:

The MSR bulk market activity continues to show some pricing resiliency despite recent declines in rates, however, MSR holders must remain diligent as the MSR market and values enter a period of declining rates and as the industry navigates through further rate cuts by the Fed. The fourth quarter over the last three years reflected weaker Bulk MSR prices, and if this trend holds in 2024, the market should anticipate bulk MSR values to be weaker by 8-12 bps lower than current market levels. However, if new loan production does not pick up over the next 2-3 months, we could continue to observe multiples around 5.0x of servicing fees.

Recent bulk MSR trading values reflect levels of 4.90x – 5.15x multiples of servicing fees for agency loans. Many potential sellers remain on the sidelines while there are large servicers interested in replenishing their portfolios’ fast declining principal balances. If mortgage rates continue to decline, sellers may opt to lock in their MSR gains before further mortgage rates deterioration.

Non QM and Second Mortgages Trends:

Second mortgages and HELOC loan originations continue their growth at a rapid growth rate that exceeds 20% QoQ. Similarly, Non-QM originations continue to increase, however, quality of loans and the higher underlying interest rate on those loans could pose some performance risks in the future. We anticipate this growth to continue through the remainder of 2024 and into 2025. Many lenders have already included such loan products in their product offerings. Investors continue to invest in non-QM MSRs and securities providing reasonable yields and returns. Growth in certain products within this segment, such the DSCR loans, as the real estate market has been shifting towards investment properties offering investors attractive solutions that the GSEs don’t currently offer. Performance trends for such products have been relatively positive and are expected to remain stable into the foreseeable future. Underlying fair values and demand for such products are very competitive; non-QM MSR products fair values are between 3.65 - 4.125 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.25 – 2.75 multiple of servicing fees.

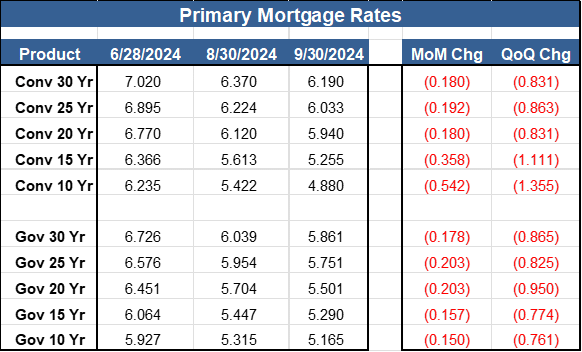

Mortgage Rates:

As of September 30, 2024, the current 30 Year base mortgage rate is 6.1896%, which represents about 18 basis points decline from August 31, 2024, mark, and 83 basis points decline since Q2. We anticipate existing portfolio fair values to decline by 2-4 basis points from their 8/31/2024 marks, depending on the underlying portfolio characteristics and vintage.

While overall values should remain strong, most of value volatility will be concentrated within the 2023 and 2024 vintages as they are more sensitive to rate changes compared to 2020 – 2022 vintages. Almost all of 2020-2022 vintages have already reached maximum potential values and we should anticipate those values to soften as mortgage rates trend closer to 6.00%.

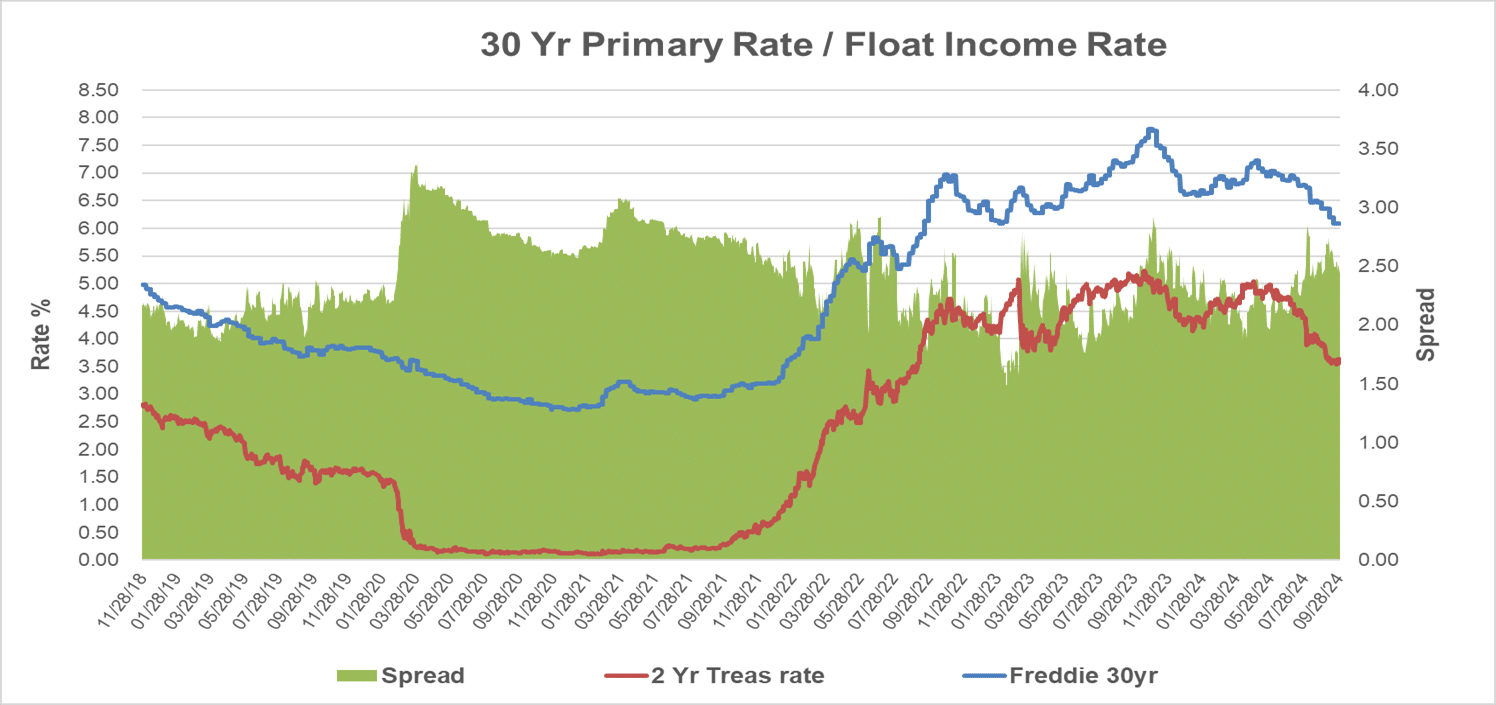

Escrows and Float Income:

Mortgage escrows are usually the second largest contributor to the overall MSR value as float income rates remain high. Escrow float income makes up about 10%-20% of the overall MSR revenue. However, depending on the Fed’s decision on rate cuts and the frequency of such cuts, MSR holders should anticipate some negative impact on the overall value in the range of 3-8 basis points. At the same time, anticipated increases in borrowers monthly escrow payments during 2024 and 2025 should offset some of the declines in values attributed to lower float income rates. Borrowers monthly escrow payments have increased by an average of about 15%-20% per year since 2022 and we should expect another 5%-15% during the next 18 months. The increases will have a positive impact on MSR values; However, the increases will further impact borrowers’ financial burdens that could potentially lead to higher delinquencies, particularly in regions where property values are very high. As an example, Florida borrowers have experienced a 15%-25% increase in their monthly mortgage payments due to higher hazard insurance premiums. The increases could also lead to higher escrow advances that servicers must prepare for which could impact operations, especially since most mortgage operations are generally already under financial stress.

Rates Indices:

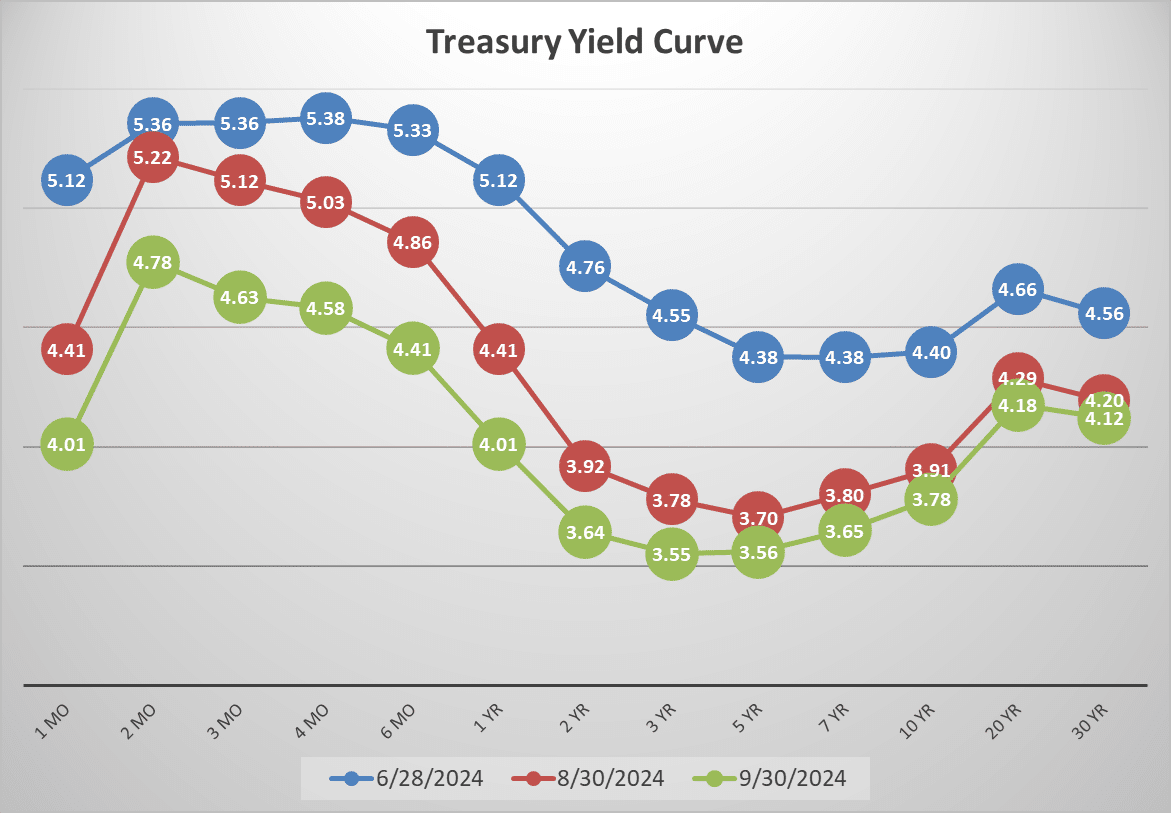

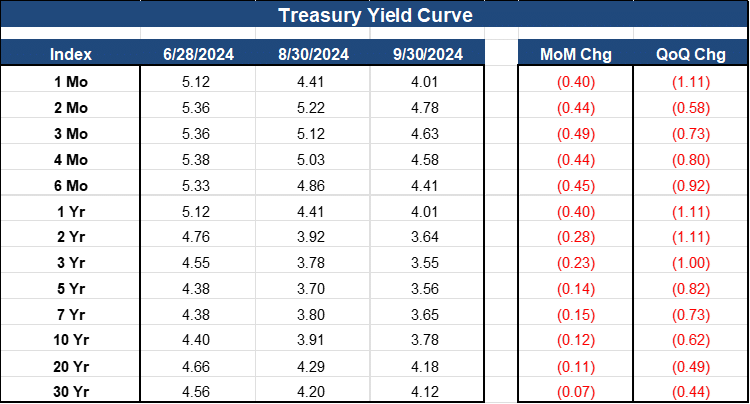

Prior to the recent Fed’s announcement of 50 basis points rate cut, the Treasury yield curve reflected market economic stress; However, the transformation of the yield curve shape started to reflect market and Fed’s optimism about controlling inflation. The yield curve trajectory to normalcy is reflected in September’s yield curve shape, something the market has not experienced since Q2, 2022.

Fair Value Guidance:

We also remind clients that while MSR fair values in basis points remain steady and strong, MSR dollar values are eroding at a faster pace because 2020 -2022 production have very low interest rates, therefore, as borrowers make their regular monthly payments, current scheduled principal payments make up approximately 40-60% of total principal runoff which includes portfolio payoffs. Most lenders are currently retaining only about 10%-30% of their production which barely covers the principal balance that ran off. This is the primary driver that is causing the dollar value of portfolios to continue to decline while the basis points values either flat or increase.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between -1 to -3 bps change from August 31, 2024, marks.

- Government loans between -2 to -4 bps change from August 31, 2024, marks.

- GNMA loans are experiencing a continuous uptick in delinquency rates which generally began in Q2, 2022. Due to the increase in delinquencies, we continue to monitor those trends and are consequently more cautious with our current GNMA fair value estimates.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net