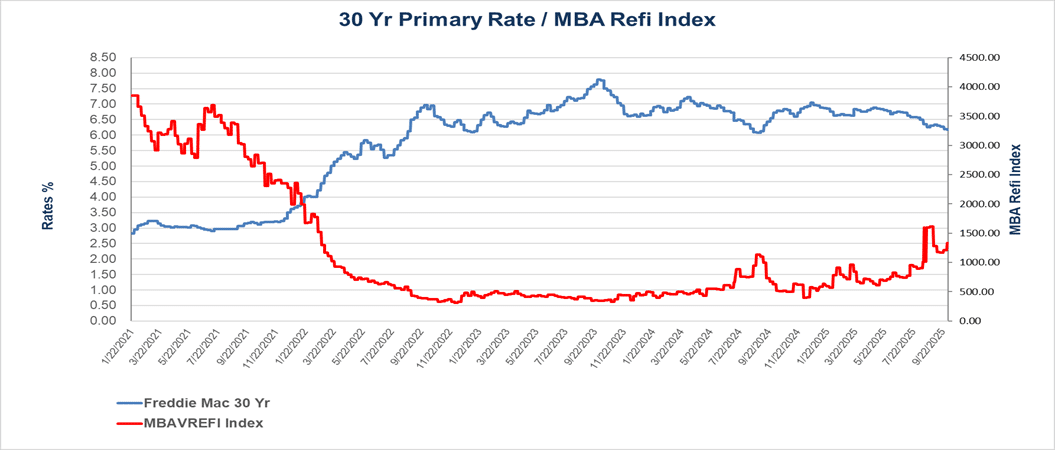

Mortgage rates initially moved lower immediately after the Federal Reserve October’s 25 basis points rate cut; However, mortgage rates have since reversed course and have increased since the announcement. The likelihood of another rate cut in November has moderated due to lack of economic data because of the government shutdown. Several Federal reserve governors have voiced reluctance to cast their votes in favor of another 25-basis points rate cut in November. The current benchmark interest rate is 3.75%-4.00%.

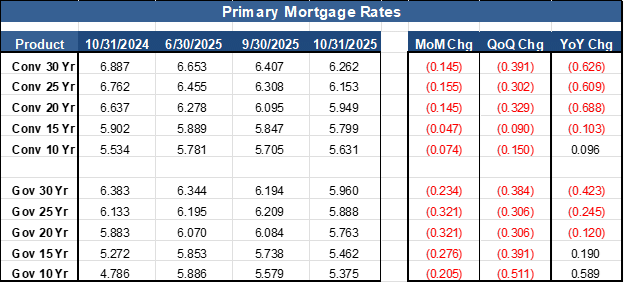

MCT’s Base Mortgage Rate declined from 6.41% to 6.26% at the end of October, representing a 15 basis point decline since September 30, 2025. The Mortgage Bankers Association and Fannie Mae project that rates will remain in the range of 6.00% - 6.50% for the remainder of 2025.

Buyer sentiment remains low, and consumers and businesses alike remain cautious about the general health and direction of the economy, government shutdown, and increasing job security concerns. Hiring rates and layoff rates are currently low as currently employed people are reluctant to switch jobs as they eye the economy’s health and slowly rising living expenses.

The housing market is navigating through inventory challenges; the overall housing inventory remains tight as sellers remained reluctant to list their homes. New listings have decreased by about 3.2% compared to 2024. First-time home buyers are at an all-time low, making up about 20% of the market, which is the lowest share of the market recorded since 1981.

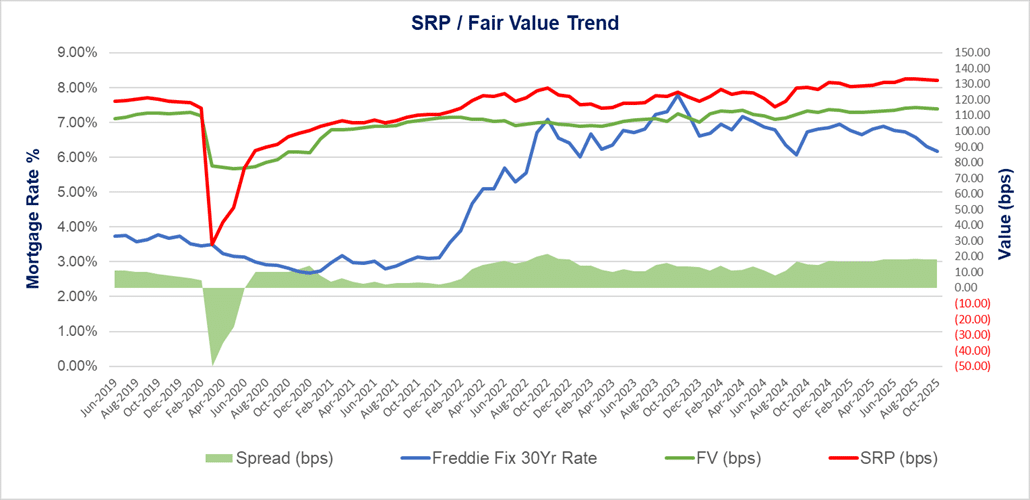

New Production Value Trends:

The refinance opportunities have increased, particularly for borrowers with loans that were originated during the past 24 months. Older loan vintages have record home equity amounts but have not reacted in large numbers to the recent decline in mortgage rates. We estimate that more borrowers will likely refinance when mortgage rates reach levels around 6.00%.

MCT’s data show significant prepayment speeds increase during October due to mortgage rates declines since September.

The current average SRP levels remain at about 15-25 basis points higher than the average fair value. The MSR market could potentially experience lower valuations if the Federal reserve continues with their rate reductions. We continue to advocate for caution when capitalizing new MSR production at moderate price levels as current SRP levels reflect the aggregator’s economies of scale rather than actual fair value.

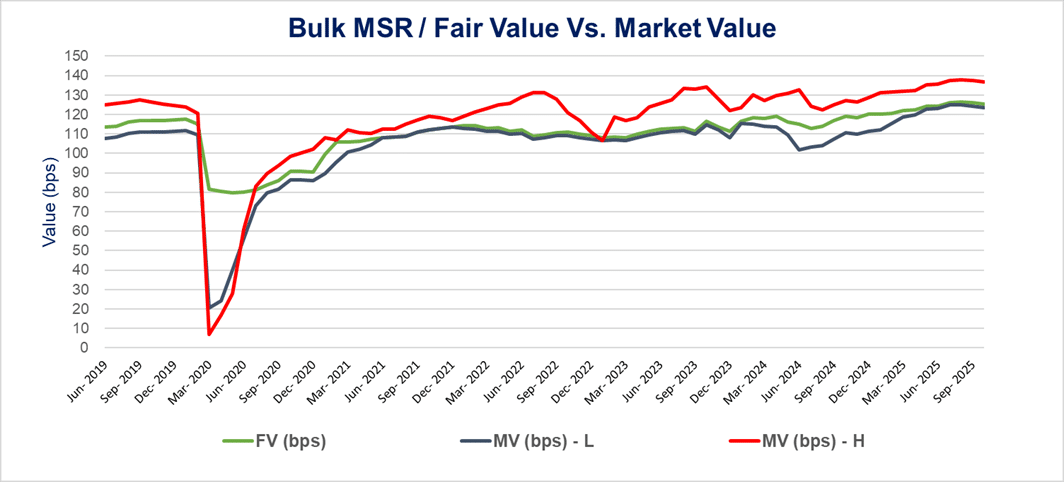

Bulk MSR Market

Investor appetite for MSRs has remained strong over the last few years, even with the recent easing in mortgage rates. Several large bulk MSR trades took place during October directly among buyers and sellers. This trend should continue for the remainder of 2025. MSRs continue to offer attractive yields and income for servicers, especially when loan originations volume remains low.

Bulk MSR trades for moderately seasoned Agency portfolios with interest rates below 5.00% continue to trade at servicing fees multiples between 5.25X and 5.75X. Government MSRs with no delinquencies and with interest rates below 5.00% continue to trade at 4.00X or higher.

Non-QM and Second Mortgages Trends

Some mortgage industry veterans are now considering Non-QM loans as a mainstream mortgage product more vital to the mortgage lending industry. With traditional production volumes continuing to face pressure with more borrowers now outside agency guidelines.

The tightening of the spread in interest rates between Non-QM and Agency products continues to fuel demand for such mortgage products and offers more liquidity for such products. Current interest rate spread between agency mortgage loans and Non-QM mortgage loans is ranging between 35 and 75 basis points.

Non-QM prepayment speeds continue to rise as more borrowers are opting to refinance into lower interest rate loans as Non-QM liquidity and interest rate levels have improved since early 2025.

HELOCs and closed-end second mortgage lenders continue to experience robust production during the month of October as tappable home equity now exceeds $ 11 trillion. Market participants should expect continuous growth within this segment throughout the remainder of 2025.

The bulk MSR market for these two segments remains virtually nonexistent. Underlying fair values for non-QM MSR products remain between 3.65 – 4.40 multiple of servicing fees while Second Mortgages and HELOC MSR products fair values are between 2.30x and 3.25x multiples of servicing fees.

Mortgage Rates

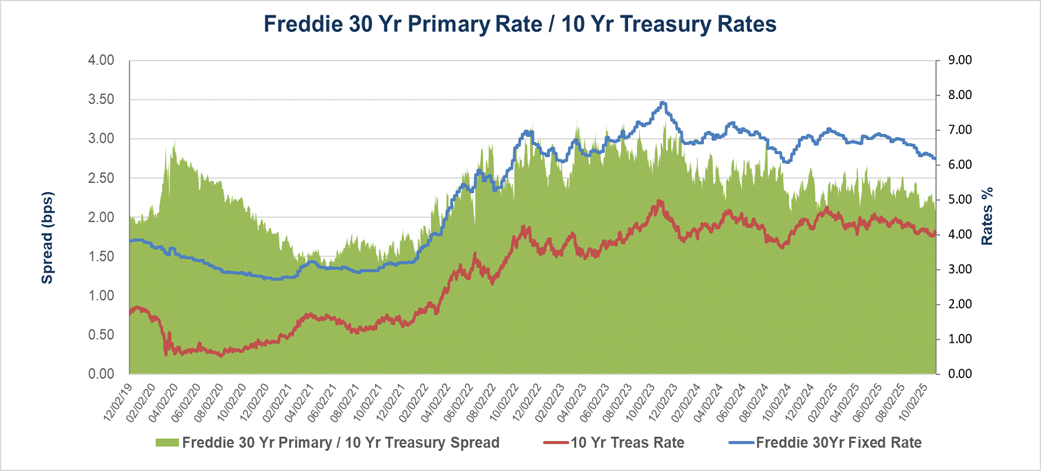

As of October 31, 2025, the current fixed 30 Year mortgage rate is 6.262%, which represents about 15 basis points decline from September 30, 2025, mark.

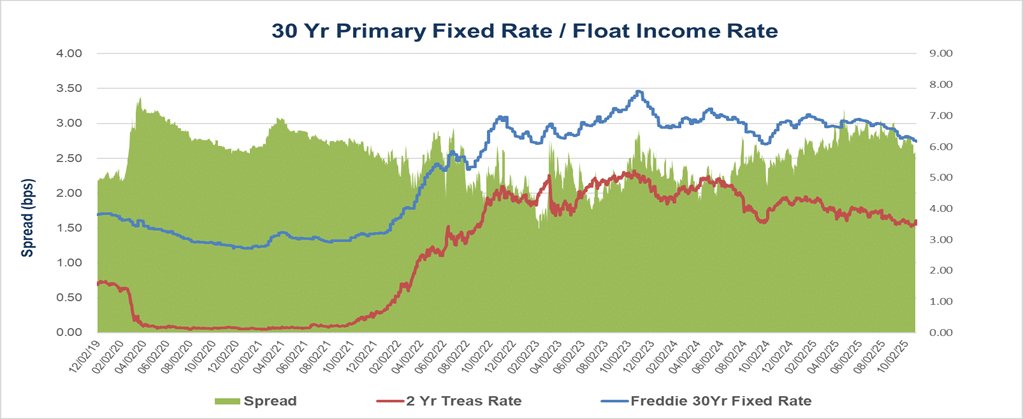

Escrows and Float Income

Mortgage escrow values have remained relatively unchanged since their September 30, 2025 marks due to float income rates have remained relatively unchanged during the same period. Escrow float income value is the second largest contributor to the overall MSR value.

Rates Indices

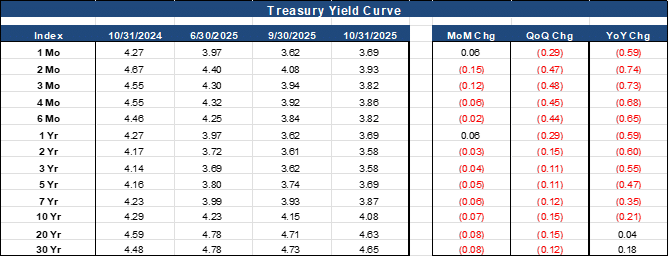

The government shutdown and other economic news continue to weigh on the overall economy and the mortgage industry. The debate about the Federal Reserve’s next move is adding uncertainty to current mortgage and real estate markets.

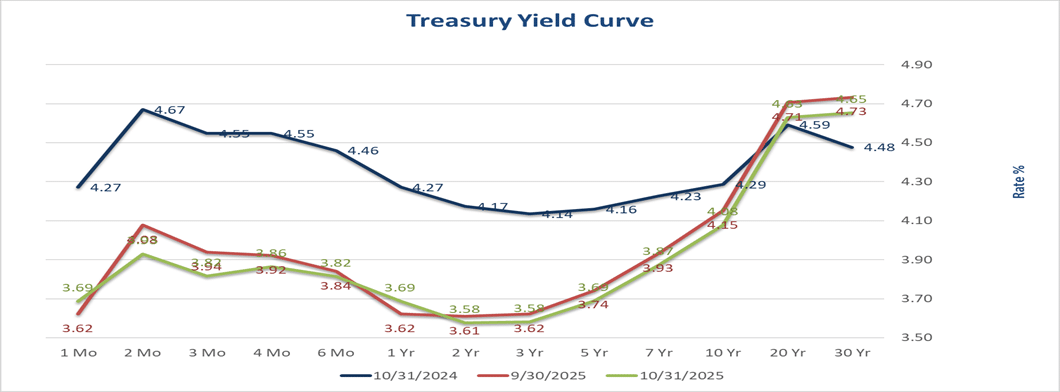

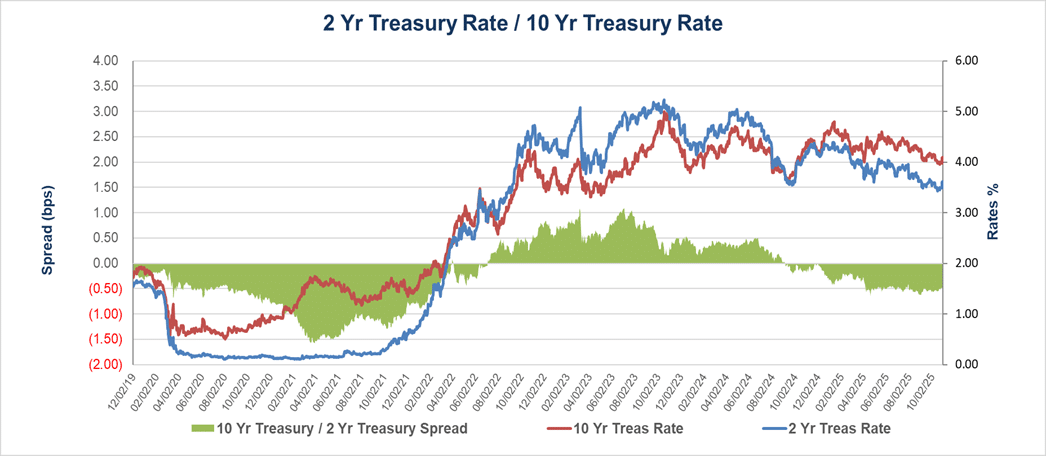

The yield on the benchmark 10-year Treasury is at 4.08%, seven (7) basis points lower than the prior month. The current yield curve is slightly flatter than the prior month, however, the Treasury curve remains steeper as the lower end of the curve dropped while the long end of the curve remained high, reflecting investor’s continued demand for higher yields due to the current economic uncertainty.

Fair Value Guidance

Our October 31, 2025, fair values guidance for existing portfolios should slightly decrease from their September 30, 2025, marks. The float income rate has remained relatively unchanged since September 30, 2025; Therefore, it has little impact on mortgage escrows components of the value. The decrease in mortgage rates from September 30, 2025, marks will contribute to most of the decline in fair values.

MSR holders should expect a decrease in fair values ranging from less than one basis point to two (2) points, primarily because of the decrease in mortgage rates.

For portfolios that have a mix of Conventional and Government loans, we anticipate Fair Value changes as follows:

- Conventional loans between -1 to -2 bps change from September 30, 2025, marks.

- Government loans between -1 to -3 bps change from September 30, 2025, marks.

If you have any questions or would like to schedule a call with our MSR team, please contact us today.

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continues to revolutionize how mortgage assets are priced, locked, protected, valued, and exchanged – offering clients the tools to thrive under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

Media Contact:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

pr@mctrade.net